[ad_1]

That is an opinion editorial by Leon Wankum, one of many first monetary economics college students to jot down a thesis about Bitcoin in 2015.

Evolutionary psychologists imagine that the flexibility to “protect wealth” gave trendy people the decisive edge in evolutionary competitors with different people. Nick Szabo wrote an fascinating anecdote about how in his essay “Shelling Out: The Origins of Money.” When homosapiens displaced homo neanderthalensis in Europe circa 40,000 to 35,000 B.C., inhabitants explosions adopted. It is troublesome to elucidate why, as a result of the newcomers, homosapiens, had the identical measurement mind, weaker bones and smaller muscle groups than the neanderthals. The most important distinction could have been wealth transfers made simpler and even doable by collectibles. Proof reveals homosapiens sapiens took pleasure in gathering shells, making jewellery out of them, displaying them off and buying and selling them.

It follows that the potential to protect wealth is among the foundations of human civilization. Traditionally, there have been quite a lot of wealth preservation applied sciences which have continuously modified and tailored to the technological prospects of the time. All wealth preservation applied sciences serve a selected perform: storing worth. Chief among the many early types is handmade jewellery. Beneath I’ll examine the 4 mostly used wealth preservation applied sciences immediately (gold, bonds, actual property and equities) to bitcoin to indicate why they underperform and the way effectively bitcoin can assist us save and plan for our future. For equities, I focus particularly on ETFs as fairness devices used as a method of long-term financial savings.

Element of necklace from a burial at Sungir, Russia, 28,000 BP. Interlocking and interchangeable beads. Every mammoth ivory bead could have required one to 2 hours of labor to fabricate.

What Makes A Good Retailer Of Worth?

As defined by Vijay Bojapati, when shops of worth compete in opposition to one another, it’s the distinctive attributes that make a great retailer of worth that permits one to out-compete one other. The traits of a great retailer of worth are thought-about to be sturdiness, portability, fungibility, divisibility and particularly shortage. These properties decide what’s used as a retailer of worth. Jewellery, for instance, could also be scarce, but it surely’s simply destroyed, not divisible, and definitely not fungible. Gold fulfills these properties much better. Gold has over time changed jewellery as humankind’s most well-liked know-how for wealth preservation, serving as the simplest retailer of worth for five,000 years. Nonetheless, for the reason that introduction of Bitcoin in 2009, gold has confronted digital disruption. Digitization optimizes virtually all value-storing features. Bitcoin serves not solely as a retailer of worth, but additionally as an inherently digital cash, finally defeating gold within the digital age.

Bitcoin Versus Gold

Sturdiness: Gold is the undisputed king of durability. Many of the gold that has been mined stays extant immediately. Bitcoin are digital information. Thus it isn’t their bodily manifestation whose sturdiness needs to be thought-about, however the sturdiness of the establishment that points them. Bitcoin, having no issuing authority, could also be thought-about sturdy as long as the community that secures them stays intact. It’s too early to attract conclusions about its sturdiness. Nonetheless, there are indicators that, regardless of situations of nation-states making an attempt to manage Bitcoin and years of assaults, the community has continued to perform, displaying a exceptional diploma of “anti-fragility”. In reality, it is among the most dependable pc networks ever, with almost 99.99% uptime.

Portability: Bitcoin’s portability is much superior to that of gold, as data can transfer on the velocity of sunshine (due to telecommunication). Gold has misplaced its enchantment within the digital age. You’ll be able to’t ship gold over the web. On-line gold portability merely does not exist. For many years, the lack to digitise gold created issues in our financial system, traditionally based mostly on gold. With the digitization of cash, over time it was now not understandable whether or not nationwide currencies have been really backed by gold or not. Additionally, it’s troublesome to move gold throughout borders due to its weight, which has created issues for globalised commerce. Because of gold’s weak point by way of portability, our present fiat-based financial system exists. Bitcoin is an answer to this drawback as it’s a native digital scarce commodity that’s simply transportable.

Storing Gold Versus Storing Bitcoin

Divisibility: Bitcoin is purely digital, so its divisibility is much better compared to gold. Information can be subdivided and recombined almost infinitely at almost zero cost (like numbers). A bitcoin might be divided into 100,000,000 items known as satoshi. Gold then again is troublesome to divide. It requires particular instruments and carries the danger of dropping gold within the course of, even when it is simply mud.

