[ad_1]

Marcus Lindstrom/E+ through Getty Pictures

Actual property shares continued to dip as a hotter-than-expected inflation data marred sentiments, whereas the Q1 earnings season kicked off on a blended word.

The Actual Property Choose Sector SPDR Fund ETF (NYSEARCA:XLRE), which tracks the S&P 500 actual property shares, closed 2.97% decrease this week at 37.24 factors. The fund posted losses in two out of the 5 classes, significantly ending 4.11% down on Wednesday on the back of the patron inflation information.

“We now count on the FOMC will not start to ease coverage till its Sept. 18 assembly,” Wells Fargo said.

In the meantime, JPMorgan’s disappointing guidance and the outcomes from main banks and asset managers contributed to the market averages ending lower on Friday.

The broader S&P 500 put in its worst weekly efficiency since late October final 12 months. Along with the inflation report, the shares have been additionally pressured by Treasury yields, which surged to their highest ranges of 2024, and the geopolitical tensions within the Center East.

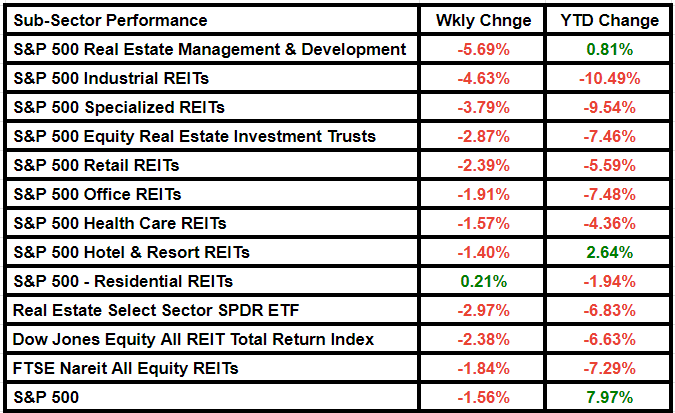

On comparable strains, Dow Jones Fairness All REIT Whole Return Index fell 2.38% through the course of the week and the FTSE Nareit All Fairness REITs index was down 1.84%.

Looking for Alpha’s Quant Ranking system changed its recommendation on XLRE to Sturdy Promote from Promote on Friday. The fund’s Momentum is rated D- and Danger D+. SA analysts continue to grade the fund as Purchase.

XLRE is a big actual property ETF with diversified publicity to the sector, specializing in high quality operators and excluding mortgage REITs. The ETF has outperformed broad-based actual property funds such because the Vanguard Actual Property ETF, which holds a extra various portfolio, SA contributor REITer’s Digest said.

Fund Flows

The Actual Property Choose Sector SPDR Fund ETF noticed internet outflows of $66.48M this week, in comparison with the outflows of $26.47M final week, according to the info options supplier VettaFi.

Outflows of $11.76M have been reported on Wednesday and $48.87M on Thursday, VettaFi stated.

Fund flows into or out of an ETF are an indicator of investor sentiment associated to the asset. With the inflation staying sizzling, bullish sentiment continues to decline.

Subsector Efficiency

Actual Property Administration & Growth emerged as the largest laggard this week, shedding 5.69% of worth from final week. The sector has remained a gainer year-to-date. Industrial REITs and Specialised REITs have been the opposite notable losers. Residential REITs stood out amongst subsectors, gaining by 0.21%. The subsector has benefitted from waning housing affordability and rising rents.

CBRE Group (CBRE), American Tower (AMT) and SBA Communications (SBAC) have been the highest S&P 500 actual property losers of the week. AvalonBay Communities (AVB), Camden Property Belief (CPT) and Mid-America Condominium Communities (MAA) have been the foremost gainers. Altisource Portfolio Options (ASPS), Opendoor Applied sciences (OPEN) and Ohmyhome (OMH) have been the opposite notable actual property losers.

[ad_2]