[ad_1]

D-Keine

The RiverNorth/DoubleLine Strategic Alternative Fund (OPP) is a quite distinctive closed-end fund aka CEF that income-hungry traders can make use of of their efforts to realize their objectives. The fund does very nicely on this respect, because it presently boasts a large 14.36% yield, regardless of a current distribution minimize. Certainly, this yield is greater than simply about another closed-end fund that presently trades available in the market.

Morningstar classifies the RiverNorth/DoubleLine Strategic Alternative Fund as a taxable high-yield bond fund. As we are going to see on this article, this classification is maybe not totally correct, however it’s higher than most different classifications that might be assigned to it. Right here is how this fund’s yield compares to different closed-end funds that share the identical classification:

|

Fund |

Present Yield |

|

RiverNorth/DoubleLine Strategic Alternative Fund |

14.36% |

|

Allspring Earnings Alternatives Fund (EAD) |

9.35% |

|

Apollo Tactical Earnings Fund (AIF) |

11.11% |

|

BlackRock Company Excessive Yield Fund (HYT) |

9.58% |

|

Neuberger Berman Excessive Yield Methods Fund (NHS) |

13.61% |

Clearly, we are able to see that the RiverNorth/DoubleLine Strategic Alternative Fund compares fairly nicely to most of its friends when it comes to yield. Eagle-eyed readers may additionally word that the yields of all of those funds, aside from the Apollo Tactical Earnings Fund, have typically been growing in current weeks. This is because of the truth that long-term rates of interest have been rising year-to-date as traders have misplaced their confidence that the Federal Reserve will quickly scale back rates of interest in 2024 and have been permitting bond yields to rise in accordance with this new perception.

Yesterday’s assembly of the Federal Open Market Committee is definitely not more likely to change this perception, as policymakers truly increased their estimate of the long-term rate of interest, suggesting that charges could also be completely greater going ahead than we have now turn out to be accustomed to over the previous fifteen years.

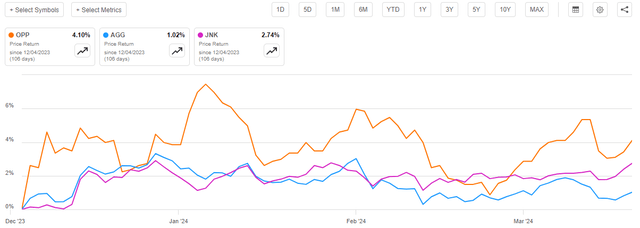

As common readers can doubtless keep in mind, we beforehand discussed the RiverNorth/DoubleLine Strategic Alternative Fund in early December 2023. The market at the moment was very completely different, as we have been nonetheless in a really euphoric market as traders have been quickly buying bonds and different property earlier than the Federal Reserve lowered rates of interest in 2024. Following the beginning of the brand new yr, this euphoria wore off and traders have been permitting bond costs to fall because it appears more and more unlikely {that a} speedy rate of interest discount will occur within the close to future. As such, we’d anticipate that the fund has not delivered the best efficiency available in the market because the publication of that article. In truth, although, the fund has accomplished very nicely as its share value is up 4.10% since that date, beating each the Bloomberg U.S. Combination Bond Index (AGG) and the Bloomberg Excessive Yield Very Liquid Index (JNK):

We do see although that the fund exhibited some appreciable volatility when it comes to share value efficiency in early January 2024. This will have been because of the fund chopping its distribution, which I additionally predicted would happen in my earlier article. This motion naturally prompted the market to reprice the fund’s shares, which is pure as a result of closed-end funds are a minimum of partially priced based mostly on their yields. It’s much like the best way a grasp restricted partnership will decline in value if it cuts its distribution, even when the entire fundamentals stay precisely the identical.

