[ad_1]

PM Pictures

Written by Nick Ackerman, co-produced by Stanford Chemist.

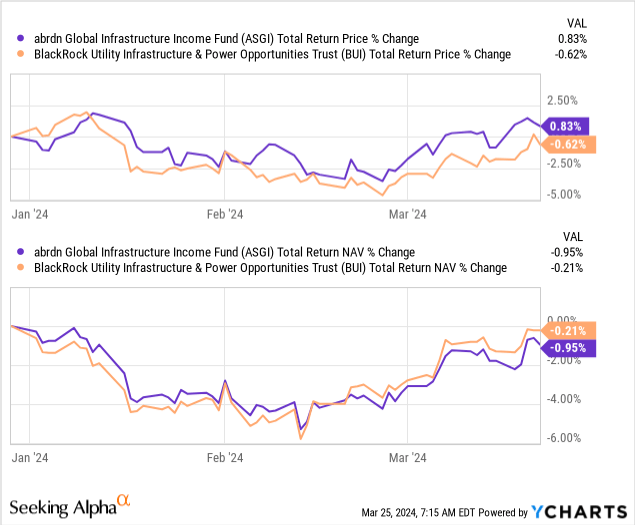

Heading into 2024, I had an article detailing why I believed that BlackRock Utilities, Infrastructure & Energy Alternatives Belief (BUI) and abrdn World Infrastructure Earnings Fund (NYSE:ASGI) had been alternatives for conservative utility/infrastructure performs. As we shut out close to the primary quarter of the 12 months, these performs aren’t essentially understanding as hoped.

Ycharts

At this time, we’ll look at these two funds to know what is going on on and why I nonetheless contemplate each of them worthwhile and conservative investments.

abrdn World Infrastructure Earnings Fund

- 1-Yr Z-score: 1.17

- Low cost: -13.50%

- Distribution Yield: 10.22%

- Expense Ratio: 1.65%

- Leverage: N/A

- Managed Belongings: $514 million

- Construction: Time period (anticipated liquidation date round July 28, 2035)

ASGI’s investment objective is “to hunt to offer a excessive stage of complete return with an emphasis on present earnings.”

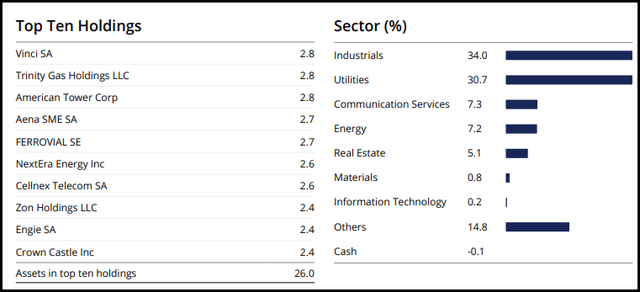

To realize this goal, the funding technique is sort of easy. They may “put money into a portfolio of income-producing private and non-private infrastructure fairness investments from world wide.” The biggest publicity for this fund stays industrials, because it has tended to be for fairly some time with this fund. Alternatively, utilities nonetheless make up a significant portion of this fund’s portfolio as properly.

ASGI High Ten Holdings And Sector Publicity (abrdn)

BlackRock Utilities, Infrastructure & Energy Alternatives Belief

- 1-Yr Z-score: -0.65

- Low cost: -3.53%

- Distribution Yield: 6.81%

- Expense Ratio: 1.08%

- Leverage: N/A

- Managed Belongings: $496.7 million

- Construction: Perpetual

BUI’s investment objective is to “present complete return by a mixture of present earnings, present positive factors and long-term capital appreciation.”

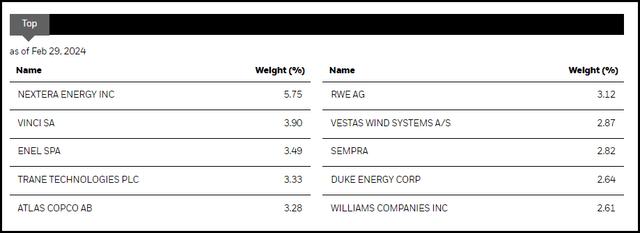

To realize this goal, they’ve fairly a little bit of flexibility. They may make investments “primarily in fairness securities issued by firms which might be engaged within the Utilities, Infrastructure, and Energy Alternatives enterprise segments wherever on the earth and by using an choice writing (promoting) technique in an effort to reinforce present positive factors.”

