[ad_1]

What is going to it take for everybody to understand that we live by the best Ponzi scheme within the historical past of cash? From the second the Fed was born. Inflation has been silently robbing you of your wealth. And particularly as soon as the backing of gold was gone. Nevertheless it’s not so silent anymore, is it? Have you ever checked your meals and residing bills currently? What most individuals don’t understand is that traditionally, when a foreign money is about to utterly collapse, it’s matched with each report ranges of inflation and the phantasm of a inventory market going up. This would be the subsequent historic switch of wealth, and people who maintain gold would be the few who preserve privateness and management over their wealth. Concentrate intently as a result of this video will present you the clear course of which is about to unfold and precisely what you are able to do about it when you nonetheless have time!

CHAPTERS:

0:00 Introduction

1:54 QE Colossal Mistake

3:55 Watch out for a Rising Inventory Market

5:02 An In a single day Reset

7:23 Buying Energy

9:10 Zimbabwe

12:30 Turkey’s Inflation

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

What is going to it take for everybody to understand that we live by the best Ponzi scheme within the historical past of cash? From the second the Fed was born, inflation has been silently robbing you of your wealth and particularly as soon as the backing of gold was gone. Nevertheless it’s not so silent anymore, is it? Have you ever checked your meals and residing bills currently? What most individuals don’t understand is that traditionally, when a foreign money is about to utterly collapse, it’s matched with each report ranges of inflation and the phantasm of a inventory market going up. This would be the subsequent historic switch of wealth. And those that maintain gold would be the few who preserve privateness and management over their wealth. Concentrate intently trigger this video will present you the clear course of which is about to unfold and precisely what you are able to do about it. Whilst you nonetheless have time, developing.

I’m Lynette Zang, Chief Market Analyst right here at ITM Buying and selling of full service bodily gold and silver supplier, however actually specializing in customized methods. And I gotta ask you, don’t you suppose you could have one? Are you taking a look at what’s occurring on the earth? As a result of we’re all a part of that world. I imply the US is mostly a mess as properly, however we’re not alone in it. So if you happen to haven’t completed this already, trigger you actually should have a plan, click on that Calendly hyperlink under and arrange a time to speak with us as a result of I’m gonna present you what it actually appears to be like like and let’s simply dive proper in.

