[ad_1]

RapidEye

The surge in expertise shares echoes previous market euphoria, but issues come up amid present financial challenges. This text analyzes historic parallels and potential implications for the SPDR S&P 500 Belief ETF (NYSEARCA:SPY), stressing warning and prudent threat administration. Specializing in key indicators and macroeconomic components, this text presents insights into the state of great indexes within the US monetary markets. It additionally explores related financial indicators that assist body discussions surrounding SPY. The choice to downgrade SPY to a promote place displays a proactive response to shifting market dynamics. As we await insights from forthcoming occasions just like the FOMC assembly, sustaining vigilance and flexibility stays essential for buyers.

A Macro Perspective

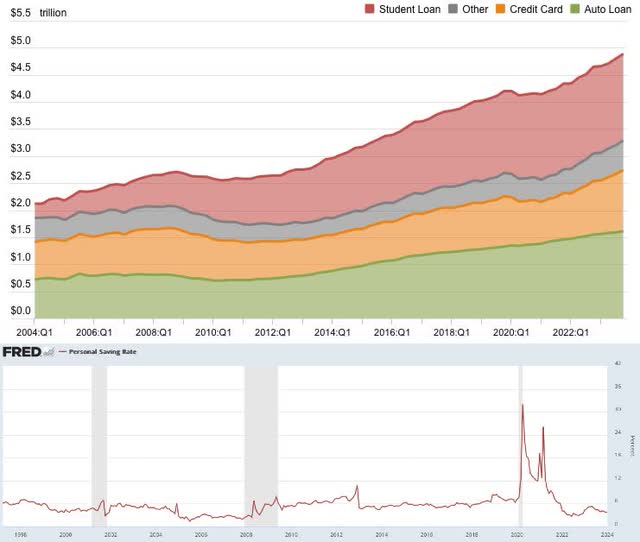

Following the 2008 financial downturn and the gradual restoration from the COVID-19 pandemic, American customers have considerably ramped up their reliance on debt. Family debt surged by $212B in simply the fourth quarter of 2023, reaching a staggering $17.5T. Non-housing debt, notably credit card debt, has ballooned to $1.13 trillion, marking a 136% improve since 1999 and highlighting the substantial dependence on borrowed funds for shopper spending. In the meantime, rates of interest on new credit cards have soared to a median of 24.66%, a substantial portion exceeding even 30%.

Concurrently, various credit score fee strategies like “purchase now, pay later” [BNPL] have gained traction, notably amongst non-white millennials and older Technology Z people with family incomes beneath $75,000. Nevertheless, this surge in debt has coincided with a decline within the personal saving rate, which hit a multi-year low of three.8% in January 2024, akin to ranges seen in March 2000. That is down from 8.5% earlier than the pandemic and a peak of 32% in April 2020, elevating issues about customers’ monetary stability.

FRBNY Client Credit score Panel/Equifax, FRED

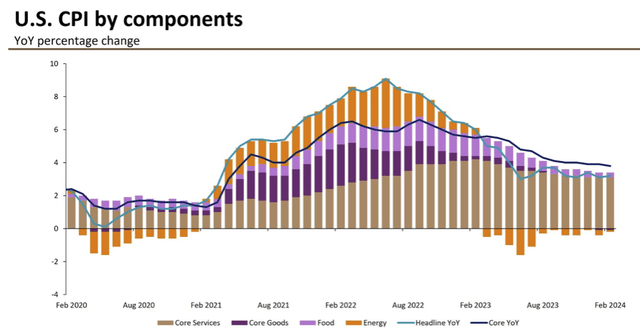

The core Client Value Index [CPI], excluding meals and vitality costs, offers a extra dependable image of inflationary strain within the economic system with out extra unstable components. Though cooling down considerably from its peak noticed throughout 2022, the index once more offers indicators of resilience, regardless of the Federal Funds charges standing at ranges not noticed since 2001.