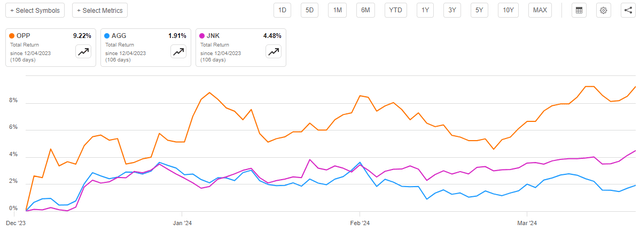

One fascinating factor right here although, is that traders within the RiverNorth/DoubleLine Strategic Alternative Fund truly did a lot better over the interval than the share value efficiency would counsel. It’s because closed-end funds corresponding to this one sometimes pay out most or all of their funding income to the shareholders by way of distributions.

The tip result’s that the dimensions of the fund’s portfolio stays comparatively steady over time and the traders get money funds equivalent to the returns delivered by the portfolio. These money distributions characterize an actual return to the fund’s traders and subsequently lead to traders within the fund truly doing a lot better than the share value efficiency alone would counsel. This additionally signifies that we have to incorporate the distributions that the fund pays to its traders in any evaluation of its outcomes. Once we do that, we see that shareholders on this fund have truly gained 9.22% because the date that the earlier article was printed:

As soon as once more, we are able to see that this was considerably higher than both of the bond indices managed to ship over the interval. This may undoubtedly enchantment to any investor, no matter their precise objectives. In any case, it’s attainable to keep away from paying taxes on the distributions just by holding your shares in some type of tax-advantaged account.

As three months have handed because the time of our earlier dialogue on this fund, an excellent many issues have modified. Particularly, the fund minimize its distribution and launched its semi-annual report for the primary half of the 2024 fiscal yr. We’ll need to pay particular consideration to this report, because it ought to present us with a substantial amount of perception into how nicely the fund navigated the unstable bond market circumstances that existed throughout the second half of 2024.

About The Fund

In accordance with the fund’s website, the RiverNorth/DoubleLine Strategic Alternative Fund has the first goal of offering its traders with a really excessive stage of present earnings. This makes a substantial amount of sense for a fund that’s managed by each RiverNorth and DoubleLine, as each corporations are pretty well-known as bond managers. RiverNorth has additionally managed to earn a fame for participating in some various methods corresponding to closed-end fund arbitrage, much like Saba Capital (one other fund supervisor that has managed to earn a reasonably good fame amongst traders on this area). As I identified in a current article,

As a rule, bonds present all of their funding return within the type of direct funds to their traders. A bond investor purchases a newly issued bond at face worth, collects a daily coupon cost from the issuer that corresponds to curiosity on the mortgage, after which receives the face worth again when the bond matures. There are not any internet capital beneficial properties over the lifetime of the bond as a result of bonds don’t have any inherent hyperlink to the expansion and prosperity of the issuing firm. Thus, the bond’s yield is the one supply of internet funding returns.

Contemplating this, it is smart for a bond fund to give attention to the era of earnings as its main goal. In truth, no different goal actually is smart as a result of bonds can not ship capital beneficial properties over the long run. Any investor who purchases a bond when it’s first issued and holds it till it matures will solely get the coupon funds.

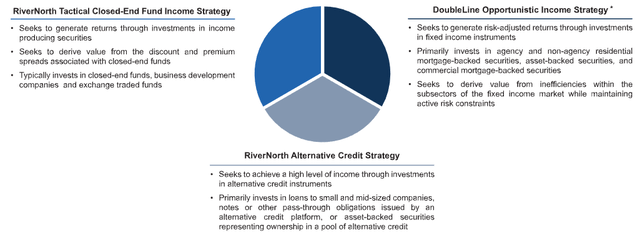

As famous in my earlier article on this fund although, the RiverNorth/DoubleLine Strategic Alternative Fund will not be a pure bond fund. In truth, it invests its property in three completely different buckets:

The one certainly one of these buckets that’s akin to a conventional closed-end bond fund is the Opportunistic Earnings Technique bucket. This phase of the fund is managed by DoubleLine Capital, which is usually thought of to be one of many higher bond fund managers round. As proven above, this phase of the fund invests largely in varied sorts of asset-backed securities corresponding to residential and business mortgages, automobile loans, bank card receivables, and related issues.

