[ad_1]

tadamichi

I am not a fan of junk debt at this level within the cycle. I feel credit score danger is rising and CCC-rated bonds are significantly weak. That does not imply that one cannot spend money on bonds. It simply means one ought to take into account prime quality bonds. In case you’re in search of a great way to entry company bonds of upper high quality, the SPDR® Portfolio Company Bond ETF (NYSEARCA:SPBO) is value contemplating. This ETF goals to duplicate the efficiency and yield of the Bloomberg U.S. Company Bond Index as intently as potential, earlier than accounting for charges and bills. The Index is comprised of investment-grade company bonds issued by U.S. and non-U.S. industrial, utility, and monetary establishments, making it a various and broad-based funding device.

Digging into SPBO’s Holdings

SPBO’s portfolio is primarily composed of almost 100% investment-grade company bonds. These bonds are identified for his or her low default charges, making them a comparatively safer funding in comparison with different securities. With a gorgeous 30-Day SEC Yield of 5.35%, the curiosity revenue generated outweighs the default danger given the broader prime quality of the holdings.

Holdings embody:

- US Greenback: This accounts for about 0.43% of the portfolio weight, representing a small however essential portion of the holdings.

- JPMorgan Chase + Co Subordinated 09/33 VAR: This bond issued by JPMorgan Chase is a subordinated debt with a variable rate of interest. It constitutes roughly 0.21% of the portfolio weight.

- Financial institution of America Corp Sr Unsecured 01/27 VAR: This senior unsecured bond from Financial institution of America kinds round 0.19% of the portfolio weight. Being a senior debt, it holds priority over different money owed in case of liquidation.

- Wells Fargo + Firm Sr Unsecured 09/25 3.55: This senior unsecured bond from Wells Fargo makes up roughly 0.18% of the portfolio.

- Common Motors Monetary Co Firm Guar 10/26 4: This bond from Common Motors Monetary Firm, assured by the mother or father firm, contributes to about 0.18% of the portfolio weight.

That is effectively diversified total, which signifies that even when a person bond did default, it should not have a huge impact on the fund total.

Sector Composition and Weightings

The very best weightage is given to Industrial company bonds (57.80%), adopted by Financials (32.58%), and Utilities (9.12%). A small portion (0.50%) is held as money, offering liquidity to the fund. The Industrials sector on the fairness aspect has been surprisingly robust, which bodes effectively for the bond aspect as effectively. Financials may nonetheless be tough, however as a result of these are primarily the “too large to fail” banks, I do not suspect it is a main danger.

Evaluating SPBO with Comparable ETFs

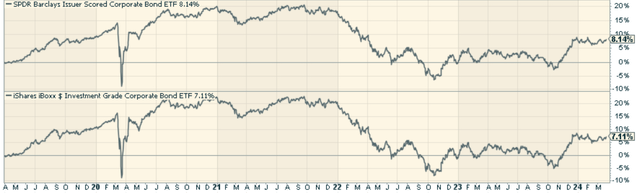

SPBO competes with a number of different company bond ETFs. Nonetheless, its low-cost construction, diversified portfolio, and spectacular yield make it stand out. One ETF value evaluating in opposition to is the iShares iBoxx Funding Grade Company Bond ETF (LQD). The 2 observe the identical funding grade high quality a part of the bond market, and performance-wise are in-line with one another. SPBO does appear to have a slight efficiency edge although.

Professionals and Cons of Investing in SPBO

SPBO affords a excessive yield and a portfolio of high-quality investment-grade bonds, making it a gorgeous proposition for revenue traders. Nonetheless, it’s not with out its dangers. Market fears reminiscent of a possible financial recession can negatively affect investment-grade company bonds. Nonetheless, traders ought to see such market downturns as shopping for alternatives to build up extra SPBO shares at discounted costs, particularly on condition that the Fed appears to be intent on chopping charges quickly.

Ought to You Spend money on SPBO?

Investing in SPBO requires a long-term perspective. Whereas the fund doesn’t provide fast, short-term capital beneficial properties, it does provide potential capital appreciation and a gradual curiosity revenue in the long term. Buyers must be affected person and maintain onto their investments, reaping the advantages of the enticing yield.

Buyers looking for so as to add a top quality portfolio of investment-grade company bonds to their portfolio ought to critically take into account SPBO. Its present yield, mixed with the potential for long-term capital beneficial properties, makes it a gorgeous funding possibility.

Markets aren’t as environment friendly as standard knowledge would have you ever imagine. Gaps typically seem between market indicators and investor reactions that assist give a sign of whether or not we’re in a “risk-on” or “risk-off” setting.

The Lead-Lag Report may give you an edge in studying the market so you may make asset allocation choices based mostly on award successful analysis. I’ll provide the signals–it’s as much as you to determine whether or not to go on offense (i.e., add publicity to dangerous property reminiscent of shares when danger is “on”) or play protection (i.e., lean towards extra conservative property reminiscent of bonds/money when danger is “off”).

[ad_2]