[ad_1]

PhonlamaiPhoto

Funding Thesis

The First Belief NASDAQ Clear Edge Inexperienced Power Fund (NASDAQ:QCLN) is exclusive. It is considered one of solely a handful of renewable power ETFs buying and selling on U.S. exchanges. QCLN can even generate huge features, similar to its 184% complete return in 2020. Nevertheless, it is additionally able to doing exactly the alternative. In the present day, QCLN’s constituents are buying and selling about as removed from their 52-week excessive costs than another U.S. Fairness ETF in the marketplace. If you wish to be grasping when others are fearful, there is not any higher time to purchase QCLN.

To make sure, QCLN is extremely speculative, as I mentioned in my last review in November 2022. Nevertheless, hypothesis has a spot in some portfolios so long as you recognize the dangers. In the present day, I’ll study QCLN’s previous efficiency, present fundamentals, and the outlook for the renewable power market. Whereas not for me, I hope this info will enable you resolve if QCLN is definitely worth the gamble.

QCLN Overview

Technique Dialogue and Portfolio Composition

QCLN tracks the Nasdaq Clear Edge Inexperienced Power Index, deciding on U.S.-listed frequent shares and ADRs categorized as expertise producers, builders, distributors, or installers within the following 4 sub-sectors:

- Superior Supplies

- Power Intelligence

- Renewable Electrical energy

- Power Storage & Conservation

Picks should have a minimal market capitalization of $150 million, a mean each day buying and selling quantity of at the very least 100,000 shares, and a closing value per share above $1. The Index follows a modified market-cap-weighting scheme, rebalances quarter, and reconstitutes semi-annually. Presently, QCLN’s GICS sub-industry composition is as follows:

- Semiconductors: 20.72%

- Electrical Elements & Gear (Industrials): 18.35%

- Semiconductor Supplies & Gear: 16.32%

- Car Producers (Shopper Discretionary): 14.32%

- Semiconductors (Expertise): 11.98%

- Renewable Electrical energy (Utilities): 9.53%

- Specialty Chemical compounds (Supplies): 8.10%

- Digital Gear & Devices (Expertise): 3.97%

- Mortgage REITs (Financials): 1.58%

- Diversified Metals & Mining (Supplies): 1.26%

- Heavy Electrical Gear (Industrials): 1.25%

- Fertilizers & Agricultural Chemical compounds (Supplies): 1.12%

- Impartial Energy Producers & Power Merchants (Utilities): 0.94%

- Oil & Fuel Storage & Transportation (Power): 0.92%

- Building & Engineering (Industrials): 0.41%

- Oil & Fuel Refining & Advertising (Power): 0.30%

- Bike Producers (Shopper Discretionary): 0.22%

- Building Equipment & Heavy Transportation Gear: 0.16%

- Automotive Retail (Shopper Discretionary): 0.13%

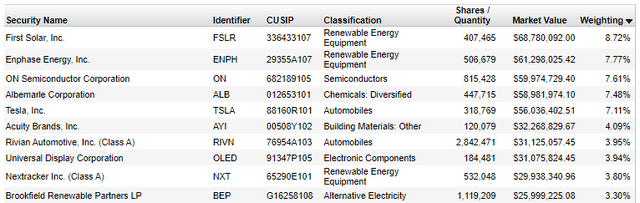

The 2 semiconductor sub-industries complete 37% of QCLN, so it is stunning that the ETF has lagged the S&P 500 Index by 74% since my final evaluation. However QCLN does not maintain Nvidia (NVDA), Micron Expertise (MU), or Broadcom (AVGO). As an alternative, it’s led by First Photo voltaic (FSLR), Enphase Power (ENPH), and ON Semiconductor (ON), three shares down 19.62%, 37.48%, and three.89% over the past 12 months.

