[ad_1]

Jonathan Kitchen

As inflation probably re-accelerates, traders proceed to indicate rising demand for progressive monetary devices that an defend in opposition to rising worth. To that finish, it is price trying on the Horizon Kinetics Inflation Beneficiaries ETF (NYSEARCA:INFL). INFL is an actively managed Alternate Traded Fund that seeks long-term progress of capital in actual phrases, i.e., adjusted for inflation. The fund goals to realize this goal by investing predominantly in home and international fairness securities of firms anticipated to profit from rising costs of actual property. INFL was launched on January 11, 2021. It has an expense ratio of 0.85%, and over $640 million in property underneath administration.

INFL Holdings: A Nearer Look

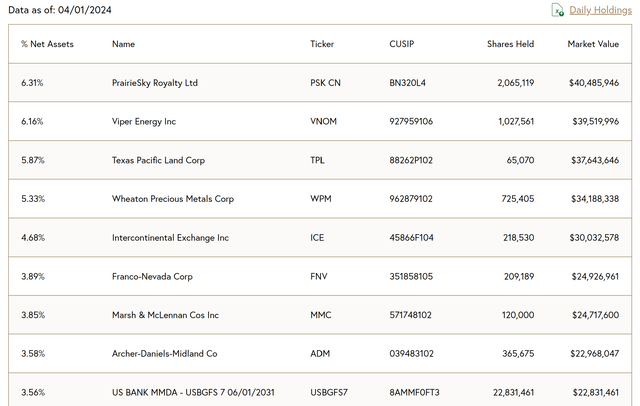

INFL’s portfolio is a mix of conventional listed U.S. shares, royalty trusts, Grasp Restricted Partnerships (MLPs), and a bunch of listed shares of commodity exchanges from completely different components of the world. The fund’s high 10 holdings account for roughly 45% of the fund’s internet property. These embrace firms like PrairieSky Royalty Ltd, Wheaton Valuable Metals Corp, Texas Pacific Land Corp, Viper Power Inc, and Intercontinental Alternate Inc, amongst others.

Sector Composition and Weightings

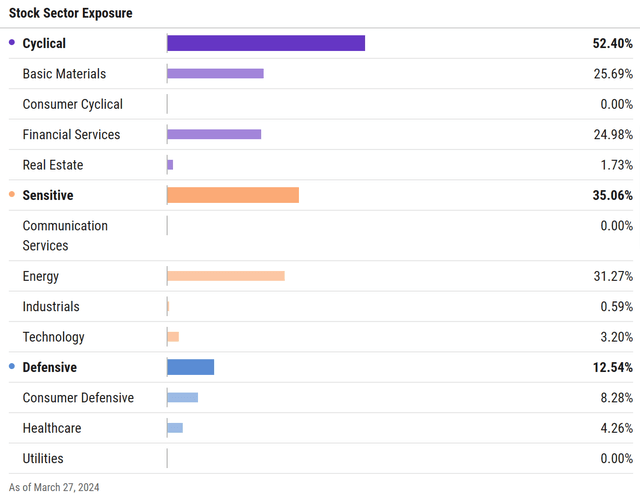

The INFL fund’s sector allocation is primarily throughout three sectors: power, supplies, and financials. About 31% of the fund’s complete publicity was to the power sector, making it essentially the most important sector inside the fund. The supplies and monetary sectors observe intently.

The fund’s strategy relies on the concept during times of inflation, firms with arduous property, pricing energy, and the flexibility to go on worth will increase to prospects are likely to carry out nicely. Subsequently, it isn’t shocking to see a considerable allocation to sectors like power and supplies that always home such firms.

INFL vs. Different Comparable ETFs

When in comparison with different inflation-focused ETFs, INFL stands out on account of its actively managed strategy and its distinctive mix of holdings. In contrast to many different inflation-hedging funds that put money into Treasury Inflation-Protected Securities or commodities straight, INFL invests in equities of firms anticipated to profit from inflation. This strategy may probably supply extra substantial returns throughout inflationary intervals, albeit with the next degree of threat.

One other distinguishing function of INFL is its comparatively excessive administration price of 0.85%. That is considerably greater than the typical expense ratio of fairness ETFs, which is round 0.16%. Nevertheless, given the lively administration and the distinctive funding technique of the fund, some traders may think about the upper price justifiable.

The Professionals and Cons of Investing in INFL

Like several funding, investing in INFL comes with its personal set of advantages and disadvantages.

Professionals:

-

Inflation Safety: As its title implies, INFL goals to supply safety in opposition to inflation. It does this by investing in firms which might be anticipated to profit from rising costs. This makes INFL a gorgeous possibility for traders looking for to hedge their portfolios in opposition to inflation.

-

Diversification: INFL presents diversification advantages by investing in a mixture of completely different property. Its portfolio contains conventional listed U.S. shares, royalty trusts, MLPs, and a bunch of listed shares of commodity exchanges from completely different components of the globe. This diversified strategy will help unfold threat and probably improve returns.

-

Lively Administration: INFL is actively managed, which implies that its portfolio managers often monitor the portfolio and make changes as obligatory. This lively strategy can probably result in higher efficiency in comparison with passively managed funds.

Cons:

-

Excessive Expense Ratio: As talked about earlier, INFL expenses a comparatively excessive administration price of 0.85% in comparison with the typical fairness ETF expense ratio of 0.16%. This greater price may probably eat into the fund’s returns over time.

-

Market Danger: Like several fairness funding, INFL is topic to market threat. It could actually and sure will go down with shares in downturns.

-

Inflation Danger: Whereas INFL goals to guard in opposition to inflation, there isn’t a assure that it will likely be ready to take action. If inflation doesn’t rise as anticipated or if the businesses through which INFL invests don’t profit from inflation as anticipated, the ETF’s efficiency may undergo.

Conclusion: To Make investments or To not Put money into INFL

In conclusion, the Horizon Kinetics Inflation Beneficiaries ETF is an intriguing possibility for traders searching for an inflation hedge. Its distinctive strategy of investing in firms which might be anticipated to profit from rising costs presents the potential for substantial returns throughout inflationary intervals. Nevertheless, the fund’s comparatively excessive expense ratio and the dangers related to fairness investing imply that it is probably not appropriate for all traders. Good fund I feel general for what it is attempting to do.

Markets aren’t as environment friendly as typical knowledge would have you ever consider. Gaps typically seem between market alerts and investor reactions that assist give a sign of whether or not we’re in a “risk-on” or “risk-off” surroundings.

The Lead-Lag Report may give you an edge in studying the market so you may make asset allocation choices based mostly on award profitable analysis. I’ll provide the signals–it’s as much as you to resolve whether or not to go on offense (i.e., add publicity to dangerous property reminiscent of shares when threat is “on”) or play protection (i.e., lean towards extra conservative property reminiscent of bonds/money when threat is “off”).

[ad_2]