[ad_1]

US stock indexes surged to new heights on Wednesday following the Federal Reserve’s choice to keep up rates of interest and uphold its projection of three fee cuts this yr.

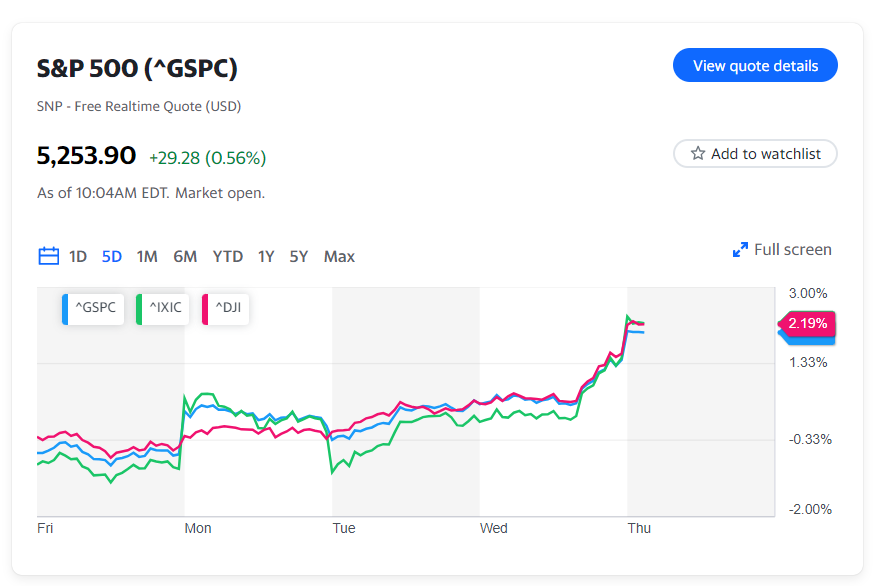

The S&P 500 (^GSPC) climbed by 0.8%, reaching a historic shut above 5,200 at 5,224.62. Concurrently, the Dow Jones Industrial Common (^DJI) surged roughly 1%, attaining a report closing of 39,512. Main the cost was the Nasdaq Composite (^IXIC), dominated by tech shares, which soared over 1% to culminate at a brand new excessive of 16,369.

All three main indices rebounded from marginal declines previous to the Fed’s announcement.

Accompanying its coverage assertion, the Fed disclosed up to date financial projections in its Abstract of Financial Projections (SEP), notably together with its “dot plot” illustrating policymakers’ anticipated rate of interest trajectories.

Fed officers anticipate the fed funds fee to lower to 4.6% by the conclusion of 2024, suggesting a possible 0.75% discount this yr, in alignment with market expectations leading into Wednesday.

Regardless of the information, bond markets exhibited minimal movement, with yields on the 10-year Treasury (^TNX) experiencing slight decreases to roughly 4.28%, following a notable enhance of over 20 foundation factors over the previous fortnight.

Total, the market’s response to the Fed meeting underscored a widening participation out there rally, with the small-cap benchmark index (^RUT) surging almost 2%, and 6 out of the 11 S&P 500 sectors rallying by greater than 1%.

[ad_2]