[ad_1]

Common readers are effectively conscious that back in July, Zero Hedge first (lengthy earlier than it grew to become a operating theme amongst so-called “macro specialists”) identified {that a} gaping 1+ million job differential had opened up between the closely-watched and market-impacting, if simply gamed and manipulated, Institution Survey and the much more correct if unstable, Family Survey – the 2 core elements of the month-to-month non-farm payrolls report.

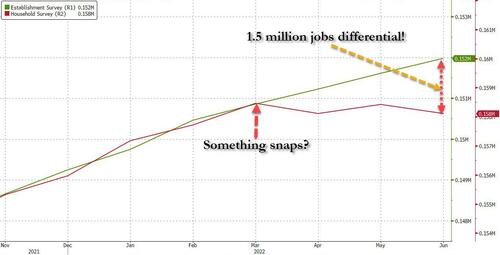

We first described this divergence in early July, when wanting on the June payrolls information, we discovered that the hole between the Housing and Institution Surveys had blown out to 1.5 million beginning in March when “one thing snapped.” We described this in “Something Snaps In The US Labor Market: Full, Part-Time Workers Plunge As Multiple Jobholders Soar.”

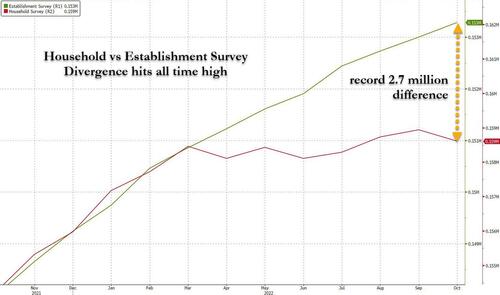

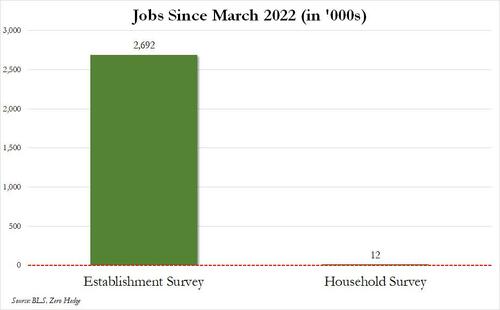

Since then the distinction solely obtained worse, and culminated earlier this month when the hole between the Institution and Family surveys for the November dataset practically doubled to a whopping 2.7 million jobs, a bifurcation which we described in “Something Is Rigged: Unexplained, Record 2.7 Million Jobs Gap Emerges In Broken Payrolls Report.”

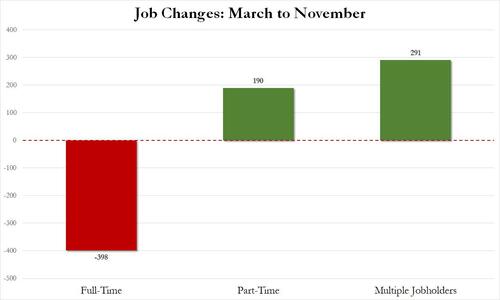

Whether or not this divergence was as a result of incorrect seasonal changes (a remnant of the overreaction taken by the Dept of Labor following the covid crunch to normalize for a brand new regular labor market), as a result of misguided Delivery-Demise assumptions (right here too, the Dept of Labor was assuming early cycle new enterprise creation which clearly is incorrect with the economic system late cycle and thousands and thousands of companies shutting down, ignoring the open PPP fraud that came about in early/mid-2000s as everybody “opened up” companies to get free cash from the federal government), as a result of Institution Survey lack of ability to inform the distinction between full, half and multiple-jobs – as a reminder we first confirmed that since March, the US had misplaced 400K full-time jobs offset by far decrease paying part-time jobs in addition to double-counted a number of jobholders…