In February, the core Client Value Index [CPI] elevated by 0.4% month-over-month [MoM] and a barely softer 3.8% year-over-year [YoY]. This rise was primarily fueled by elevated proprietor’s equal hire and medical care companies costs. As depicted within the chart above, core companies inflation continues to indicate resilience, with the shelter element serving as the first driver, comprising one-third of the general CPI.

Headline inflation, as measured by the general Private Consumption Expenditures [PCE] index, displays the costs U.S. customers pay for a wide selection of products and companies, together with vehicles, meals, clothes, housing, and healthcare. The most recent YoY reading of two.4% stays considerably above the Federal Reserve’s [FED] 2% symmetric goal stage defined since 2012. This means that for this metric to weaken considerably, there must be a decline in shelter costs.

The Federal Reserve, in its proactive position, carefully screens the employment market, notably wage development, as one other essential component of the economic system. The FED goals for a “delicate touchdown” state of affairs the place it achieves its goal inflation with out inflicting vital disruption in employment and thereby avoiding main adverse impacts on the economic system. Nevertheless, to scale back inflationary strain, the economic system should calm down, and the Fed can solely straight affect the demand throughout the U.S. economic system. In different phrases, consumption have to be moderated till worth stability is achieved. This conundrum recurs with every fee cycle.

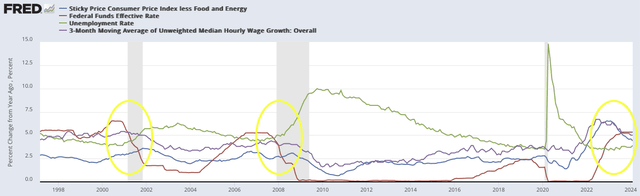

Trying on the previous 24 years, whereas excluding the COVID-induced international disaster, vital similarities and variations might be noticed earlier than the recessions that hit the U.S. economic system in March 2001 and December 2007.

In each earlier situations, inflationary strain was considerably decrease, nevertheless it’s essential to notice that the Federal Funds fee has remained near zero for a lot of consecutive years since 2009, following the monetary disaster. This extended low-interest fee setting has not simply contributed to however considerably exacerbated the substantial accumulation of debt, as mentioned earlier. This example has distorted the US shopper’s buying energy and nominal wealth, primarily deferring the inevitable second when the implications have to be confronted and money owed repaid.

In each historic situations, wage development needed to lower considerably beneath precise ranges, whereas a surge in unemployment has been an inevitable consequence of the adverse catalyst triggering the financial downturn. In the present day, each measures stay at unfavorable ranges, making it difficult for the Fed to realize its objectives, prompting the central financial institution to take care of rates of interest at larger ranges. It seems that a big cooldown within the labor market is not only mandatory however an imminent chance for different metrics to observe go well with and attain the inflation goal. The urgent query shouldn’t be if, however when and the way extreme this cooldown will happen, probably within the type of a recession.

Of explicit relevance on this evaluation is the potential influence on the US inventory market, which is at present at traditionally excessive ranges. A recession may probably result in a downturn and a big plunge in inventory costs as investor sentiment weakens and company earnings come underneath extreme strain. Nevertheless, the precise magnitude and period of such an influence would rely upon varied components, together with the severity of the recession, the effectiveness of coverage responses, and broader market dynamics.

One of many major drivers of the particular surge within the fairness market is the emergence of Synthetic Intelligence [AI] and the derived forecasts of future income for vital market members in related industries resembling chip makers, cloud computing firms, tech giants, and cutting-edge {hardware} and software program producers. The surge in technology-centric mega caps generally known as “The Magnificent Seven,” together with Microsoft Company (MSFT), Apple Inc. (AAPL), NVIDIA Company (NVDA), Alphabet Inc. (GOOGL) (GOOG), Amazon.com, Inc. (AMZN), Meta Platforms, Inc. (META), and Tesla, Inc. (TSLA), which have outperformed the S&P 500 (SP500) by 2 to 108 occasions prior to now ten years, has led to some perplexity, if this current parabolic bull market isn’t going through an identical euphoric enlargement noticed throughout the dotcom bubble, whereas the underlying economic system is coping with challenges mentioned earlier. Monetary stability is going through vital issues. The SP500, the Nasdaq Composite (IXIC), and the Nasdaq 100 (NDX) are market capitalization-weighted indexes, which signifies that the efficiency of bigger firms has considerably extra influence on the index’s total returns than smaller firms. These seven shares comprise about 30% of the S&P 500’s whole weighting, though they comprise simply 1.6% of the shares within the index. To ascertain if the indexes are pushed larger by only a few shares, observing the market participation is crucial.

