[ad_1]

Hispanolistic

The Constancy Excessive Dividend ETF (NYSEARCA:FDVV) is an index ETF specializing in dividend-paying U.S. equities, with smaller investments in worldwide equities. FDVV’s above-average 3.3% dividend yield and low-cost valuation make the fund a purchase. On the similar time. I am unable to say that I discover the fund clearly stronger than most different giant dividend ETFs out there, together with the Schwab U.S. Dividend Fairness ETF (SCHD). FDVV is ok, however nothing particular.

FDVV – Fundamentals

- Funding Supervisor: Constancy.

- Underlying Index: Fidelity High Dividend Index.

- Dividend Yield: 3.26%.

- Expense Ratio: 0.15%.

- Whole Returns CAGR 5Y: 13.23%.

FDVV – Overview and Evaluation

Technique and Portfolio

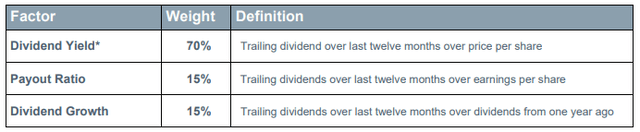

FDVV is an index ETF, monitoring the Fidelity High Dividend Index. It’s a surprisingly difficult index, which begins by rating relevant securities by dividend yield, payout ratio, and dividend development. Weights are as follows:

The index then combines the rating above with a dimension issue, in a course of meant to scale back dimension bias. Presumably, this implies guaranteeing the same common market cap to the market / related fairness index. The index then selects shares based mostly on their scores and trade. The precise course of is as follows:

Sector weights are depending on sector dividend yields. Safety weights inside every sector are depending on market cap.

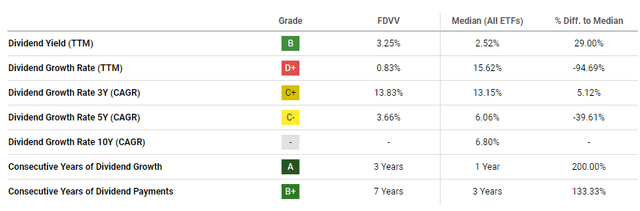

Total, the method appears a bit convoluted and complicated. The resultant portfolio does appear affordable sufficient, with FDVV investing in virtually 100 shares from all related trade segments. The biggest holdings are as follows:

FDVV

As might be seen above, FDVV focuses on well-known blue chips, together with Apple Inc. (AAPL), Microsoft Company (MSFT), The Coca-Cola Firm (KO) and PepsiCo, Inc. (PEP). A few of these are fairly standard investments in dividend investing circles, together with Coca-Cola and PepsiCo. FDVV does appear to exclude a lot of the frothier tech corporations, with the notable exception of NVIDIA Company (NVDA). Nvidia does pay a dividend, however it yields a paltry 0.02%. Outright excluding the corporate would most likely make extra sense, for my part a minimum of.

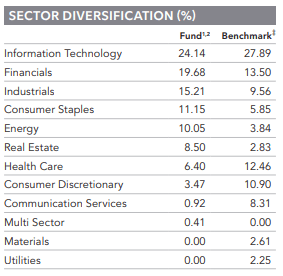

FDVV offers traders with publicity to most sectors, except for supplies and utilities. As is the case for many dividend ETFs, the fund is chubby sure old-economy industries, together with industrials and client staples, whereas being underweight tech and development. Sector weights appear a bit extra balanced than common, nevertheless, with a large 24.1% tech allocation.