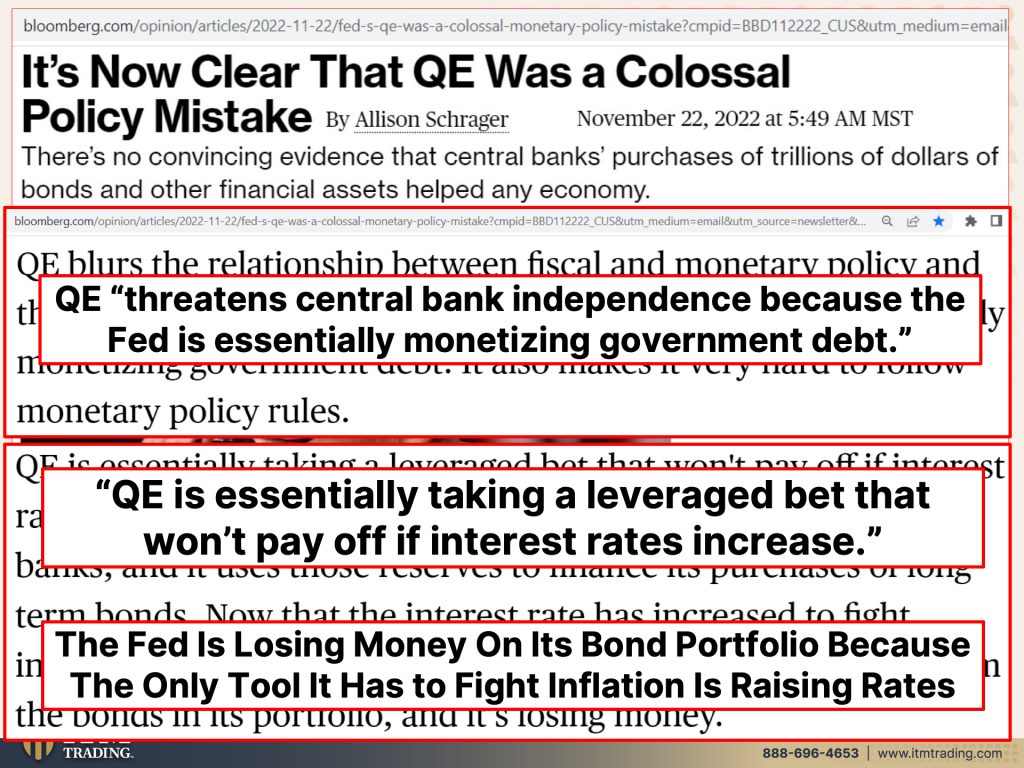

As a result of fairly frankly it ought to be fairly clear that QE was a colossal coverage mistake. Completely. What did all this cash printing do however inflate these belongings that as they’re making an attempt to undo their coverage at the moment are falling. They’re gonna should pivot. Not but, however they may once they create this subsequent disaster, that is the one software that they really have left. As a result of what QE actually does is it threatens the central financial institution independence as a result of the Fed is actually monetizing authorities debt. Don’t name it that although. Let’s put one other identify on it, however I’m sorry. Whenever you put a lipstick on a pig, I’m sorry, it’s nonetheless a pig prefer it or lump it. QE is actually taking a leveraged wager. What’s leverage it’s debt upon debt, upon debt upon debt that we received’t repay, that received’t repay If rates of interest improve, guess what? Rates of interest are rising as a result of they again themselves right into a nook the place it doesn’t actually matter what selection they make. One thing nasty this fashion comes the Fed is shedding cash on its bomb portfolio as a result of the one software it has to battle inflation is by diminishing demand by elevating charges. In order that signifies that’s true for all the world central banks that have been monetizing authorities debt at 0%, possibly they’ll get to five%. Is that basically gonna cease inflation? No, you wanna cease inflation, you’ve gotta go above it. However the inflation genie is out of this bottle and there’s, I’m sorry, there’s simply no placing it in stated firstly of it, I assumed this was a begin of hyperinflation. I’ve seen completely nothing that will change that.

