[ad_1]

A staff of funding strategists from Piper Sandler sheds mild on the everyday triggers behind stock-market corrections, figuring out three important culprits: rising unemployment, growing bond yields, or surprising international shocks.

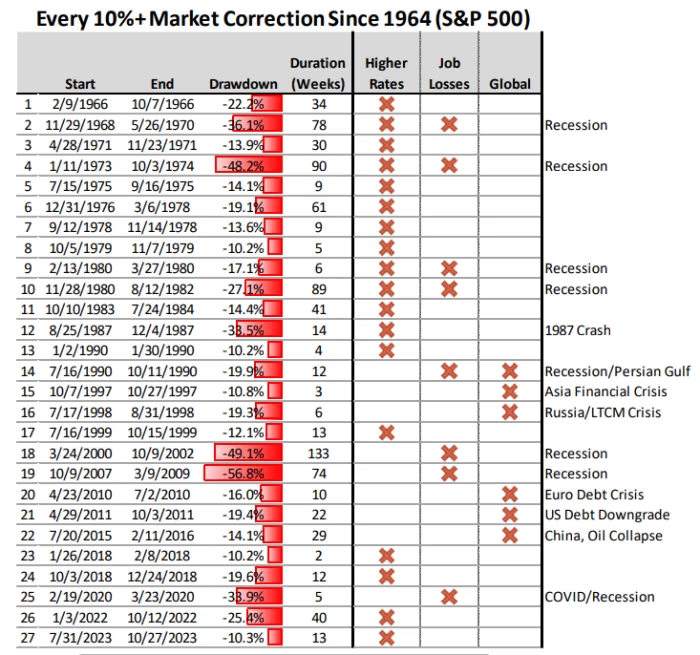

The current surge within the S&P 500, up practically 30% in 5 months, has even bullish analysts contemplating the potential of a “wholesome” correction. Nevertheless, corrections don’t spontaneously happen; they normally require a catalyst. To anticipate potential triggers for the following vital downturn, Piper Sandler’s Michael Kantrowitz and his staff analyzed the 27 corrections of 10% or extra for the S&P 500 since 1964.

Their analysis reveals that every of those corrections was predominantly propelled by one in all three elements: escalating unemployment, climbing bond yields, or unexpected international occasions. Typically, it’s a mix of those elements, as evidenced by the 2 equity-market corrections in 1980.

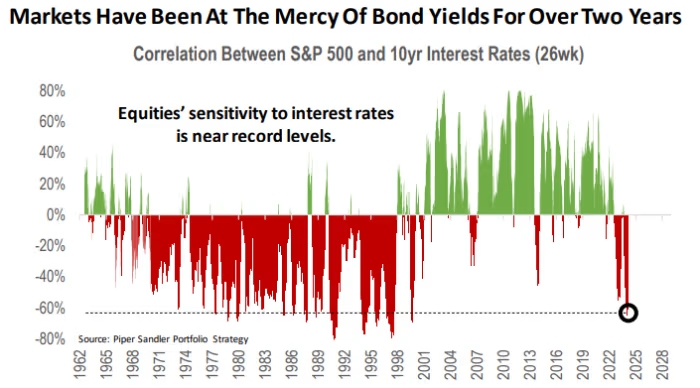

So, what’s most definitely to provoke the following 10% correction? In keeping with Kantrowitz and staff, the first menace to stable markets is rising bond yields. The newest correction, ending on October 27 with the S&P 500 down 10.3%, was additionally triggered by climbing yields.

Up to now two years, shares’ susceptibility to rising yields has soared to ranges close to these noticed on the peak of the dot-com bubble. This suggests that stocks might react negatively to additional will increase in long-term bond yields, regardless of their relative immunity to such rises because the starting of 2024.

Kantrowitz emphasizes {that a} modest uptick in unemployment might truly benefit the market by performing as a counterforce in opposition to rising yields. Sometimes, bond yields lower throughout financial slowdowns as demand for defensive property like bonds rises.

Final yr, shares skilled a three-month sell-off as Treasury yields surged. The bottom level of the downturn got here shortly after the 10-year Treasury yield hit over 5%, a stage not seen in 16 years.

Though Treasury yields are as soon as once more edging greater within the first quarter, expectations of sturdy financial development supporting company earnings have to date shielded shares. The ten-year Treasury observe’s yield has risen by 39 foundation factors because the yr started, reaching 4.252%, whereas the S&P 500 has climbed by 9.4% and 26.7% because the begin of the quarter and since October 27, respectively.

Equally, the Nasdaq Composite is up 9.6% because the starting of the primary quarter, closing at 16,452.69 as of Tuesday, whereas the Dow Jones Industrial Common has gained 4.5%, or 1,670.79 factors, to achieve 39,388.56.

[ad_2]