[ad_1]

RapidEye

Introduction

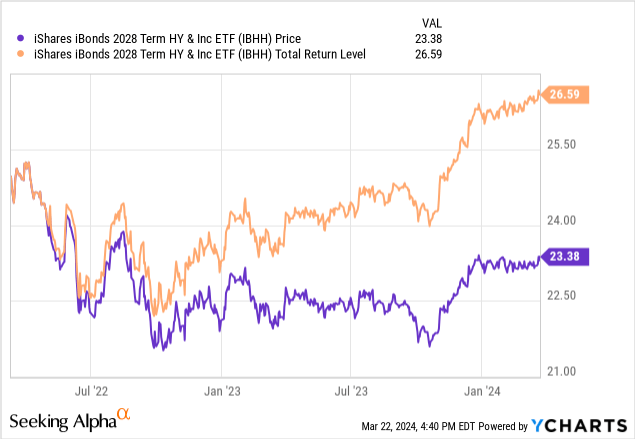

As readers of my mounted revenue ladder articles know, I personal a number of bonds or notes rated beneath investment-grade, affectionately known as Junk bonds. As one would count on, some deserved that classification and I didn’t promote two till after getting burned badly. One answer was including each the iShares iBonds 2029 Time period Excessive Yield and Revenue ETF (IBHI) and the iShares iBonds 2028 Time period Excessive Yield and Revenue ETF (BATS:IBHH), which I’ll evaluate and examine to a detailed competitor, the Invesco BulletShares 2028 Excessive Yield Company Bond ETF (NASDAQ:BSJS).

After evaluating these two ETFs after which their YTM worth towards others in each collection, I gave the BSJS ETF a Purchase score; with the IBHH ETF getting a Maintain.

iShares iBonds 2028 Time period Excessive Yield and Revenue ETF evaluate

In search of Alpha describes this ETF as:

The funding seeks to trace the funding outcomes of the Bloomberg 2028 Time period Excessive Yield and Revenue Index composed of U.S. dollar-denominated, excessive yield and different revenue producing company bonds maturing in 2028. The index consists of U.S. greenback denominated, taxable, fixed-rate, excessive yield and BBB or equivalently rated company bonds scheduled to mature between January 1, 2028 and December 15, 2028, inclusive. The fund will spend money on non-U.S. issuers to the extent essential for it to trace the index.

Supply: seekingalpha.com IBHH

IBHH has $67m in AUM and costs traders 35bps in charges. The TTM yield is 6.65%.

Index evaluate

Bloomberg describes this index collection as:

The Bloomberg 20XX Time period Excessive Yield and Revenue Index is a focused maturity benchmark that measures the efficiency of the USD-denominated, fixed-rate, taxable excessive yield and BBB-rated funding company bond market maturing between January 1,20XX and December 15, 20XX. The index is comprised of excessive yield bonds till 1.5 years previous to index maturity. After that time, the index will grow to be a composite index, comprised of sub-indices of excessive yield and BBB-rated company bonds additionally maturing between January 1, 20XX and December 15, 20XX.

The index limits issuer publicity to a most of three% of whole market worth of the index and redistributes the surplus market worth amongst the excessive yield and funding grade subindices on a pro-rata foundation. Within the closing yr, principal and curiosity collected within the index are reinvested pro-rata for the primary six months of the yr. Within the closing six months, principal from maturing and referred to as bonds might be represented within the index by a money element, which isn’t reinvested and doesn’t earn any curiosity, till the ultimate maturity date on December 15, 20XX.

Supply: assets.bbhub.io/professional/sites

IBHH holdings evaluate

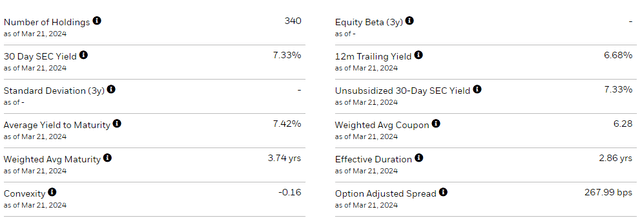

iShares gives the next portfolio traits for IBHH:

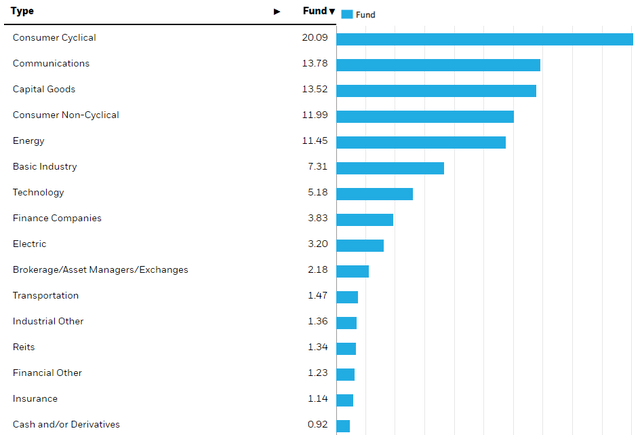

Essential knowledge from above might be in contrast towards the opposite ETF later. This ETF has concentrated publicity to Shopper Cyclicals (20+%) and excessive publicity to 4 different sectors (10+%), all of which symbolize over 70% of the entire portfolio.