The Market Breadth, gauged by the MMFI and represented as the proportion of shares buying and selling above their 50-day transferring averages [MAV], has dropped from its peak reported on the finish of December 2023, now standing near the 50% mark. Specializing in the 200-day MAV, the MMTH has additionally dropped from its peak, with 59% of shares standing above their long-term transferring common. Each indicators are near essential help ranges, with MMTH worth motion reflecting larger indecision however trending decrease. Each indicators reject the thesis of broad market participation, hinting at the next dependency of the present rally on a comparatively minor variety of shares.

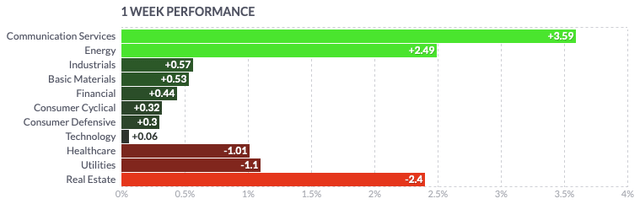

Over the previous 12 months, almost all sectors of the US economic system have carried out positively, with notably notable positive factors seen within the expertise, communication companies, and monetary sectors. Solely utilities sector firms have skilled slight losses.

Of late, the vitality sector has been on an upward trajectory, propelled by a surge in crude oil costs. This resurgence in gasoline costs, bouncing again from their January lows, has posed inflation discount challenges.

Prior to now week, there have been indicators of broader weak spot, notably in the true property sector and amongst firms within the utilities, healthcare, and expertise teams.

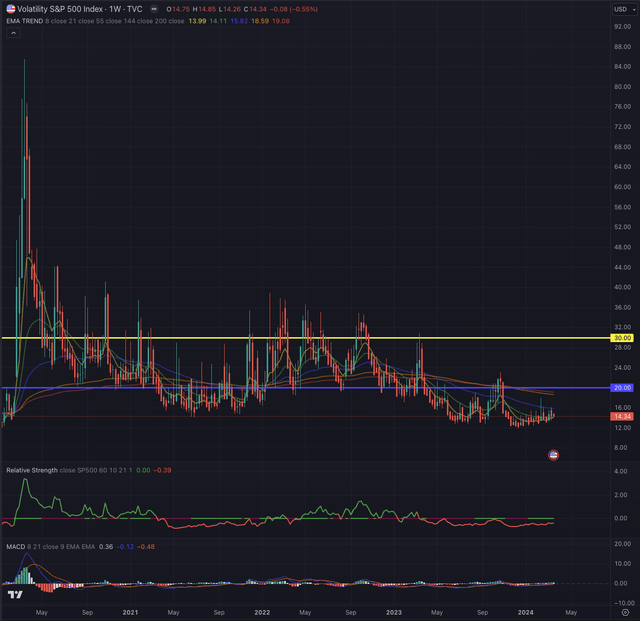

The CBOE Volatility Index (VIX) tends to be reasonable throughout bull markets and better in bear markets. Spikes within the VIX are sometimes noticed throughout excessive uncertainty or surprising vital occasions, usually considered as adverse catalysts for the inventory market. Though this benchmark alone isn’t an indicator for future developments, and VIX may float round these low ranges for an prolonged time, the index is standing at comparable ranges as earlier than vital occasions have been noticed, triggering excessive volatility within the fairness market. Statistically, prior to now 34 years, the index has spent considerably extra time above the present ranges than beneath, suggesting the next likelihood of elevated volatility forward.

