[ad_1]

A quant has defined that the previous sample within the Bitcoin taker buy-sell ratio metric could recommend one of the best window to start out promoting the asset.

Bitcoin Taker Purchase Promote Ratio Could Reveal Promoting Alternatives

In a CryptoQuant Quicktake post, an analyst mentioned the pattern within the Bitcoin “taker buy sell ratio.” This indicator retains monitor of the ratio between the Bitcoin taker purchase and taker promote volumes.

When the worth of this metric is bigger than 1, the traders are keen to buy cash at the next value proper now. Such a pattern implies a bullish sentiment is the dominant power available in the market.

Then again, the indicator being below the mark suggests the promoting strain could also be larger than the present shopping for strain within the sector. As such, the bulk could share a bearish mentality.

Now, here’s a chart that exhibits the pattern within the 30-day transferring common (MA) Bitcoin taker buy-sell ratio over the previous couple of years:

The 30-day MA worth of the metric seems to have been happening in latest days | Supply: CryptoQuant

Because the above graph exhibits, the 30-day MA Bitcoin taker buy-sell ratio has lately fallen beneath the 1 degree. The quant has highlighted within the chart the area of the metric the place the bull run peaks in 2021 shaped.

The indicator would seem to dip beneath 0.97 throughout each the heights registered in that bull run. In response to the analyst, such indicator values recommend the euphoria part of the market the place the sensible cash begins to promote. Nonetheless, the costs proceed to carry on because the retail traders proceed to FOMO into the asset.

Up to now, the indicator has approached the 0.98 degree in its newest decline, implying that it’s not but on the ranges the place the opportunity of a prime may develop into vital if the sample of the earlier bull run is something to go by.

The Bitcoin taker purchase promote ratio can also be used as a shopping for sign, with the 1.02 degree being an essential degree. The quant notes, nevertheless, that the metric is healthier at displaying an overbought market than it’s for pinpointing oversold circumstances.

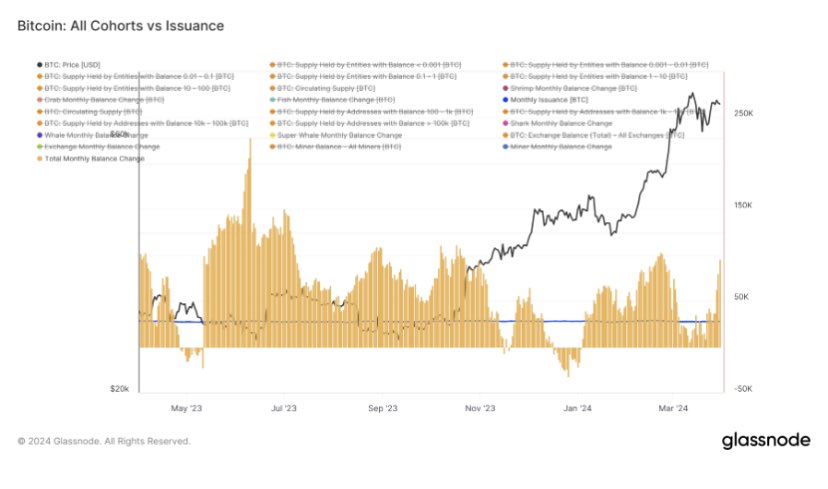

In different information, as an analyst identified in a post on X, all of the Bitcoin investor teams have accrued a internet quantity of 95,000 BTC ($6.5 billion on the present change fee) over the previous month.

The pattern within the month-to-month steadiness change for all BTC cohorts | Supply: @jvs_btc on X

This speedy accumulation means that the Bitcoin investor teams have been shopping for up considerably greater than the miners have produced. The chart exhibits that an accumulation streak of comparable ranges adopted the latest rally within the asset, so this newest one may also be bullish for the asset.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $68,600, up greater than 3% over the previous week.

Seems to be like the worth of the coin has registered a pointy drop up to now 24 hours | Supply: BTCUSD on TradingView

Featured picture from iStock.com, Glassnode.com, CryptoQuant.com, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data offered on this web site solely at your individual threat.

[ad_2]