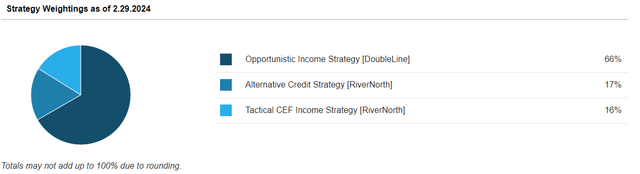

Regardless of the chart above, which was pulled from the fund’s web site, making it seem as if a couple of third of the fund’s property are invested in every bucket, this isn’t the case. In truth, as of proper now, about 66% of the fund’s property are invested within the Opportunistic Earnings Technique phase:

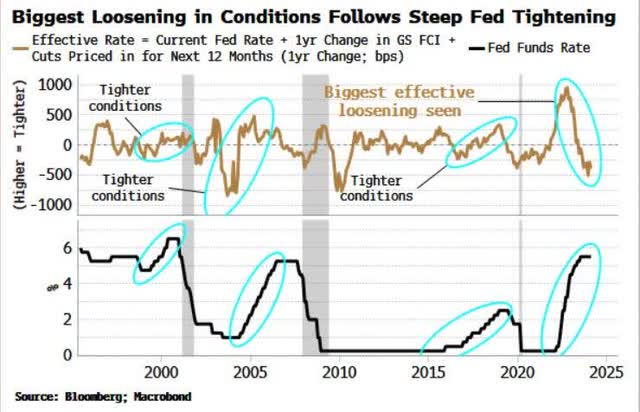

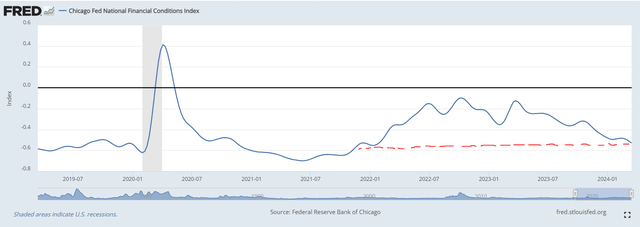

These allocations are barely completely different than what we noticed the final time that we checked out this fund. The final time that we mentioned it, the latest information accessible was as of October 31, 2023, and the fund had 64% of its property invested within the Opportunistic Earnings Technique phase and 18% of its property invested in every of the opposite two segments. Thus, it seems that the fund barely elevated its allocation to conventional bonds on the expense of the opposite two asset courses. I’ll admit that I’m not as assured about this transfer because the fund’s administration, as there may be nonetheless an opportunity that the Federal Reserve won’t be able to chop rates of interest in step with the present predictions. As Simon White, Bloomberg’s macro strategist, points out, monetary circumstances are presently looser than they have been on the time that the Federal Reserve began elevating the federal funds fee in March 2022:

Zero Hedge/Reposted from Bloomberg

The Federal Reserve’s personal information confirms this:

Federal Reserve Financial institution of St. Louis/Edits by Writer

My horrible graphical abilities apart, the Chicago Fed Nationwide Monetary Circumstances Index sits at -0.53056 proper now. The final time that it was this low was in January of 2022. Thus, regardless of Chairman Powell’s declare that monetary circumstances are weighing on the financial system, that doesn’t seem like the case. As I’ve identified in a number of different current articles, the month-over-month private consumption expenditures information additionally seems to be trending upward. As such, it is perhaps tough for the Federal Reserve to truly execute its prediction of three 25-basis level rate of interest cuts in 2024 except it’s prepared to reignite inflation proper earlier than a presidential election.

This might counsel that bonds stay overpriced, as they’ll nearly definitely decline a bit if the Federal Reserve fails to execute the present fee minimize projections. That signifies that various credit score, which could be very incessantly variable-rate, might be poised to outperform conventional bonds in 2024. As such, the fund is perhaps higher off with a smaller allocation to its Opportunistic Earnings Technique Bucket, nevertheless it has apparently been growing it.

