[ad_1]

Anthony Bradshaw

Many buyers appear to be ignoring gold and the gold mining sector whereas they as a substitute pursue “scorching cash” investments comparable to Bitcoin and AI shares like NVIDIA (NVDA). Nevertheless, gold has lately been hitting new highs, and the value of gold may have a lot additional to run within the coming years. Gold mining shares normally should not at new highs and this has created a disparity in values and a probably sturdy shopping for alternative. There are some very large looming international issues that would result in sturdy features for gold and gold mining shares within the coming years, and this might unleash a secular bull marketplace for treasured metals and miners.

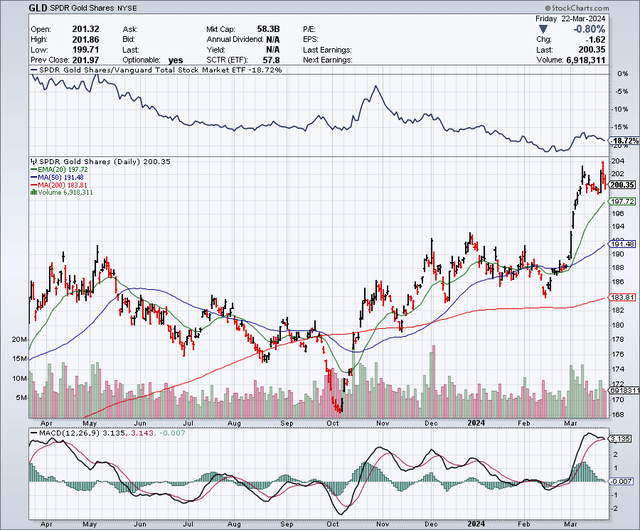

The 5-12 months Chart For Gold

Because the 5-year chart for the SPDR Gold Shares ETF (GLD) reveals, the value of gold only recently eclipsed prior report highs. This sort of breakout transfer sometimes results in extra features going ahead, though there could possibly be pullbacks alongside the best way. It is price noting that the 50-day shifting common has lately moved over the 200-day shifting common, and this has created a bullish “Golden Cross” formation on the chart.

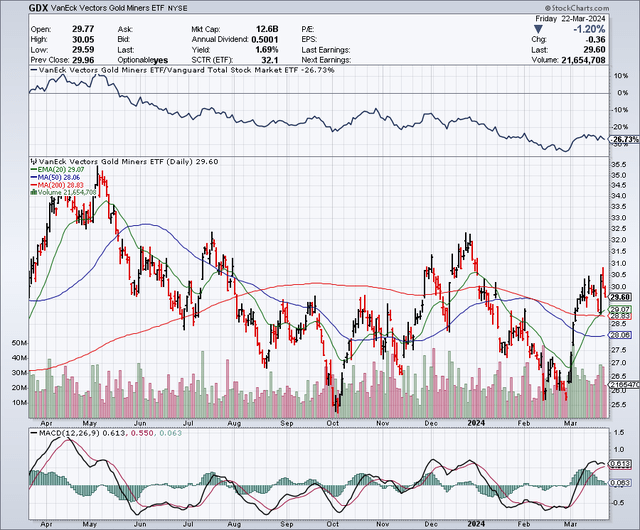

The 5-12 months Chart For Gold Miners

Because the 5-year chart for the VanEck Vectors Gold Miners ETF (NYSEARCA:GDX) reveals, the report excessive value was hit again in 2020 at round $42. Despite the fact that it has jumped in current days, it is just buying and selling within the $29 vary and a transfer again to the previous excessive would signify a possible acquire of round 40%. What’s notable right here is that in distinction to the gold ETF, there is no such thing as a “Golden Cross” formation on the chart but. Nevertheless, the present share value of this ETF is buying and selling above the 50-day and 200-day shifting averages, and if that continues to carry, it’s only a matter of time earlier than a possible breakout for gold mining shares is signalled by a Golden Cross formation. If this happens, I imagine it is going to put into play the previous $42 excessive for this ETF, and probably generate a roughly 40% acquire within the subsequent 12 months or so, with even bigger features doable within the coming years.

There are a number of the reason why buyers may gain advantage from having publicity to gold and particularly gold mining shares, which seem like undervalued at present ranges and probably poised to breakout. Let’s check out among the causes now:

#1 The U.S. Nationwide Debt

The debt in the USA is now at report ranges and it’s accelerating at an alarming charge. I’m not an enormous fan of Bitcoin, however I can see why folks all around the world are desperately searching for a “retailer of worth”. So many third world nations have skilled huge forex depreciation and inflation and they’re proper to need some kind of asset that may’t be printed by a central financial institution. With the U.S. debt degree reaching report ranges, the U.S. is wanting increasingly more like a 3rd world nation in terms of fiscal accountability. The U.S. debt is now nicely over $34 trillion and that works out to a debt of greater than $102,000 per citizen. Since many voters do not pay taxes, this debt load is equal to about $267,000 per taxpayer. Meaning if you’re a taxpayer, your portion of the debt is at this sky-high degree and rising. You probably have by no means appeared on the U.S. Debt Clock, please have a look here, and you may see how alarming and the way shortly our debt load is rising, each minute of each day.

