[ad_1]

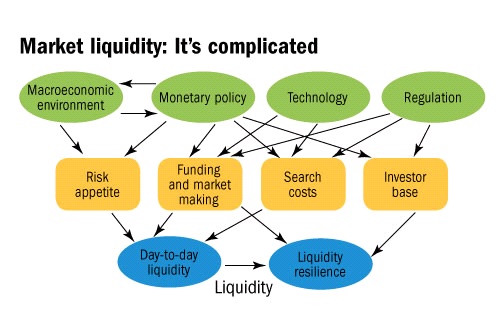

An asset’s liquidity refers back to the ease with which an asset might be purchased or bought. Inside the monetary markets, the time period usually pertains to the speedy conversion of a monetary safety to usable money, since money is taken into account essentially the most liquid asset. By extension, market liquidity measures the pace that commerce can execute with out inflicting any change to the underlying market value. In consequence, market liquidity is extremely essential to Foreign exchange markets, the place shopping for and promoting a foreign money pair received’t create vital value motion of the foreign money itself.

Market Liquidity Defined

Tangible shops of worth akin to property, collectibles, items and autos are all troublesome to purchase or promote relative to money. Every monetary automobile falls on a special location of the liquidity spectrum, with illiquid belongings representing the toughest to commerce.

However, liquid belongings with speedy commerce occasions (like securities) can commerce fingers a number of occasions a day with transaction volumes effectively into the hundreds of thousands. Such buying and selling pace is of specific significance for brokers and market makers, as with no seamless quantity of trades, market operate decreases. Liquidity permits for costs to raised mirror the ebbs and flows of provide and demand, and market makers can cost a diffusion on the bid-ask value (and even present liquidity to shoppers because the market calls for). Liquid belongings by nature can transact with ease, and that retains costs secure for a extra lively and protected market.

With out liquidity, brokers can run into bother attributable to the opportunity of drastic value fluctuations. Since illiquid belongings are exhausting to trade, market exercise mutes and bid-ask spreads widen. Even when the merchandise is of immense worth (e.g. uncommon collectibles), the prolonged sale course of ends in few patrons. The asset is difficult to promote and the market members are restricted, so stress builds on the vendor to cost the merchandise at a reduction. The very act of buying and selling an illiquid asset can decrease its accepted value, even past the anticipated guide worth. An absence of depth out there causes losses and makes for a disordered market.

The Significance of Market Liquidity

Market liquidity is essential as a result of it decreases threat.

If there are not any patrons for a selected asset, its money worth turns into irrelevant. It doesn’t matter if it’s a inventory or an artwork piece, with no buying and selling associate, the merchandise can return no wealth. Immense illiquidity introduces commerce threat.

Traders are cautious of that liquidity threat and search monetary autos with loads of lively patrons and sellers. Brokers do effectively by discovering or supplying such liquidity to their clients, contributing to the expansion of the market itself. The bigger the variety of gamers within the subject, the upper the chance you’ll be able to provide funding alternatives to shoppers at costs they’re keen to simply accept.

Excessive market liquidity additionally lowers general prices, for each brokers and shoppers. If there may be an imbalance of provide and demand, the distinction between what buyers will bid and what a vendor asks widens. The few members in a selected asset can not agree on the value, so commerce execution time extends. Prices enhance, hurting all market gamers.

Conversely, with excessive market liquidity, quite a few patrons and sellers can execute transactions. Any vendor can quickly flip to purchase a foreign money with out it affecting value stability. Excessive market liquidity and the presence of many patrons make value changes attributable to buying and selling occurring in small increments.

How Liquidity Impacts Asset Worth

If buyers really feel like the prices to commerce or purchase a foreign money are too excessive, they may shift to extra promising ventures. For instance, sluggish order routing, brokerage commissions and settlement prices can all forestall lively capital allocation. For brokers and market makers, an absence of exercise decreases commerce quantity, decrease fee values or provides on liquidity premiums. Development for markets and organizations slows, hurting income.

With that information, governments, companies and market makers all try to create an environment friendly market construction. Traders will all the time weigh the prices of not submitting a commerce with the convenience of a transaction, a clean fairness market move created by liquidity protects asset values and investor safety.

STP Vs Market Maker

Foreign exchange transactions are extremely liquid and happen Over-the-Counter (OTC) with merchants the world over. In consequence, the primary market members are liquidity suppliers and main banks. FX Brokers have a alternative of executing investor trades with the market members (often called the interbank market) via two fashions, Straight By way of Processing (STP) or Market Maker.

