[ad_1]

mikkelwilliam

Abstract

Most popular shares are troublesome to research and worth given their quasi-debt and fairness traits. When risk-free charges are low, the devices present greater yields than bonds with decrease volatility than the frequent shares of the identical firm. When charges rise the costs fall greater than bonds given their fairness traits, i.e. firms don’t must pay the dividends nor the principal. On the present juncture within the US price cycle, it seems most popular shares could provide greater risk-adjusted features than company bonds. I analyzed the biggest ETF within the sector, the iShares Most popular and Earnings Securities (NASDAQ:PFF) to gauge its present yield and potential below completely different price eventualities. Below the belief that 10-year treasury yields declined to three% the ETF could have a 13% capital achieve potential plus 7% in yield pick-up. Nonetheless, this ETF doesn’t seem to outperform friends or high-yield bonds.

Efficiency

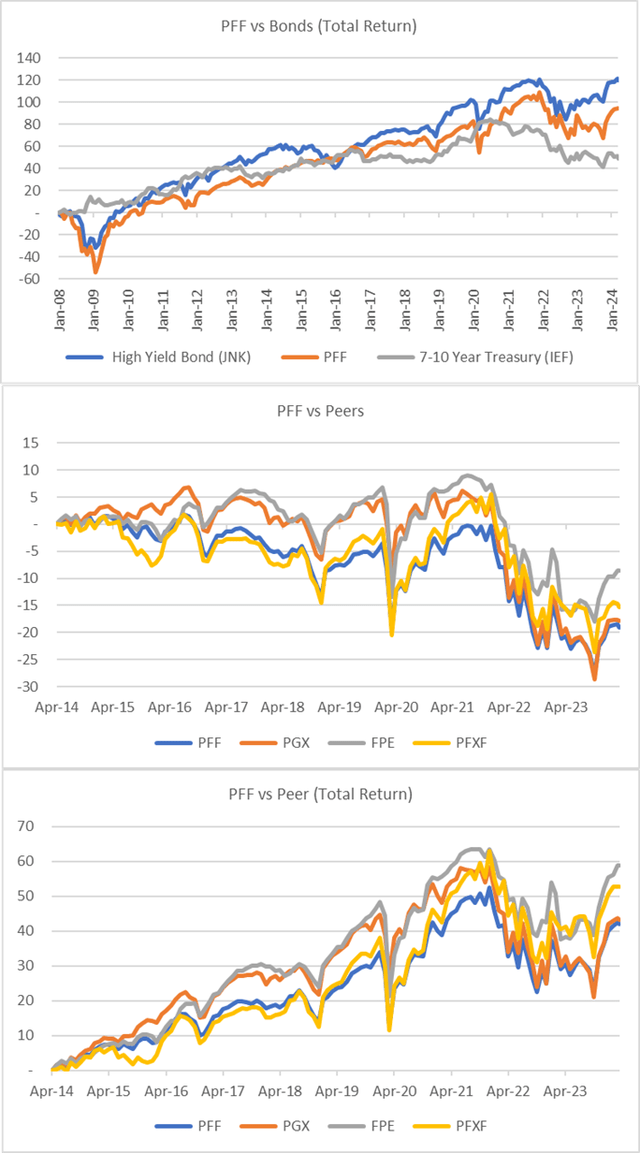

I in contrast the PFF efficiency to the US Treasury (7-10 yr maturity) and US Excessive yield for the reason that ETF’s inception and located that junk bonds have had a greater long-term whole return. The UST was far much less unstable main as much as the Fed’s present inflation combating cycle, which can name into query standard knowledge that US authorities debt is essentially the most safe.

Within the second and third charts, I in contrast PFF’s efficiency vs. chosen friends that had a 10-year monitor file vs. pure worth and whole return metrics. As will be seen, the PFF is persistently on the backside of the group. The First Belief Most popular Securities and Earnings ETF (FPE) did greatest, which can be attributable to its lively and world technique vs. US Indexing.

PFF vs Bonds & Friends (Created by creator with information from Capital IQ)

Friends & Indexes

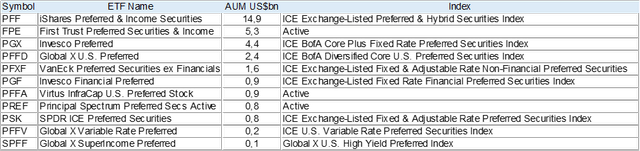

There aren’t many most popular share-focused ETF to select from, and plenty of monitor broad indexes that typically are dominated by the monetary sector that advantages from the non permanent nature of that most popular capital affords them. As will be seen within the desk under, Intercontinental Change (ICE) supplies practically all of the indexes for the popular ETF section.