Fungibility: Gold might be distinguished for instance by an engraved brand, however might be melted down and is then absolutely fungible. With bitcoin, fungibility is “tough”. Bitcoin is digital data, which is the most objectively discernible substance in the universe (like the written word). Nonetheless, since all bitcoin transactions are clear, governments may ban the usage of bitcoin that has been used for actions deemed unlawful. Which might negatively affect bitcoin’s fungibility and its use as a medium of alternate, as a result of when cash shouldn’t be fungible, every unit of the cash has a special worth and the cash has misplaced its medium of alternate property. This doesn’t have an effect on bitcoin’s store-of-value perform, however fairly its acceptance as cash, which might negatively affect its value. Gold’s fungibility is superior to bitcoins, however gold’s portability disadvantages make it ineffective as a medium of alternate or a digital retailer of worth.

Shortage: Gold is comparatively scarce, with an annual inflation price of 1.5%. Nonetheless, the provision shouldn’t be capped. There are all the time new discoveries of gold and there is a possibility that we will come across large deposits in space. Gold’s value shouldn’t be completely inelastic. When gold costs rise, there’s an incentive to mine gold extra intensively, which might enhance provide. As well as, bodily gold might be diluted with much less valuable metals, which is troublesome to test. Moreover, gold held in on-line accounts by way of ETCs or different merchandise usually has a number of makes use of, which can be troublesome to regulate and negatively impacts the value by artificially growing provide. The provision of bitcoin, then again, is hard-capped, there’ll by no means be greater than 21,000,000. It’s designed to be disinflationary, that means there shall be much less of it over time.

Bitcoin’s annual inflation price is at present 1.75% and can proceed to lower. Bitcoin mining rewards are halved roughly each 4 years, in accordance with the protocol’s code. In 10 years, its inflation price shall be negligible. The final bitcoin shall be mined in 2140. After that, the annual inflation price of bitcoin shall be zero.

Auditability: This isn’t a novel promoting proposition for a retailer of worth, however it’s nonetheless essential as a result of it gives details about whether or not a retailer of worth is appropriate for a good and clear monetary system.

Bitcoin is completely audible to the smallest unit. Nobody is aware of how a lot gold exists on this planet and nobody is aware of how a lot US {dollars} exist on this planet. As identified to me by Sam Abbassi, bitcoin is the primary completely, publicly, globally, auditable asset. This prevents rehypothecation danger, a follow whereby banks and brokers use belongings posted as collateral by their purchasers for their very own functions. This takes an infinite quantity of danger out of the monetary system. It permits for proof of reserves, the place a monetary establishment should present their bitcoin deal with or transaction historical past with a view to present their reserves.

Bitcoin Versus Bonds

In 1949 Benjamin Graham, a British-born American economist, professor and investor, printed „The Clever Investor“, which is taken into account one of many founding books of worth investing and a traditional of economic literature. Considered one of his tenets is {that a} “balanced portfolio” ought to include 60% shares and 40% bonds, as he believed bonds defend traders from vital danger within the inventory markets.

Whereas a lot of what Graham described then nonetheless is smart immediately, I argue that bonds, significantly authorities bonds, have misplaced their place as a hedge in a portfolio. Bond yields can’t sustain with financial inflation and our financial system, of which bonds are an element, is systematically in danger.

It’s because the monetary well being of most of the governments that kind the guts of our financial and monetary system is in danger. When authorities stability sheets have been in first rate form, the implied danger of default by a authorities was virtually zero. That’s for 2 causes. Firstly, their skill to tax. Secondly, and extra importantly, their skill to print cash to pay down its borrowings. Previously that argument made sense, however ultimately printing cash has develop into a “credit score boogie man”, as defined by Greg Foss,

Governments are circulating extra money than ever earlier than. Information from the Federal Reserve, the central banking system of the US, reveals {that a} broad measure of the inventory of {dollars}, often called M2, rose from $15.4 trillion in the beginning of 2020 to $21.18 trillion by the tip of December 2021. The rise of $5.78 trillion equates to 37.53% of the entire provide of {dollars}. Which means the greenback’s financial inflation price has averaged nicely over 10% per 12 months over the past 3 years. U.S. Treasury Bonds are yielding less.

The return that one could earn on their money tomorrow, by parting with that cash immediately ought to theoretically be optimistic to compensate for danger and alternative price. Nonetheless, bonds have become a contractual obligation to lose money when Inflation is priced in. As well as, there’s the danger of a scientific failure. The global financial system is irreversibly broken and bonds as a basis of it, are at excessive danger.

There is an irresponsible amount of credit in the market. In current many years, central banks have had very unfastened debt insurance policies and nation states have incurred large amounts of debt. Argentina and Venezuela have already defaulted. There’s a risk that extra international locations will default on their debt. This default doesn’t imply they will’t pay again their debt by printing extra money. However, this would devalue a national currency, causing inflation and making most bonds with their comparatively low yields even much less engaging.