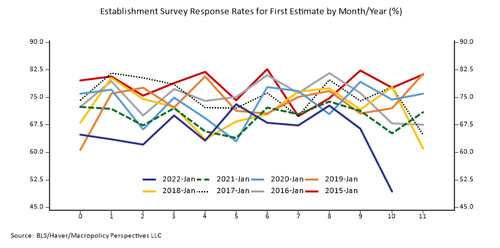

… as a result of file excessive charge of estimation – recall the 49% Institution survey response charge was a lot decrease than the 70-75% charge typical in November, that means the Dept of Labor was actually making numbers up to “full” the survey…

… or another cause, maybe together with the Biden admin tapping sure Bureau of Labor Statistics officers on the shoulder and advising them to indicate sturdy numbers in the event that they need to maintain their… effectively… jobs, we didn’t know, however we did know that based on the Family Survey, simply 12,000 jobs have been created since March, whereas based on the Institution Survey – which strikes markets and units Fed coverage – the rise in jobs over the identical interval was 2.692 million!

We convey all this up once more as a result of late on Dec 13, the Philadelphia Fed revealed one thing surprising: as a part of the regional Fed’s quarterly reassessment of payrolls within the type of an “early benchmark revision of state payroll employment“, the Philly Fed confirmed what we’ve got been saying since July, particularly that US payrolls are overstated by at the least 1.1 million, and certain far more!

First, some background.

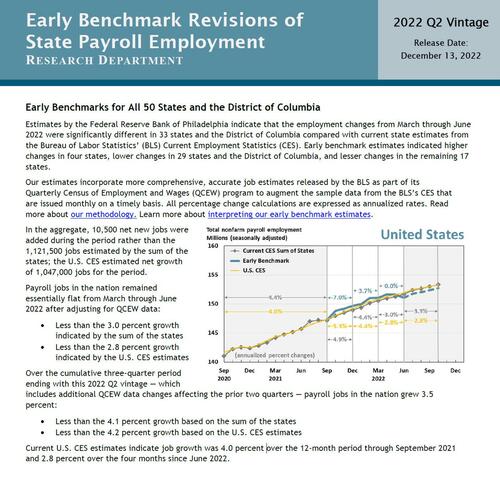

Because the Philly Fed notes, “estimates by the Federal Reserve Financial institution of Philadelphia point out that the employment adjustments from March via June 2022 have been considerably totally different in 33 states and the District of Columbia in contrast with present state estimates from the Bureau of Labor Statistics’ (BLS) Present Employment Statistics (CES). Early benchmark estimates indicated larger adjustments in 4 states, decrease adjustments in 29 states and the District of Columbia, and lesser adjustments within the remaining 17 states.

Wait, the Philly Fed tabulates jobs? Is not that the roles of the BLS?

Why sure, the BLS does that each month. The issue is that to efficiently publish a report inside days after any given month ends, the BLS report offers up in accuracy what it makes up in velocity. Way more correct experiences can be found elsewhere, they only include an enormous lag. That is the place the Philadelphia Fed is available in: from the latest quarterly report…

Our estimates incorporate extra complete, correct job estimates launched by the BLS as a part of its Quarterly Census of Employment and Wages (QCEW) program to reinforce the pattern information from the BLS’s CES which are issued month-to-month on a well timed foundation. All proportion change calculations are expressed as annualized charges. Learn extra about our methodology. Study extra about interpreting our early benchmark estimates.

Okay, okay, what did this “extra correct”, “extra complete” report discover? It discovered that…

Within the combination, 10,500 web new jobs have been added throughout the interval reasonably than the 1,121,500 jobs estimated by the sum of the states; the U.S. CES estimated web progress of 1,047,000 jobs for the interval.

Keep in mind what we mentioned in July once we first looked on the March-June divergence between the Family and Institution survey: we mentioned that “since March, the Institution Survey reveals a acquire of 1.124 million jobs whereas the Family Survey reveals an employment lack of 347K!” Stated in any other case, we discovered that payrolls “calculated” by the Institution Survey have been overestimated by 1.5 million. Shockingly, the Philly Fed appears to agree, and experiences that as an alternative of the roughly 1.1 million jobs reported by the BLS, solely 10,500 new jobs have been added!