The divergence of returns is proof {that a} rising tide doesn’t carry all boats with regards to the semiconductor {industry}. Amongst 89 shares, one-year value returns had been as little as -86.64% and 74.45% for Maxeon Photo voltaic Applied sciences (MAXN) and SolarEdge Applied sciences (SEDG), and sadly, QCLN holds each. The distinction is certainly high quality. Whereas QCLN’s ten semiconductor holdings have a 5.43/10 Revenue Rating, calculated utilizing particular person Looking for Alpha Profitability Grades, the iShares Semiconductor ETF (SOXX) scores 9.08/10. I will evaluation QCLN’s fundamentals in additional element shortly, however first, let’s take a look at QCLN’s observe document since its February 2007 begin date.

Efficiency Evaluation

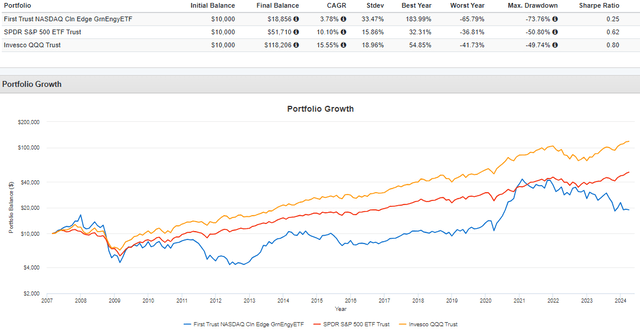

The next chart highlights how QCLN has delivered a 3.78% annualized acquire since its inception, considerably lower than the SPDR S&P 500 ETF (SPY) and the Invesco QQQ ETF (QQQ). Volatility was about twice as a lot, however the main draw is the 183.99% “finest 12 months” determine from 2020.

QCLN additionally gained 63.75% in 2007 and 93.91% in 2013. Nevertheless, the ETF declined the next 12 months in each instances and has solely delivered constructive returns in consecutive years in 2019-2020. After posting losses of three.21%, 30.37%, 10.03%, and 17.76% from 2021 to 2024 YTD, it is not unreasonable to imagine a powerful rebound is on the horizon.

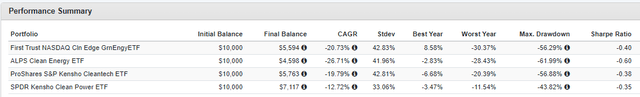

In my funding thesis, I discussed how QCLN’s constituents are buying and selling farther from their 52-week excessive costs greater than almost each different ETF. That is based mostly on making use of the next method to 839 funds:

[Current Price – 52 Week Low] / [ 52 Week High – 52 Week Low]

QCLN’s outcome was 31.48%, barely forward of the ALPS Clear Power ETF (ACES) and about 10% decrease than the ProShares S&P Kensho Cleantech ETF (CTEX). In different phrases, clear power shares are undoubtedly struggling throughout the board, so let’s look nearer on the fundamentals to see what’s occurring.

QCLN Evaluation

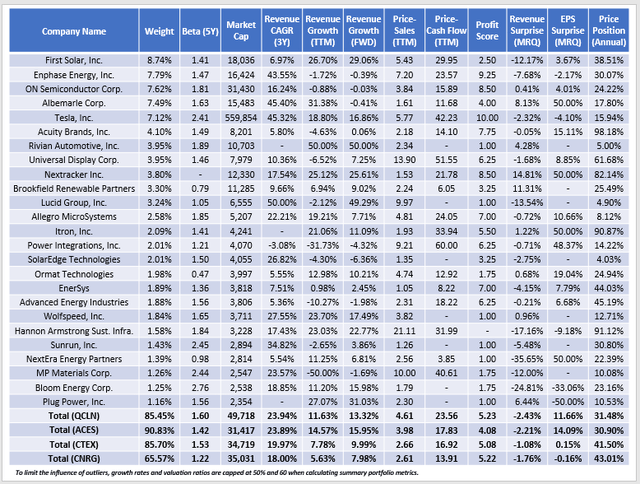

The next desk highlights chosen elementary metrics for QCLN’s prime 25 holdings, totaling 85.45% of the portfolio. As comparators, I’ve additionally included metrics for ACES, CTEX, and the SPDR S&P Kensho Energy ETF (CNRG), one other Renewable Power ETF to contemplate.

