[ad_1]

ipuwadol

Because the US inventory market has been reaching new highs month over month because of sturdy tech bull-run, buyers with modest to average danger tolerance buyers, who typically hesitate to chase high-beta investments and depend on low-beta worth and dividend-focused shares, have been struggling to generate wholesome returns since early 2023. I consider betting on low-volatility shares and ETFs wouldn’t assist in producing market-beating returns within the present and future market situations. Subsequently, it may be smart to vary the technique by concentrating on shares or ETFs with the potential to capitalize on the bull run whereas providing draw back safety. One option to obtain a excessive risk-adjusted return is to chase ETFs, akin to Constancy® Elementary Giant Cap Core ETF (BATS:FFLC), which consists of greater than 104 well-established worth and development shares from the S&P 500 index.

Inventory Market Outlook

SP 500 worth efficiency (Looking for Alpha)

The S&P 500 rallied greater than 32% within the final twelve months as tech shares carried out exceptionally with many main tech behemoths doubling and tripling in worth. Furthermore, regardless of lofty valuations, market fundamentals and earnings development energy recommend that the bull run is more likely to final over the brief to medium-term. In 2024, the Fed plans to slash charges thrice whereas the US financial development is anticipated to stay average. Unemployment charge has elevated barely and inflation seems to be falling right into a focused vary. All this bodes effectively for a comfortable touchdown, which is a robust sign for the inventory market and enterprise actions.

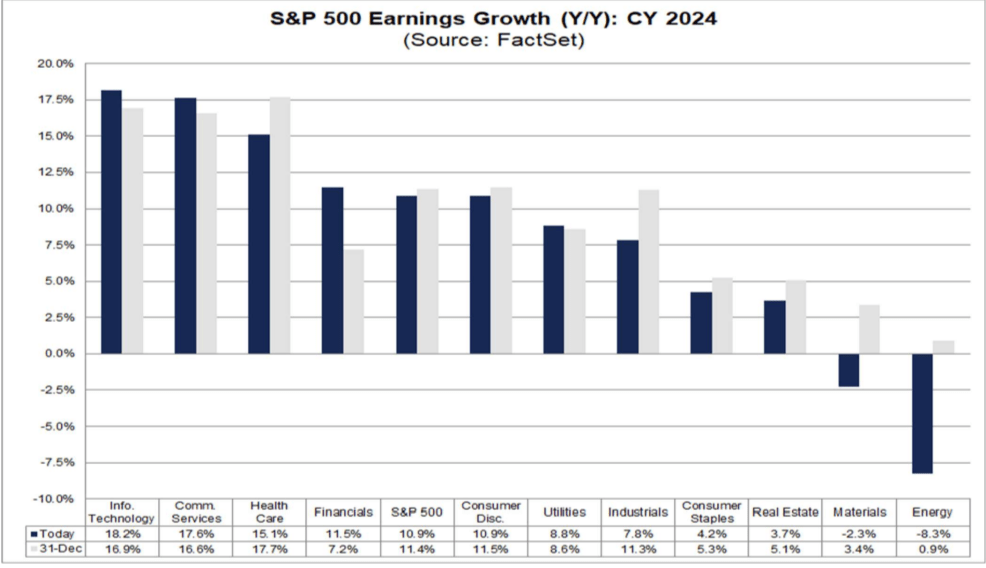

2024 earnings forecast (FactSet)

Moreover, the earnings development power, notably of tech shares, is more likely to again the uptrend. The tech sector is anticipated to generate 19% earnings development whereas communication and client cyclical shares are additionally poised to publish a excessive double-digit earnings development in 2024. Earnings and share worth development prospects of large-cap shares from the monetary, healthcare, and industrial sectors are additionally sturdy. Subsequently, it’s extremely probably that the bullish market situations are more likely to final with the tech and development shares main the uptrend.