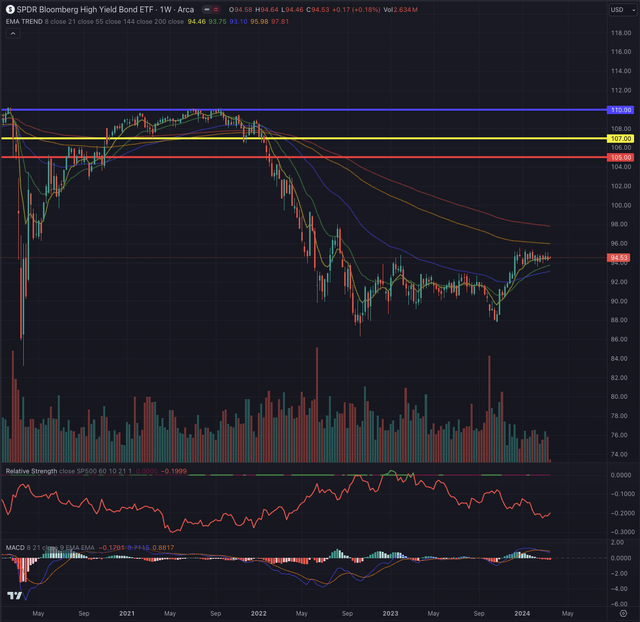

The SPDR Bloomberg Barclays Excessive Yield Bond ETF (JNK), which screens extremely liquid, high-yield, US dollar-denominated company bonds, is consolidating across the yearly excessive whereas nonetheless standing at considerably decrease ranges as noticed earlier than and instantly after the pandemic crash. This displays buyers’ comparatively cautious threat urge for food in a high-interest-rate setting, the place low-risk bonds and different belongings provide enticing returns whereas lowering fee expectations push cash managers to reshuffle their portfolios accordingly. Whereas it’s nonetheless early to substantiate any speculation, JNK lacks the momentum to beat the overhead resistance and will retrace towards the low-90s studying.

The place are we now?

In my analysis on January 17, 2024, I recommended the next likelihood of seeing SPY advancing, estimating $490.50 as the primary goal and sequentially $500 because the second goal.

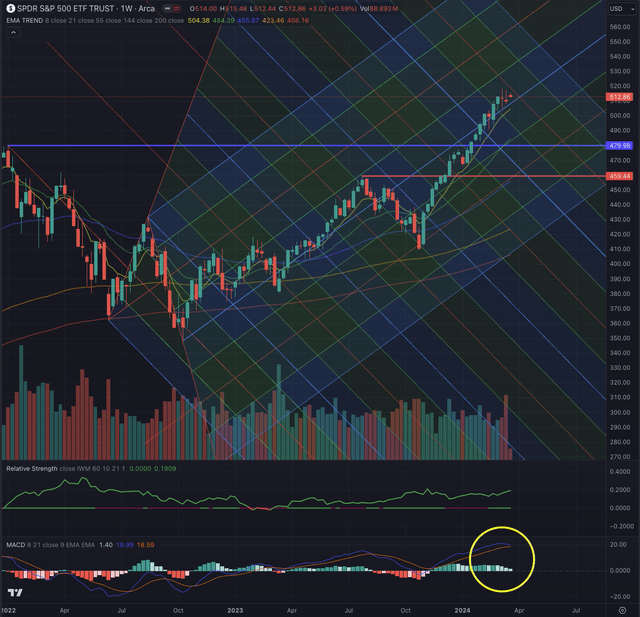

I consider the chance of the buildup of doubtless extra constructive momentum, outlined by the MACD and the relative power towards the IWM. Each indicators recommend an early upward swing, whereas quantity has additionally been lowering, which is one other trace to a attainable vital transfer incoming.

Alternatively, I additionally underscored the upper threat represented by the SP500 forming a brand new all-time excessive [ATH], and consequently, I anticipated a probable breakout to occur in a second try whereas seeing SPY consolidating additional.

SPY broke out the week after my article was printed, reaching my recommended targets with vital momentum. This led me to reevaluate the state of affairs and replace my contingency plan.