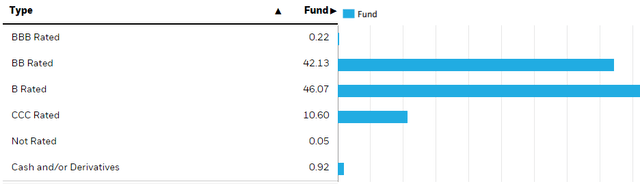

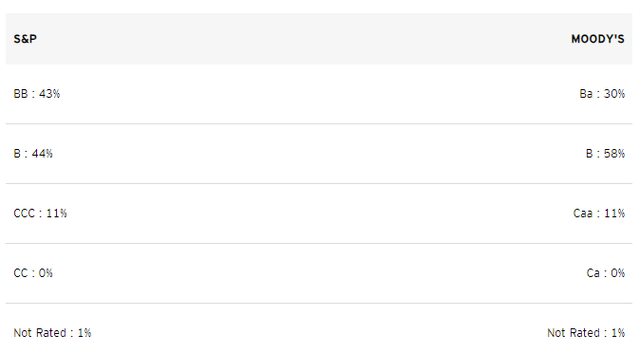

IBHH does not simply maintain non-investment-grade bonds however they’re extremely uncovered to the decrease rated ones inside the “junk” scores.

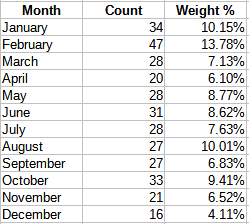

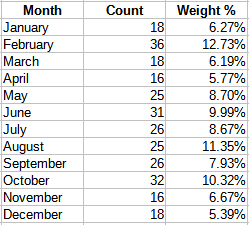

Based on S&P Global, the 3-year cumulative defaults charges traditionally are: .91% for BBB, 4.2% for BB, leaping to 12.4% for B and virtually half (45.7% of C rated debt. I used iShares knowledge to see how the bonds mature over the course of 2028, with no new reallocations occurring after the June bonds mature.

iShares.com; compiled by Writer

High holdings

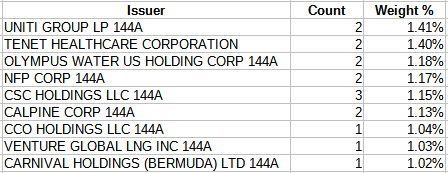

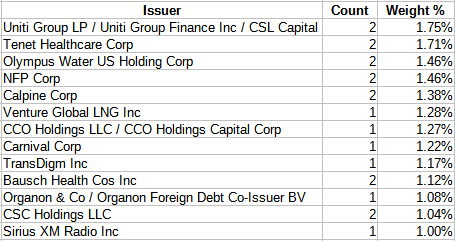

Utilizing XLS, I used to be in a position to get an inventory of all of the Issuers with 1+% publicity:

iShares.com; compiled by Writer

So whereas there’s a excessive publicity to B and C fee bonds, nobody Issuer gives excessive danger.

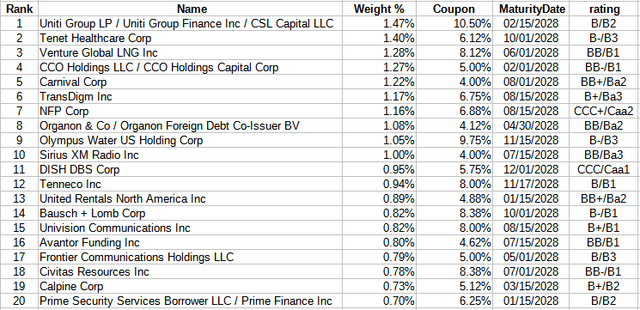

iShares.com; compiled by Writer

IBHH holds over 340 bonds, the High 20 account for 17% of the portfolio. It takes the smallest 120 positions to match that weight. The ETF does maintain two bonds that mature in 2029 (.03% weight) that I’d assume had their maturity date prolonged after the preliminary providing.

