[ad_1]

ewg3D/E+ through Getty Photos

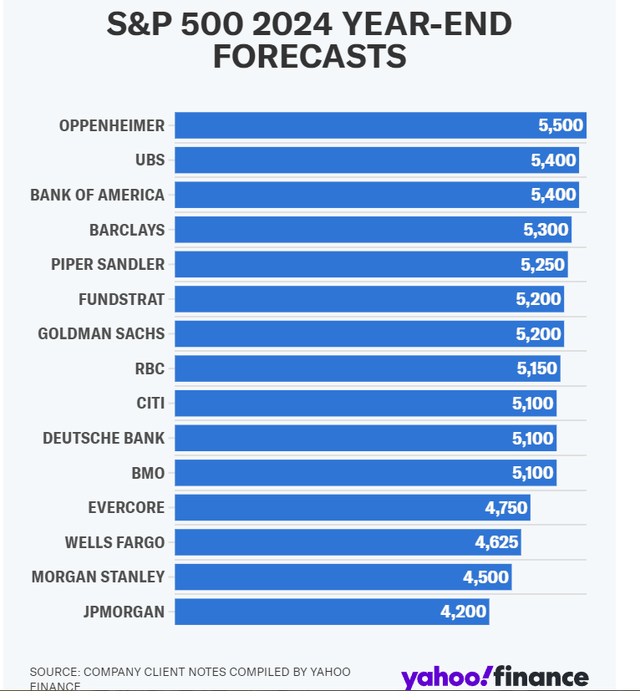

Right here we’re coming into Spring in late March 2024 and the inventory market indexes are making new all-time highs. But a number of Wall Avenue funding strategists see even higher highs by the top of the yr. A kind of firms that has a value goal for the S&P 500 that’s 5% increased than the closing value of 5,225 as of Friday March 22 is Oppenheimer.

Oppenheimer chief funding strategist John Stoltzfus now sees the benchmark index ending the yr at 5,500, reflecting a roughly 5% enhance from Friday’s shut.

Yahoo Finance

Moreover, he notes that the market could not attain a high till 2025 and infrastructure shares specifically presently characterize a shopping for alternative:

Associated to this outlook, Oppenheimer additionally pointed to infrastructure as a shopping for alternative, spotlighting the World X U.S. Infrastructure Improvement ETF (BATS:PAVE).

In my recent article on world infrastructure traits discussing the abrdn World Infrastructure Revenue Fund (ASGI), I mentioned how world infrastructure is discovering its candy spot in 2024. And in my very own analysis on development shares, I’ve seen a current pattern within the inventory market with some small cap development shares which have seen enormous returns over the previous one to 2 years resulting from substantial investments in infrastructure within the US particularly.

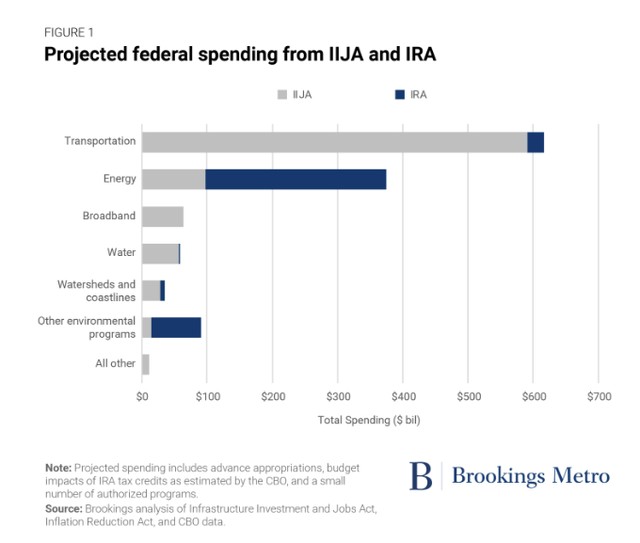

A number of of these firms are primarily based in Texas, which is main the US in infrastructure investments after passing $7.5B in statewide funds for vitality, water, and broadband tasks. Add to that the federal funding from the 2 infrastructure payments that had been handed by Congress up to now two years: the Bipartisan Infrastructure Law and the Inflation Reduction Act of 2022, and there’s a lot of federal and state degree funding out there for transportation, vitality, broadband, manufacturing, and different enhancements to the nation’s infrastructure.

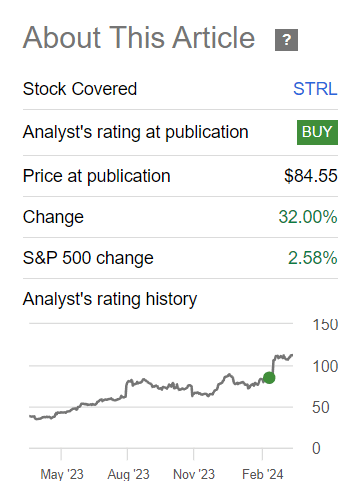

A kind of Texas-based firms is Sterling Infrastructure (STRL), which I suggested was a Buy ahead of Q4 earnings a month in the past. Since that article was revealed, STRL inventory has risen by greater than 30% after reporting report earnings.