On the weekly chart, SPY demonstrates a sturdy breakout from its earlier all-time excessive [ATH], nearing the formation of a cup-and-handle sample, albeit barely dislocated. This benchmark has exhibited notably extra strong efficiency than the broader US fairness market, as represented by the iShares Russell 2000 ETF (IWM). The numerous upward motion suggests the potential formation of a brand new impulse wave, indicating buyers might encounter wave 4 shortly. The MACD is at present at record-high prolonged ranges, signaling a attainable reversal.

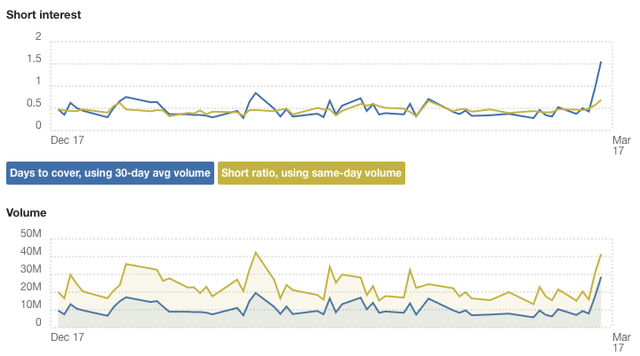

Brief curiosity on the SPY has reported a big spike, with an enormous surge in days to cowl, main the indicator to its highest ranges prior to now three months.

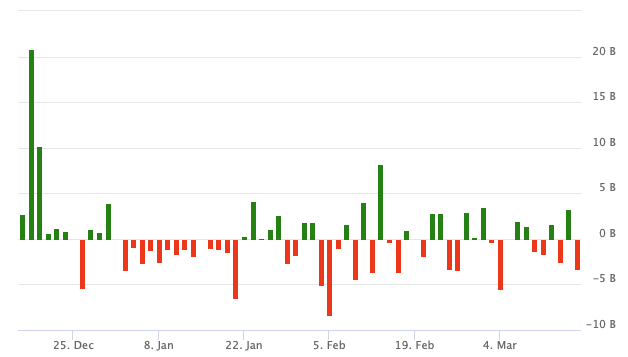

The SPY fund flows present a internet influx of $3.44B prior to now three months, down from the beforehand reported quantity of $43.92B two months earlier, signaling a attainable peak in funds flows, consistent with the noticed worth motion.

VettaFi

What’s coming subsequent?

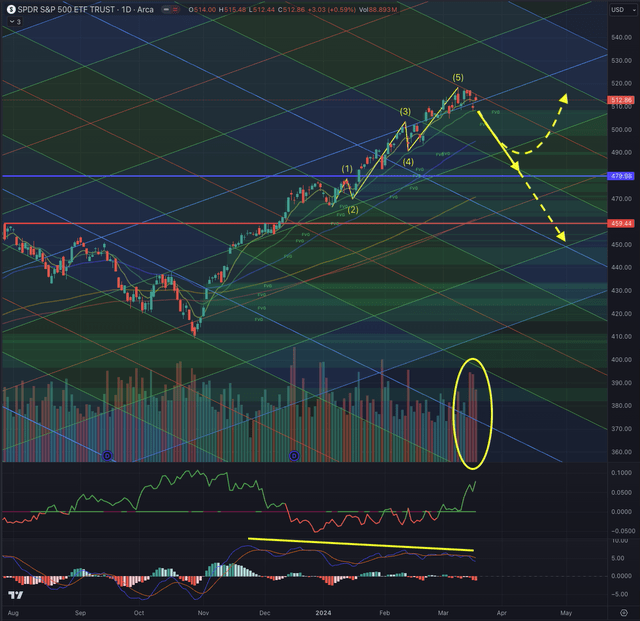

Trying on the every day chart, the robust uptrend is trailed by the short-term EMA8 and EMA21, whereas the index is performing considerably higher than the broader US fairness market, as noticed in its relative power. The motion occurred with solely minor retracements, underscoring the highly effective momentum.

Nevertheless, SPY is displaying indicators of forming a prime, as noticed within the current worth motion, which hints at distribution days. When in comparison with its transferring averages, the extension of its precise worth underscores the upper chance of this assumption.

