[ad_1]

piranka

The Columbia Seligman Premium Expertise Progress Fund (NYSE:STK), $31.72 closing market value, has been the most well-liked and finest performing expertise progress CEF since its inception in November 2009.

A giant purpose for that is because of STK’s lead portfolio supervisor, Paul Wick, who has been with the fund since its inception and oversees all the transferring components of the fund.

How is that completely different than most option-income CEFs? Most option-income CEFs, whether or not they concentrate on utilizing the S&P 500 (SPY), $518.84 closing market value, and/or the Nasdaq-100 (QQQ), $441.11 closing market value, as their benchmark, will normally have a portfolio of shares designed to imitate the efficiency of their benchmark and will even maintain all of the shares of the benchmark.

The opposite limitation of most option-income CEFs is that they promote (write) a set notional worth proportion towards the whole worth of their portfolio it doesn’t matter what the broader market is doing.

In different phrases, nearly all option-write CEFs make use of a comparatively non-actively managed portfolios and are pretty methodical of their written choice technique. However for STK, the portfolio managers not solely make the most of an actively managed fairness portfolio, however in addition they have an actively managed choice technique utilizing the CBOE NASDAQ-100 Volatility Index (the VXN Index) to find out the notional worth proportion for the present month.

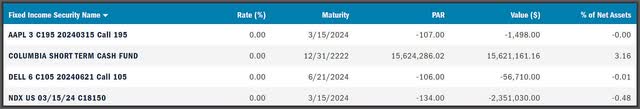

For individuals who do not perceive notional worth, it means the greenback worth of the choices if exercised. For instance, in STK’s most up-to-date portfolio holdings as of Feb. 29, 2024, the mounted revenue portion of STK’s portfolio is proven beneath and contains the next written choices on the Nasdaq-100 NDX in addition to some particular person choices on Apple (AAPL) and Dell (DELL):

Columbia Seligman

Word: The Columbia brief time period money fund is STK’s cash market fund.

So if STK is brief -134 choice contracts on the Nasdaq-100 NDX with a strike value of 18150 then the notional worth of the contracts is definitely worth the variety of contracts x the strike value x 100, which equals $243,210,000.

And if the overall worth of STK’s portfolio was roughly $493 million as of Feb. 29, then meaning the fund held brief choices value a notional worth of roughly 49% of the overall portfolio worth.

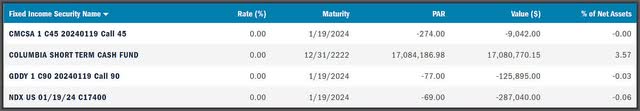

However if you happen to again as much as December 2023, the mounted revenue portion of STK’s portfolio seems to be like this:

Columbia Seligman

Right here you’ll be able to see that the fund held brief choices towards Comcast (CMCSA), and GoDaddy (GDDY) however extra importantly, the fund held solely –69 brief contracts on NDX.

Which means that the notional worth of the contracts on the finish of final yr was a a lot decrease $120 million vs. a complete portfolio worth of roughly $479 million. Thus the notional worth written was solely 25% again then.

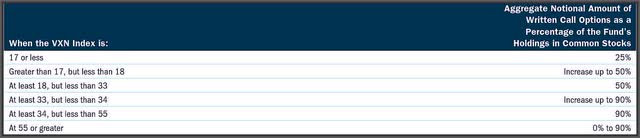

I do not know of another fairness CEF that makes use of the CBOE Nasdaq-100 Volatility Index to find out the month-to-month notional Worth of choices written and that is how its outlined in STK’s Annual Report as of 12/31/23:

The VXN Index measures the market’s expectation of 30-day volatility implicit within the costs of near-term Nasdaq 100 Index choices. The VXN Index, which is quoted in proportion factors (e.g., 19.36), is a number one barometer of investor sentiment and market volatility regarding the Nasdaq 100 Index. On the whole, the Funding Supervisor intends to write down extra name choices when market volatility, as represented by the VXN Index, is excessive (and premiums acquired for writing the choice are excessive) and write fewer name choices when market volatility, as represented by the VXN Index, is low (and premiums for writing the choice are low).

And right here that’s in a desk format:

Columbia Seligman

And that is from STK’s Fact Sheet:

The mixture notional quantity of the decision choices will usually vary from 25% to 90% of the underlying worth of the fund’s holdings of widespread inventory. The fund expects to generate present revenue from premiums acquired from writing name choices on the Nasdaq 100 or its ETF equal

So how is that helpful to shareholders? Typically, it signifies that STK will let its holdings trip when volatility is low and can write (promote) extra written choices when volatility is excessive.

Now evaluate to option-income CEFs that do not alter their written choice proportion and persistently write a excessive proportion of choices, say 75% to 100%, towards their portfolio worth. And that may imply dramatically much less NAV upside seize throughout a bull market like we have seen.

Then again, for option-income CEFs that promote a comparatively low proportion of choices, say, 25% to 50%, towards their portfolio worth, they will imply they’re much extra uncovered to the draw back in a bear market.