Leverage

As is the case with most closed-end funds, the RiverNorth/DoubleLine Strategic Alternative Fund employs leverage as a way of boosting the efficient yield of its portfolio. I defined how this works in my earlier article on this fund:

Mainly, the fund is borrowing cash and utilizing that borrowed cash to buy fixed-income property. So long as the bought property have a better yield than the rate of interest that the fund has to pay on the borrowed cash, the technique works fairly nicely to spice up the efficient yield of the portfolio. As this fund is able to borrowing at institutional charges, that are considerably decrease than retail charges, that can often be the case.

Sadly, the usage of debt on this style is a double-edged sword as a result of leverage boosts each beneficial properties and losses. As such, we need to make sure that a fund will not be using an excessive amount of leverage as a result of that may expose us to an excessive amount of threat. I don’t often wish to see a fund’s leverage exceed a 3rd as a share of its property for that reason.

As of the time of writing, the RiverNorth/DoubleLine Strategic Alternative Fund has leveraged property comprising 35.50% of its portfolio. That is lower than the 36.09% leverage that the fund had the final time that we mentioned it, though admittedly this leverage decline will not be as giant as those that we have now seen from another bond-heavy closed-end funds.

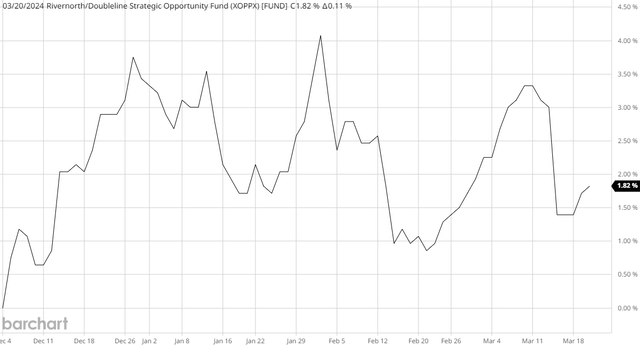

As has been the case with many different funds, the rationale for this decline in total leverage is that the fund’s portfolio has elevated in measurement. As we are able to see right here, the fund’s internet asset worth per share has gone up by 1.82% because the final time that we mentioned it:

Many readers will undoubtedly word that this can be a considerably decrease enhance than the fund’s share value delivered over the identical interval. This might have some implications for the fund’s valuation, which we are going to talk about later on this article. The vital takeaway for now could be that the fund’s portfolio has gotten bigger, largely because of a mixture of realized and unrealized beneficial properties that haven’t but been paid out to the traders. The entire excellent quantity of the fund’s borrowings remained the identical over the interval, so its debt now represents a smaller portion of a bigger portfolio. That is good to see as decrease ranges of leverage sometimes correlate to decrease volatility, significantly within the case of a market correction.

Nonetheless, we are able to nonetheless see that the fund’s leverage stays a bit above the one-third stage that we ordinarily desire. That is true, however a fixed-income fund can often carry a better stage of leverage than an fairness fund as a result of the property on the whole are much less unstable. Whereas the RiverNorth/DoubleLine Strategic Alternative Fund will not be a pure fixed-income fund, we have now already seen that the majority of its property are in bonds and various credit score securities, so it’s fairly shut to 1. The fund’s leverage can be not a lot above the one-third stage that we would favor so total the leverage might be okay proper now. We should always not want to fret an excessive amount of about it.

Distribution Evaluation

As talked about earlier on this article, the first goal of the RiverNorth/DoubleLine Strategic Alternative Fund is to supply its traders with a really excessive stage of present earnings. In pursuit of this goal, the fund invests its property right into a portfolio consisting of closed-end funds, bonds, and various credit score securities. All of those property ship a considerable share of their whole returns to their house owners within the type of direct funds. On this case, it’s the fund that receives these funds, which it swimming pools collectively and combines with any capital beneficial properties that it manages to comprehend by exploiting modifications within the costs of the property within the portfolio.

This fund even takes issues a step additional by borrowing cash, which permits it to gather funds from extra securities than it might afford just by relying by itself property alone. Because the bought property will incessantly have a better yield than the rate of interest that the fund has to pay on the borrowed cash, it is ready to pocket the distinction and thus increase the efficient yield that it receives from the property. The fund then pays out all of this cash to its traders, internet of its bills. We would anticipate that this may permit the fund’s shares to boast a really excessive yield.

