[ad_1]

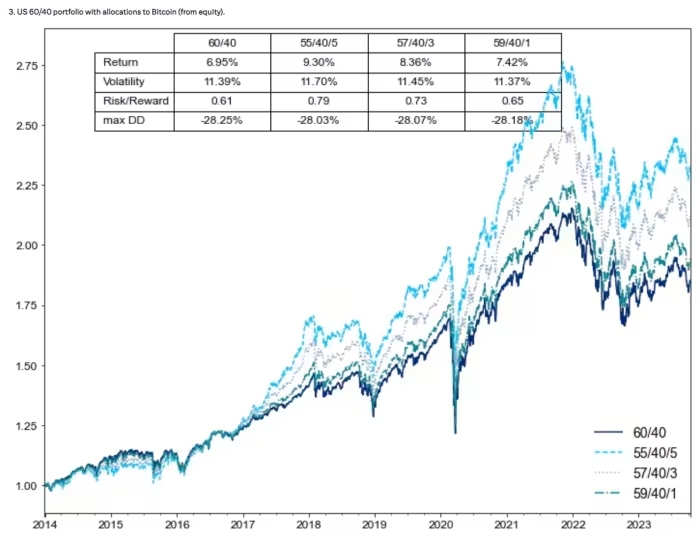

Exploring options to the standard 60/40 portfolio, there’s a proposal by Alex Saunders and David Glass from Citi suggesting a 55% shares, 40% bonds, and 5% bitcoin allocation.

This proposition features traction with the arrival of spot bitcoin ETFs, simplifying funding with out the custody or liquidity points related to bodily or futures-based bitcoin investments.

While not endorsing cryptocurrencies’ fundamental value, Citi’s analysts current a compelling case for including bitcoin. Their evaluation exhibits improved returns with a 5% bitcoin allocation, notably boosting common annual returns with out considerably altering most drawdowns.

Historic information helps this, with a major Sharpe ratio enchancment within the early years. Even post-bitcoin futures launch to SEC approval, an allocation of as much as 12% could also be optimum, suggesting potential advantages for buyers with various danger appetites.

Nonetheless, future expectations are crucial. For a 5% allocation to be justifiable, bitcoin would wish to generate returns of 12% to 16%, exceeding conventional asset courses’ anticipated returns.

With bitcoin’s recent surge and Citi’s mannequin goal, the prospects for assembly or surpassing these expectations appear promising.

[ad_2]