For the previous 50 years, when equities have bought off, traders fled to the “security” of bonds which might recognize in “danger off” environments. This dynamic constructed the inspiration of the notorious 60/40 portfolio — until that reality lastly collapsed in March 2020 when central banks determined to flood the market with cash. The try and stabilize bonds will solely result in an elevated demand for bitcoin over time.

Graham’s philosophy was first and foremost, to protect capital, after which to attempt to make it develop. With bitcoin it’s doable to retailer wealth in a self sovereign means with completely zero counterparty or credit score danger.

Bitcoin Versus Actual Property

Given the excessive ranges of financial inflation in current many years, holding cash in a financial savings account shouldn’t be sufficient to protect the worth of cash. Consequently, many hold a significant portion of their wealth in real estate, which has develop into one of many most well-liked shops of worth. In this capacity, bitcoin competes with real estate, the properties related to bitcoin make it a perfect retailer of worth. The provision is finite, it’s simply moveable, divisible, sturdy, fungible, censorship-resistant and noncustodial. Actual property can’t compete with bitcoin as a retailer of worth. Bitcoin is rarer, extra liquid, simpler to maneuver and more durable to confiscate. It may be despatched anyplace on this planet at virtually no price on the velocity of sunshine. Actual property, then again, is straightforward to confiscate and really troublesome to liquidate in occasions of disaster, as lately illustrated in Ukraine, the place many turned to bitcoin to protect their wealth, accept transfers and donations, and meet daily needs.

In a recent interview with Nik Bhatia, Michael Saylor detailed the downsides of actual property as a retailer of worth asset. As defined by Saylor, actual property normally wants loads of consideration in terms of upkeep. Lease, repairs, property administration, excessive prices come up with actual property. Industrial actual property for instance, could be very capital intensive and subsequently uninteresting for most individuals. Moreover, makes an attempt to make the asset extra accessible have additionally failed, with second tier actual property investments comparable to actual property funding trusts (REITs) falling in need of really holding the asset.

As Bitcoin (digital property) continues its adoption cycle, it might change actual property (bodily property) as the popular retailer of worth. Consequently, the worth of bodily property could collapse to utility worth and now not carry the financial premium of getting used as a retailer of worth. Going ahead, bitcoin’s return shall be many occasions higher than actual property, as bitcoin is simply on the beginning of its adoption cycle. As well as, we are going to almost definitely not see the identical sort of returns on actual property investments as we have now prior to now. Since 1971, home costs have already increased nearly 70 times. Past that, as Dylan LeClair factors out in his article-turned podcast, “Conclusion Of The Long-Term Debt Cycle”, governments are inclined to tax residents at occasions like this. Actual property is definitely taxed and troublesome to maneuver exterior of 1 jurisdiction. Bitcoin can’t be arbitrarily taxed. It’s seizure and censorship resistant exterior of the area of anyone jurisdiction.

Bitcoin Versus ETFs

Alternate-traded funds (ETFs) emerged out of index investing, which makes use of a passive funding technique that requires a supervisor to solely make sure that the fund’s holdings match these of a benchmark index. In 1976, Jack Bogle, founding father of the Vanguard Group, launched the primary index fund, the Vanguard 500, which tracks the returns of the S&P 500. Immediately, ETFs handle nicely over $10 trillion. Bogle had a tenet: energetic inventory selecting is a pointless train. I recall him stating a number of occasions in his interviews that over a lifespan, there’s solely a 3% likelihood {that a} fund supervisor can persistently outperform the market. He concluded that common traders would discover it troublesome or unimaginable to beat the market, which led him to prioritize methods to cut back bills related to investing and to supply efficient merchandise that allow traders to take part in financial progress and save. Index funds require fewer trades to maintain their portfolios than funds with more active management schemes and subsequently have a tendency to provide extra tax-efficient returns. The idea of an ETF is sweet, however bitcoin is healthier. You’ll be able to cowl loads of floor by means of an ETF, however you continue to should restrict your self to at least one index, business, or area. Nonetheless, while you purchase bitcoin, you purchase a human productiveness index. Bitcoin is like an “ETF on steroids”. Let me clarify :

The promise of Bitcoin ought to at the least be on everybody’s lips by now. A decentralized pc community (Bitcoin) with its personal cryptocurrency (bitcoin), which, as a peer-to-peer community, permits the alternate and, above all, the storage of worth. It’s the greatest cash we have now and the bottom protocol for essentially the most environment friendly transaction community there’s (Lightning Community). It is rather doubtless that Bitcoin will develop into the dominant community for transactions and retailer of worth within the not too distant future. At that time, it would act as an index of world productiveness. The extra productive we’re, the extra worth we create, the extra transactions are executed, the extra worth must be saved, the upper the demand for bitcoin, the upper the bitcoin value. I’ve come to the conclusion that as an alternative of utilizing an ETF to trace particular indices, I can use bitcoin to take part within the productiveness of all of humanity. As you would possibly anticipate, bitcoin’s returns have outperformed all ETFs since its inception.