And a few extra information:

Payroll jobs within the nation remained primarily flat from March via June 2022 after adjusting for QCEW information:

- Lower than the three.0 p.c progress indicated by the sum of the states

- Lower than the two.8 p.c progress indicated by the U.S. CES estimates

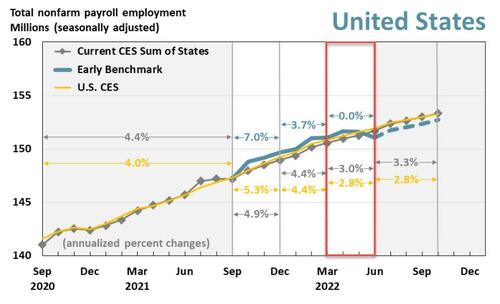

That is proven graphically within the chart under: particularly, the evaluation seems to be on the quarter within the purple field, the place the inexperienced line, or the extra correct “early benchmark” revision of official information, dipped decidedly under the CES trendline (i.e., the nonfarm payrolls).

For individuals who are too lazy to click on the source report, right here is the abstract web page:

In fact, the above evaluation solely seems to be on the March-June interval. What about subsequent months and quarters? Nicely, we must wait at the least 3 months to get the June-Sept information, however utilizing the identical method which we now know works, and which seems to be on the divergence between Family and Institution surveys, it’s secure to say that the job “overstating” which was 1.5 million in June based on Zero Hedge and 1.1 million based on the Philly Fed, has nearly doubled to 2.7 million from March to November. The one query is what the ultimate, much more correct Philly Fed estimate can be when it’s revealed a while in 6 months time.

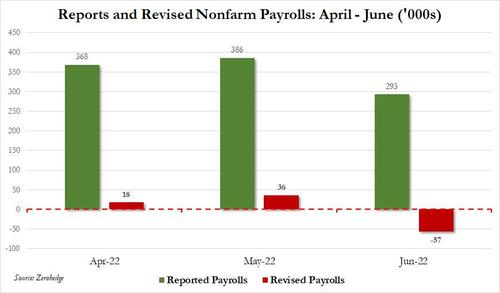

However a good larger query is when does the BLS notice (or reasonably admit) what’s going on and engages in a shotgun backward revision of knowledge? The probably reply is that the BLS will merely wait till one among its annual historic information revision intervals, when the Bureau of Labor Statistics quietly admits that historic information was larger by just a few million, and re-benchmarks present months going ahead as if nothing had occurred. Within the meantime, nevertheless, the Fed is shaping financial coverage utilizing the clearly flawed assumption that the US labor market is “sizzling”, “tight” and “sturdy”, when in actuality we now know that between March and June, month-to-month payrolls have been overstated by about 350,000. This issues as a result of that is what the BLS reported for payrolls for these months:

- April 368K

- Could 386K

- June 293K

Now take these numbers and alter them to subtract a median of 350K from every month (to get the revised Philly Fed payroll over this era) and also you get this:

And visually.

Nonetheless suppose the Fed can be climbing 75bps this summer time if as an alternative of a median month-to-month job acquire of 350K, Powell was seeing zero month-to-month payroll will increase?

And much more importantly, now that the cat is out of the bag and the Philly Fed has launched this big credibility difficulty in all latest payrolls information, how lengthy till this turns into a political difficulty, and the way lengthy till Republicans – who take management of the Home in January – begin hearings to reveal to the US that the collapse within the labor market didn’t begin with the Republican takeover however was effectively in place final summer time.

And at last, how lengthy till the Fed – which made it clear that it’s now not centered purely on inflation numbers (that are sliding quick anyway) however can even be taking a look at clearly incorrect jobs information – makes it a degree that the US labor market is in far worse form, it’s in reality contracting, than it was when it determined to hike 75bps a number of occasions in a row?

Supply: Early Benchmark Revisions of State Payroll Employment

Loading…

[ad_2]