[ad_1]

We proceed including new information to the SpreadCharts app. This time for indices. Though we’re targeted totally on commodities, understanding the broader market is crucial for each dealer or investor.

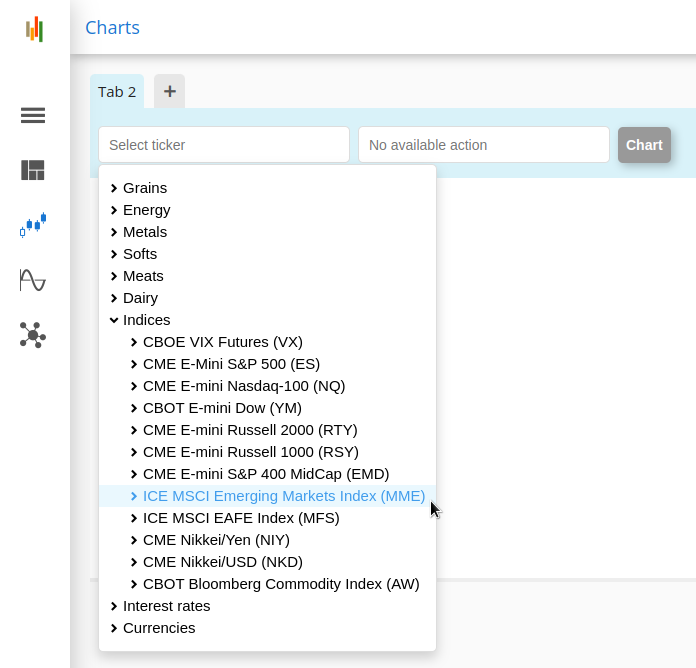

The brand new contracts are listed beneath:

- ICE MSCI Rising Markets Index

- ICE MSCI EAFE Index

- CME E-mini Russell 1000

- CME Nikkei/Yen

- CBOT Bloomberg Commodity Index

You’ll find them within the SpreadCharts app underneath the Indices group.

How can this information be helpful for commodity merchants? I’ll embody three fascinating examples.

Crises started in Asia

Rising markets have develop into extra vital than ever earlier than. The catalyst was the rise of China. Certain, the USA continues to be the biggest world financial system. Nevertheless, China is the world’s largest shopper of most commodities.

Almost the entire crises since 2015 both originated or turned felt first in rising markets. Sounds doubtful? Nicely, take a look at the ICE MSCI Rising Markets Index (backside) in comparison with S&P 500 (high). Whereas US shares had been making increased highs, rising market shares had been already promoting off. And the US market finally rolled over too.

Main indicator for the US Greenback

The second use case is the EAFE/EM ratio. I typically use it as one of many main indicators for the US Greenback. The concept is that reversals in fairness flows between developed and rising markets typically precede reversals in currencies. After all, you possibly can spot conditions the place it failed, however nothing is 100% dependable within the markets. But it surely undoubtedly is sensible to make use of this ratio as half of a bigger analytical framework.

Sentiment information

Beforehand, I used the EEM ETF for visualizing rising market shares. However this ETF pays a dividend, and utilizing it in ratios with different ETFs with completely different payout dates can lead to main distortions within the information. The ICE EM and EAFE futures don’t undergo from this drawback.

Furthermore, we’ve got the Commitments of Merchants information for these EM/EAFE ICE indices within the SpreadCharts app. That’s excellent for analyzing sentiment in these markets. For instance, the EM shares are extremely oversold, in accordance with the COT information.

You’ll be able to browse the brand new information proper now within the SpreadCharts app, both within the free or the premium version. Simply don’t overlook to fetch the brand new model utilizing Ctrl+Shift+R.

[ad_2]