[ad_1]

KanawatTH

Funding Thesis

After strong efficiency by way of FY23 and into FY24, international markets led by the U.S. have delivered substantial positive factors for buyers for the reason that markets bottomed in late 2022. Rate of interest hikes in most developed international locations are on maintain because the reserve banks of sovereign nations assess the expansion outlook of their international locations versus their respective inflation projections. Most lately, the U.S. Federal Reserve introduced their projections last week that they proceed to anticipate three fee cuts this yr, with the ECB echoing related sentiments earlier this month.

Such rate-cut projections are productive for the outlook on inventory markets the world over, as decrease charges spur progress as soon as once more. Buyers trying to diversify away from the U.S. inventory markets, which by some valuation measures are beginning to look costly, have many areas in international markets to allocate their capital. For these buyers trying to acquire broad publicity to international markets, the iShares MSCI ACWI fund (NASDAQ:ACWI) is one such ETF that gives buyers the chance to speculate capital in a broad vary of world shares.

The balanced method that ACWI provides appears interesting to me, however the deep diversification of shares mixed with the relative underperformance of this fund makes the prospects of the ACWI ETF look unattractive to me. For causes outlined within the publish beneath, I’ll fee this as a Maintain for now.

Concerning the ACWI ETF

The iShares MSCI ACWI ETF is managed by BlackRock’s ETF arm, iShares. The fund provides buyers a simplified portfolio development course of by offering publicity to a variety of inventory markets in international locations all all over the world throughout developed in addition to rising market economies, whereas minimizing any rebalancing wants within the course of. The fund’s prospectus suggests that the ACWI ETF needs to be used to “diversify internationally and search long-term progress in your portfolio,” so it’d attraction to solely these buyers who need entry to international markets however have a long-term horizon.

The ACWI ETF achieves its funding goal by monitoring the funding outcomes of the U.S. dollar-denominated MSCI ACWI Index. The index consists of enormous and mid-cap developed and rising market equities unfold throughout two dozen Rising Market economies and an analogous variety of Developed Market economies. The index tracks over 2000 parts, so I can anticipate an analogous degree of deep diversification within the ACWI ETF as nicely.

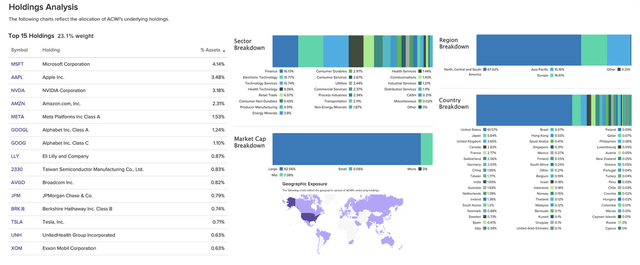

Here’s a chart that exhibits the High 15 Holdings vs. the Structure of ACWI’s Funds by classes.

MSCI ACWI ETF’s holdings illustrated in charts (etfdb)

Peer comparability

Right here is how ACWI ETF compares with a few of its friends. The checklist beneath is ordered by largest-to-smallest fund by way of Property Managed.

MSCI ACWI ETF vs its Friends. Observe that ACWI ETF’s dividend payout is semiannual. (sa)

Each the ACWI fund and its largest peer by property managed, Vanguard Complete World Inventory Index Fund ETF (VT), are comparatively newer as in comparison with the SPDR International Dow ETF (DGT), which has been round for the reason that begin of this century. Now, evaluating ACWI with VT, I see that it prices buyers 25 cents extra for each $100 of capital to remain invested in ACWI. On prime of that, the trailing dividend yield distinction of 0.32% doesn’t make the ACWI as interesting. Nonetheless, ACWI does outperform VT marginally for each time interval, apart from the ten yr interval, the place it outperforms VT by 4.2%. Additionally notice that ACWI’s dividend payout is semiannual.