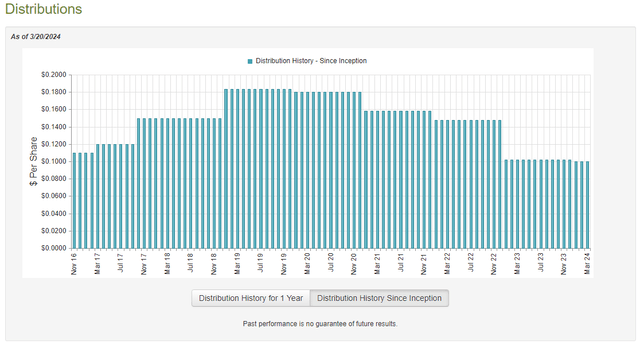

That is certainly the case, because the RiverNorth/DoubleLine Strategic Alternative Fund pays a month-to-month distribution of $0.1003 per share ($1.2036 per share yearly), which provides it a 14.36% yield on the present value. As we noticed within the introduction, this yield is significantly greater than that of most different funds which might be presently buying and selling within the markets and thus may show very engaging to income-focused traders. Sadly, this fund has not been significantly in line with respect to its distributions over its historical past. As we are able to see right here, the fund’s distribution has been steadily declining since 2019:

The newest distribution minimize got here in January of this yr, though it was a really small minimize because the month-to-month distribution went from $0.1021 per share to $0.1003 per share. That is nonetheless a big sufficient minimize to have a noticeable impact in your earnings should you personal a considerable variety of shares, nevertheless. It’s also not what we need to see in an inflationary surroundings, as inflation is consistently decreasing the variety of items and companies that we are able to buy with the distribution that the fund pays out. The Federal Reserve mentioned yesterday that inflation is more likely to stay “greater for longer,” so the very last thing that we actually need is a distribution minimize that amplifies the lack of buying energy that comes with inflation.

Nonetheless, as I identified in my earlier article on this fund, it most likely did want to chop the distribution because it was struggling to take care of it on the earlier stage. As such, we should always most likely take a look on the fund’s funds to see how doubtless it’s that the distribution shall be sustainable at this new stage.

Thankfully, we have now a really current doc that we are able to use for the needs of our evaluation. As of the time of writing, the latest financial report for the RiverNorth/DoubleLine Strategic Alternative Fund corresponds to the six-month interval that ended on December 31, 2023. This can be a a lot newer report than the one which we had accessible to us the final time that we mentioned this fund, which is sort of good to see.

The second half of 2023 was plagued with volatility within the bond markets, as bonds took a beating over the summer time as long-term rates of interest rose dramatically because of the market’s realization the Federal Reserve wouldn’t be decreasing its benchmark fee anytime quickly. The central financial institution truly raised the federal funds fee in July 2023, which additionally most likely had an antagonistic impression available on the market. This all modified within the ultimate two months of the yr, as traders began shopping for up bonds to lock in a excessive yield previous to the Federal Reserve chopping rates of interest in 2024. These two disparate market environments might have prompted this fund to both take some capital losses or e-book some income. The newest monetary report ought to give us a good suggestion of how nicely it navigated the circumstances that existed.

For the six-month interval, the RiverNorth/DoubleLine Strategic Alternative Fund acquired $12,126,666 in curiosity together with $1,598,820 in dividends from the property in its portfolio. Once we mix this with a small quantity of earnings from different sources, we get a complete funding earnings of $13,734,438 for the interval. The fund paid its bills out of this quantity, which left it with $11,325,710 accessible for shareholders.

This was, sadly, not practically sufficient to cowl the $14,042,153 that the fund truly paid out throughout the interval. At first look, that is fairly regarding as we might ordinarily desire a debt-focused fund corresponding to this to have the ability to absolutely cowl its distributions out of internet funding earnings. The fund clearly failed in that process.

