[ad_1]

Immediately, we’re including new knowledge for an important power market to the SpreadCharts app. It’s Oman Crude oil that trades on Dubai Mercantile Change.

I used to be personally very enthusiastic about getting this knowledge. In case you observe our analysis, both within the premium model of the app or on our Twitter, you recognize that power is one among our favourite teams of commodities. And our customers have benefited tremendously from our experience each in oil and gas.

Crude oil is the highest power market globally as a consequence of its intrinsic properties. It’s a concentrated type of power that’s simply transportable.

Whereas pure gasoline will also be transported throughout continents by LNG ships, the liquefaction, transport, and regasification course of are far more pricey. Subsequently, NatGas makes the perfect sense when you’ve got pipeline infrastructure connecting the manufacturing with demand. Storing NatGas can be difficult as a consequence of its gaseous state.

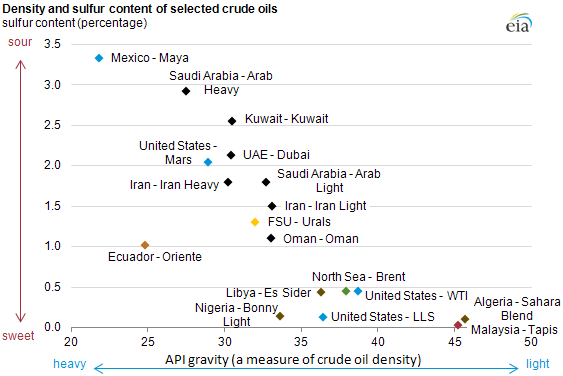

Crude oil, however, is straightforward and low-cost to move and retailer. However not all crude oil is made equal. There are several types of oil measured by their density and sulfur content material. Refineries are tooled to course of particular crude blends to optimize the output of various merchandise like gasoline, diesel, or kerosene. For instance, US refineries are set as much as course of extra medium to heavy crudes as a consequence of their historic reliance on one of these oil from the Center East. Conversely, much less advanced refineries in growing international locations may want mild candy crude oil.

Supply: U.S. Power Info Administration (eia.gov)

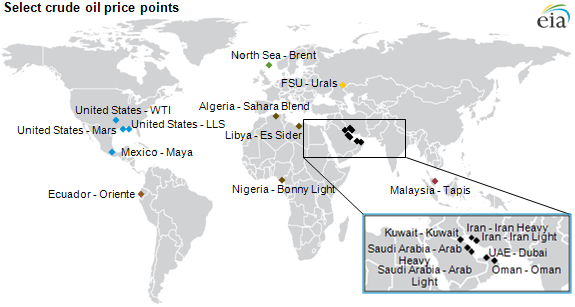

The purpose is that with the intention to assess international provide/demand, following simply the WTI crude oil that’s standard amongst retail merchants shouldn’t be sufficient. We already had the seaborn Brent along with landlocked WTI knowledge within the app which offered our customers an excellent protection of the market. Immediately, we’re including the Oman contract representing the Center Japanese crude oil with completely different bodily qualities to Brent and WTI, as described above.

Whereas there are different crude oil benchmarks within the Center East (see the map above), Oman’s contract place is exclusive. It’s the world’s solely bitter physical-delivery crude oil futures contract. Its reputation has been mirrored by all the key Persian Gulf producers who use the Oman contract as a part of the pricing construction for his or her oil, totaling some 5.5 million barrels per day.

Supply: U.S. Power Info Administration (eia.gov)

Furthermore, this contract is extra delicate to Chinese language demand, which has been game-changing over the previous decade. Though it’s been considerably changed not too long ago by the discounted Russian oil after the warfare in Ukraine began, that is unlikely to final. The Center East will almost certainly stay the dominant Asian oil provider. China is on its solution to turning into the world’s largest oil refiner, rising the Oman benchmark’s significance even additional.

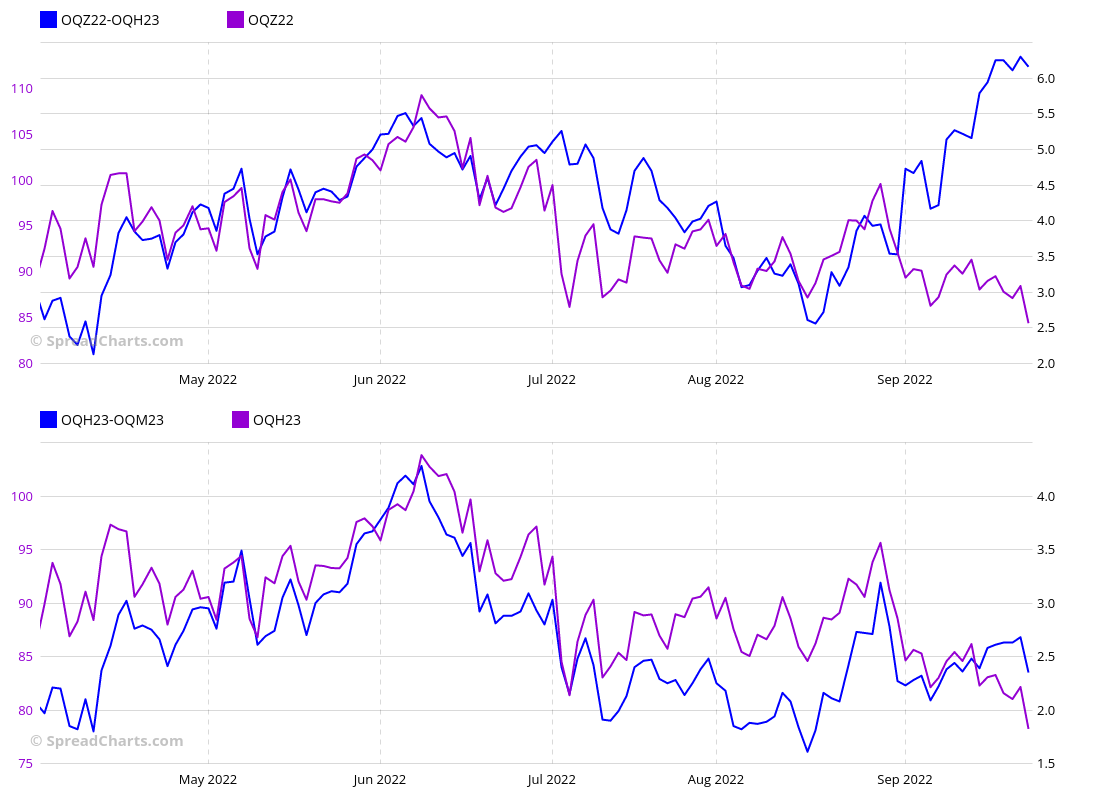

SpreadCharts’ customers is not going to be left behind and may observe the Oman crude oil value on daily basis. Personally, the time period construction will get probably the most of my consideration. That’s no shock to you if you recognize our analytical method. So, along with WTI and Brent spreads, we are able to now watch the Oman crude interdelivery spreads, similar to these on the chart under.

I hope you’ll take pleasure in this new knowledge as I do. We’re attaching contract specs under.

|

|

|

| Contract identify | Oman Crude oil |

|

|

|

| Change | Dubai Mercantile Change |

|

|

|

| Ticker | OQ |

|

|

|

| Expiration months | F, G, H, J, Ok, M, N, Q, U, V, X, Z |

|

|

|

| Forex | USD |

|

|

|

| Contract dimension | 1000 US barrels |

|

|

|

| Level worth | $1000 |

|

|

|

| Tick dimension / worth | 0.01 / $10 |

|

|

|

| Settlement | Bodily |

|

|

|

[ad_2]