Listed here are 4 observations:

1. QCLN has a 1.60 five-year beta, indicating it is extremely risky in comparison with the broader market. We noticed this earlier within the efficiency chart, however this determine suggests it is much more risky than its friends. That is been the case since CTEX launched in September 2021, whereas CNRG was the least risky and held up the perfect.

2. Most renewable power shares are within the small- and mid-cap classes. QCLN has the best weighted common market capitalization ($50 billion), however that is solely resulting from its comparatively excessive allocation to Tesla (TSLA). Tesla stays a progress inventory, however that progress is slowing. Tesla has a forty five.32% annualized three-year gross sales progress fee, however the firm solely grew gross sales by 18.80% over the past 12 months, with comparable expectations (16.86%) for the subsequent 12 months.

That sample is constant for QCLN (23.94% / 11.63% / 13.32%). Nevertheless, the estimated progress charges for these shares are seemingly unreliable. Take into account how QCLN’s estimated one-year gross sales progress fee was 31.57% in November 2022, which did not materialize.

3. QCLN’s valuation ratios are additionally troublesome to calculate. The reason being that 27/56 constituents (22.33% of the portfolio by weight) posted a web revenue loss over the past twelve months and thus do not have a P/E. Subsequently, solely QCLN’s 4.61x trailing price-sales ratio is related, and sadly, it is the best of the 4 ETFs. QCLN’s 23.56x trailing price-cash stream ratio, which covers about 78% of the portfolio, can be the best.

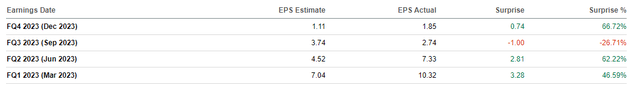

4. QCLN’s share value has declined, partly, as a result of its constituents missed gross sales expectations by 2.43% within the final quarter. The desk above additionally reveals an earnings shock of 11.66%, however prime holdings like First Photo voltaic, Enphase Power, and ON Semiconductor delivered surprises within the low-single-digits or worse. Others, like Albemarle (ALB), beat EPS expectations by 66.72%, and as proven under, the big surprises, each constructive and damaging, have been the norm over the past 4 quarters.

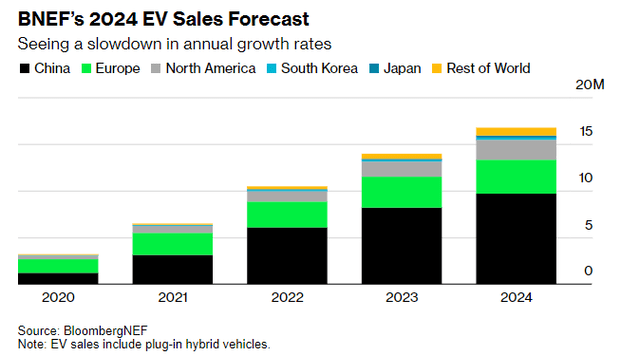

ALB, a prime lithium producer, has seen its share value decline by 39.61% over the past 12 months as lithium costs sank. Getting into 2023, the bullish argument was tight provide and robust demand for EVs. Nevertheless, BloombergNEF now sees a slowdown in annual progress charges, citing Tesla’s “getting older mannequin lineup” and decrease shopper demand forecasts from GM and Ford.

Funding Suggestion

QCLN is a extremely speculative play that ought to solely type a small portion of your portfolio, relying in your threat tolerance. Sadly, its fundamentals do not provide a lot perception apart from that Wall Road analysts do not know the place the renewable power {industry} is heading, both. On the one hand, that is excellent news. QCLN’s is among the most beaten-down ETFs over the past 12 months, and there is a respectable likelihood it is oversold. Nevertheless, assigning a purchase score would counsel its fundamentals are strong, and I’ve perception into the place commodity costs, significantly lithium, are headed, which isn’t the case. Subsequently, whereas huge short-term features are attainable, I like to recommend traders keep away from QCLN and give attention to less-speculative progress ETFs as a substitute. Thanks for studying, and I look ahead to your feedback under.

[ad_2]