One other solution to analyze the debt load in the USA, is to match the Gross Home Product or “GDP” of our nation to the debt load. Proper now the U.S. Authorities Debt is equal to roughly 124% of the nation’s nominal GDP. Only for comparability, again in 1974, the U.S. debt was solely equal to 35% of the GDP. As lately as 2019, the debt was 105% of GDP, and this reveals how a lot worse this has turn out to be, in nearly 4 years.

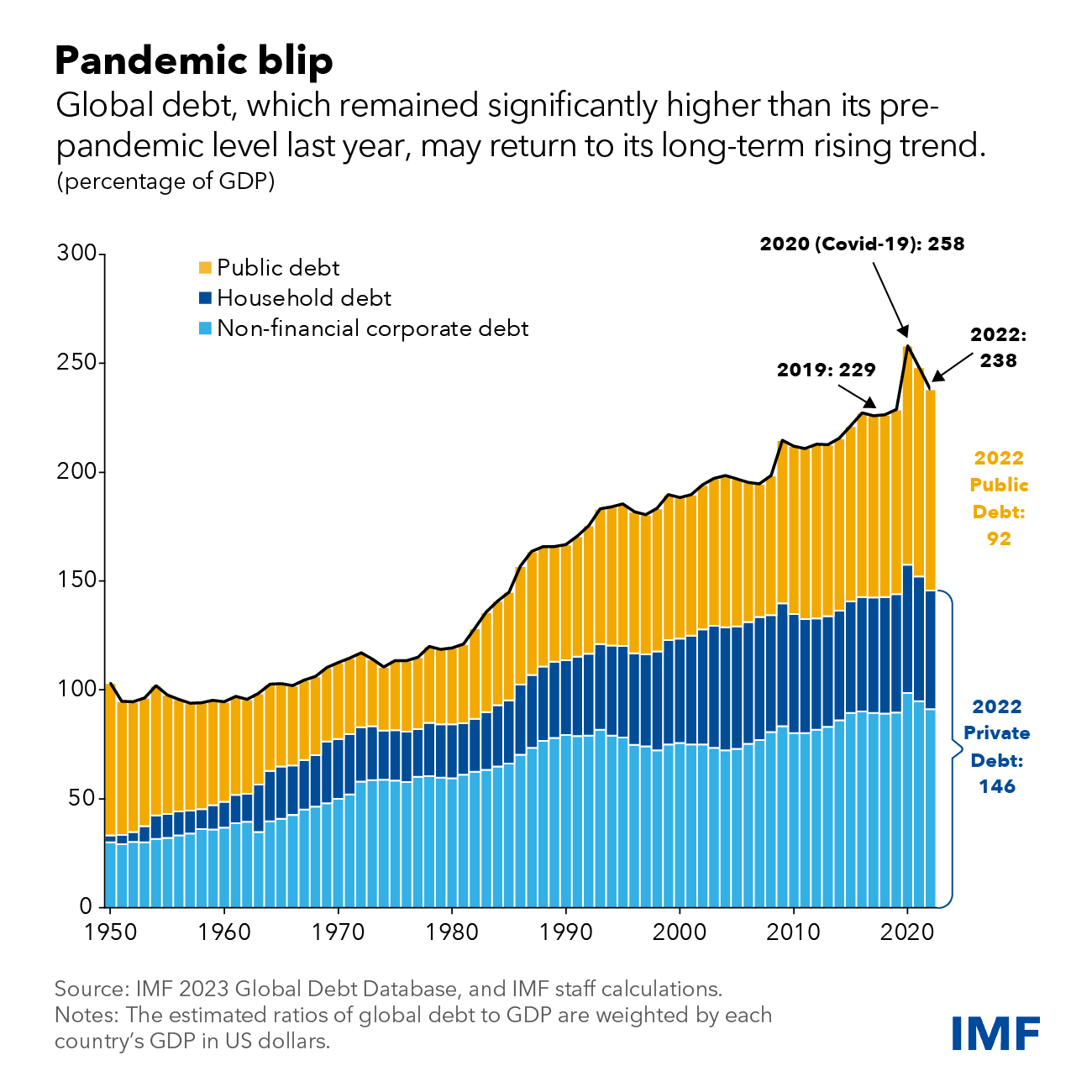

Many countries are awash in debt. If you happen to recall the large issues concerning the debt ranges in Greece just a few years in the past, it’s price noting that their debt to GDP ratio is at the moment round 172%. Venezuela is at the moment proper round 133%. As most buyers know, Venezuela shouldn’t be an financial system we wish to mannequin after and but in a 12 months or two we may simply have the identical debt to GDP ratios. As an investor, we have to be involved about U.S. debt ranges, however we additionally want to contemplate that international debt ranges are uncontrolled and this can be a very bullish issue for gold and gold mining shares. As you possibly can see from the graph beneath, the worldwide debt ranges proceed to rise. The Worldwide Financial Fund or “IMF” is anxious concerning the sustainability of this rising debt load. In February 2024, the IMF introduced that international debt hit a report excessive at $313 trillion. This reveals the world is awash in debt and it continues to develop. Debt can result in decrease development, and it will possibly additionally result in a debt and forex disaster. That is one thing buyers can hedge towards by proudly owning gold and gold mining shares.

IMF 2023 World Debt Database, and IMF employees calculations

#2 The Banking System

Despite the fact that the U.S. financial system has been displaying energy, we now have seen quite a lot of regional banks instantly collapse. Banks are inherently extraordinarily leveraged enterprise fashions and because of this, I now not put money into banks. As most of us who use In search of Alpha to enhance our returns and develop our information when it comes to alternatives, I take pleasure in (and take critically) studying what Avi Gilburt has to say, and for fairly some time now, he has been warning us about potential risks within the U.S. banking system. He has made many prescient calls and it is smart to take these warnings critically. I believe my greatest concern is that if we’re seeing some very massive regional banks collapse when the financial system is powerful, what would occur within the occasion of an precise recession to our banking system? Banks are inclined to fall like dominoes when instances get powerful.

A few of the financial institution failures that occurred in 2023, had been at the least partially on account of points with the massive bond losses that had been a results of the Federal Reserve elevating rates of interest so excessive. This stays a difficulty for some banks, however the different concern is the extent of commercial real estate loans that many banks are beginning to see losses on. If we expertise a recession, this might add one other large threat to the banking sector.