Nonetheless, there are different strategies via which the fund can acquire the cash that it requires to cowl the distribution. For instance, it would be capable of earn capital beneficial properties by promoting securities that go up in value. The fund additionally may obtain some return of capital distributions from the closed-end funds that it contains in one of many RiverNorth-managed segments of its portfolio. Realized capital beneficial properties and acquired return of capital distributions will not be thought of to be funding earnings for tax or accounting functions, however they clearly do characterize cash coming into the fund that may be paid out to traders.

The fund, nevertheless, had considerably combined outcomes at incomes cash by way of these various strategies. It did report internet realized losses totaling $14,094,515 however these have been offset by $20,213,202 internet unrealized beneficial properties throughout the interval. General, the fund’s internet property elevated by $634,708 after accounting for all inflows and outflows throughout the interval.

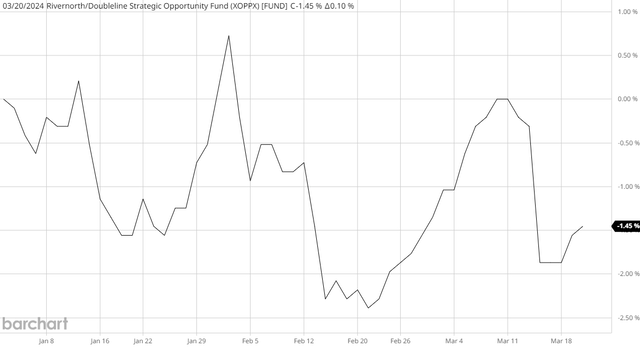

Thus, the RiverNorth/DoubleLine Strategic Alternative Fund did handle to cowl its distribution throughout the second half of 2023, albeit barely. The largest concern right here is that the fund was solely capable of cowl it as a result of the extremely bullish market within the ultimate two months of 2023 drove up asset costs sufficient to present the fund ample unrealized capital beneficial properties to offset the quantity that it pays out in extra of internet funding earnings. That is regarding as a result of unrealized beneficial properties will be rapidly erased by a market correction. This seems to have been the case year-to-date, as we are able to see right here:

This chart exhibits the fund’s internet asset worth year-to-date. As we are able to see right here, it has declined by 1.45% because the begin of the yr, which was additionally the opening date of the ultimate half of the fiscal yr. Thus, it seems that the fund has did not cowl its distribution to date this yr, even after the distribution minimize. This might definitely be regarding, as it could require the fund to chop its distribution once more if the bond market fails to ship ample beneficial properties to offset the losses that it has suffered to date in addition to the entire remaining distributions to be paid out. That could be a tall order, and it does lend some help to our total thesis right here that the fund ought to most likely be allocating more cash to the 2 non-fixed-income buckets as they’re much less delicate to rates of interest.

Valuation

As of March 20, 2024 (the latest date for which information is presently accessible), the RiverNorth/DoubleLine Strategic Alternative Fund has a internet asset worth of $9.49 per share however the shares presently commerce at $8.42 every. This offers the fund’s shares an 11.28% low cost on internet asset worth on the present share value. That is nowhere close to as engaging because the 13.26% low cost that the shares have had on common over the previous month. Nonetheless, a double-digit low cost is a reasonably good entry level for any closed-end fund, so the present value appears acceptable if you wish to add this fund to your portfolio.

Conclusion

In conclusion, the RiverNorth/DoubleLine Strategic Alternative Fund benefited from the extremely sturdy expectations of rate of interest cuts that dominated the bond market within the ultimate two months of the yr. These expectations allowed the fund to earn ample unrealized beneficial properties to cowl its distribution. Nonetheless, it was nonetheless pressured to chop the cost and it has did not cowl even this decrease distribution year-to-date. Whereas the Federal Reserve did reiterate its expectations for fee cuts later this yr, there are nonetheless causes to doubt that prediction as inflation continues to stay excessive and monetary circumstances stay extremely unfastened.

All we have now to do is have a look at the gold market to comprehend that few individuals imagine that the Federal Reserve goes to have the ability to each scale back charges and maintain inflation beneath management. As such, there might nonetheless be appreciable dangers right here, and because the majority of this fund is invested in interest-rate delicate securities, now won’t be the most effective time to purchase the RiverNorth/DoubleLine Strategic Alternative Fund.

[ad_2]