Bitcoin Returns Versus ETFs Returns

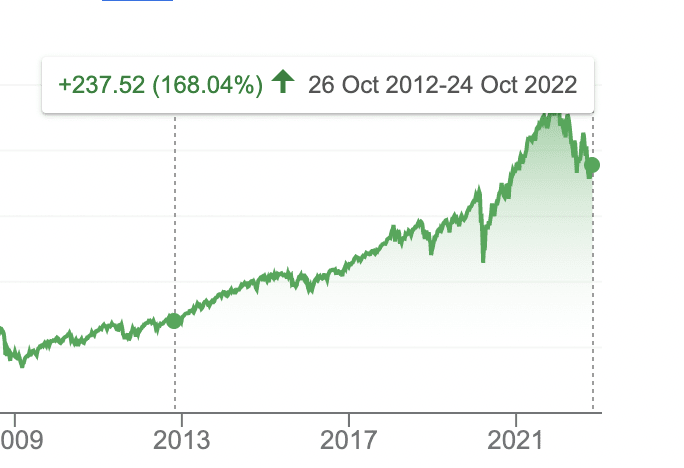

The SPDR S&P 500 ETF Belief is the biggest and oldest ETF on this planet. It’s designed to trace the S&P 500 inventory market index. The efficiency over the past decade (October 26, 2012 to October 25, 2022) was 168.0%, which interprets to a mean annual return of 16.68%. Not dangerous, particularly given that every one an investor needed to do was maintain.

Nonetheless, over the identical interval, bitcoin‘s efficiency was: 158,382.362%. Greater than 200% every year. We have all heard the phrase that previous efficiency isn’t any indicator of future efficiency, that could be true. However that’s not the case with bitcoin. The upper a inventory goes the riskier it turns into, due to the P/E ratio. Not bitcoin. When bitcoin increases in price, it turns into much less dangerous to allocate to, due to liquidity, measurement and world dominance. The Bitcoin Community has now reached a measurement the place it WILL final (Lindy Effect).

We are able to subsequently conclude that bitcoin is more likely to proceed to outperform ETFs going ahead.

Bitcoin has different benefits over an ETF. First, it has a decrease price construction. Second, the latter is a basket of securities held by a 3rd social gathering. You aren’t free to eliminate your ETFs. In case your financial institution, for no matter purpose, decides to shut your account, your ETFs are gone too. Bitcoin, then again, can’t be taken away from you or denied entry so simply. Moreover, bitcoin might be moved throughout the web at will on the velocity of sunshine, making confiscation almost unimaginable.

Conclusion

Bitcoin is the perfect wealth preservation know-how for the digital age. A completely scarce digital native bearer asset with no counterparty danger that can not be inflated and is definitely transportable. A digital retailer of worth, transferable on the world’s strongest pc community. Contemplating that the Bitcoin community may theoretically retailer the entire world’s wealth (International wealth reached a report excessive of $530 trillion in 2021, according to the Boston Consulting Group), it could be essentially the most environment friendly means we people have discovered to retailer worth ever. By holding bitcoin your wealth goes to be protected, doubtless growing it by 10x,100x, possibly 500x, throughout this early monetization course of. If you hold out for the next few decades.

In closing, I might wish to revisit Jack Bogle, who was an enormous affect on me. As described by Eric Balchunas, Bogle‘s life work is addition by subtraction. Eliminating the administration charges, eliminating the turnover, eliminating the brokers, eliminating the human emotion and the bias. His complete life’s work had been in an analogous path, and as such, I believe bitcoin suits nicely along with his funding ethos. Bogle’s major philosophy was “widespread sense” investing. He advised Reuters in 2012. “Most of all, you have to be disciplined and it’s a must to save, even should you hate our present monetary system. As a result of should you don’t save, then you definitely’re assured to finish up with nothing.” Bitcoin is similar to what Bogle envisioned with passive mutual funds. A long run financial savings automobile for traders to put their disposable revenue with low price and little danger. Do not be distracted by bitcoin’s volatility or destructive press, to cite Jack Bogle: stay in the course. We’re simply getting began, keep humble and stack sats. Your future self will thanks.

This text is the final in a three-part collection through which I purpose that can assist you perceive a number of the advantages of utilizing Bitcoin as a “device.”

In part one, I explained what opportunities bitcoin offers for real estate investors.

In part two I described how bitcoin can help us find optimism for a brighter future.

It is a visitor submit by Leon Wankum. Opinions expressed are totally their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.

[ad_2]