[ad_1]

Is there something thrilling about rates of interest? They’re boring and commerce by complicated derivatives which are onerous to grasp.

Whereas I’m no professional on charges, I do know sufficient to grasp it’s completely crucial to be aware of no less than the fundamentals.

Why? Effectively, as a result of the charges will not be only one amongst many elements affecting the markets. They’re THE most necessary issue. Rates of interest decide the worth of cash, affecting every part from shares, bonds to commodities.

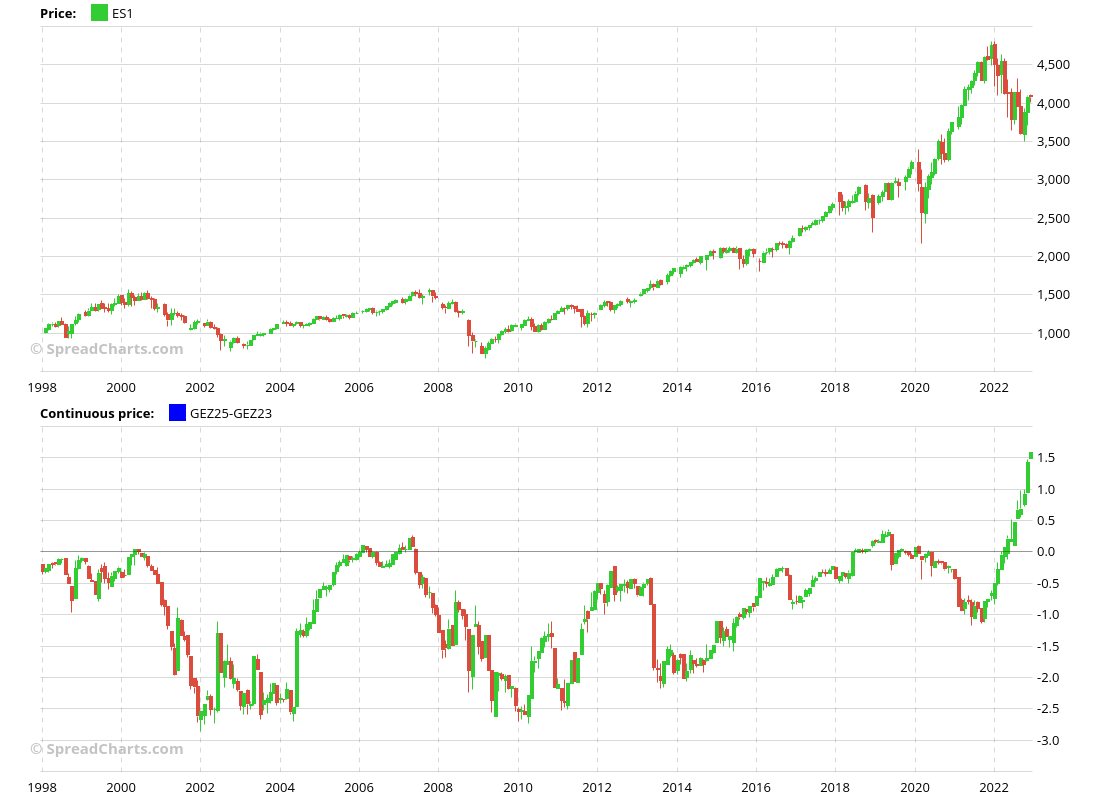

Right here is the proof. The chart beneath compares the worth of the S&P 500 with the anticipated Fed Funds fee on the finish of 2022. Firstly of this 12 months, the market anticipated the speed would end the 12 months beneath 1%. It couldn’t be extra mistaken. The Fed raised charges many instances this 12 months, and present market expectations are the Fed Funds fee will end the 12 months properly above 4%.

That’s an enormous mismatch between expectations and actuality. It’s not a coincidence that we now have a bear market in shares. The rise in rates of interest sucked liquidity from the market and made cash dearer. All of a sudden, all these unprofitable corporations have a tough time sustaining their inflated enterprise as they used to.

Eurodollars

However at the moment, I wish to speak concerning the Eurodollar market. That’s NOT the change fee between Euro and Greenback. I’ve the Eurodollar rate of interest futures market in thoughts (ticker GE). It’s the 3-month rate of interest on {Dollars} outdoors of the US banking system, for instance, in European banks.

That’s not just a few area of interest market. Actually, Eurodollar is probably the most liquid futures market worldwide. Nothing comes shut, not even S&P 500 futures or commodities like crude oil. That ought to not shock you in the event you think about trillions of {dollars} of loans around the globe hedged with Eurodollar futures.

On SpreadCharts, we frequently observe the Eurodollar interdelivery spreads, just like the one beneath. It may be an extremely useful software for timing US recessions. We totally defined it in one among our macro outlook movies for customers of the premium version of SpreadCharts earlier this 12 months.