FDVV

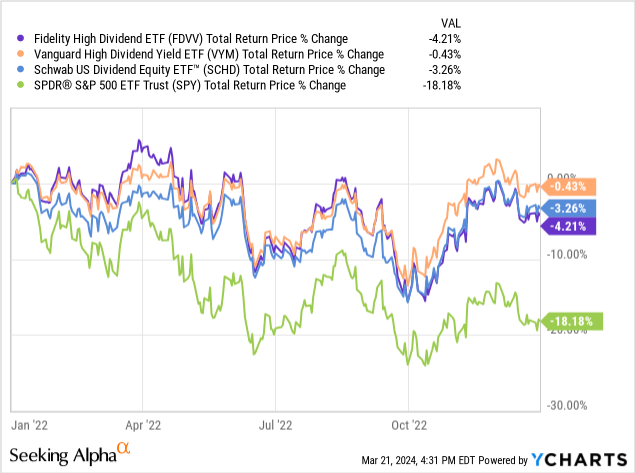

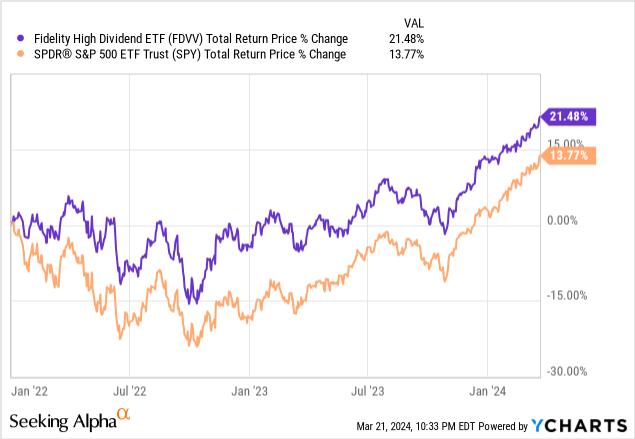

Dividend ETFs are inclined to outperform when tech underperforms, and vice versa. FDVV does too, however by lower than most of its dividend friends. For example, evaluate the fund’s efficiency with that of the S&P 500 and its friends throughout 2022, when tech underperformed:

Knowledge by YCharts

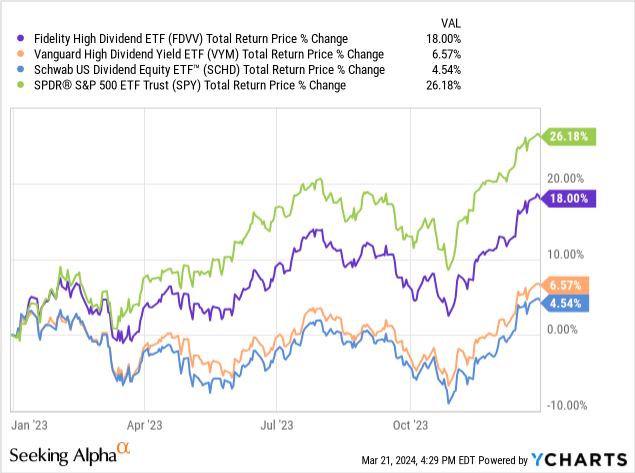

And 2023, when tech outperformed:

Knowledge by YCharts

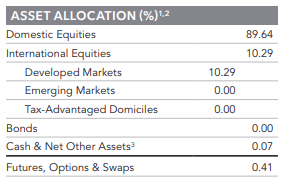

Lastly, FDVV focuses on U.S. equities, with smaller allocations to different developed market shares.

FDVV

Total, FDVV looks like a really vanilla dividend fairness ETF, sans the small worldwide fairness publicity.

Dividend Evaluation

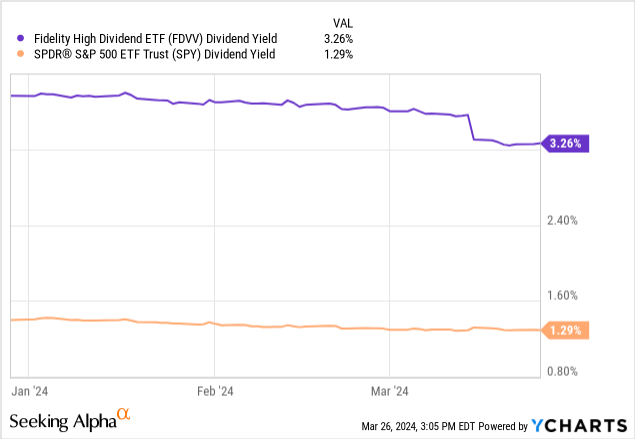

FDVV’s underlying index takes into consideration dividend yields when developing its portfolio, which leads to an above-average 3.3% dividend yield for the fund itself. For reference, the S&P 500 at the moment yields 1.3%, lower than half.

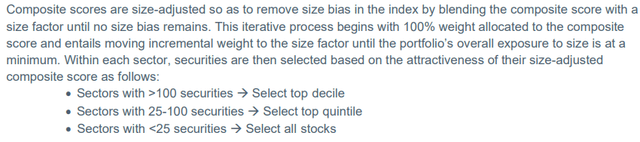

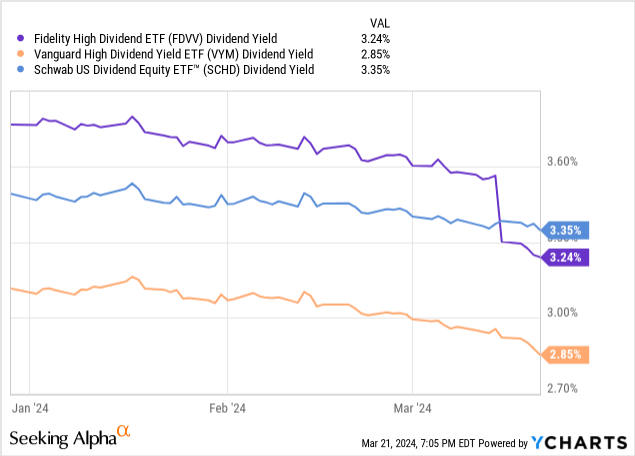

FDVV’s dividends appear about common for a dividend ETF, nevertheless, a minimum of compared to a few of its bigger friends.

