[ad_1]

EUR/USD Costs, Charts, and Evaluation

- The German financial system is struggling in accordance with 5 main financial institutes.

- Two ECB rate cuts earlier than the August vacation break?

Study Find out how to Commerce EUR/USD with Our Complimentary Information

Recommended by Nick Cawley

How to Trade EUR/USD

The German financial system is in hassle and is anticipated to increase by the barest of margins in 2024, in accordance with 5 main financial analysis institutes. The institutes have revised their change in German GDP within the present yr, ‘considerably downward by 1.2 proportion factors to 0.1%, in comparison with their fall report.’ The German authorities lately reduce their 2024 progress forecast to only 0.2%, with one official saying that the nation’s financial system is in ‘troubled waters’. The German financial system contracted by 0.3% in Q3 2023 and by 0.2% within the fourth quarter.

Joint Economic Forecast Spring 2024

For all market-moving financial information and occasions, see the real-time DailyFX Economic Calendar

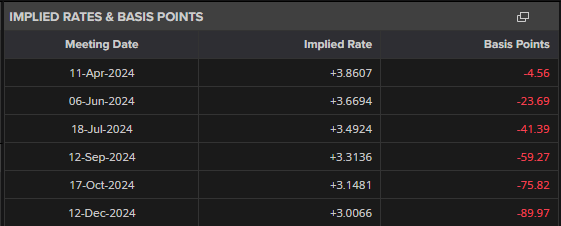

The European Central Financial institution (ECB) is anticipated to chop its borrowing price by 25 foundation factors on the June sixth coverage assembly, and in accordance with present market pricing, they could reduce once more in July, forward of the August vacation season. The German financial system will want the ECB to aggressively unwind its present restrictive monetary policy in order that it will possibly develop within the second half of the yr.

Recommended by Nick Cawley

Recommended by Nick Cawley

Master The Three Market Conditions

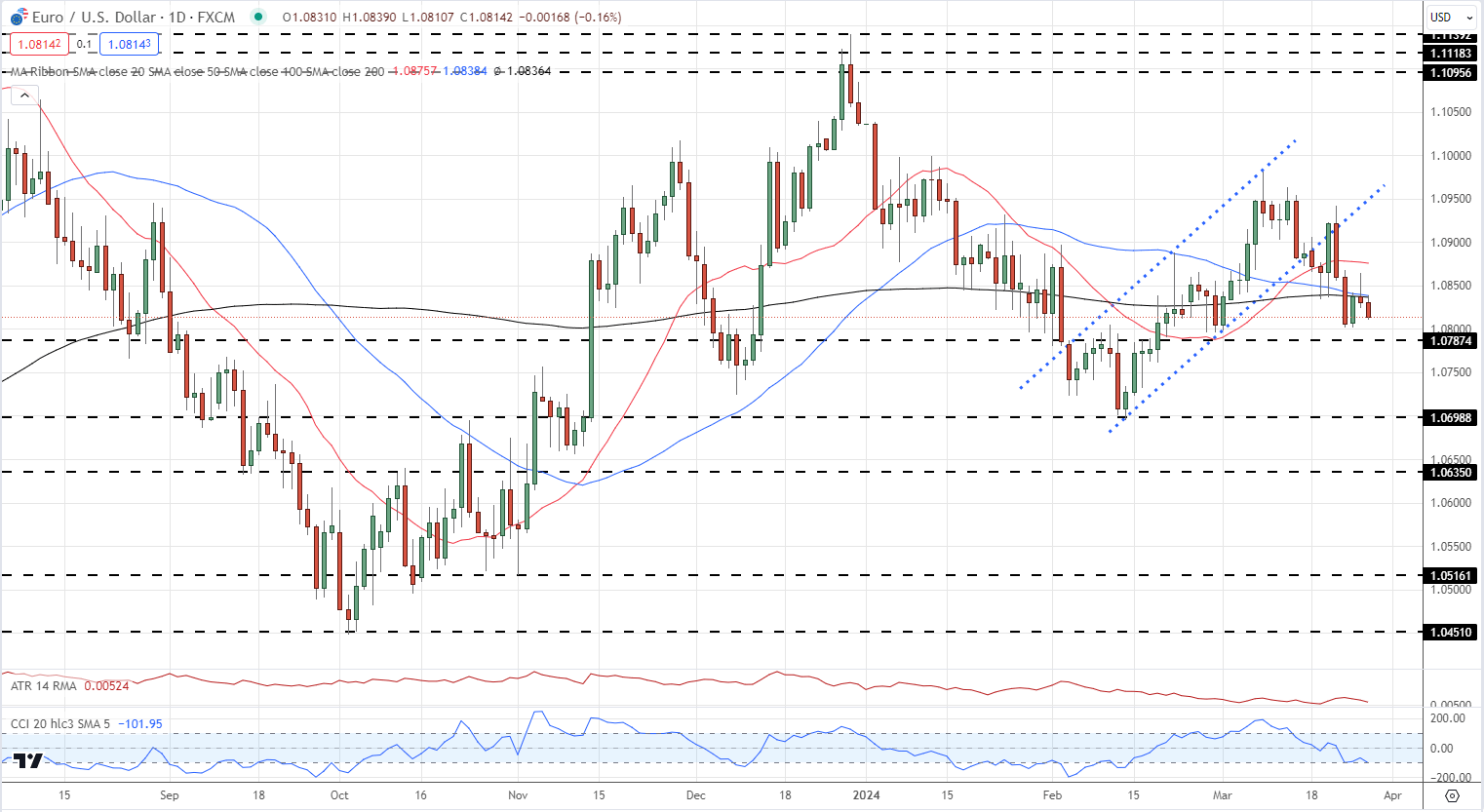

EUR/USD is buying and selling round 1.0815, a fraction above the latest double 1.0800 low. The US dollar has regained some power in latest days and a mix of a powerful USD/weak EUR will possible see the pair check this latest low shortly. Beneath right here, 1.0787 comes into focus forward of the mid-February lows seen at a fraction beneath 1.0700.

EUR/USD Every day Value Chart

Charts utilizing TradingView

Retail dealer information exhibits 54.96% of merchants are net-long with the ratio of merchants lengthy to quick at 1.22 to 1.The variety of merchants net-long is 5.09% larger than yesterday and three.17% decrease from final week, whereas the variety of merchants net-short is 1.29% larger than yesterday and three.11% larger from final week.

We usually take a contrarian view to crowd sentiment, and the actual fact merchants are net-long suggests EUR/USD prices could proceed to fall.

| Change in | Longs | Shorts | OI |

| Daily | 6% | -2% | 2% |

| Weekly | 5% | -2% | 2% |

What’s your view on the EURO – bullish or bearish?? You’ll be able to tell us through the shape on the finish of this piece or you may contact the writer through Twitter @nickcawley1.

[ad_2]