[ad_1]

urbazon

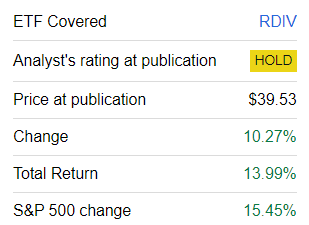

Persevering with my sequence of updates on dividend ETFs, as we speak I want to provide a recent have a look at the Invesco S&P Extremely Dividend Income ETF (NYSEARCA:RDIV), which I beforehand assessed in August 2023, concluding with a Maintain ranking.

Why we ought to focus on RDIV as soon as once more? As it is a high-turnover, extremely selective dividend technique with quarterly rebalancing, we must always analyze the variations in portfolio composition that may have emerged and what issue modifications they could have resulted in. Subsequent, we must always focus on whether or not the expansion, high quality, and worth mixture the ETF is providing in the meanwhile is perfect for the present market regime or not.

What’s RDIV?

In response to its website, RDIV’s technique relies on the S&P 900 Dividend Income-Weighted Index. As we all know from the methodology abstract supplied within the truth sheet, the thought is to pick out 60 beneficiant dividend payers from the S&P 900 (which is itself the S&P 500 plus the S&P 400) in 4 steps:

- take away the important thing 5% of the S&P 900 constituents with the very best dividend yields, which, as I’ve already defined within the earlier notes, may need a perform of a easy value-trap display screen (assuming how sturdy RDIV’s high quality traits are, this unsophisticated methodology is clearly working);

- take away “the highest 5% of securities inside every sector by dividend payout ratio;” I ought to add right here that that is one other value-trap, dividend sturdiness display screen;

- choose 60 names with the very best dividend yields;

- alter their weights utilizing the income issue, additionally making use of a 5% single-company cap.

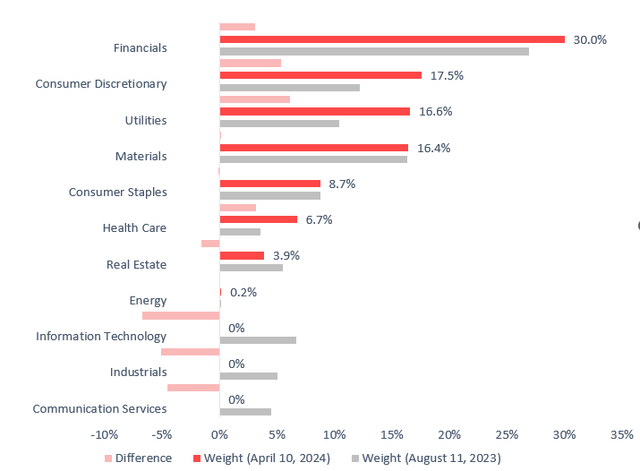

Importantly, the index shouldn’t be supposed to supply publicity to all 11 GICS sectors. To corroborate, as of April 10, there have been simply 8 sectors on this portfolio, as communication, info know-how, and industrials have been absent.

Created by the writer utilizing information from RDIV

Furthermore, RDIV’s weighting rules end in some peculiarities, as there have been 18 financials on this basket that accounted for roughly 30% of the online property as of April 10. On the similar time, there have been 16 actual property gamers with solely 3.89% weight.

What has modified within the RDIV portfolio?

Since my August 2023 article, RDIV’s underlying index has been rebalanced twice, in October and January, with the following rebalancing due this April. As a consequence, holdings accounting for about 30.5% of the ETF’s portfolio as of August 11 have been eliminated. The 5 most notable removals have been as follows:

| Inventory | Sector | Weight (as of August 11, 2023) |

| Intel (INTC) | IT | 5.25% |

| 3M (MMM) | Industrials | 5.08% |

| Paramount International (PARA) | Communication | 4.5% |

| Truist Monetary Company (TFC) | Financials | 4.37% |

| Advance Auto Components (AAP) | Shopper Discretionary | 1.65% |

Created utilizing information from the ETF

Under are the 5 largest additions:

| Inventory | Sector | Weight (as of April 10, 2024) | DY TTM |

| Ford (F) | Shopper Discretionary | 5.695% | 4.6% |

| Nordstrom (JWN) | Shopper Discretionary | 2.198% | 3.8% |

| T. Rowe Value Group, Inc. (TROW) | Financials | 0.988% | 4.2% |

| Agree Realty (ADC) | Actual Property | 0.072% | 5.2% |

| Entergy (ETR) | Utilities | 2.007% | 4.2% |

Created utilizing information from Looking for Alpha and the ETF

What are RDIV’s issue traits? Right here, regardless of 19 holdings out of 60 eliminated, we see simply minor, largely beauty modifications. Total, it is a predominantly large-cap, high-yield, deeply undervalued, top-quality combine with unappealing progress traits (together with nuances on the dividend entrance). Let me elaborate on that under.

Worth

RDIV stays a superb possibility for worth maximalists who’re looking out for dividend alternatives within the large-cap universe.

| Metric | April 2024 | August 2023 |

| Market Cap, $ billion | 45.59 | 44.25 |

| EY | 5.65% | 4.9% |

| P/S | 1.94 | 1.90 |

| DY | 4.72% | 4.88% |

| Quant Valuation B- or greater | 86.7% | 82.1% |

| Quant Valuation D+ or decrease | 1.45% | 1% |

Calculated by the writer utilizing information from Looking for Alpha and the ETF

Its weighted-average market cap has risen barely, largely as a consequence of the capital appreciation of the holdings. On this combine, mid-caps account for 16.3% of the online property, which is sort of on par with the ETF’s allocation to mega-caps, 14.7%, as per my calculations. We additionally see a stable enchancment within the WA earnings yield. The median EYs are on par: 6.2% in August vs. round 6% in April. Adjusted for the affect of loss-making firms, the EY stood at 6.9% in August and at 6.1% in April.

For context, under are the earnings yields of the S&P 400 and the S&P 500 indices, calculated utilizing P/E information from the web sites of the SPDR S&P MIDCAP 400 ETF Belief (MDY) and the SPDR Portfolio S&P 500 ETF (SPLG).

| Index | EY |

| S&P 400 | 5.6% |

| S&P 500 | 3.9% |

Additionally, I ought to observe that the share of holdings with the B- Quant Valuation ranking or greater is so giant that I’d name RDIV an ETF with pure-value traits.

High quality

RDIV’s portfolio is an ideal illustration of how a profound worth tilt might be achieved with out compromising on high quality, as illustrated by the burden of the holdings with a B- Quant Profitability ranking or higher.

| Metric | April 2024 | August 2023 |

| ROE | 9.34% | 22.1% |

| ROA | 2.45% | 6.69% |

| Quant Profitability B- or greater | 76.73% | 81.1% |

| Quant Profitability D+ or decrease | 8.33% | 6.5% |

Calculated by the writer utilizing information from Looking for Alpha and the ETF

Nevertheless, there are nuances. For instance, Return on Belongings is clearly too low, with the important thing detractors being the monetary and utilities sectors.

Progress

However, in the case of balancing inexpensiveness, high quality, and progress, one thing have to be sacrificed, and within the case of RDIV, it’s the progress issue.

| Metric | April 2024 | August 2023 |

| EPS Fwd | -1.22% | -9.4% |

| Income Fwd | -0.07% | 1.3% |

| Quant Progress D+ or decrease | 45.6% | 71.9% |

Calculated by the writer utilizing information from Looking for Alpha and the ETF

The important thing causes for the weighted-average progress charges being detrimental are that 41% of the holdings are forecast to ship decrease revenues going ahead, whereas EPS contraction is probably going for 42% of the businesses, as we will deduct from pundits’ estimates.

Dividend traits: sizable yields on the expense of progress

RDIV’s portfolio is providing a reasonably interesting weighted-average dividend yield of 4.7%. To present a bit extra shade, the DYs vary from Ally Monetary’s (ALLY) 3.16% to Crown Citadel’s (CCI) 6.45%. RDIV itself has a TTM DY of 4.09% as of writing this text.