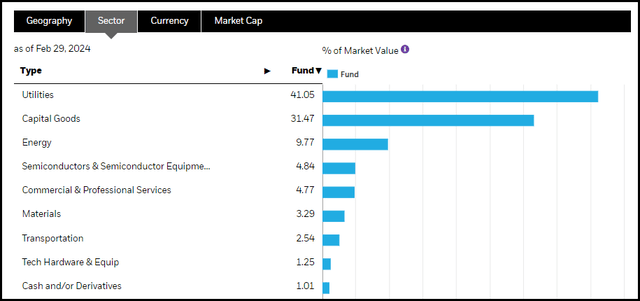

Much like ASGI, BUI additionally carries publicity to not simply the utility area particularly, as each funds present loads of diversified publicity to your entire infrastructure area. For BUI, “capital items” is the second largest sector weighting, one other time period for industrials.

BUI Sector Publicity (BlackRock)

BUI High Ten Holdings (BlackRock)

Charge Headwinds To Tailwind Restoration Elongates

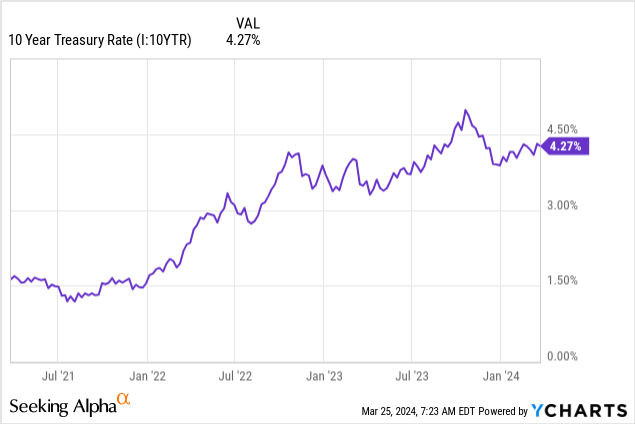

Whereas I suspected that 2024 would result in price cuts, and that is why we noticed risk-free Treasuries falling in This fall 2023, the timeline of such cuts has been pushed again. That is prompted Treasuries to as soon as once more begin heading greater, with the 10-Yr now pushing again to over 4%.

Ycharts

That, in flip, pushed the utility sector to stay below stress as risk-free charges moved upward after taking fairly a dive from the highs final October.

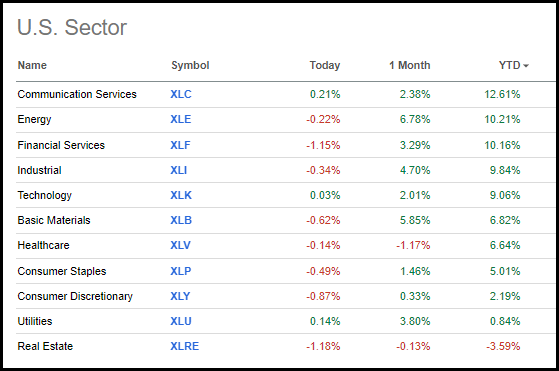

On a YTD foundation, utilities are about flat—solely topping actual property, which stays the one unfavorable sector for the 12 months.

U.S. Sector Efficiency as of 03/25/2024 (In search of Alpha)

It is very important be aware that, as we laid out above, these aren’t pure utility funds. They carry some publicity to power and industrials in addition to international publicity. So, whereas we’re seeing the power and industrial sectors carry out properly within the U.S., this does not seem like occurring across the globe.