Searching for Alpha

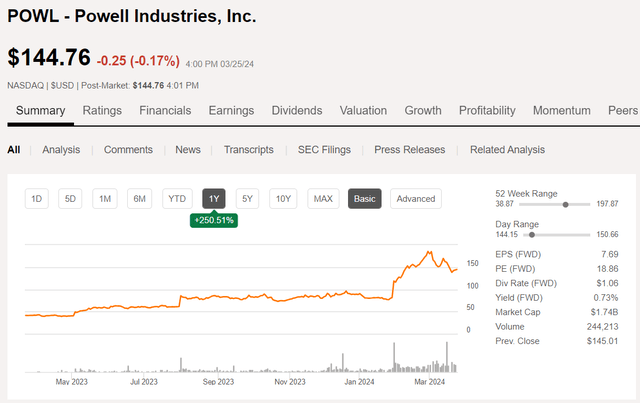

One other Texas-based firm that I final covered a year ago and that has additionally benefited from the rising funding in infrastructure spending is Powell Industries (POWL). The worth of POWL inventory has risen greater than 250% up to now yr and nonetheless has extra room to run, in keeping with some analysts.

Searching for Alpha

PAVE: An ETF for US Infrastructure Improvement

Relatively than trying to decide on particular person shares akin to POWL or STRL that can supply development potential, one different funding choice to think about that’s prone to proceed to learn from US infrastructure spending is the World X U.S. Infrastructure Improvement ETF. As the corporate explains on its website, there are a number of causes to think about PAVE for traders in search of a excessive complete return from an ETF that invests in US infrastructure growth together with a compelling want, a number of long-term catalysts, and an unconstrained method to portfolio growth.

PAVE web site

The PAVE ETF has an inception date of March 6, 2017, and presently has about $7 billion in internet property. There are simply over 182 million shares excellent, and the fund holds 99 fairness positions in infrastructure shares. The fund pays a semi-annual distribution with a yield of 0.66%. The full expense ratio is 0.47% in keeping with the fact sheet.

From the fund Overview:

The World X U.S. Infrastructure Improvement ETF seeks to put money into firms that stand to learn from a possible enhance in infrastructure exercise in the US, together with these concerned within the manufacturing of uncooked supplies, heavy gear, engineering, and development.

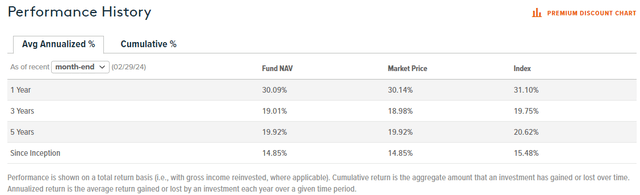

Fund efficiency has been excellent since its inception and particularly within the final yr. This desk from the fund web site exhibits fund efficiency at each NAV and market value solely barely lagging the index that it follows for a benchmark, the Indxx U.S. Infrastructure Development Index.

PAVE web site

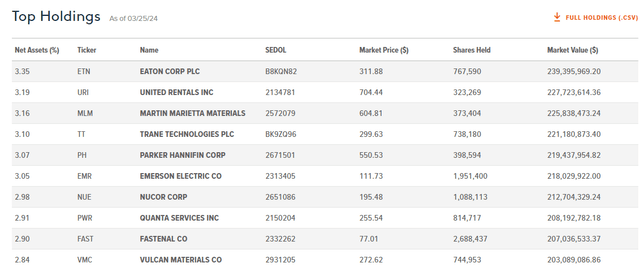

Fund Holdings

The sectors that the fund invests in embody 72% Industrials, 22% Supplies, 3% Utilities, and fewer than 2% allocations to Data Tech, Shopper Discretionary, and Financials. The highest 10 holdings as of three/25/24 in keeping with the fund web site are proven under:

PAVE web site

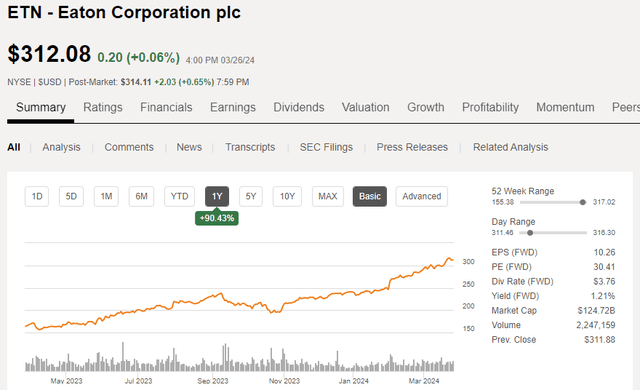

Prime holding Eaton was lately reported within the information because the leading gainer among large cap industrial shares. ETN additionally accounts for about 3% of the Industrial Choose Sector SPDR ETF (XLI).

Eaton’s 5.9% achieve for the week to a report shut prolonged its 12-month climb to about 91%. The maker {of electrical} gear has boosted its gross sales and revenue amid sturdy demand within the aerospace trade and the report variety of large-scale infrastructure tasks in the US. Eaton, which is domiciled in Dublin, Eire, is also restructuring operations and investing in modernized factories worldwide.