On the detrimental aspect, the dividend progress traits of its high-yield holdings are fairly lackluster, they usually have even deteriorated since August 2023.

| Metric (weighted common) | April 2024 | August 2023 |

| Div Progress 3Y | 4.72% | 6.06% |

| Div Progress 5Y | 4.03% | 6.69% |

Calculated by the writer utilizing information from Looking for Alpha and the ETF

Nevertheless, a nuance right here is that the important thing contributor to the dividend CAGRs was AAP, which is now not within the portfolio. The adjusted 3-year CAGR as of August was 3.8%, whereas the 5-year CAGR stood at 5.3%.

Investor Takeaway

In sum, RDIV’s portfolio contains largely large-cap, high-yield, grossly underpriced, top-quality firms with unappealing progress traits.

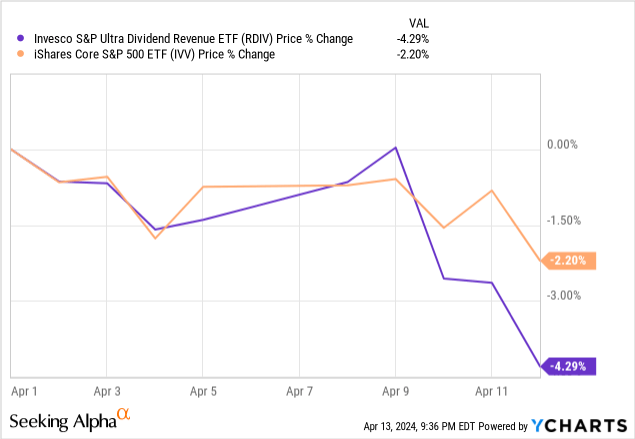

Does RDIV’s distinctive deep-value profile provide a chance in the meanwhile? It could provide it. The market is hardly proud of the latest CPI surprises and Brent value presently teetering round $91 a barrel, which is clearly an inflationary issue that can proceed taking part in out going ahead. It’s no shock buyers are nervous, because the very narrative of this market rally primarily based on a most likely excessively optimistic rate of interest reduce schedule is jeopardized. This nervousness is percolating into inventory costs, with the iShares Core S&P 500 ETF (IVV) down by round 2.2% in April. And RDIV would possibly appear to be a superb play for a price rotation. For context, the ETF carried out phenomenally throughout hawkish and bearish 2022, delivering a 7.14% whole return, whereas IVV was down by 18.16%. Nevertheless, there are just a few the explanation why I’m nonetheless impartial on RDIV.

First, it appears the ETF has been much more delicate to the latest softness than IVV.

RDIV has additionally underperformed the S&P 500 index since my August article.

Looking for Alpha

Second, since its reorganization in 2019, it has underperformed each IVV and MDY, delivering a most drawdown of 40.4% and a disappointing draw back seize ratio of 112.7%.

| Portfolio | IVV | RDIV | MDY |

| Preliminary Stability | $10,000 | $10,000 | $10,000 |

| Remaining Stability | $20,643 | $15,904 | $17,884 |

| CAGR | 16.18% | 10.08% | 12.78% |

| Stdev | 18.31% | 26.29% | 22.13% |

| Finest 12 months | 28.76% | 27.93% | 24.21% |

| Worst 12 months | -18.16% | -10.37% | -13.28% |

| Max. Drawdown | -23.93% | -40.38% | -29.63% |

| Sharpe Ratio | 0.8 | 0.42 | 0.56 |

| Sortino Ratio | 1.27 | 0.63 | 0.86 |

| Market Correlation | 1 | 0.82 | 0.94 |

Information from Portfolio Visualizer. The interval is June 2019–March 2024

Moreover, its progress publicity and comfortable dividend progress are worrisome. All in all, the Maintain ranking is maintained.

[ad_2]