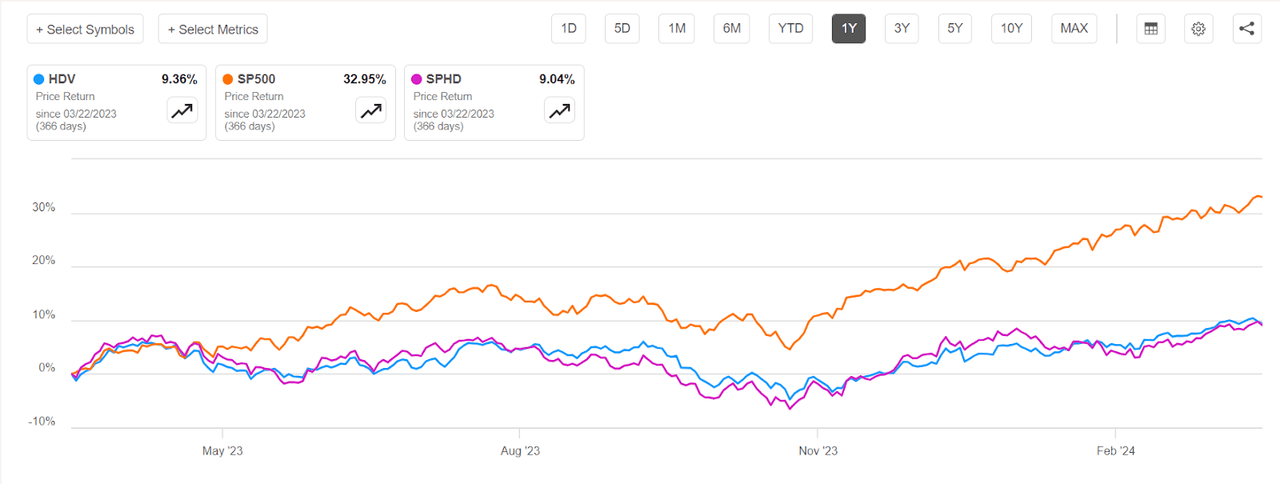

HDV and SPHD share worth efficiency (Looking for Alpha)

In the meantime, dividend centered shares and ETFs from the defensive sectors are more likely to underperform considerably in bullish situations. For example, Invesco S&P 500 Excessive Dividend Low Volatility ETF (SPHD) generated a share worth return of 9% and the entire return of 14% within the final twelve months, down considerably from the S&P 500’s worth achieve of 32% and the entire return of 35%. The return from the iShares Core Excessive Dividend ETF (HDV) continues to underperform than the broader market index. The sluggish share worth and dividend returns are blamed on their important concentrate on small and mid-caps from non-cyclical sectors. Over the previous 12 months, a lot of the S&P 500 returns and earnings development have been pushed from large-cap shares from the tech, monetary, healthcare and industrial sectors.

Why Does FFLC Is a Strong ETF for Low-Danger Tolerance Buyers?

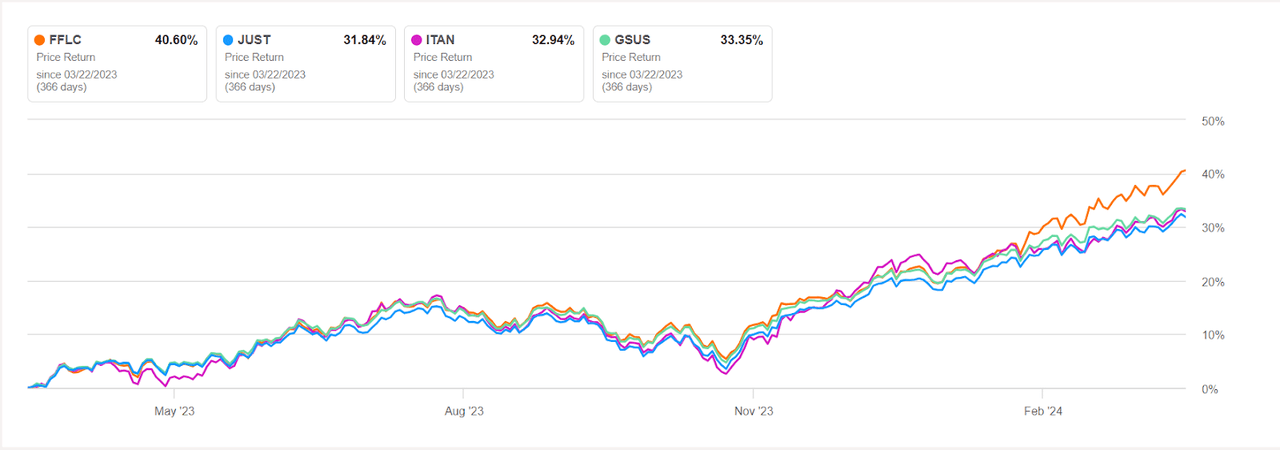

FFLC worth efficiency (Looking for Alpha)

