[ad_1]

Share this text

Bitcoin tumbled over the weekend following a drone assault by Iran on Israel. Below the affect of Center East tensions and the approaching halving, the value plunged from $68,000 to round $60,000 on Saturday, with $1.2 billion in lengthy positions liquidated. Regardless of this sharp correction, Michael Saylor, co-founder of MicroStrategy, expressed a constructive outlook, stating, “Chaos is nice for Bitcoin.”

Chaos is nice for #Bitcoin.

— Michael Saylor⚡️ (@saylor) April 13, 2024

His assertion was shared on X after Bitcoin’s weekend downturn eroded over $1.5 billion from MicroStrategy’s holdings. Nonetheless, the corporate maintains a considerable revenue exceeding $6 billion.

Saylor’s feedback sparked numerous reactions throughout the crypto neighborhood. Some criticized his timing as a result of ongoing worldwide battle, whereas others agreed together with his view of Bitcoin as a “hedge in opposition to chaos.”

Historic information reveals that Bitcoin typically faces preliminary worth declines throughout geopolitical instability however tends to recuperate as it’s seen as a long-term haven.

As an example, after the Russia-Ukraine battle started in February 2022, Bitcoin’s worth dropped to round $39,000 however rebounded to $44,000 inside per week, in accordance with information from CoinGecko. Equally, following the Israel-Hamas battle in October 2023, Bitcoin initially fell by 6% however rose to $35,000 inside a month.

Banking misery final March additionally mirrors this sample, although Saylor’s remark wasn’t essentially associated to financial chaos.

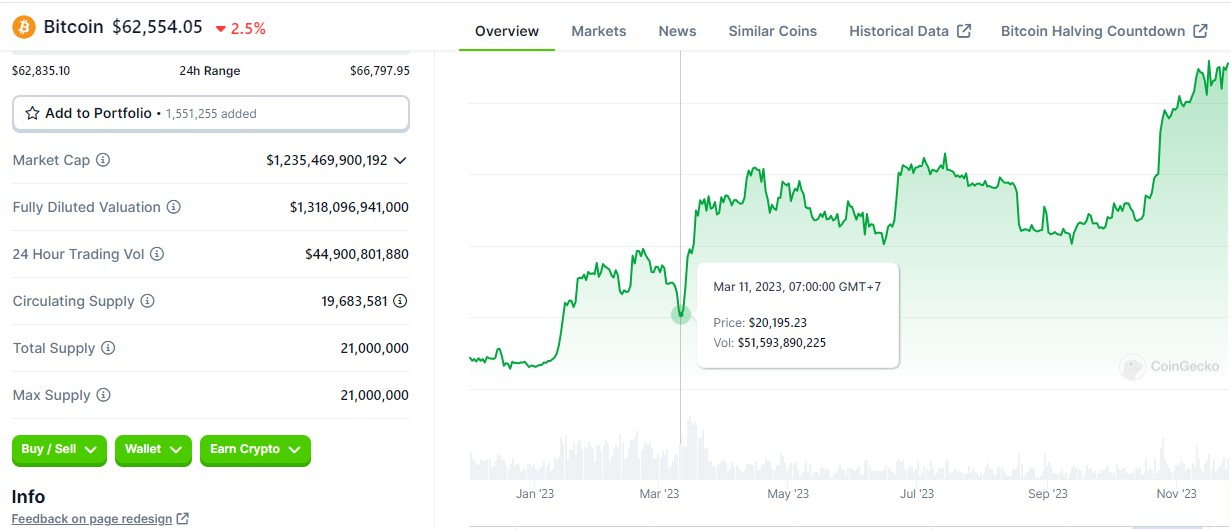

When Silicon Valley Bank faced bank runs on March 10, 2023, Bitcoin’s worth briefly dipped beneath $20,500 however quickly recovered, climbing to a nine-month high by the top of March. This restoration was additional bolstered by BlackRock’s submitting for a spot Bitcoin ETF.

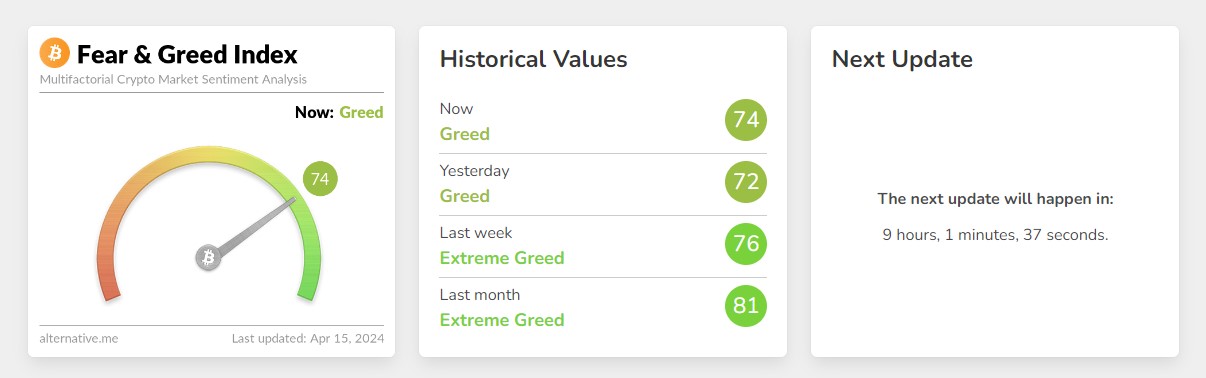

Regardless of latest battle fears, Bitcoin market sentiment stays bullish. In line with Different’s data, the Concern and Greed Index at the moment sits at 74, indicating “greed” – down from “excessive greed” however nonetheless reflecting robust investor confidence. This optimism is probably going fueled by the approaching halving occasion, which traditionally has been adopted by a worth peak for Bitcoin a number of months later.

Bitcoin reclaimed the $66,000 earlier immediately after Hong Kong officially approved spot Bitcoin and Ethereum ETFs. On the time of writing, Bitcoin is buying and selling at round $62,500, down 2.5% within the final 24 hours, per CoinGecko’s information.

Share this text

[ad_2]