Largely it signifies that STK’s portfolio managers are going to be lots extra energetic in managing the portfolio in comparison with different option-income CEFs.

That does not imply that they may at all times be proper, however it’s a must to go on Mr. Wicks and the remainder of the staff’s expertise in managing the portfolio, each in what the portfolio at the moment holds in addition to managing the written choices to make the most of volatility when it’s in your favor.

And while you take a look at STK’s precise portfolio (prime 25 out of 59 positions proven beneath) as of Feb. 29, it does not even appear that “Magazine 7-centric” anymore anyway:

Columbia Seligman

Word: The Magnificent 7 shares, (MSFT), (META), (AMZN), (GOOGL), (NVDA), (AAPL) and (TSLA), was coined by Mark Hartnett of Financial institution of America in 2023.

However extra importantly, if STK’s present portfolio of roughly 60 giant cap progress and expertise shares outperforms its benchmark, the S&P North American Expertise Sector index, then the choices that STK writes on NDX, an identical index which strikes roughly the identical because the Nasdaq-100 (QQQ), then that may end up in an outperforming NAV.

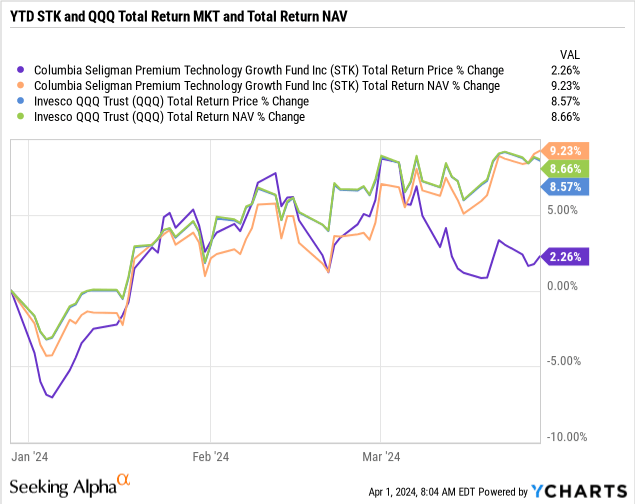

That is very troublesome for any option-write fairness CEF to outperform its benchmark in a ramp-up bull market, however to this point this yr, STK is doing simply that, up +9.2% vs +8.7% for the QQQ’s as of three/28/24:

Y-Charts

And this is the place the “distinctive alternative” in STK is available in. See the purple line above? That is STK’s whole return MKT value YTD, up solely +2.3%, and considerably beneath STK’s whole return NAV, +9.2% YTD.

Why is that taking place? It is in all probability largely attributable to the rising concern that enormous cap progress and expertise shares might have already peaked after their sturdy outperformance over the past yr, or it may very well be as a result of weak point we’re now seeing in a few of the Magnificent 7 shares, like TSLA, which is down -30.4% on the yr. However TSLA shouldn’t be even a inventory STK owns anymore.

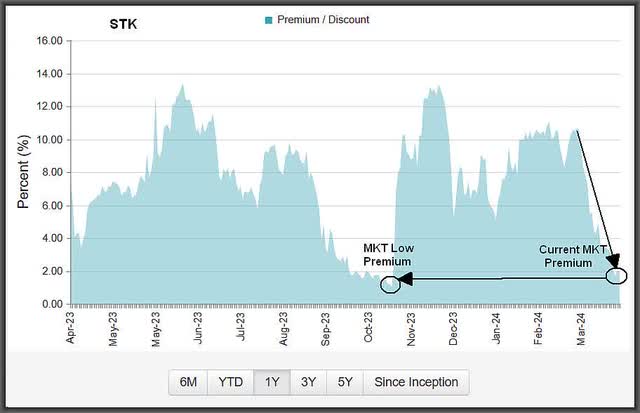

However both method, that is not giving STK the advantage of the doubt and is creating what I imagine is a chance as STK’s premium valuation strikes down from over a +10% premium a month in the past to lower than +1.8% as we speak.

In different phrases, STK is buying and selling at a valuation just about no completely different than on the market lows in late October of final yr:

CEF Join

Conclusion

Expertise and progress shares don’t essentially must outperform the markets for STK to outperform. What STK wants in the beginning is for its hand-picked portfolio of progress and expertise shares to outperform its benchmark by which it writes choices on. And to this point this yr, STK is doing simply that.

Another issues to remember about STK. The fund makes use of no leverage so there is not any added borrowing bills on prime of the administration charge.

As well as, STK has a really cheap 5.9% NAV yield which is why the fund has been in a position to preserve a constant quarterly distribution of $0.4625/share for years.

That will translate to a modest +5.8% present market yield, although in bullish years for expertise shares, STK will normally have a year-end particular capital acquire dividend as nicely, which may increase the annual yield to as excessive as +9.8%, like in 2021.

[ad_2]