Searching for Alpha

The second largest holding, URI, can be up practically 90% up to now yr. URI is rated a Purchase by SA analysts and on March 4 announced that it was buying Yak Entry for $1.1B, which it expects to be instantly accretive to EPS and FCF.

Martin Marietta Supplies (MLM) is up practically 80% up to now yr. On February 22, HSBC upgraded MLM to Maintain from Cut back primarily based on infrastructure demand.

Martin Marietta Supplies on Thursday was upgraded to Maintain from a earlier funding ranking of Cut back by analysts at financial-services agency HSBC. They mentioned the supplier of gravel and different constructing supplies has sturdy long-term pricing energy for its merchandise amid increased authorities spending on infrastructure.

Trane Applied sciences (TT) is up about 65% up to now yr. TT inventory hit a record high after reporting an earnings beat on February 1, and subsequently increased the dividend by 12%.

Parker-Hannifin (PH) is up practically 70% up to now yr. PH inventory was lately rated a top stock within the industrial equipment trade sub-sector by CFRA and made the checklist of Wells Fargo’s core industry leaders to face the take a look at of time.

Emerson Electrical (EMR) is just up by about 35% over the previous yr however will get Purchase scores from Wall Avenue and SA analysts and was lately rated top electrical sub-group pick by Berenberg. I reviewed EMR intimately in October after I rated it my finest worth decide for dividend development traders.

Nucor (NUE) is a metal producer that’s up about 30% up to now yr. Whereas NUE has not carried out in addition to another supplies shares lately, it was rated one of many most underrated steel stocks by Citi, who upgraded the inventory from Maintain to Purchase.

Hacking thinks Nucor is underrated relative to its mid-cycle return on invested capital of 15%-20%, which ought to justify 30%-40% increased multiples and probably 10x-12x EBITDA vs. historic 6x-8x, supported by a monitor report of greater than 20 years of EPS development and constructive free money stream technology.

Quanta Companies (PWR) is up practically 60% up to now yr and on February 22 reported a income and earnings beat with revenues up by 30% YOY. PWR additionally made Citi’s top 20 list of large cap stock concepts for 2024.

Fastenal (FAST) is up about 47.5% up to now yr and reached an all-time high after reporting This autumn earnings.

Quantity 10 within the high ten holdings of PAVE is Vulcan Supplies (VMC), which is up about 65% up to now yr. VMC inventory additionally rallied to a record high after This autumn earnings and a constructive outlook for 2024.

“We’re properly positioned to ship one other yr of earnings development and robust money technology in 2024,” Chairman and CEO Tom Hill mentioned. “The pricing surroundings stays constructive, and we count on pricing momentum and operational execution will result in enticing growth in aggregates unit profitability, whatever the macro demand surroundings.”

Development More likely to Proceed

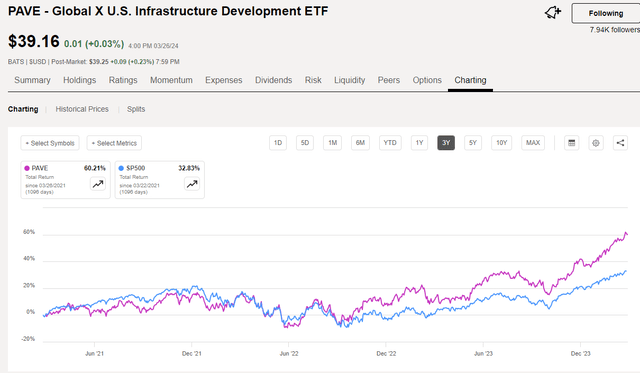

Though PAVE supplied traders a complete return of about 60% up to now three years, far exceeding the S&P 500 with its complete return of about 33%, the expansion is prone to proceed as infrastructure spending within the US picks up steam.

Searching for Alpha

In line with a February 2023 report from Brookings, the subsequent decade is anticipated to witness a considerable enhance in infrastructure spending within the US.

Brookings

A newer Brookings report from November 2023 marking the second anniversary of the Bipartisan Infrastructure Legislation signifies that greater than $300B has already been allotted to state coffers in help of infrastructure investments, but we’re nonetheless simply within the early innings.

Based mostly on our evaluation of revealed White Home information, IIJA implementation is simply now hitting its stride. Components and direct federal spending continue to maneuver at a gradual tempo, already pumping $306 billion into state coffers and direct funding tasks. And like an athlete who grows right into a sport, aggressive grant making is steadily rising, with 80% of all aggressive funding nonetheless left to be awarded.

Whereas a lot of the current development within the S&P 500 has been attributed to expertise shares which can be benefiting from the AI pattern, industrials are additionally main the way in which. In truth, according to TD Asset Management as of November 2023, 27 industrial shares had been outperforming the S&P 500.

The PAVE ETF with its 72% allocation to Industrials is one solution to leverage the spectacular development that lots of these shares are realizing with the approaching decade of US infrastructure spending that’s simply getting began.

[ad_2]