[ad_1]

cranach/iStock by way of Getty Photos

Fallen angels have considerably outperformed broader bonds and high-yield bond benchmarks for many years, as has the VanEck Fallen Angel Excessive Yield Bond ETF (NASDAQ:ANGL). I final covered ANGL in mid-2023. In that article, I argued that the iShares Fallen Angels USD Bond ETF (NASDAQ:FALN) was a barely superior funding, on account of FALN’s decrease bills and better yield. Since then, ANGL’s bills have gone all the way down to 0.25%, yields rose to five.4%, with each figures matching these of FALN. As such, I now imagine that each funds have related fundamentals and worth propositions. Each are buys, on account of their confirmed methods and powerful efficiency track-records.

Fallen Angel Overview And Evaluation

ANGL invests in fallen angels, a really particular sort of bond. To know ANGL we should perceive these securities, and the way they relate to the broader company bond market.

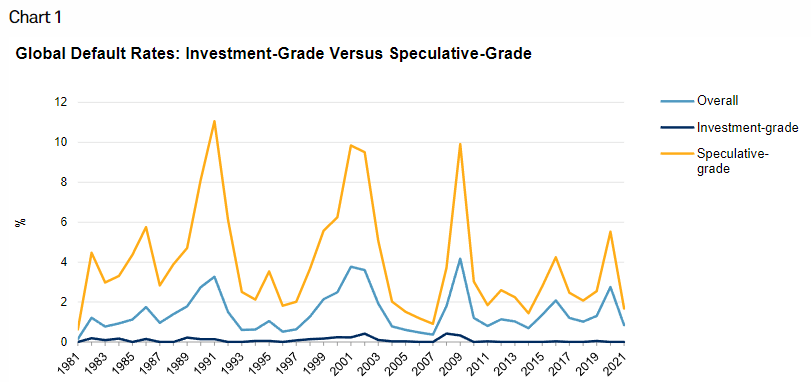

Company bonds could be divided into two segments. Funding-grade bonds, these issued by firms with sturdy steadiness sheets and low default charges. Non-investment grade bonds, these issued by firms with weaker steadiness sheets and better default charges, particularly throughout downturns and recessions.

S&P

Some institutional buyers and index funds are constrained from investing in non-investment grade bonds, on account of their excessive default charges, and so deal with investment-grade bonds. For instance, the Vanguard Whole Bond Market Index Fund ETF Shares (NASDAQ: BND), the most important bond ETF available in the market, solely invests in investment-grade bonds.

Corollary of the above is that some institutional buyers are pressured sellers of bonds downgraded from investment-grade to non-investment grade, i.e. fallen angels. For instance, if a bond held by BND had been to be downgraded to BB, the fund can be pressured to promote stated bond. Pressured promoting would result in decrease bond costs and better yields. Importantly, the magnitude of those modifications would nearly definitely be very excessive, there are many institutional buyers and plenty of pressured promoting, and therefore out of line with fundamentals.