LIBOR no extra

Now that you just’re aware of the significance of the Eurodollar market, you’ll perceive the groundbreaking change that’s about to occur.

The underlying for Eurodollar futures is the 3-month USD LIBOR fee. LIBOR stands for London Inter-Financial institution Provided Charge. All LIBOR charges are set by numerous banks that ship their quotes to ICE Benchmark Administration (IBA), a subsidiary of Intercontinental Change. These quotes ought to replicate the charges at which banks are keen to lend to one another. IBA then calculates a trimmed common for every fee and publishes the efficient fee for every forex and maturity.

The issue is that LIBOR charges will not be set by the market. That makes them liable to manipulation. Such schemes have been revealed by regulators within the aftermath of the monetary disaster in 2008. After quite a few fines, it was determined LIBOR can be terminated.

Publishing of many LIBOR charges has already ceased, and the remaining LIBOR charges shall be discontinued on the finish of June 2023. That features the 3-month USD LIBOR fee, which serves because the underlying for Eurodollar futures.

Introducing SOFR

There was a necessity for the alternative of the LIBOR. It was determined it could be SOFR, which stands for Secured In a single day Funding Charge. In contrast to LIBOR, SOFR is market-based, which makes it much less liable to manipulation.

The second most important distinction is that SOFR is a secured fee. As its title implies, SOFR measures the price of borrowing US {dollars} in a single day utilizing Treasuries as collateral. That may have unintended penalties when, for instance, there’s a lack of that specific collateral. However I wish to keep away from delving into particulars.

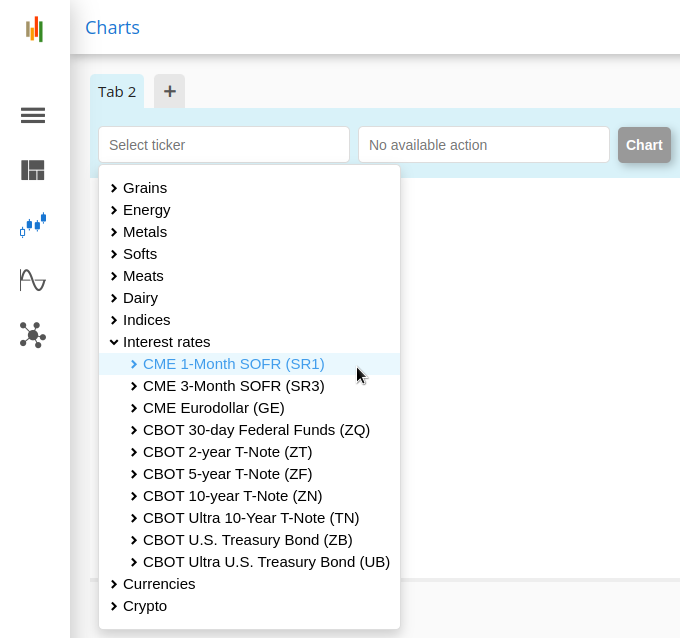

CME Group launched 1-month (ticker SR1) and 3-month (ticker SR3) SOFR futures in 2018. Recently, the liquidity of those contracts has exploded as everybody expects SOFR to take over LIBOR charges.

The transition

The essential factor is that 3-month SOFR futures will exchange Eurodollar futures. However what are the sensible implications for you as a dealer? As I mentioned, the remaining USD LIBOR charges will stop to be revealed after June 30, 2023.

CME Group set April 14, 2023, because the conversion date. April, Might, and June Eurodollar futures will proceed to commerce usually till their expiration.

Nonetheless, all Eurodollar futures expiring previous June shall be transformed into the identical expirations in 3-month SOFR futures on April 14, 2023. The conversion will occur on a 1:1 foundation, plus a worth adjustment of 26.161 bps. The precise formulation is:

SR3 futures Onset Worth = GE futures settlement worth + 26.161 bps

The existence of a predetermined conversion date that’s recognized to all market individuals has humorous penalties. For instance, right here’s the Eurodollar-SOFR unfold for December 2022 (prime) and December 2023 (backside) contracts.

We’re prepared

SpreadCharts customers gained’t be left behind. We added information for each 1-month and 3-month SOFR futures since their inception into the SpreadCharts app at the moment.

And naturally, we now have Commitments of Merchants information for each SOFR futures.

Whereas the 3-month SOFR futures will simply exchange the Eurodollars, including 1-month SOFR futures opens new methods to discover the info.

For instance, you may monitor the SOFR / Fed Funds unfold of equal period on the continual chart beneath.

Or 1-month / 3-month SOFR spreads throughout the curve (beneath) and discover its affect on different markets resembling currencies.

The chances are countless with SpreadCharts analytics.

[ad_2]