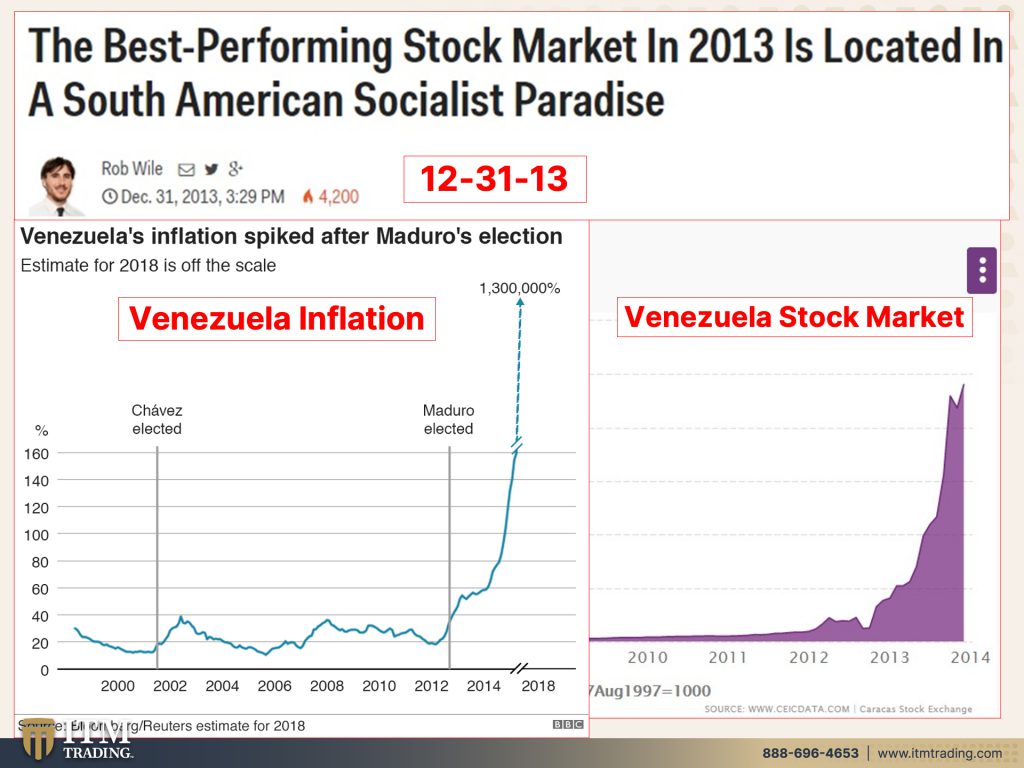

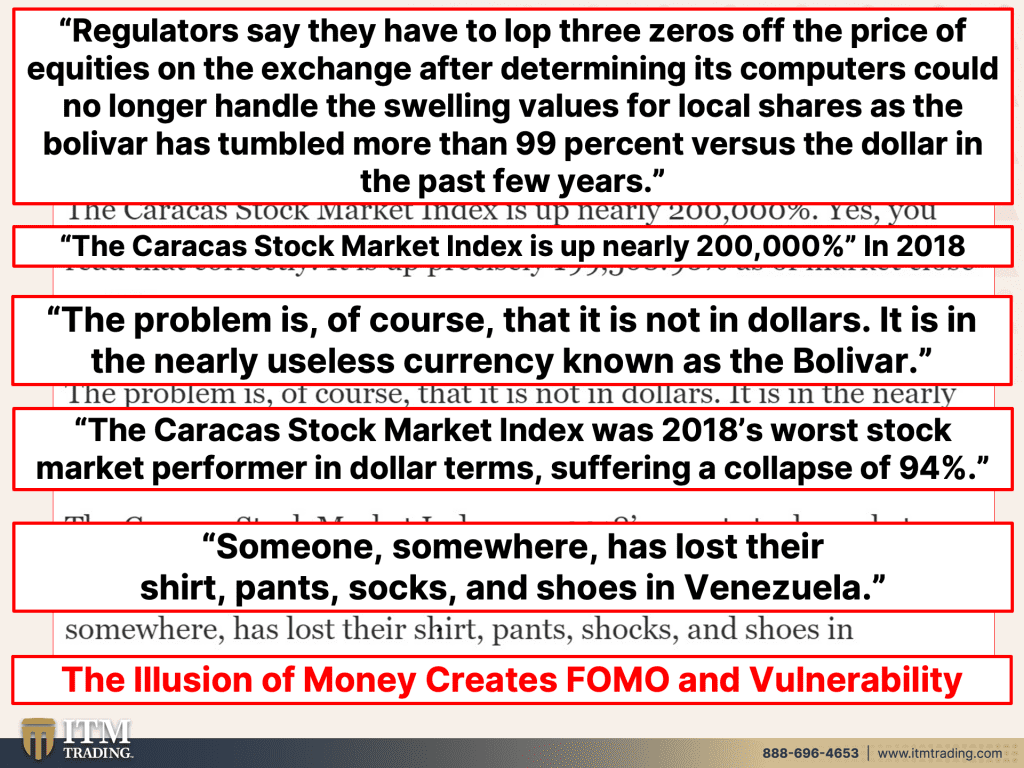

However if you happen to take a look at even the place the inventory market is true now, it’s overvalued. You’ll get a rally right here, you’ll get a rally there. That’s to sucker you into maintaining your wealth within the system. So let’s take a look at just a few cases and convey them present so you’ll be able to see what’s actually taking place. Since you’ve heard me discuss Venezuela many, many occasions and in 2012-13, principally by 2018, that they had the perfect performing inventory market on the earth, however additionally they had the best degree of inflation. So folks will run to those fiat cash merchandise, however what they’re actually lacking is what the true pattern is. It simply creates FOMO, honest of lacking out look, it’s going up besides that the worth of the foreign money you could solely convert this fiat cash product, whether or not it’s inventory markets, bond markets, ETFs, all of that rubbish is into {dollars} and inflation is exhibiting you that that’s going away.

