[ad_1]

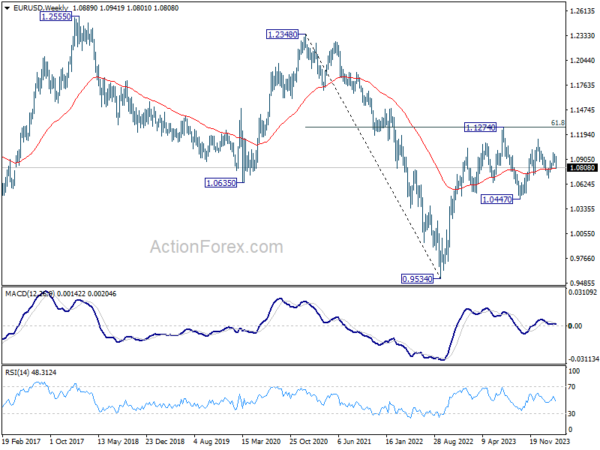

EUR/USD’s fall from 1.0980 continued final week and the robust break of 55 D EMA recommend that rebound from 1.0694 has accomplished. Preliminary bias stays on the draw back for retesting 1.0694 first. Break there’ll resume the decline from 1.1138 and goal 100% projection of 1.1138 to 1.0694 from 1.0980 at 1.0536. On the upside, above 1.0867 minor resistance will flip intraday bias impartial first. However danger will keep on the draw back so long as 1.0941 resistance holds.

Within the greater image, worth actions from 1.1274 are considered as a corrective sample to rise from 0.9534 (2022 low). Rise from 1.0447 is seen because the second leg. Whereas additional rally might can’t be dominated out, upside needs to be restricted by 1.1274 to carry the third leg of the sample. In the meantime, sustained break of 1.0694 help will argue that the third leg has already began for 1.0447 and probably beneath.

In the long run image, a long run backside is in place at 0.9534 on bullish convergence situation in M MACD. It’s nonetheless early to name for bullish pattern reversal with the pair staying inside falling channel within the month-to-month chart. However, sustained buying and selling above 55 M EMA (now at 1.1060) and break of 1.1274 resistance will elevate the possibility of reversal and goal 1.2348 resistance for affirmation.

[ad_2]