[ad_1]

The pair stays beneath stress, hovering round 0.6528 on Friday. Earlier this week, the Australian greenback confronted vital challenges, with a pointy decline towards the USD. Efforts to stabilise the trade price have seen restricted success to date.

The stronger-than-expected financial information from the US has dampened hopes for intensive rate of interest cuts by the Federal Reserve this 12 months. The capital market presently anticipates solely a 40-basis level discount, a downgrade from the 60-75 foundation factors anticipated at the beginning of the week.

The Reserve Financial institution of Australia (RBA) is contemplating initiating its financial easing insurance policies in the direction of the top of 2024. Nevertheless, Australia’s sturdy employment market and chronic client inflation complicate these plans. Current information signifies that the unemployment price dropped to three.7% in February, the bottom since September 2023, whereas inflation remained regular at 3.4% for the third consecutive month.

A latest Westpac report highlights the RBA’s want for better confidence within the inflation outlook earlier than critically considering a price minimize.

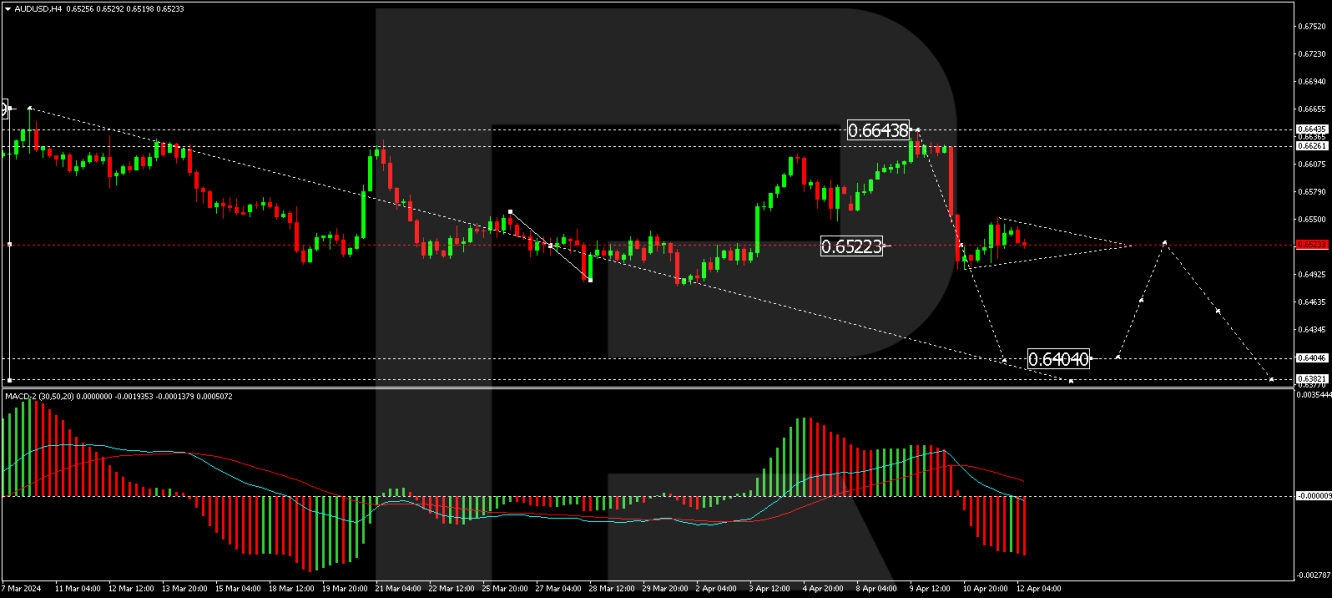

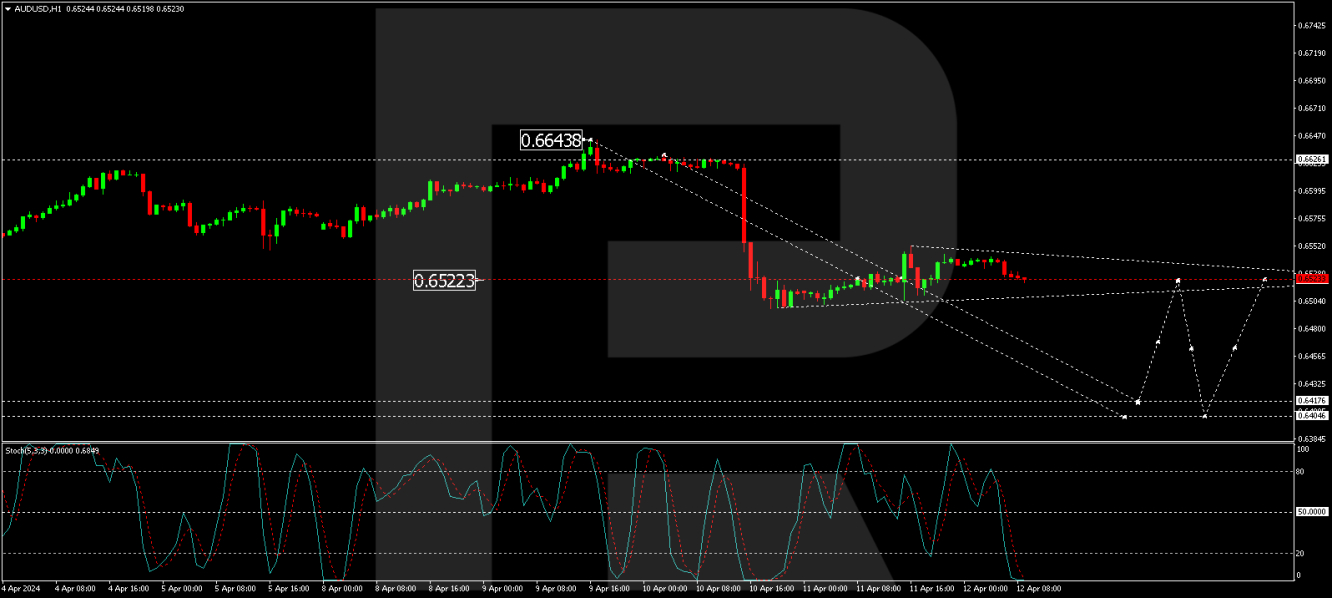

Technical evaluation of AUD/USD

On the H4 chart, the AUD/USD is growing the fifth wave of decline in the direction of 0.6832. The market has not too long ago skilled a decline to 0.6498. A consolidation vary is forming above this degree immediately. If the pair exits this vary upward, a corrective transfer to 0.6570 could happen. Conversely, a downward exit may result in the continuation of the downward wave in the direction of 0.6404. The MACD indicator helps this bearish outlook, with its sign line above zero however trending downwards sharply.

The H1 chart exhibits a consolidation round 0.6523. An upward breakout may result in a correction in the direction of 0.6570. A downward transfer from the vary may provoke an additional decline to 0.6420, probably extending to 0.6404. The Stochastic oscillator, presently beneath 20, suggests a doable rise to 50, indicating potential short-term corrections inside a broader downward development.

By RoboForex Analytical Division

[ad_2]