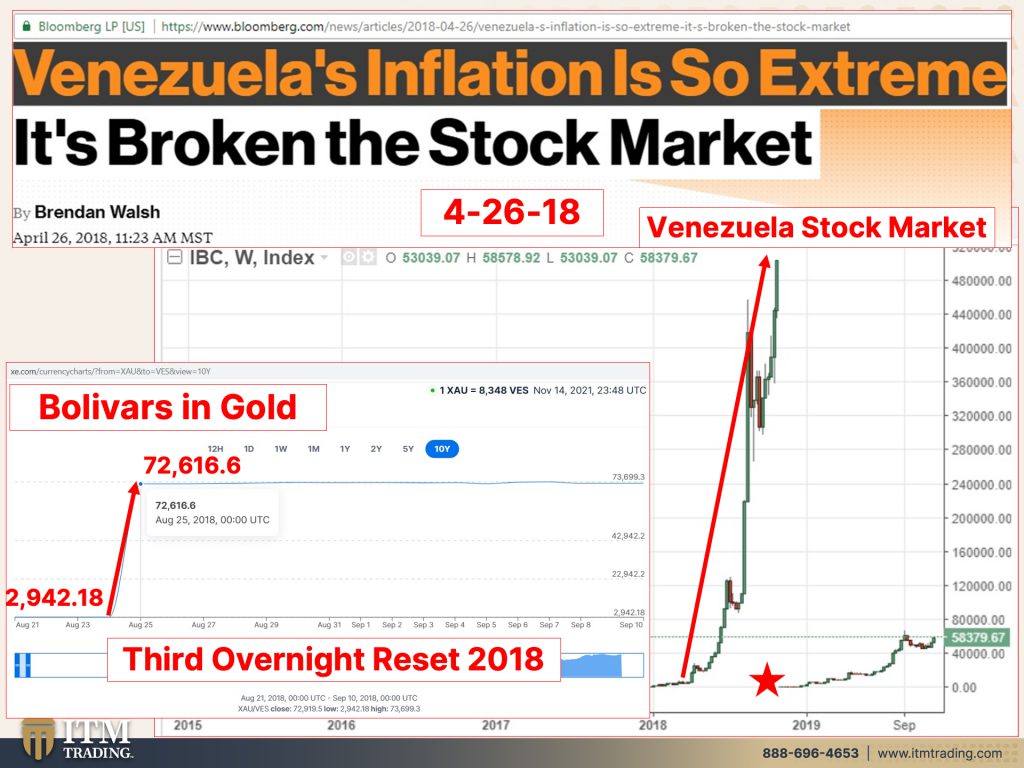

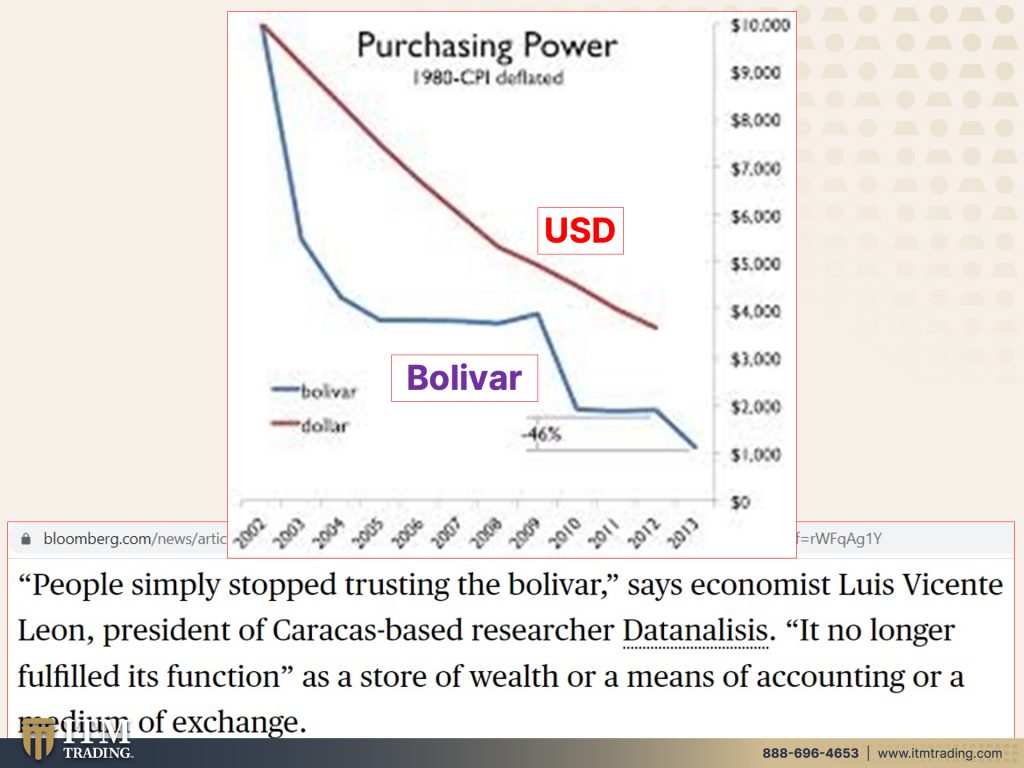

However throughout that very same time period, there’s your in a single day reset. Are you able to see it proper there? Increase. That was the primary in a single day reset the inflation, the hyperinflation began earlier than that and so they simply saved suppressing the worth. So what occurs is like gold is sort of a spring, proper? So authorities forces suppress it as a result of the rise gold value is a sign of the failing foreign money. They don’t need you to grasp that they need you to remain of their merchandise, however once they take away it and so they do this in a single day revaluation, the quantity of foreign money that you’ve got within the financial institution. And this explicit case declined by, I believe it was 94.5% and gold goes up. Do you see that chance? Now it didn’t specific to its full basic worth but, we’ll discuss that. However the second in a single day reset occurred in 2016. I imply you’ll be able to see it after which they push down the worth of gold so that you just don’t understand it till they’ve the subsequent reset. So globally, traditionally there are on common three Venezuela’s already been at 4, I’ll present you as a result of this additionally was in 2018. And take a look at that inventory market as much as the moon on lorna doone. Look, this similar factor will be stated with any fiat cash product. I’m utilizing inventory markets for example. However take a look at what occurred, increase, once they did that in a single day reevaluation, not very fairly, however what occurred to gold? Nicely, there you go, you’ll be able to see what occurred to gold. So now that is actually the spot