STP works via a linked digital system the place the dealer has no direct affect on the execution of an order. All bids or asks ship to a central, liquid pool that competes to finish trades. In consequence, trades execute shortly, and brokers tackle restricted threat. Cash is earned on buying and selling turnover, and brokers can choose from quite a lot of liquidity swimming pools that supply one of the best (and most correct) foreign money costs.

Market makers deliver the precise market liquidity to their shoppers. The market maker will purchase and promote foreign money on the open market and ship that to buyers. This usually requires the dealer to take the alternative aspect of the commerce, which means they make earnings off of shopper losses. In a extremely liquid market, when the shopper buys, the market maker sells, although the market maker decides at what costs orders are crammed. In consequence, foreign money value actions are sometimes extra secure with Market Maker brokers.

Each strategies make a market and provide liquidity to buyers who need to make purchases. The best methodology will rely upon desire and threat tolerance, MM can earn more money, however STP is extra trusted and executed sooner.

Measuring Market Liquidity

Market liquidity just isn’t a hard and fast worth, so brokers can measure general market exercise by referring to 3 key indicators:

Buying and selling Quantity – Buying and selling quantity refers back to the quantity of a selected safety that transacts over a set time period. A excessive quantity of trades signifies the presence of quite a few patrons and sellers who may make trades with ease.

Bid/Ask Spreads – The Bid/Ask unfold measures the distinction in value settlement between a purchaser and a vendor for a selected asset. The similarity, within the bid and ask costs infers sooner transaction speeds with higher value stability.

Turnover Ratios – Turnover ratios check with how usually an asset trades towards the whole variety of out there shares. If a selected firm has little inventory turnover mixed with a considerable amount of leftover inventory, buyers assume it’s unpopular. Provide is just too excessive, so it will likely be exhausting to promote the inventory at a later date, even when the inventory will increase in worth.

The Most Liquid Markets

The place can brokers discover market liquidity? Money and money equivalents stay essentially the most liquid asset class as a result of they’ll purchase virtually any items and companies. All different asset courses are outlined relative to their conversion to money, with marketable securities as essentially the most liquid.

● Foreign exchange: Governments, banks and main funding teams all have interaction at scale on the Foreign exchange markets. Overseas reserves again liabilities and international coverage, leading to a every day quantity of round $6.6 Trillion.

● Shares: Completely different markets, exchanges and indexes all help quite a lot of choices on the liquidity spectrum. On common, the help buildings in equities provide speedy execution and excessive commerce quantity, particularly for large-cap shares.

● Commodities: Whereas commodities are fairly illiquid attributable to their relation to a bodily useful resource, monetary devices (e.g. derivatives) can create market liquidity. Commodities with routine software in every day life (oil, gold and different treasured metals) keep excessive ranges of liquidity.

Conclusion

For brokers, particularly in Foreign exchange markets, liquidity is a necessity, as though the asset can transact shortly, restricted monetary establishments and liquidity swimming pools can restrict your ease of getting into or exiting a commerce (foreign money pair). Lively foreign money pairs akin to GBP/USD or USD/JPY have prolonged liquidity, permitting for simple shopping for and promoting with none drastic impact on value. Brokers would do effectively to look at for value gaps or widening bid/ask spreads as indicators of muted market exercise and the specter of illiquidity.

supply https://www.financemagnates.com/foreign exchange/education-centre/understanding-liquidity-and-market-liquidity/?tg=1657794987

-

←

→

USD $2,800USD $2,000

2 IN 1, Particular Commodity Gold and Silver EA & Costume Template Indicator, Plus Free Vps Bonus with required dealer associate memberforex

Most amount exceeded

Minimal buy quantity of 0 is required

2 IN 1, Special Commodity Gold and Silver EA & Costume Template Indicator, Plus Free Vps Bonus with required broker partner memberforex

2 IN 1

USD $2,800

USD $2,000Efficiently Added to your Buying Cart

-

←

→

USD $1,500USD $1,300

BOT TRADING SPECIAL FOR FUND MANAGER PAMM MAMM CopyTrader. Correct winner buying and selling morethan 80%, Very Easy Auto Commerce With Algo mathematic Trapping Markets with averaging lock pattern value

Most amount exceeded

Minimal buy quantity of 0 is required

BOT TRADING SPECIAL FOR FUND MANAGER PAMM MAMM CopyTrader. Accurate winner trading morethan 80%, Very Simple Auto Trade With Algo mathematic Trapping Markets with averaging lock trend price