Within the first market session of this week, SPY opened with a gap-up, primarily pushed by development and AI-centered shares, with notable contributions from “The Magnificent Seven,” notably NVDA, GOOG, and AAPL, because the latter is reportedly in talks with Google over a Gemini AI system licensing, that may construct on their search settlement, which has made Google the default search engine in Apple’s Safari browser since 2002. SPY has shaped an upward five-wave impulse sequence ranging from the consolidation noticed throughout January and lengthening till Friday, March 8, with waves 3 and 5 displaying extensions.

It is noteworthy that the MACD signifies a adverse divergence, whereas SPY has left gaps open between $512.44 and $511.70 and between $503.02 and $497.37. These gaps partially converge with vital every day and weekly Truthful Worth Gaps [FVG]. Contemplating this, it’s anticipated that SPY will stability out because it fills the gaps and aligns with the divergence recommended by the MACD indicator.

Within the occasion of a correction, SPY may take a look at help ranges round $503, $490, and even down in direction of its breakout stage at $480. SPY may goal $434 within the quick time period in a extra pessimistic state of affairs. This latter final result might be triggered by an adversarial occasion inflicting a big surge in volatility, as recommended earlier on this article. Moreover, a substantial recession or surprising adverse catalyst may have an much more detrimental influence on SPY, given its present excessive ranges.

After fastidiously contemplating the prolonged worth ranges and the underlying circumstances, I’m downgrading SPY to a promote place. For risk-averse buyers, ready for the FOMC assembly this week and the following convention anticipated on Wednesday, March 20, could also be prudent. These occasions are anticipated to offer additional insights and indicators to the markets relating to the ways the Fed could also be contemplating within the coming months.

At this stage, I’d not enter any new lengthy positions, because the risk-reward ratio doesn’t seem favorable regardless of the opportunity of persevering with the parabolic ascent, which can’t be utterly dominated out. Within the eventuality of SPY forming a brand new impulse sequence as noticed on the weekly chart, buyers must face wave 4 first, which I’d estimate retracing till the mentioned worth ranges, favoring the $480 state of affairs, earlier than forming wave 5, which could lead on SPY to succeed in ranges round $561-$567. It is essential to be cautious and conscious of the potential dangers, as such an assumption carries its threat of failure.

The underside line

Technical evaluation is a worthwhile instrument for buyers, augmenting their possibilities of success by guiding the intricacies of listed securities. Like consulting a map or utilizing GPS for an unfamiliar journey, using technical evaluation in funding choices presents a strategic information. I combine methods grounded within the Elliott Wave Concept and make the most of Fibonacci’s ideas to guage possible outcomes primarily based on possibilities. This strategy assists in validating or difficult potential entry factors, contemplating components resembling sector, trade, and worth motion. My technical evaluation endeavors to completely assess an asset’s state of affairs and calculate possible outcomes knowledgeable by these theories.

The current state of affairs does share some similarities with the circumstances noticed in 2000 and 2007. On the one hand, the euphoric run in US equities associated to AI bears a resemblance to the surge in internet-related shares throughout the dot-com bubble. Alternatively, the bloated debt ranges, fragile shopper monetary well being, and uncertainties surrounding the worldwide economic system echo facets of the monetary disaster.

Furthermore, macroeconomic indicators previous the recessions in 2000 and 2007 exhibit some parallels with the present financial panorama, hinting at a possible comparable sample. Nevertheless, this does not essentially suggest that panic promoting is the suitable response at these worth ranges. As an alternative, warning is warranted as warning indicators are current.

Whereas previous efficiency does not assure future outcomes, disregarding classes from the previous can incur vital prices. Usually, when one thing breaks, it happens at extremes, and the present state of affairs is undoubtedly stretched in lots of facets. Due to this fact, it is prudent to train warning and punctiliously handle dangers within the present market setting.

Based mostly on the issues mentioned and the evaluation of the present market circumstances, I’m downgrading SPY to a promote place.

[ad_2]