market too. So we’ll speak extra about that. That was the third revaluation. And I would like you to hearken to this as a result of regulators say they should lop three zeros off the worth of equities on the change after figuring out its computer systems might now not deal with the swelling values for native shares because the bolivar has tumbled greater than 99%, then they’re saying versus the greenback. So Venezuela shouldn’t be doing so nice, however I’d such as you to check out this buying energy chart. Now this simply goes by 2013, it’s far more speedy now and it’s evaluating the bolivar, the lack of buying energy to the US greenback. What I’d such as you to notice is that they’re each taking place <snigger>, it’s only a matter of levels. It’s actually ridiculous. However that is the boldness piece that I maintain speaking about. Folks merely cease trusting the bolivar. It now not fulfilled its operate as a retailer of wealth or a method of accounting or a medium of change. So we already know that in some unspecified time in the future within the latest previous, the Federal Reserve has taken out retailer of wealth, long-term retailer of wealth. And once they convert to the CBDC’s, they’ve taken out the short-term retailer of wealth. So that you’re by no means gonna receives a commission pretty on your labor. Nicely, when all people acknowledges that, when the boldness within the system is misplaced, that’s once we go into hyperinflation after which you’ll be able to’t even use it as a medium of change. Then you definitely’re going to barter as a result of this or something may have extra worth, particularly gold, particularly silver may have extra worth than items of paper. It’s nothing. It’s nothing.