Furthermore, the DGT fund additionally seems to be extra interesting regardless of its 0.5% expense price, which is 0.18% larger than ACWI. I consider this relative attraction might be essential to buyers as a result of DGT’s trailing dividend yield is 0.64% larger than ACWI.

Lengthy-term attraction doesn’t appear attention-grabbing on a relative foundation

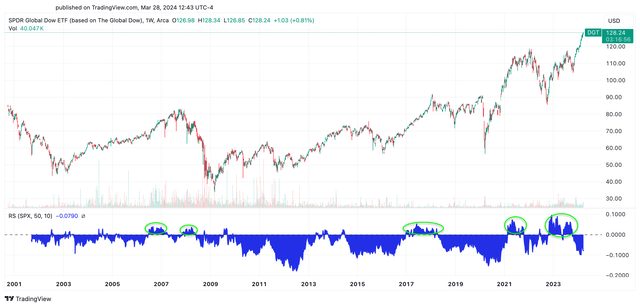

Most international broad-market ETFs set expectations to have long-term horizons with their ETFs, as I had identified earlier within the About part above in ACWI’s case. To check the relative efficiency of world broad-market ETFs vs. the S&P 500 Index, I checked out DGT’s previous efficiency vs. the S&P 500. Since DGT was an older fund, it made sense to have a look at that first.

DGT underperforms S&P 500 (TradingView)

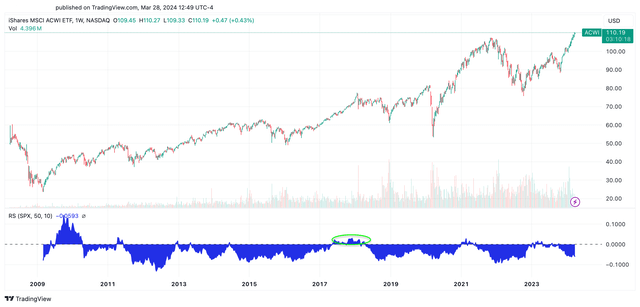

From the chart above, I’ve circled out areas of relative outperformance of the DGT versus the S&P 500 index. This exhibits that broad-market index ETFs like DGT have few cases of outperformance in comparison with the S&P 500 index. These cases of underperformance look much more pronounced when evaluating ACWI’s relative efficiency versus the S&P 500, as seen beneath.

ACWI underperforms S&P 500 extra as in comparison with DGT in earlier charts (TradingView)

In my opinion, international broad-market ETFs do not supply that a lot attraction when evaluating DGT’s relative historical past. Nonetheless, if buyers favor worldwide diversification funds like DGT and VT, they might be higher decisions as in comparison with ACWI.

Furthermore, the ACWI fund trades at a wealthy valuation as in comparison with a few of its friends. To reach on the relative valuation, I seemed on the ahead valuation that the underlying indices are at. The MSCI ACWI Index, which the ACWI fund tracks, trades at a ahead valuation of 17.4x ahead earnings, which is considerably larger than the DGT fund’s ahead valuation of 12.9. Given this outlook, I stay impartial on the ACWI fund.

Dangers and different components to think about

In 2024, one of many largest components to think about is that many international locations the world over have upcoming election cycles this yr. Elections can affect the end result of world shares in each methods, which can create volatility in inventory markets, affecting the outlook of those shares.

As well as, rate of interest environments have up to now provided steady situations for companies to function, but when reserve banks, together with the U.S. Federal Reserve, are compelled to boost rates of interest, this might create headwinds in international markets, together with shares within the ACWI.

Takeaways

After an intensive assessment of ACWI, I consider that ACWI’s worth proposition will not be interesting sufficient for buyers on the present second, given the relative efficiency of its friends. Lengthy-term buyers could proceed to remain invested, however its friends like DGT and VT funds supply higher danger/reward. For causes identified on this publish, I consider a Maintain score can be applicable for the time being for the ACWI fund.

[ad_2]