PFF Friends (Created by creator with information from Searching for Alpha)

Most popular shares nuances

The securities are generally issued by an organization to cut back leverage, i.e., as an alternative of taking up an obligation to pay again a set quantity at a future maturity day plus curiosity, an organization points most popular shares with excessive and established dividend funds. The benefit to the corporate is that they by no means must pay again or name the popular shares. As well as, an organization could have many alternative points, every with various traits, which makes choosing the instrument as vital as the corporate.

Most preferreds are issued at US$25 or par with a set coupon yield. Some have name choices, floating charges, convertible to frequent inventory, could accumulate dividends due, and so on.. Every has a distinct attribute that may be useful or unfavourable relying on the speed cycle and the corporate’s monetary well being. A most popular share can lose all of its worth if the corporate can not pay dividends, enters into default, and so on.

Bond Traits

The asset class additionally has many bond traits reminiscent of period and yield to worst (YTW) that assist establish potential return and danger. Period is the volatility of change vs. the risk-free or benchmark charges, i.e., the US Treasury, expressed in years. A period of 1 yr signifies that the worth of the popular could enhance or lower by 1% for each 100 foundation factors the US Treasury modifications. The YTW is the speed or yearly yield {that a} most popular will generate to the earliest name date that additionally incorporates the value appreciation to par or name worth. Thus, typically talking, the upper the period and larger the YTW the larger the volatility.

Lastly, bonds and preferreds can and do rise past par or maturity redemption worth through the lifetime of the instrument, primarily based totally on the predominating present risk-free price. An extended-term bond with a 5% coupon at par or 100 can rise to 125 if benchmark charges fall to 4% which signifies that at 125 the coupon is the same as 4%. This can be a simplified instance, the pricing mechanism of bonds depends upon its period, price, and name options in addition to credit score high quality.

Portfolio Overview

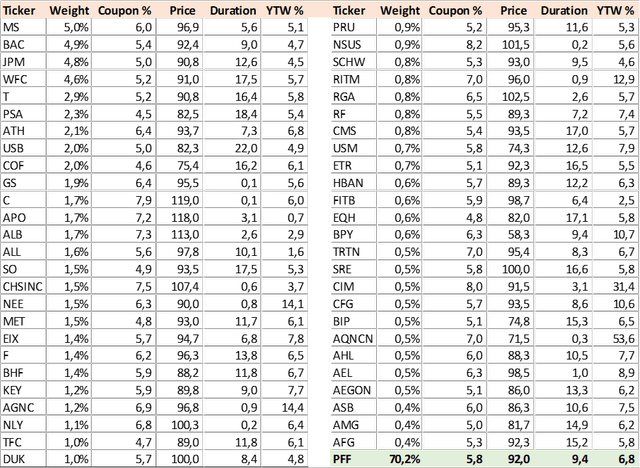

The PFF is a passive fund that tracks the ICE index, which has over 400 points however targeted on 150 firms. I downloaded the index, which is heavy within the monetary sector, and calculated the present YTW of 6.8% with a period of 9.4 years and a weighted common worth 8% under par. Beneath is a condensed snapshot of the index and by default the PFF. Observe that the costs are scaled to 100.

PFF Condensed Portfolio (Created by creator with information from Bloomberg)

Fee Sensitivity

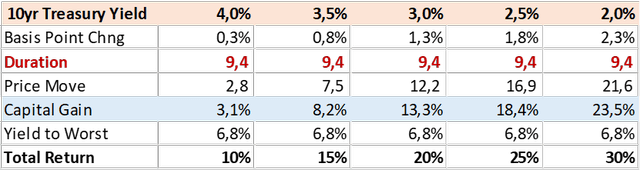

Most popular shares are largely valued as bonds and fluctuate with charges and capability to proceed paying their said dividend yield, i.e., credit score high quality. I carried out a price sensitivity evaluation to gauge the impression on costs if risk-free charges or the 10-year treasury declined, sustaining the danger unfold. Given the period of 9.4 years, this portfolio has a excessive diploma of volatility and upside potential in a Fed easing cycle. I calculated a complete return upside potential of 20% if the 10-year treasury fell to three%.

PFF Fee Sensitivity (Created by creator with information from Bloomberg)

Conclusion

I price the PFF a maintain. The long-term monitor file is lower than interesting vs. friends and various mounted earnings ETFs reminiscent of high-yield bonds, whereas the passive technique on this section is a hindrance given the multitude of nuances from one difficulty to a different of the identical firm. The popular asset class is best served with lively administration, in my opinion. Nonetheless, the ETF ought to carry out nicely in a declining price situation and warrants a Maintain score.

[ad_2]