Okay, properly they’re not the one ones and Zimbabwe is one other nation that I’ve been speaking about for years. And you’ll see folks fly to the inventory market as a result of we’ve been taught that there’s no different selection moreover shares and bonds. Rubbish. There’s a selection, there’s bodily gold, bodily silver, you bought a selection, however folks flock to that. Nominal confusion modifications the notion, not the true worth. So what’s that nominal confusion? Nicely, you would possibly give it some thought like this. In the event you had a $20 invoice 10 years in the past and also you’ve received a $20 invoice at present, nominally they’re the identical. However what that $20 invoice would purchase then versus what it could purchase now, is vastly totally different. That’s nominal confusion. That’s why a household of 4 might survive with one paycheck in 1971 at $9,500. And but you needed to be stimulated at, what was it, two 250 or 150. However persons are, that make like 200,000 a 12 months are paycheck to paycheck, proper? I imply, wouldn’t you moderately have 200 than 9,500 besides that that purchased you an entire lot extra in 1971 And what occurred to gold throughout that very same time period? It went as much as. So it helped preserve your buying energy. And as they are saying, the foremost problem we face subsequently is confidence within the financial and monetary methods of the nation. Ya, suppose? As a result of it’s a con sport and all con video games require confidence. And in order that’s why they’re at all times taking a look at client confidence and this confidence and that confidence and what’s the reply when sufficient folks attempt to promote? Particularly we’re listening to all this speak concerning the lack of liquidity and that we ought to be ready for a giant shock. Nicely, you suppose the federal government would possibly shut down the inventory market or the bond market or any of these fiat markets that they’ll simply management? Sure, they’ve completed it earlier than. They’ve completed it on this nation, they did it throughout 2008. They will shut these down and that’s the place your wealth stays. And also you inform me who’re you gonna complain to? There’s no person to complain to. There’s nothing you are able to do.

However let’s come ahead now as a result of traders excited to purchase Zimbabwe plan to mint gold to curb that inflation whereas la our traders, these are entities that may really afford to purchase that one ounce gold coin. The lots, you suppose that they, they’ll have billions of Zimbabwe {dollars} and so they can’t afford eggs. They’re not shopping for the gold. So principally what we’re seeing right here is that the winners have been chosen and it wouldn’t be if God forbid, however it wouldn’t be you or me if we have been in Zimbabwe as a result of we’re the general public and we’re simply the suitable measurement to fail. It’s the identical, oh pardon me, it’s the identical saga over and over and over.

And what about Turkey inflation tops? 85% as they rule out rate of interest hikes. So that you see, it doesn’t matter what they do, whether or not they hike rates of interest, we nonetheless have speedy inflation or they don’t. Central banks and governments are between a rock and a tough place. So formally Turkey inflation rose 85.5% 12 months over 12 months for the seventeenth consecutive month as meals and vitality costs continued to say no, meals costs have been 99% increased than the identical interval final 12 months. 99% increased housing rose by 85% and transport was up 117%.