Though FFLC is a brand new ETF with low property beneath administration and buying and selling quantity, its portfolio composition makes it one of many enticing choices for modest to average risk-tolerance buyers. It has outperformed the broader market index by a big share in 2023 and 12 months thus far. The ETF’s outperformance is attributed to its technique of selecting essentially sound giant cap shares through the use of a bottom-up method. Its stock-picking technique concentrates on figuring out early indicators of a shift out there situation and aligning the portfolio with these modifications to learn from the shift. Moreover, its portfolio composition contains top-performing shares from each development and worth classes, which helps it capitalize on the present tech-driven bull run whereas providing a draw back safety.

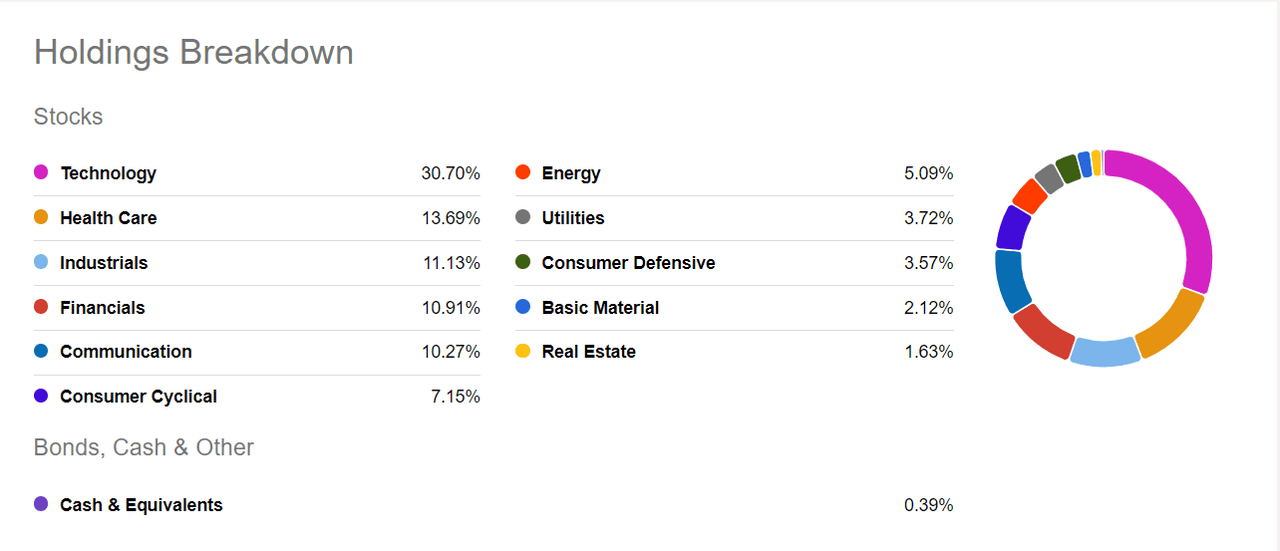

FFLC portfolio sector publicity (Looking for Alpha)

Its portfolio is well-diversified throughout varied sectors, with fast-growing expertise and communication shares accounting for almost 31% and 10% of your complete portfolio. Moreover, the ETF contains solely top-performing mega-cap tech shares which are benefiting from the AI growth. These shares embody Microsoft (MSFT), Apple (AAPL), Meta (META), NVIDIA (NVDA), Amazon (AMZN) and Alphabet (GOOG). All these shares belong to the magnificent 7 group, which generated a median 110% worth development in 2023 and contributed considerably to the S&P 500’s bull run. Furthermore, these shares have prolonged their sturdy momentum into 2024. For example, shares of NVIDIA are up almost 90% because of bolstering demand for its AI-supported chips. Its December quarter income of $22.1 billion elevated 265.3% 12 months over 12 months, with expectations for 82% income and 90% earnings improve in 2024. Microsoft and Alphabet are additionally anticipated to generate double-digit income and earnings development.

