[ad_1]

The USD/JPY pair stabilised round 151.35 by Tuesday, not removed from its latest peaks, because the weak point of the Japanese yen has prompted verbal interventions from Japanese authorities.

Japan’s Finance Minister, Shunichi Suzuki, talked about that measures to normalise the yen are fairly probably. He cited extreme volatility as growing uncertainty for the nation’s buying and selling companions and creating adversarial situations for enterprise operations.

Financial coverage official Masato Kanda remarked that the yen’s present weak point doesn’t replicate elementary components, labelling latest depreciation waves as speculative. Kanda said that authorities are intently monitoring foreign money actions and really feel the necessity to “hold a finger on the heart beat” of the market. Japan is prepared to reply to yen volatility appropriately, although choices are but to be made.

The yen’s decline gained momentum final week when the Financial institution of Japan raised its rate of interest for the primary time in 17 years, ending eight years of adverse rates of interest. The capital market was ready for this transfer, because the BoJ had meticulously laid the groundwork for such a step.

The Financial institution of Japan intends to take care of an accommodative financial coverage for an prolonged interval, which acts towards the yen’s worth.

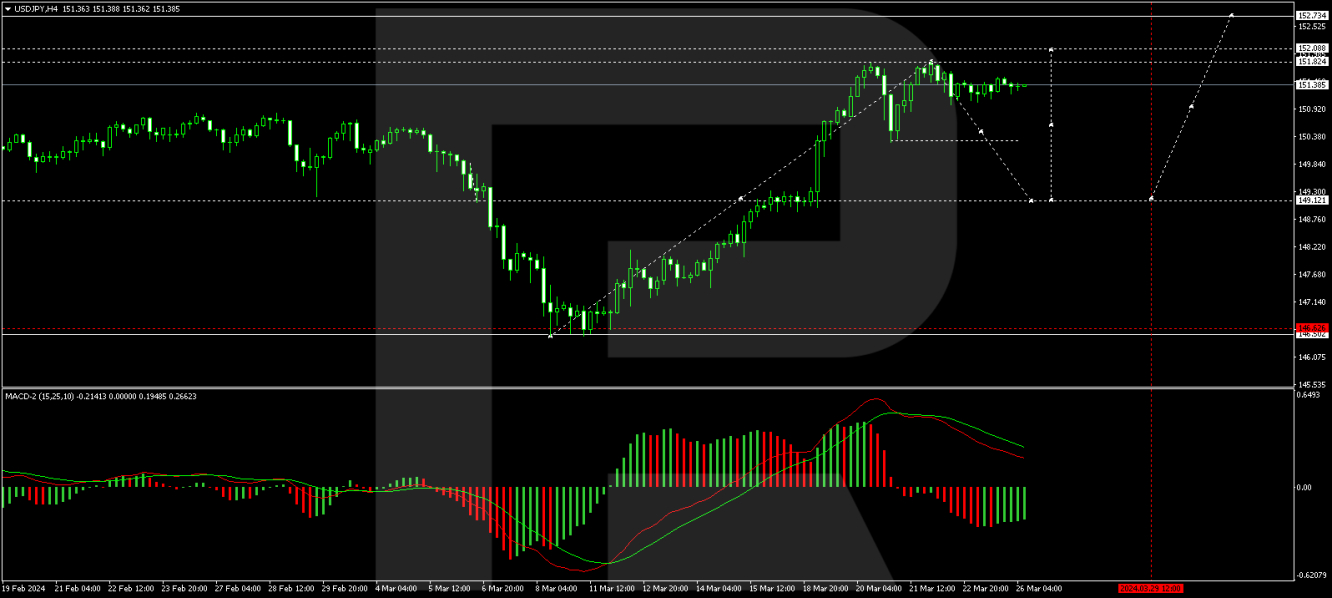

Technical evaluation of USD/JPY

On the H4 chart of USD/JPY, a development wave to 151.85 has been accomplished. This goal is native and estimated. The market is presently forming a consolidation vary under this stage. With a downward breakout from this vary, a correction to 149.12 is feasible, after which a brand new development wave to 152.70 is anticipated. The MACD oscillator helps this state of affairs, with its sign line directed downwards in direction of the zero line.

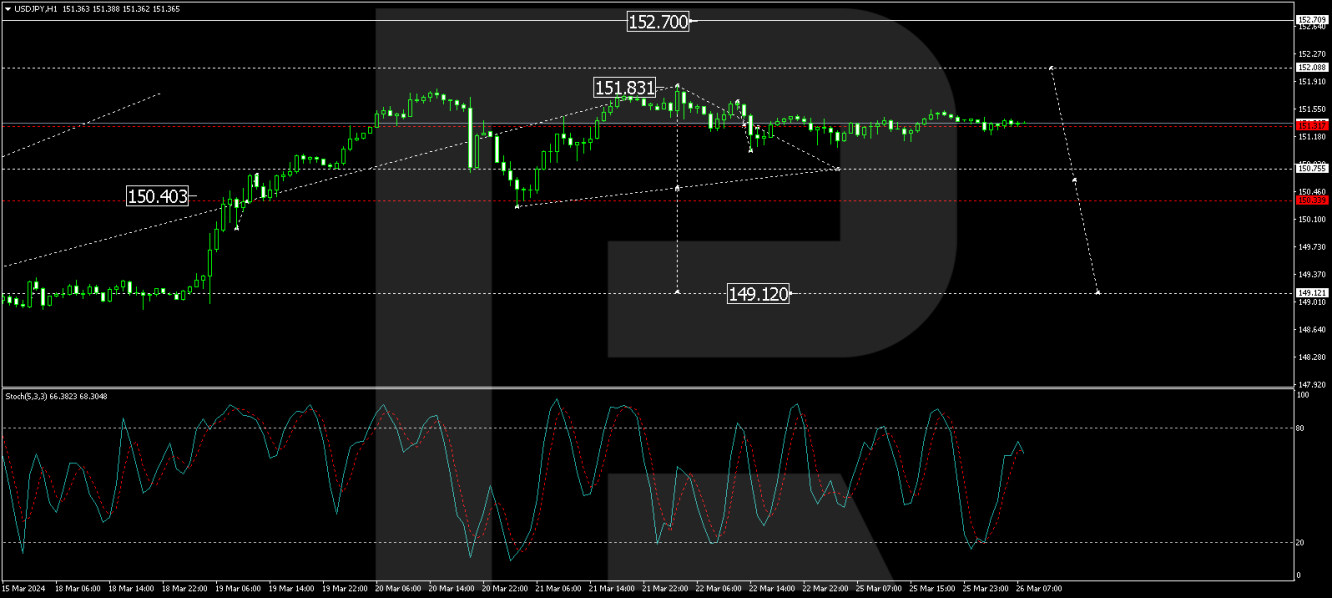

On the H1 chart of USD/JPY, a slim consolidation vary has shaped round 151.31. A downward breakout and continuation of the correction to 150.75 are anticipated. Breaking by this stage would open potential in direction of reaching 149.20, adopted by a rise to 151.85. The Stochastic oscillator confirms this state of affairs, with its sign line under 80 and getting ready for a decline to twenty.

By RoboForex Analytical Division

[ad_2]