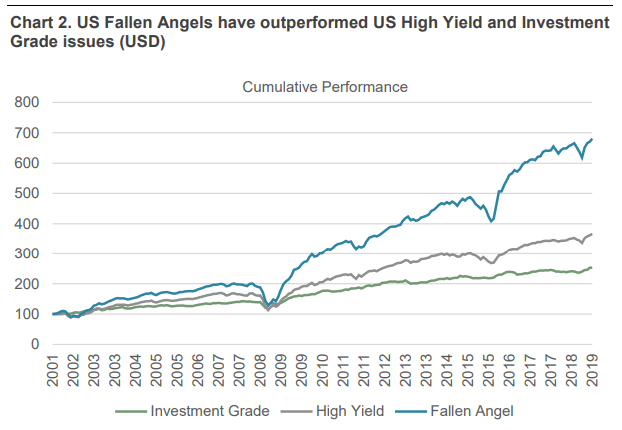

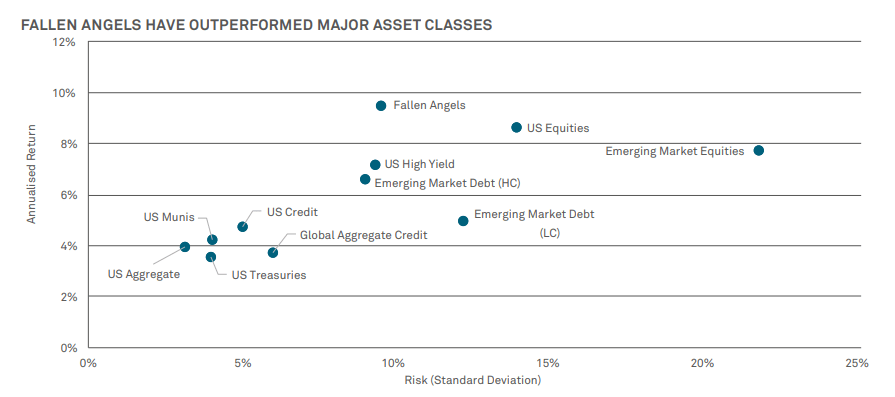

Traders can make the most of the above by shopping for fallen angels. Doing so means shopping for closely discounted bonds with above-average yields for his or her stage of danger. Doing so must also result in above-average returns, as circumstances stabilize and costs recuperate. Fallen angels have outperformed most different high-yield bonds for many years, and by very large margins.

Russell Funding Companies

Danger-adjusted returns have been fairly sturdy too, much less so within the newer previous.

Russell Funding Companies

With the above in thoughts, let’s have a more in-depth have a look at ANGL.

ANGL – Overview and Evaluation

Technique and Holdings

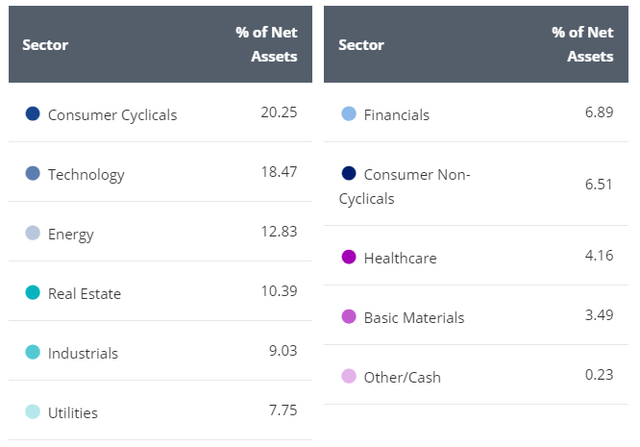

ANGL is an index ETF investing in fallen angel, monitoring the ICE US Fallen Angel Excessive Yield 10% Constrained Index. It’s a surprisingly diversified fund, with investments in 145 securities from most related business sectors.

Focus is increased than common, with the fund’s high ten issuers accounting for over 40% of its portfolio. Issuers are capped at 10.0%, though there are solely three with allocations increased than 5.0%.

ANGL appears fairly well-diversified for a fallen angel ETF. Because the fund focuses on a particular phase of high-yield company bonds, diversification is far decrease than common. Traders may contemplate pairing the fund with others specializing in totally different property, though I am fairly bullish on ANGL regardless.

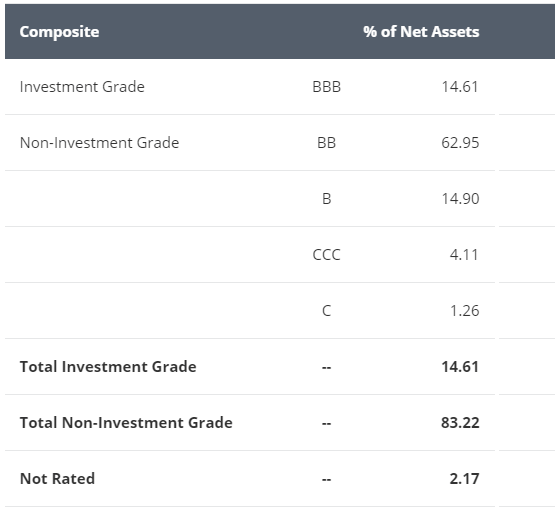

ANGL focuses on non-investment grade bonds however holds a surprisingly massive 14.6% place in investment-grade securities. These are nearly definitely lately upgraded bonds, and ought to be bought within the coming weeks / months.