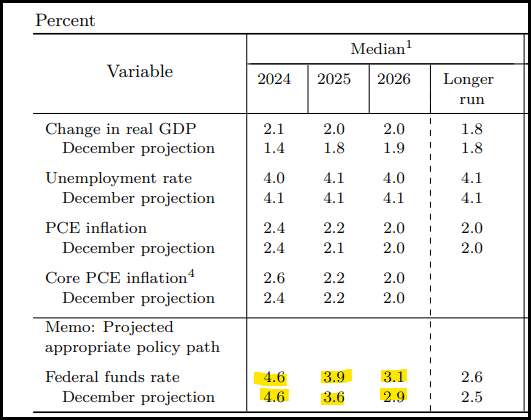

Charges had been transferring greater based mostly on the idea that the variety of price cuts had been diminished from the place the market was initially considering. The latest Fed projections stay with an outlook of three cuts for 2024. Based mostly on the newest projection materials, the projections for cuts in 2025 and 2026 did come down from earlier ranges.

Fed Charge Projections (Fed Projection Materials (highlights from writer))

In fact, all of that is nonetheless depending on information and the way it strikes going ahead. The newest inflation information, which was hotter than anticipated and with the labor market remaining robust, have stored the U.S. financial system resilient. Which means that whereas the projection is for 3 cuts, that might be in the reduction of to 2 and even none for 2024.

What that would imply for ASGI and BUI is that the timeline for these funds to start out performing higher can be pushed again. With that mentioned, it’s nonetheless extremely anticipated that we’re on the peak charges for this price cycle by way of the Fed’s goal. What the risk-free Treasury Charges do is as much as the market to resolve. For that cause, I imagine that these funds are nonetheless displaying alternative.

Enticing Valuations

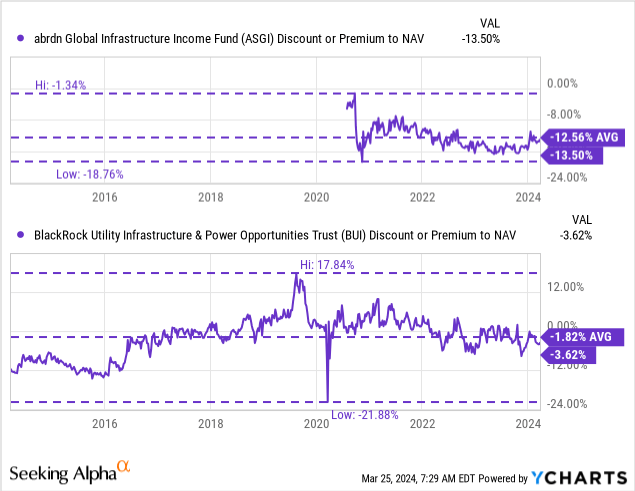

On the chance entrance, one other potential enticing characteristic is that each of those funds are buying and selling at reductions to their web asset worth per share.

Ycharts

On an absolute foundation, ASGI presents the higher alternative right here, however on a relative foundation to historic ranges, each have attraction. BUI had traded at a premium fairly repeatedly within the final a number of years. That makes a reduction right here now fairly compelling.

The conservative half right here is that each of those funds do not make use of leverage by borrowings. That is one much less transferring half that buyers have to fret about, as leverage amplifies each the upside and draw back strikes of an funding.

With charges anticipated to remain a bit greater for a bit longer now, borrowing prices for the leverage being employed on a majority of closed-end funds can come below additional stress. A number of funds have hedges in place, however these hedges do not final perpetually, and decrease charges sooner will assist these funds. In fact, I am not advocating for fully dumping all of your leveraged CEFs and fully altering one’s portfolio. That mentioned, it’s a good reminder simply to pay attention to what one is holding general and really feel comfy with these better dangers.

Distributions

In fact, these funds additionally pay out enticing distributions to buyers whereas they anticipate higher instances.

They each make investments closely in equities and for that cause, they’ll require capital positive factors to fund their distributions. That might be tougher in a flat market that we seem to seek out ourselves in for the utility area, however then once more, these funds do carry publicity outdoors of utilities. With a broader and international basket of fairness investments, they might discover alternatives elsewhere to clip positive factors to pay to buyers.

