[ad_1]

After three days of great beneficial properties, the Australian greenback is retreating towards its American counterpart, with the pair falling to 0.6573.

The US greenback has rebounded after Federal Reserve officers expressed doubts about a right away financial coverage easing. The dialogue round rates of interest and the timing of their discount has grow to be a central subject available in the market. Alerts that the Fed is ready to chop charges 3 times this yr, making borrowing prices extra reasonably priced, have put strain on the US greenback, permitting different currencies to get better. Nevertheless, indicators that the Federal Reserve remains to be awaiting extra knowledge earlier than deciding have led to a rebound within the USD and a decline in total market sentiment.

Australia’s statistical knowledge revealed that import volumes grew by 4.8% month-over-month in February, in comparison with a earlier improve of 1.4%. Export volumes decreased by 2.2% month-over-month, with January’s determine at 1.5%. The optimistic commerce steadiness in February was the bottom in 5 months, primarily because of a drop in abroad shipments of iron ore.

For the third consecutive assembly, the Reserve Financial institution of Australia (RBA) has left the rate of interest unchanged at 4.35% yearly, its highest stage in 12 years. In the meantime, the RBA has omitted any point out of potential fee hikes from its feedback, assured in decreasing inflationary strain. This has led to forecasts that borrowing prices in Australia could lower later this yr.

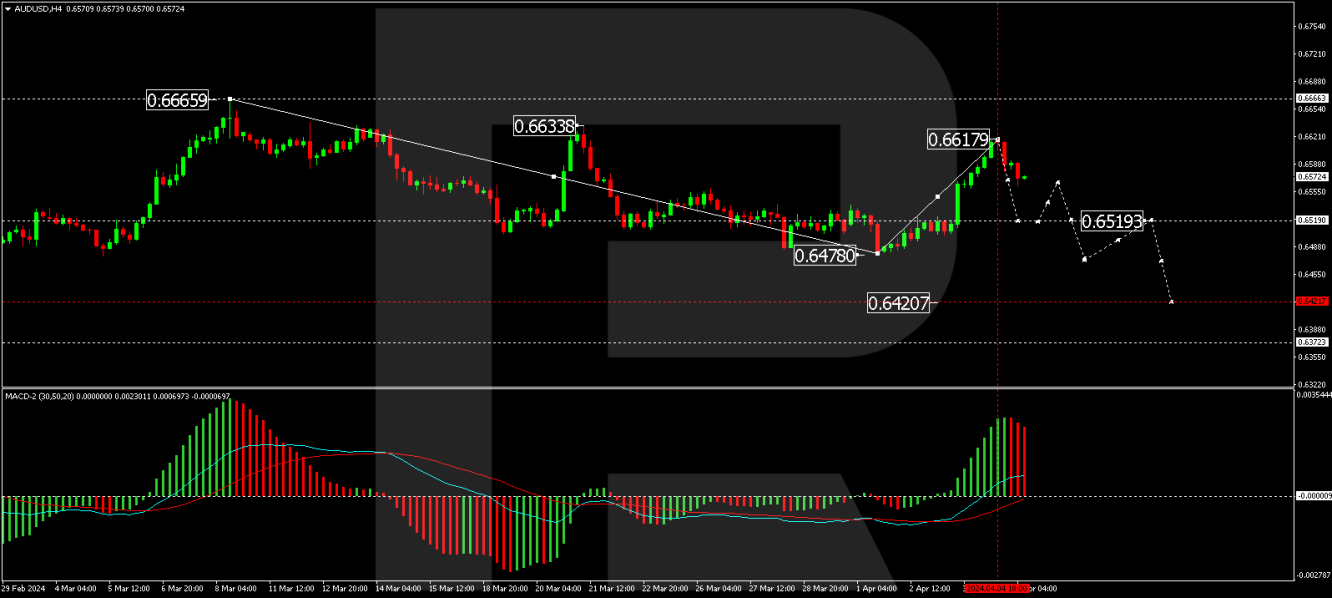

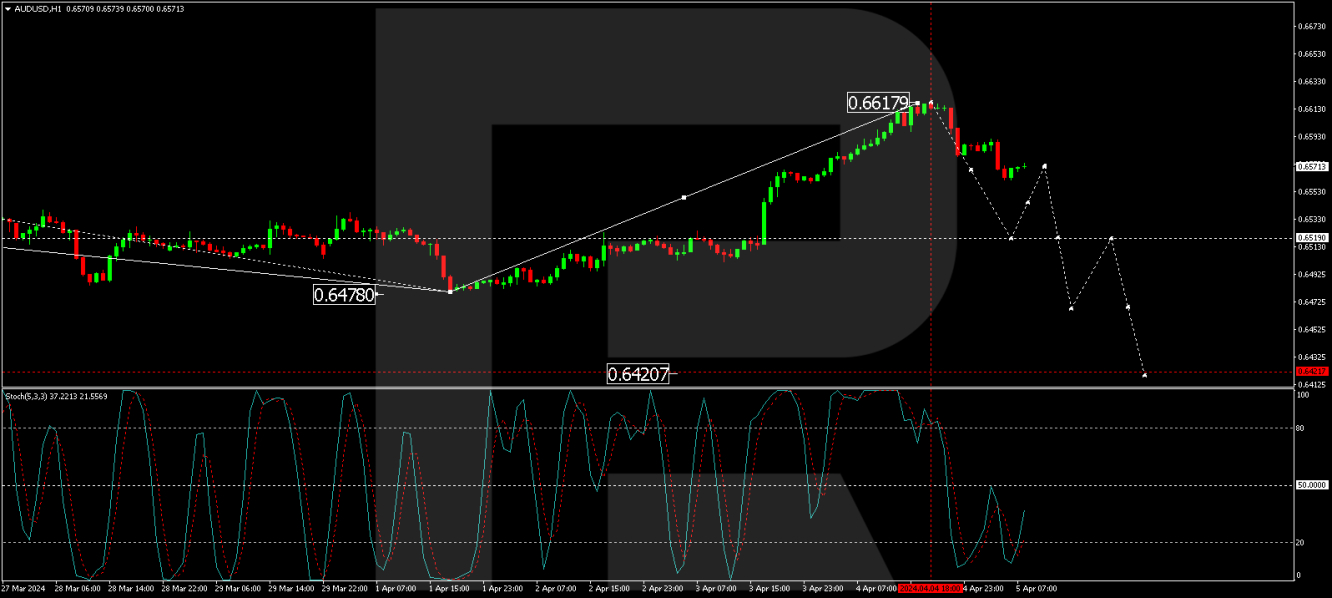

Technical evaluation of AUD/USD

On the H4 chart of AUD/USD, a downward wave to 0.6480 and a correction to 0.6617 have been accomplished. We anticipate the beginning of a brand new decline to 0.6422. The primary construction of the decline is forming at this time, focusing on 0.6520. After finishing this, we anticipate a consolidation vary. Exiting this vary downward might result in a wave in the direction of 0.6472, doubtlessly extending the pattern right down to 0.6422. The MACD indicator, with its sign line under zero, helps this state of affairs, anticipating new lows.

On the H1 chart of AUD/USD, a downward wave construction to 0.6520 is forming. Following this, a correction to 0.6572 is anticipated, and a decline to 0.6490, with the pattern persevering with to 0.6422, is anticipated. The Stochastic oscillator, with its sign line presently under 20 however poised to rise to 50, technically helps this state of affairs.

By RoboForex Analytical Division

[ad_2]