Knowledge by YCharts

On a extra destructive notice, dividends are a lot much less steady and riskier than common, declining by virtually 20% throughout 2020. In my view, and taking into account the fund’s technique and holdings, the decline was probably as a result of modifications in portfolio composition, not dividend cuts per se. For example, neither Apple nor Microsoft, two of FDVV’s largest holdings, minimize their dividends in the course of the pandemic, however the fund did. FDVV’s friends have been usually in a position to develop their dividends in the course of the pandemic, together with the S&P 500, the Vanguard Excessive Dividend Yield Index Fund ETF Shares (VYM), and the Schwab U.S. Dividend Fairness ETF (SCHD).

On a extra constructive notice, FDVV’s dividends have seen fairly good development since inception, rising at a 6.0% CAGR. Progress has been very risky, as evidenced within the information beneath.

Total, FDVV’s dividends appear to be fairly good, and one thing of a profit for shareholders. Bear in mind, the fund’s 3.2% yield is greater than twice the fairness common and development has been strong however risky. Different dividends ETFs supply broadly comparable yields and extra steady development track-records, nevertheless.

Valuation Evaluation

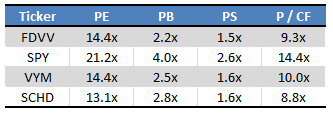

FDVV focuses on equities with above-average yields. Dividend yields are one thing of a valuation metric, so this leads to a fund with a relatively low-cost valuation vis a vis broader fairness indexes, together with the S&P 500. Valuations appear broadly just like different dividend ETFs, nevertheless.

Morningstar – Desk by Writer

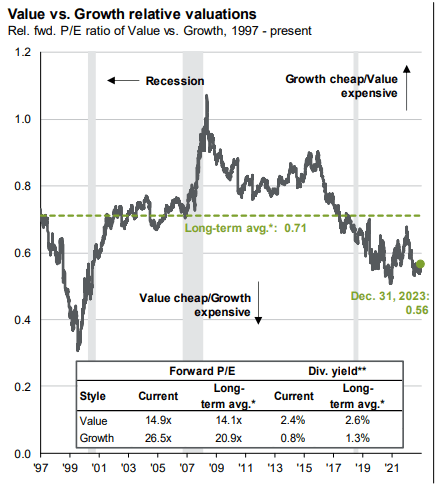

Extra broadly, worth shares are at the moment buying and selling with notably low-cost valuations, a minimum of vis a vis development shares. Valuation gaps are round 15% wider than common.

JPMorgan Information to the Markets

Cheaply valued shares and funds may outperform, contingent on valuations normalizing. Valuations have fluctuated these previous few years, with worth considerably outperforming throughout 2022 and development considerably outperforming throughout 2023. The general pattern is considerably murky, however constructive these previous two years.

Knowledge by YCharts

Total, FDVV’s low-cost valuation may result in additional beneficial properties, an essential profit for shareholders. Beneficial properties are removed from sure, and I do not actually see any short-term catalyst for these both although.

Efficiency Observe-Document

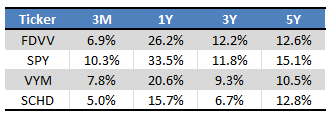

FDVV’s general efficiency track-record is cheap sufficient, though nothing excellent. I am seeing slight underperformance relative to the S&P 500 since inception, however slight outperformance relative to friends for a similar. Returns have improved post-pandemic, with FDVV outperforming in the course of the previous three years.

Searching for Alpha – Desk by Writer

FDVV’s efficiency is broadly reflective of the fairness and worth fairness market. Returns have been good since inception, particularly so after valuations bottomed out just a few years in the past. At present costs and valuations, I am bullish.

FDVV – Fast Peer Comparability

FDVV looks like an inexpensive sufficient fund, though the identical is true of most different dividend ETFs, and FDVV doesn’t appear considerably, or clearly, stronger than these.

Dividend yields are about common.

Dividend development and dividend stability considerably below-average.

Whole returns a bit increased, however akin to these of SCHD.

Valuations appear fairly shut to look averages.

FDVV’s trade exposures appear nearer to these of the S&P 500 than most different dividend ETFs, sans the worldwide fairness investments.

Total, though FDVV and its friends do considerably differ, variations are small, and don’t clearly favor one fund over the opposite. FDVV is ok, however so are most different dividend ETFs. I really feel that is essential, and never one thing that’s true for a lot of different funds. A fund just like the JPMorgan Fairness Premium Earnings ETF (NYSEARCA:JEPI) may be very totally different than different coated name ETFs, as an example. The identical is true for the Panagram BBB-B Clo ETF (CLOZ) and different bond ETFs. The dividend ETFs do appear far more related, and what variations they’ve don’t clearly benefit a particular fund. At the least for my part.

Conclusion

FDVV’s above-average 3.3% dividend yield and low-cost valuation make the fund a purchase.

[ad_2]