ANGL

ANGL’s investment-grade bonds nearly definitely led to sizable good points within the current previous. It is because upgraded bonds are inclined to rise in value, as increased credit score high quality results in elevated investor demand. ANGL ought to promote these bonds quickly, successfully locking-in good points. This can be a considerably frequent prevalence for the fund, as fallen angels are solely barely riskier than investment-grade bonds (keep in mind they had been investment-grade initially).

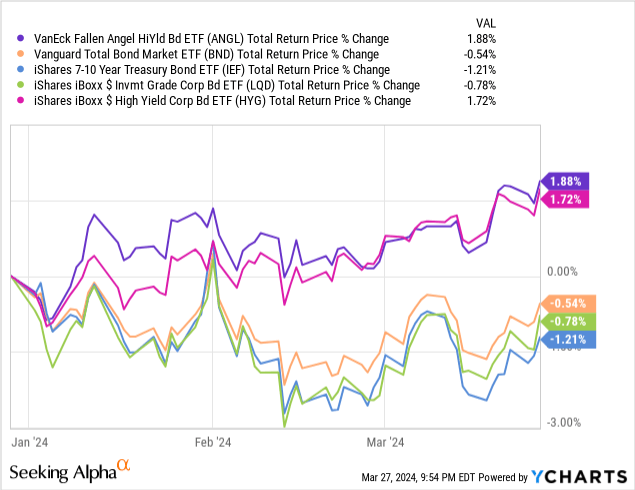

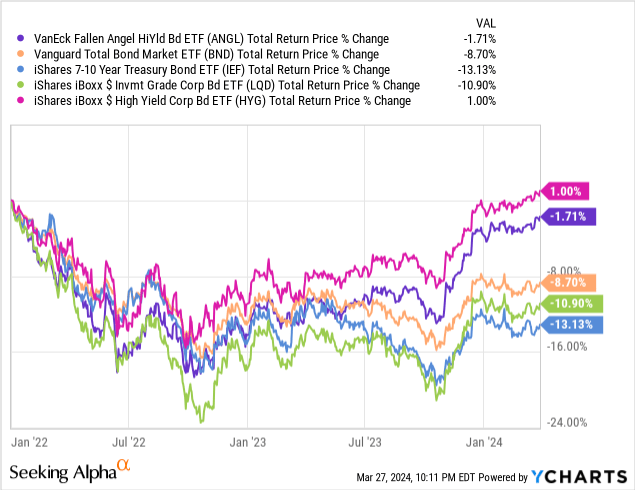

For what it is price, ANGL has outperformed YTD, broadly in-line with expectations. Returns have been fairly much like these of high-yield company bond benchmarks although, though it does rely on the particular time interval in query.

Information by YCharts

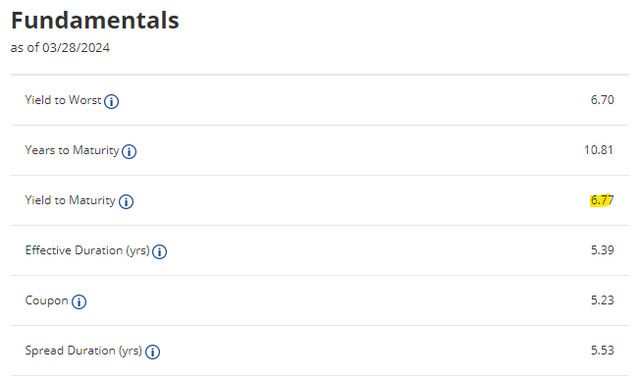

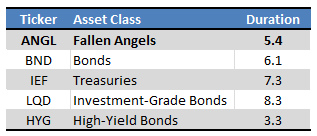

Lastly, ANGL’s length of 5.4 years is barely beneath the bond common, however reasonably increased than the high-yield bond common. Figures are broadly constant for the fund’s credit score high quality / holdings.