#3 Central Banks Are Shopping for Gold

In response to Bloomberg, international gold demand hit a report in 2023, and sustained central financial institution purchases of gold had been anticipated to proceed into 2024. A few of this shopping for seems to be based mostly on the concept the Federal Reserve goes to start out slicing charges in 2024, thereby making gold a extra engaging asset. There are additionally quite a lot of nations which can be making an attempt to finish the dominance of the U.S. Greenback as a reserve forex, and gold is without doubt one of the choices.

#4 A Drop In Charges Might Increase Gold And Mining Shares

There’s about $6 trillion in money market funds proper now, however the Federal Reserve is predicted to decrease charges in 2024, and doubtless past. As charges drop, it makes holding property like gold extra engaging. Proper now, cash market funds are yielding over 5%, however that would get lower in half within the subsequent couple of years, which may trigger many buyers to search for extra engaging funding alternate options. If we see a recession within the subsequent couple of years and customers are fearful concerning the banking system, this might enhance demand for gold and gold mining shares will profit.

What I do not Like About Gold And Mining Shares

Gold may drop in worth, particularly if charges keep larger for longer. Gold mining shares are usually unstable and that could possibly be an even bigger than anticipated draw back threat for some buyers. Gold mining corporations are sometimes positioned in nations which can be unstable, and mining is inherently harmful. Because of this, I by no means make investments an excessive amount of in a single gold mining inventory. GDX affords diversification by investing in lots of gold shares, and this reduces geopolitical dangers in addition to the danger of a serious security incident.

In Abstract

Gold is now buying and selling at new report highs and this breakout may finally drive the same breakout rally to new highs for gold mining shares. Buyers may turn out to be more and more involved about retaining a lot of their internet price invested within the U.S. Greenback, and likewise in a U.S. financial institution. The U.S. Greenback and U.S. banking system and nationwide debt ranges may pose extra of a threat than many people at the moment acknowledge. The U.S. nationwide debt is alleged to be rising by about $1 trillion, each 100 days. It appears the one path to cope with this debt is to both have a debt disaster, or to inflate the debt away by decreasing the U.S. Greenback buying energy over time. Each of those options are very bullish for gold and the mining sector. I believe it’s only a matter of time earlier than gold makes even larger highs, and this could assist gas a rally in GDX, which may take it again to report highs (this could be a 40% acquire) and past.

No ensures or representations are made. Hawkinvest shouldn’t be a registered funding advisor and doesn’t present particular funding recommendation. The data is for informational functions solely. You need to all the time seek the advice of a monetary advisor.

[ad_2]