So I’m not likely fairly certain the place they received the 85%, however okay, what concerning the inventory market? Woo-hoo, Turkey inventory markets 80% rally fuels world high positive aspects in 2022. Attention-grabbing, isn’t it? As a result of you’ll be able to see proper right here, and this by the way in which is November third, this headline and this headline is November twenty second. So what are you taking a look at right here? Shares will not be maintaining tempo with inflation, particularly once we enter into the hyperinflation. They don’t as a result of there’s nothing there to reinvest. And by the way in which, what we’re taking a look at now, and so they’re speaking about how all of the inventory markets, how a lot of the inventory market positive aspects have been primarily based on buybacks and firms took on numerous debt to do this and blah, blah blah. Nicely there you go. I imply this might not have, after I noticed that, I went like, ah, even caught me abruptly to have it so blatant.

However what are they doing? Nicely, Turkey Uzbekistan proceed to purchase gold and hypothesis grows that China is shopping for anonymously trigger China doesn’t really need the world to understand how a lot they’ve. And you realize, it was 2006 once they allowed their public to begin really shopping for gold. And the place might they maintain that gold? Oh, within the banks, how handy. I imply actually, who desires to retailer all these items? Why would you need to hassle to do this? And I’ll inform you why. As a result of if you happen to don’t maintain it, you don’t personal it. And it honestly is simply that straightforward. And by the way in which, what has gold completed by way of the Turkish Lira? Nicely, right here you go. It’s at a excessive. Now I taking a look at this as a technician, I can see 1, 2, 3, that’s a triple high, proper? So there’s some type of strain that’s holding it, in all probability it’s spot gold. So you realize, that’s simple sufficient to do. It’ll be fascinating to see what occurs when it breaks out, however it should get away. I’m one hundred percent sure of that. I’ve completely zero doubt. So spot gold does present some degree of safety, however bodily gold and bodily silver in your possession is the perfect safety. That’s why I personal it. I don’t do bullion, as you guys know, as a result of we’ve talked about this a lot as a result of I can see the potential for, and I don’t know, possibly they may do it overt confiscation, possibly they received’t. However all of this manipulation, frankly, is a type of confiscation. All of this inventory market, all of this cash printing to make these belongings appear to be they’re going up. When in actuality it’s the worth of this that simply retains taking place. They don’t need you to grasp that. As a result of if you happen to maintain your wealth within the system and the system goes, what are you gonna do? There’s nobody so that you can complain to.

Be sure to watch final week’s video title, Regime Shift and Altering World Order. You’re gonna get a lot outta that as a result of we’re, you realize, I stated all alongside to 2022 is a pivotal 12 months. Nicely, 2023 for me is a scary 12 months. However if you happen to haven’t completed so but, you wanna watch final week’s video on actual property. And at last, don’t forget to go to BGS as a result of we do want, that is, that is your basis. However we do want to consider Meals, Water, Power, Safety, Barterability, Wealth Preservation, Neighborhood and Shelter. It’s all a part of the mantra. And you could be safe in each single approach as a result of you could just remember to can present these issues for your self. In the event you haven’t already, click on that Calendly hyperlink under, meet with considered one of our consultants. They’ll allow you to set up your targets if you happen to don’t have them, I imply, if in case you have ’em, discuss ’em as a result of that’s what any technique ought to be primarily based on. And if you happen to haven’t completed this but, just remember to subscribe, go away a remark, give us a thumbs up, please, and share, share, share. And till subsequent time, please be secure on the market. Bye-Bye.

SOURCES:

https://www.xe.com/currencycharts/?from=XAU&to=VES&view=10Y

https://tradingeconomics.com/zimbabwe/stock-market-turnover-ratio-percent-wb-data.html

https://ftalphaville.ft.com/2008/06/23/13987/the-mad-market-of-zim/

https://www.goldonomic.com/zimbabwe.htm

https://www.exchangerates247.com/currency-converter/?from=XAU&to=ZWD&data=historical

https://www.indexmundi.com/g/g.aspx?c=zi&v=65

[ad_2]