[ad_1]

- Early April noticed the EUR/USD pair breach a resistance zone close to 1.07, initiating an upward development.

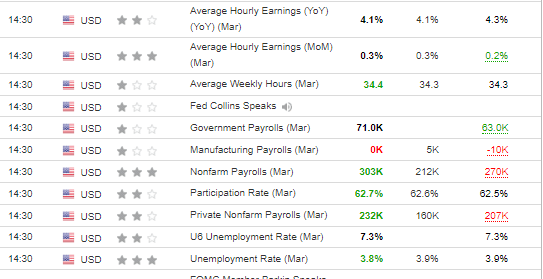

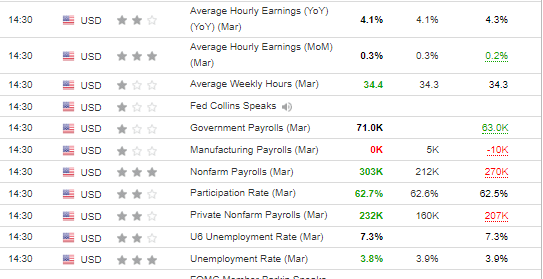

- Regardless of strong US labor market knowledge final Friday, bullish momentum endured, driving the native uptrend within the forex pair.

- Market focus now shifts to imminent inflation knowledge and the ECB choice, and the pair may take a look at that degree relying on the information.

- In 2024, make investments like the large funds from the consolation of your house with our AI-powered ProPicks inventory choice device.

Final week, the pair broke via a vital demand zone across the 1.07 worth degree, igniting the present upward development.

Regardless of robust US launched on Friday, the bulls continued to dominate, sustaining the native uptrend.

Now, the way forward for the forex pair hinges largely on upcoming knowledge launched on Wednesday, in addition to the European Central Financial institution’s financial coverage .

In the meantime, current strong financial indicators from the US have sparked hypothesis about the potential for no rate of interest cuts from the Federal Reserve this yr.

Following the preliminary market response that boosted the , aligning with the general knowledge development, Monday’s session noticed a lot of the EUR/USD’s declines reversed.

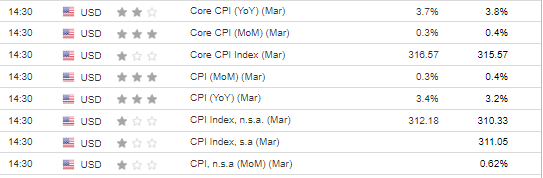

It seems that the market is eagerly anticipating Wednesday’s knowledge on inflation, which can considerably affect the brief and medium-term change charge of the principle forex pair.

Preliminary forecasts predict a slight rise in client inflation to three.4% year-on-year. If inflation exceeds expectations, it may result in renewed strain on costs, probably breaking the examined assist round 1.07.

Fed Hawks Circling

Regardless of expectations of unchanged rates of interest at Thursday’s ECB assembly, the financial institution’s authorities will doubtless proceed their narrative of monitoring and analyzing incoming knowledge from the European financial system.

Initially of the yr, the market was extremely sure that the Federal Reserve would pivot in just some months, probably even in March, because of ongoing disinflation and issues a couple of important financial slowdown.

Nonetheless, as the primary quarter has handed, the first query now isn’t when the pivot will happen, however whether or not it is going to occur in any respect this yr.

Presently, the market is estimating a couple of 50% likelihood of a Fed transfer in June, with expectations for 3 cuts within the subsequent months.

Nonetheless, given the development of frequently pushing again the chance of a pivot by a number of months, it’s believable that the primary quarter of 2025 may develop into a viable possibility.

Why may the Fed delay additional? Firstly, there’s no strain from the financial system for charge cuts, as each GDP readings and labor market knowledge present no important indicators of a recession.

Moreover, disinflation has notably slowed down. Therefore, to keep away from a situation akin to the Seventies, the Federal Reserve is inclined to postpone the beginning of the cycle for so long as attainable.

EUR/USD Defends 1.07 Assist

The EUR/USD, having bounced again round 1.07, is now sitting across the midpoint of the vary between 1.07 and 1.10. It appears doubtless that this example will persist till tomorrow’s inflation knowledge is launched.

The beforehand talked about ranges now function the principle assist and resistance areas, relying on whether or not we witness a optimistic or detrimental situation.

If there’s a detrimental shock, and it aligns with the Fed’s hawkish rhetoric, it is going to probably immediate the EUR/USD to say no once more.

[ad_2]