Beside mega-cap tech shares, the ETF has important publicity to large-cap healthcare, monetary and industrial sectors. These sectors are additionally anticipated to generate double-digit earnings development in 2024. Consequently, their shares are additionally following the broader market bull run. The healthcare sector is up 6% 12 months thus far whereas the commercial and monetary sectors reported almost a ten% achieve. Total, the ETF’s portfolio composition positions it to capitalize on the bull run and decrease the draw back danger.

Peer Comparability and Quant Score

FFLC share worth efficiency in comparison with friends (Looking for Alpha)

FFLC outperformed its friends within the final twelve months, because of its portfolio administration methods. Its friends, akin to Goldman Sachs JUST U.S. Giant Cap Fairness ETF (JUST), generated wholesome returns however underperformed in comparison with FFLC. The underperformance is blamed on its considerably diversified portfolio and concentrate on numerous mid and small-cap shares. Equally, Goldman Sachs MarketBeta US Fairness ETF’s (GSUS) portfolio composition of almost 484 shares decrease its focus on top-performing shares and will increase its publicity to non-profitable shares from small and mid-cap section.

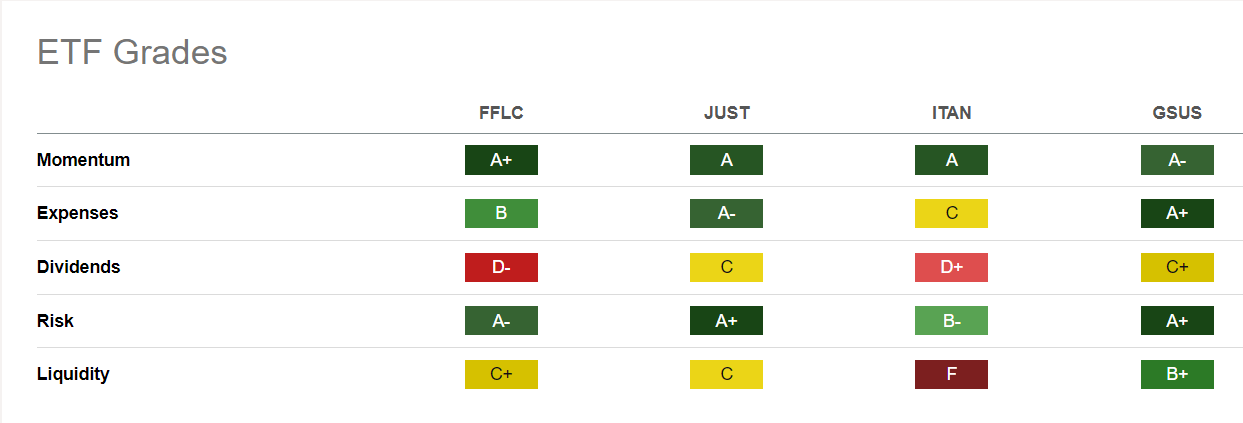

FFLC and friends quant ranking (Looking for Alpha)

FFLC additionally seems like one of the best ETF amongst its friends primarily based on quant ranking. Its A-plus rating on the momentum issue and destructive A on danger vindicates my opinion about its potential to generate excessive risk-adjusted returns. Its dividend rating is low however dividends don’t matter when chasing returns by way of worth appreciation in bullish market situations. Additionally it is ranked at 1st spot in its sub-asset class.

In Conclusion

Buyers with modest and average risk-tolerance may obtain excessive risk-adjusted returns in a bullish situation by investing in ETFs like Constancy® Elementary Giant Cap Core ETF. Its essentially sturdy portfolio has the potential to capitalize on the uptrend whereas decreasing the draw back danger. The ETF’s current efficiency additionally means that its portfolio is considerably aligned with market situations and more likely to thrive in a bull run.

[ad_2]