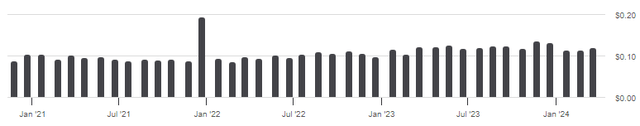

IBHH distributions evaluate

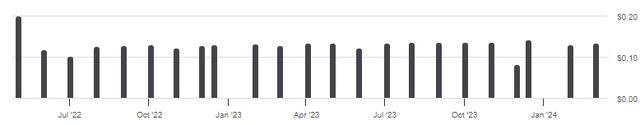

With little portfolio turnover as soon as the ETF begins, payouts can be anticipated to alter little, as has been the case with IBHH.

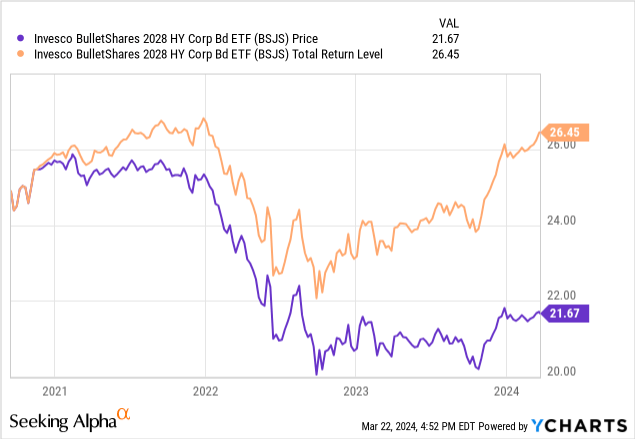

Invesco BulletShares 2028 Excessive Yield Company Bond ETF evaluate

In search of Alpha describes this ETF as:

The fund invests in U.S. dollar-denominated company bonds with efficient maturities within the yr 2028. The fund invests in excessive yield securities rated between BB+ and CCC- by S&P and Fitch and between Ba1 and Caa3 by Moody’s. The fund seeks to trace the efficiency of the BulletShares USD Excessive Yield Company Bond 2028 Index, through the use of consultant sampling approach. Invesco Trade-Traded Self-Listed Fund Belief – Invesco BulletShares 2028 Excessive Yield Company Bond ETF was shaped on September 14, 2020 and is domiciled in america.

Supply: seekingalpha.com BSJS

BDJS has $163m in AUM and costs traders 42bps in charges. The TTM yield is 6.75%.

Index evaluate

The BSJS ETF factsheet talked about that efficient the primary of this yr, the Underlying Index identify modified from the Nasdaq BulletShares®USD Excessive Yield Company Bond 2028 Index to the Invesco BulletShares® Excessive Yield Company Bond 2028 Index. The next Index definition was offered:

The Index gives publicity to a diversified basket of US dollar-denominated, funding grade bonds, all with a maturity — or, in some circumstances, efficient maturity — of 2028. The Index combines the exact maturity publicity of a person bond with the diversification advantages of a broad basket of securities, and is anticipated to have a return profile much like a held-to-maturity bond.

Supply: invescoindexing.com

Key traits embody:

| Coupon | 4.10% |

| Efficient Period (years) | 3.67 |

| Years to Maturity | 4.20 |

| Yield to Maturity | 5.15% |

| High quality | BBB+ |

| Variety of Bonds | 367 |

BSJS holdings evaluate

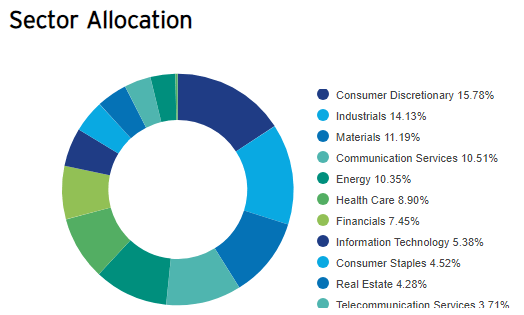

Sector allocations are as follows:

invesco.com

Utilities publicity is 3.47%. Like IBHH, BSJS is high loaded by sectors too however not fairly as dangerous because the iShares ETF. Scores present an analogous combine as IBHH holds.

Right here, based mostly on S&P scores, the beneath BB weights involves 55%, in comparison with 57% for IBHH. Word that Temper’s charges the holdings harder than S&P at the moment is. Utilizing these scores, 69% of the portfolio is fee beneath BB!