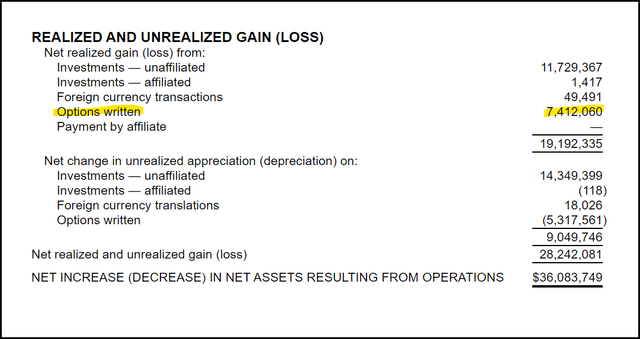

Additional, BUI has a lined call-writing technique that may additional usher in potential capital positive factors. Over 2023, that was one thing that BUI was in a position to do as properly, because the choices written introduced in simply over $7.4 million in realized positive factors for the fund.

BUI Realized/Unrealized Positive factors/Losses (BlackRock (highlights from writer))

Each have NAVs greater than their inception – although ASGI is a comparatively newer fund, in order that ought to be stored in thoughts. Increased NAVs now recommend that traditionally, they had been in a position to cowl their distributions to buyers with out eroding away belongings.

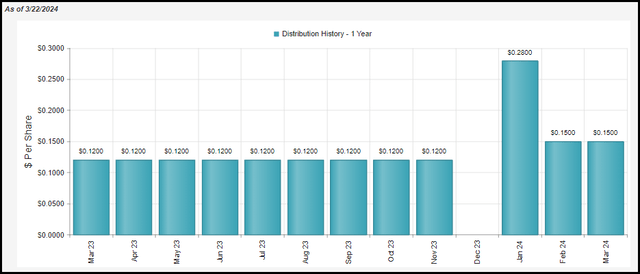

ASGI pays a managed distribution coverage that started recently. The coverage relies on 9% “of the common each day NAV for the earlier month as of the month-end previous to declaration…” This coverage began in 2024, and it resulted in an preliminary bump to the distribution. Now, within the final two months, the month-to-month distribution has labored out to $0.15. Given the coverage, the distribution will change over time.

ASGI Distribution Historical past (CEFConnect)

If the NAV is transferring greater, the distribution must also be transferring greater and vice versa. I imagine that over time, the fund will start to erode its belongings now to assist this 9% managed distribution coverage. That mentioned, that does not imply that returns cannot be respectable going ahead. One ought to simply anticipate that over time, the distribution will pattern decrease together with its NAV.

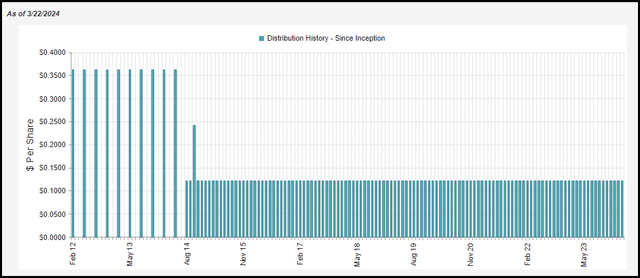

For BUI, they’ve gone with the commonly extra favorable coverage of simply preserving a flat and stage distribution coverage. That does not imply that the distribution cannot change over time, however the modifications aren’t mechanical based mostly on any particular metric. A minimum of not one that’s broadcasted to the general public; they might have their very own inner stage the place the Board feels they should reduce.

This fund has delivered the identical distribution since its inception. The caveat right here is that it was quarterly at first, however after they switched to a month-to-month schedule, they went with the month-to-month equal. With this, the fund’s newest distribution price comes to six.81%, with a NAV price fairly related at 6.57%. This may be because of carrying solely a shallow low cost, which suggests these charges are fairly shut.

BUI Distribution Historical past (CEFConnect)

Conclusion

ASGI and BUI aren’t off to a scorching begin in 2024, like I hoped to see. That being mentioned, I nonetheless imagine their future seems to be brighter, however the restoration time has elongated with projections that cuts will are available in later and slower than anticipated. Over the long run, I nonetheless imagine that these two funds are fairly interesting as funding alternatives, and however, they nonetheless stay conservative choices within the utility/infrastructure area.

[ad_2]