[ad_1]

Hispanolistic/E+ through Getty Photographs

I imagine it is an understatement to say that there’s a lot of uncertainty concerning the macroeconomic outlook proper now. A worry of a recession has not ceased. Perhaps that is the rationale that worth investing appears to be in vogue once more; shopping for one thing for lower than its price can solely shine as a precept when folks really feel defensive. And there is quite a lot of defensiveness going round as of late.

So if a shift in the direction of worth funds is happening, it’d have a very good purpose. However there are many these on the market, making it onerous for buyers to tilt to undervalued shares with confidence. On this publish, I’ll present a evaluate of one among them with the hope of not solely serving to you perceive its deserves and weaknesses, however perhaps additionally providing a means to consider such funds while you come across them.

Distillate U.S. Basic Stability & Worth ETF (NYSEARCA:DSTL), launched in October 2018 by ETF Sequence Options and co-managed by Vident Asset Administration and Distillate Capital Companions LLC, is an ETF centered on delivering long-term capital appreciation utilizing a worth investing strategy with an emphasis on high quality. Because it was launched, it has grown its AUM to $1.8 billion. Let’s take a better look, beginning with its strategy…

Methodology

First, let’s briefly describe how the ETF selects shares. There may be not quite a lot of transparency in terms of the primary checks that the supervisor applies to slim down its obtainable universe. Sadly, standards like profitability, money move, and liquidity are too obscure.

Nonetheless, the measures that the fund supervisor makes use of after the primary filtering spherical are extra particular, though there isn’t any point out of the particular values it appears to be like for. It assesses valuation through the FCF yield and checks the historic and forecast money move volatility, one thing that I admire contemplating how shallow valuation is when it is based mostly on latest outcomes that might mirror non-recurring (extraordinary) good points captured by money move. Nonetheless, that’s being really taken care of by the measure of FCF yield because the supervisor appears to be like for the “normalized” free money move for which non-recurring gadgets are adjusted. As for the denominator, it makes use of enterprise worth right here, not market cap. This captures the capital construction of the enterprise, which, in flip, widens the context essential to assess worth. It is sensible that you just should not desire a inventory that seems undervalued when utilizing market cap because the FCF yield’s denominator over one other with a barely decrease yield however with loads much less debt and extra liquidity; market cap is blind to those issues, however they will make or break a enterprise and so they, subsequently, decide worth.

Talking of market capitalization, you need to know that solely large-cap shares are thought-about for this fund. Final, the supervisor checks for indebtedness to exclude corporations that use quite a lot of leverage; it makes use of the debt/earnings ratio as a measure. After which, the portfolio is reconstituted quarterly utilizing these measures.

Thoughts that the portfolio will embody about 100 shares at any time. This seems counterproductive to me. I do not imagine you possibly can considerably outperform with large-cap shares in the long term should you maintain so many, as your portfolio is prone to behave extra just like the market as time goes by. Worth investing is about shopping for a safety for lower than it is price and that minimizes threat. However in a counter-intuitive means, this threat minimization can be the very purpose that it may yield income. Subsequently, a portfolio that a lot diversified tries to do one thing that the choice of worth shares already takes care of; lowering threat. And by additionally holding 100 shares at any time, you beat the entire function of a worth strategy, maybe solely to attenuate volatility, which is not synonymous with “threat” for all of us.

Efficiency

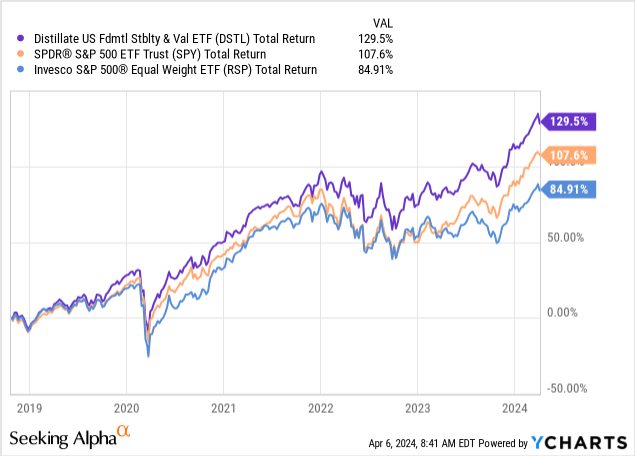

That being stated, many buyers might admire the commonly low volatility of the fund. It seems that DSTL has managed to outperform the SPDR S&P 500 ETF Belief (SPY) because it was launched in a constant method which suggests low volatility:

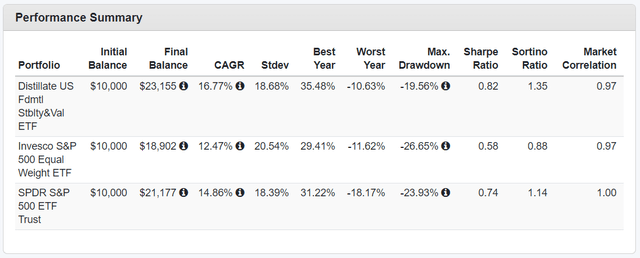

As you possibly can see, it additionally outperformed the Invesco S&P 500 Equal Weight ETF (RSP) which has outperformed SPY in the long term. Furthermore, it achieved its returns with a decrease customary deviation and a much less extreme most drawdown than RSP:

Whereas that is spectacular, I need to flip your consideration to one thing that I imagine offers some context for the efficiency of the fund going ahead. As I stated above, the market has been defensive not too long ago. This defensiveness might have discovered expression in a shift from progress to worth funds and, consequently, be the rationale for a worth fund to outperform throughout this era.

Keep in mind that in a bull market, being defensive is pricey. The standard route is hedging or holding extra liquid investments and even money that may end up in a chance value. As of late, nevertheless, there are extra worth alternatives within the large-cap house, making ETFs reminiscent of DSTL the plain selection for defensive buyers. So, buyers who’re all for inserting their cash someplace for the long run should ask this query: how a lot undervalued would the longer term 100 holdings of the fund be when in comparison with the present ones?

Dangers

In different phrases, the quick monitor report does not scream purchase me right here. And now that we’ve got sufficient context, I imagine it’s cheap to claim that the 0.39% expense ratio is excessive. The “promise” is not engaging sufficient for the worth requested.

Additionally, DSTL had a turnover of 95% in 2023. Can buyers say with confidence that the excessive transaction prices implied right here will probably be definitely worth the potential alpha?

The factor is that the general value right here might weigh closely on the efficiency of the fund in the long term. This has occurred earlier than with ETFs that had been launched on the proper time to benefit from the necessity of their methods in a sure context of macroeconomic circumstances, solely to underperform the market because the monitor report lengthened.

So, a very powerful threat long-term buyers might need to take into account right here is expounded to a possible alternative value. This ETF might be part of all the worth funds which have underperformed in the long term (and we’ve got lots of them). That creates a really actual alternative threat.

Verdict

In conclusion, I’m score DSTL a maintain for now. Merchants who suppose that the potential drivers behind the latest outperformance will probably be current within the quick time period might discover this automobile helpful. However long-term buyers seeking to be defensive might take into account the less expensive to carry RSP, which has proved that equal weighting generally is a easy and but efficient worth investing strategy in its essence.

What are your ideas? Do you personal DSTL or intend to? Additionally, let me know should you discovered this text helpful or not less than fascinating; it means loads. Thanks for studying!

[ad_2]