As its WAM signifies, BSJS has extra weight within the later months of 2028 than IBHH does, barely.

invesco.com; compiled by Writer

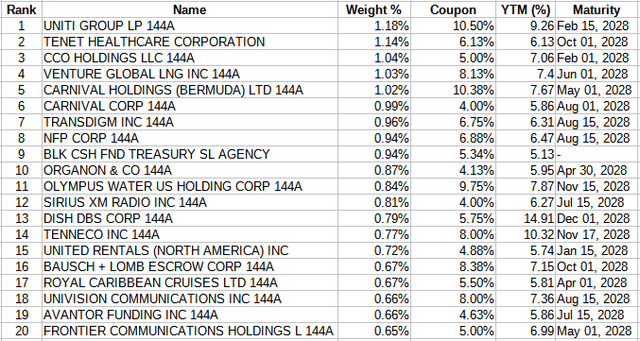

High holdings

BSJS has extra 1+% Issuer weights than IBHH has, although once more none over 2%.

invesco.com; compiled by Writer

The above Issuer record matches what I noticed for IBHH.

invesco.com; compiled by Writer

Right here, the High 20 account for 20% of the portfolio, barely greater than the focus inside IBHH. The identical weight on the backside takes 110 positions. There aren’t any bonds maturing previous 2028.

BSJS distributions evaluate

Exhibiting an analogous sample as IBHH, payouts have proven minimal variation, a truth that ought to please traders.

Evaluating ETFs

The subsequent desk summaries key options of every ETF

| Issue | IBHH ETF | BSJS ETF |

| Inception date | 3/8/22 | 9/14/20 |

| AUM | $67m | $164m |

| Charges (bps) | 35 | 42 |

| # of bonds held | 342 | 290 |

| High ten % | 10.1% | 12.0% |

| Turnover fee | 29% | 5% |

| Yield | 6.67% | 6.75% |

| YTM | 7.60% | 7.77% |

| Common worth | $95.30 | $94.99 |

| Common coupon | 6.28% | 6.38% |

| Efficient period | 2.86 | 3.02 |

| Common maturity | 3.74 | 4.36 |

| Portfolio score | B | B |

| Buying and selling quantity | 31k | 78k |

As I’d have anticipated since their sole funding purpose is similar, the ETFs diff little however there are components that appear to favor BSJS, equivalent to:

- A a lot decrease turnover ratio, which cuts the price of sustaining the portfolio.

- Slight benefit in each present yield and YTM, which, in contrast to open-ended ETFs, is extra related right here.

- Longer durations and maturities which might point out their portfolio has extra bonds maturing later in 2028. That ought to assist help the yield because the portfolio is transformed to money that yr.

- A decrease weighted common bond worth permitting for extra worth appreciations because the portfolio absolutely matures earlier than the termination date.

- A lot increased buying and selling quantity which ought to translate into tighter bid/ask spreads when coming into and exiting one’s place.

There are solely two that favor IBHH; decrease charges and fewer High 10 focus.

Portfolio technique

Whereas discussing this as I used to be writing, I used to be logically requested, “Why these ETFs versus different mounted revenue investments choices?”. I answered them this fashion:

- At present, company bonds present extra revenue that the safer decisions of financial institution CDs or debt points by the US or different governments. Whereas spreads are historic tight, the current danger/return image is okay for me.

- By utilizing an ETF, I believe the additional danger of investing in decrease rated bonds will offset the upper default danger these bonds carry if owned individually. By utilizing a Goal Time period ETF, I not solely obtain the above level, but in addition set a termination date with minimal interest-rate danger.

- My present mounted revenue allocation has little publicity to HY company debt, which for me means including both ETF provides diversification to my combine. That gained’t be the case for everybody.

- Since each managers off a collection of termination dates, by proudly owning a number of, I can decrease the danger I focus on subsequent.

Mounted revenue investor want to remember a seldom point out danger the face when proudly owning bonds that mature; that being reinvestment danger. That’s the danger of not having the ability to purchase new bonds with the identical coupon because the one which simply matured. Right here, I see that coming into play as traders have a spread of years every issuer gives to choose from. If one thinks rates of interest could have a gentle decline over an extended interval, the most suitable choice can be to “lock in” as we speak’s YTM obtainable. The subsequent desk reveals a number of the ETFs in every collection illustrating that worth.

| 12 months | Ticker | YTM | Ticker | YTM |

| 2026 | IBHF | 7.62% | BSJQ | 7.72% |

| 2027 | IBHG | 7.53% | BSJR | 7.41% |

| 2028 | IBHH | 7.60% | BSJS | 7.77% |

| 2029 | IBHI | 7.64% | BSJT | 7.47% |

| 2030 | IBHJ | 7.05% | BSJU | 6.96% |

For the Bulletshares collection, the BSJS ETF lined right here seems to be the most effective mixed of YTM and availability. For the iShares, going out to 2029 needs to be thought of by proudly owning the IBHI ETF. Since this text targeted on the 2028 pair, I’ll give the BSJS ETF a Purchase score, the IBHH solely a Maintain.

[ad_2]