EA PAMM MAMM CopyTrader

USD $1,500

USD $1,300Efficiently Added to your Buying Cart

-

←

→

USD $1,800USD $1,500

Indicator Hierarki Zone Supplier Limitless Vertion For HFT, DMA ECN Dealer

Pair Main, CFD, Commodity, Steel, Crypto

All TF. Really useful For Scalper & Swing Dealer. Solely For Actual Account MT4Most amount exceeded

Minimal buy quantity of 0 is required

Indicator Hierarki Zone Dealer Unlimited Vertion For HFT, DMA ECN Broker

Pair Major, CFD, Commodity, Metal, Crypto

All TF. Recommended For Scalper & Swing Trader. Only For Real Account MT4Hierarki Zone Dealer Unlimited

USD $1,800

USD $1,500Efficiently Added to your Buying Cart

-

←

→

USD $1,800USD $1,500

Mode Usually-Not HFT. Very Easy Auto Commerce With Algo mathematic, Time Body M1 auto lock fitur hedging, H1 Intraday No Martiangle with No Hedging, No dll msimg File, No kernel32.dll (“historical past commerce”), No Want DataFeed, request robotic By Telegram https://t.me/BudimanCahyo

Most amount exceeded

Minimal buy quantity of 0 is required

Mode Normally-Not HFT. Very Simple Auto Trade With Algo mathematic, Time Frame M1 auto lock fitur hedging, H1 Intraday No Martiangle with No Hedging, No dll msimg File, No kernel32.dll (“history trade”), No Need DataFeed, request robot By Telegram https://t.me/BudimanCahyo

Intraday Day Scalping Robot

USD $1,800

USD $1,500Efficiently Added to your Buying Cart

-

←

→

USD $1,500USD $1,300

EA Samurai Limitless Vertion For DMA ECN Dealer

Pair Main and All Pair

TF M5, M30. Solely For Actual Account MT4Most amount exceeded

Minimal buy quantity of 0 is required

EA Samurai Unlimited Vertion For DMA ECN Broker

Pair Major and All Pair

TF M5, M30. Only For Real Account MT4Samurai EA Unlimited

USD $1,500

USD $1,300Efficiently Added to your Buying Cart

-

←

→

USD $2,000USD $1,800

Bot Particular For Dealer Challange Dealer Agency Fund. TF H1, D1, M5 , declare free vps & free upkeep montly and low cost 20% required our agency dealer associate.

Most amount exceeded

Minimal buy quantity of 0 is required

Bot Special For Trader Challange Broker Firm Fund. TF H1, D1, M5 , claim free vps & free maintenance montly and discount 20% required our firm broker partner.

Special Bot For Broker Firm Hedge Fund

USD $2,000

USD $1,800Efficiently Added to your Buying Cart

-

←

→

USD $2,800USD $2,000

EA Particular For Gold, Silver, AddOn Index Germany DAX, Index Australia 200 (no Want Information Feed or Calculation Unfold) For DMA ECN or Prime Dealer, really helpful for Scalper, Swing. TF M1, M5, M15 H1, H4, D1 , declare free vps & free upkeep montly with required our dealer associate. Contact Telegram @MemberForexBot

Most amount exceeded

Minimal buy quantity of 0 is required

EA Special For Gold, Silver, AddOn Index Germany DAX, Index Australia 200 (no Need Data Feed or Calculation Spread) For DMA ECN or Prime Broker, recommended for Scalper, Swing. TF M1, M5, M15 H1, H4, D1 , claim free vps & free maintenance montly with required our broker partner. Contact Telegram @MemberForexBot

Special Silver Gold

USD $2,800

USD $2,000Efficiently Added to your Buying Cart

-

←

→

USD $1,500USD $1,100

Tick GJ EA Lifetime Vertion, Lock 2 Acc MT4, For DMA NDD ECN Dealer

Pair GJ, EJ and Nasdaq, S&P

TF M5, M1

FREE VPS 6 monthMost amount exceeded

Minimal buy quantity of 0 is required

Tick GJ EA Lifetime Vertion, Lock 2 Acc MT4, For DMA NDD ECN Broker

Pair GJ, EJ and Nasdaq, S&P

TF M5, M1

FREE VPS 6 monthTick GJ

USD $1,500

USD $1,100Efficiently Added to your Buying Cart

[ad_2]