[ad_1]

As a contemporary quarter commences, there’s a slight slowdown in inventory momentum in comparison with premarket exercise. After marking its twenty second document excessive, the S&P 500 wrapped up the primary quarter, hinting {that a} pause may be within the playing cards.

Traders are parsing by remarks from Fed Chair Jerome Powell, who not too long ago said that he didn’t discover any surprises within the central financial institution’s most popular inflation measure and didn’t see an urgency to decrease charges. Extra insights from Powell are anticipated later this week, alongside essential information like job figures.

Are main buyers overlooking a probably profitable asset class presently? That’s the implication of our name of the day, sourced from a Sunday weblog publish by the Mosaic Asset Firm, which underscores a “bullish case for commodities.”

Curiously, gold costs soared to new heights on Monday.

The context is that “charge cuts are anticipated whereas the financial system steers away from recession.” Whereas this scenario bodes well for stocks, numerous commodities have additionally garnered constructive consideration, in accordance with Mosaic.

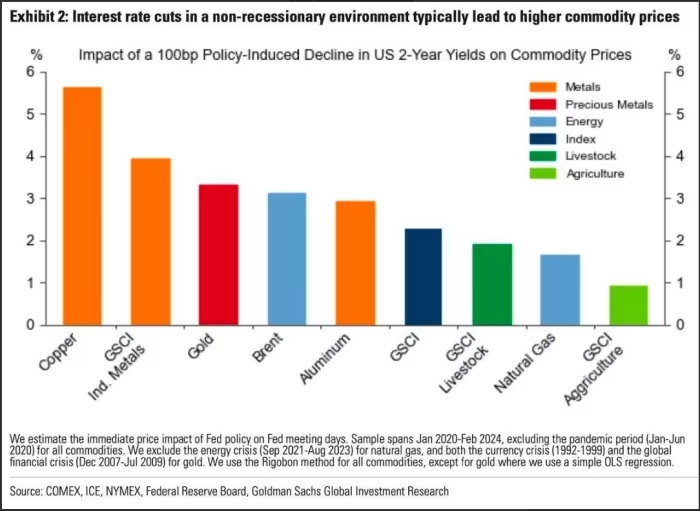

Their illustrated information reveals how completely different commodities have fared in non-recessionary durations when the 2-year yield is on a downward trajectory, with notable positive aspects for copper, industrial metals, oil, and gold:

Furthermore, Mosaic means that the commodity commerce is additional supported by the tepid curiosity proven by skilled buyers. “Commodities have considerably trailed behind, with the general decline in costs mirrored within the S&P GSCI commodity index since mid-2022, leaving fund managers with little incentive to pursue efficiency.”

Referring to Financial institution of America’s latest survey of fund managers, Mosaic factors out that institutional portfolios are presently the least uncovered to commodities relative to bonds for the reason that monetary disaster of 2008. They point out that such herd conduct can swiftly reverse if commodities start to rebound.

“Institutional buyers, whereas evaluating their portfolio allocation, would possibly change into a driving drive behind commodity demand if momentum positive aspects traction. That is notably true contemplating that commodities are presently at traditionally discounted ranges in comparison with equities,” states Mosaic.

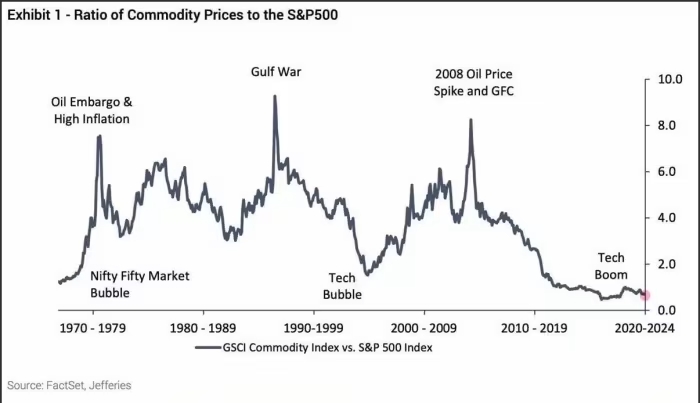

They highlight that the commodities-to-stock price ratio is nearing historic lows, a state of affairs that has beforehand triggered a “vital mean-reversion in favor of commodities.” Their subsequent graph illustrates this ratio relationship again to 1970 — a rising development indicating commodities outperforming shares, and a declining development signaling the other:

“Though the present ratio has lingered at low ranges for a lot of the previous decade, the surroundings is popping favorable for commodities to excel from these depressed ranges,” they comment. Taking all these components under consideration, there seems to be an attractive danger/reward prospect.

[ad_2]