Fund Filings – Desk by Writer

Because of the above, ANGL ought to outperform most bonds when charges improve, underperform when charges lower. Reverse is true relative to high-yield company bonds particularly. For instance, a fast have a look at the fund’s efficiency since early 2022, when the Fed began to hike charges.

Information by YCharts

Different components affect the fund’s efficiency, which brings me to my subsequent level.

Efficiency Observe-Report

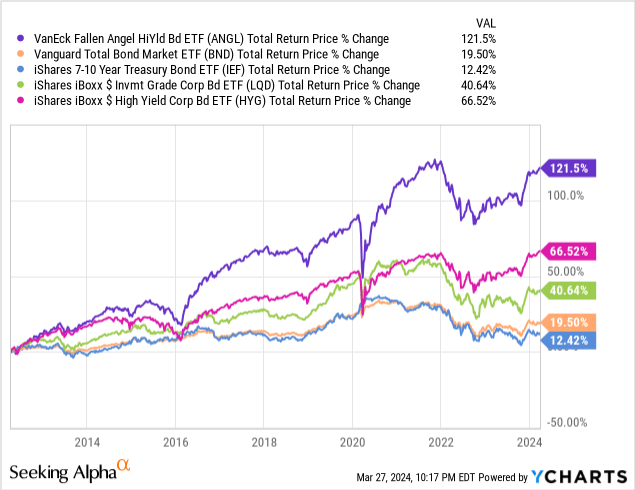

ANGL’s efficiency track-record is powerful, with the fund outperforming most bonds and bond sub-asset courses since inception, and by wholesome margins.

Information by YCharts

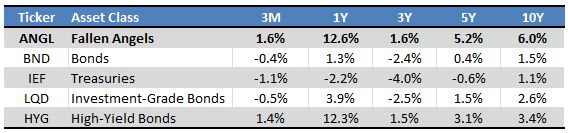

particular time durations, it appears the fund’s outperformance is fairly constant, though a lot weaker for the reason that Fed began to hike.

Searching for Alpha – Desk by Writer

ANGL’s outperformance was completely on account of fallen angels themselves outperforming, because of the aforementioned points with pressured promoting. In easy phrases, fallen angels outperform, as do fallen angel ETFs. Because the fund’s efficiency and returns had been pushed by structural market points, outperformance is about to proceed, for my part no less than.

Dividend Evaluation

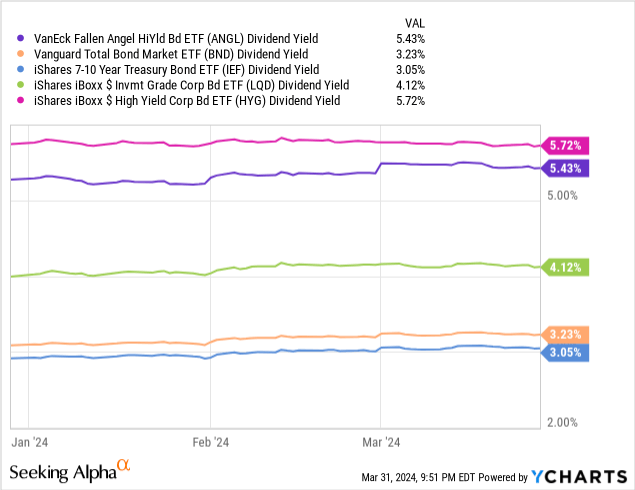

ANGL presently sports activities a 5.4% yield, increased than the bond common, however decrease than the high-yield bond common.

ANGL’s dividend yield doesn’t take into accounts potential capital good points from the fund’s holdings maturing at par. Taking these into consideration, potential returns / yield to maturities rise to six.8%, a bit increased than the above.

On the similar time, the figures above don’t take into accounts potential good points from shopping for fallen angels at fireplace sale costs, nor from these recovering in value quickly after.

Total, ANGL’s dividend yield is someplace between OK and good, however it’s positively not the fund’s key profit or attribute. Its funding technique and efficiency are. A lot of high-yield ETFs have increased yields than ANGL, extraordinarily few have comparable / increased returns.

Conclusion

ANGL’s confirmed technique, outperformance, and good 5.4% dividend yield make the fund a purchase.

[ad_2]