[ad_1]

pixelfit

Funding Thesis

Producing additional earnings that you should utilize to cowl your month-to-month bills or to reinvest (to learn from the compounding impact) is among the principal benefits of following a dividend earnings funding method.

The most recent acquisition for The Dividend Revenue Accelerator Portfolio is the Cohen & Steers High quality Revenue Realty Fund (NYSE:NYSE:RQI). I’m satisfied that this fund will show to be an necessary addition for our portfolio because it helps us to not solely improve its diversification (the proportion of the Actual Property Sector has elevated from 5.71% to 12.25% of the general portfolio), but additionally to considerably improve its Weighted Common Dividend Yield.

The Cohen & Steers High quality Revenue Realty Fund presently pays a Dividend Yield [TTM] of 8.16%. On account of its incorporation into The Dividend Revenue Accelerator Portfolio, the Weighted Common Dividend Yield [TTM] of the portfolio has been raised from 4.30% to 4.73% (with out together with the Schwab Quick-Time period U.S. Treasury ETF on this calculation). After this addition, the 5 Yr Weighted Common Dividend Progress Price [CAGR] stands at 7.56%.

These numbers spotlight the portfolio’s robust means to mix dividend earnings with dividend development, attaining a major goal of our funding technique.

On this article, I’ll exhibit in better element why I imagine that the Cohen & Steers High quality Revenue Realty Fund has been an necessary incorporation into our portfolio. I may also dive deeper into the fund’s largest holdings.

Earlier than delving into the specifics of the Cohen & Steers High quality Revenue Realty Fund, let’s first revisit the important thing options of our dividend portfolio for individuals who aren’t but aware of it.

The Dividend Revenue Accelerator Portfolio

The Dividend Income Accelerator Portfolio’s goal is the era of earnings through dividend funds, and to yearly elevate this sum. Along with that, its objective is to achieve an interesting Complete Return when investing with a diminished threat degree over the long run.

The Dividend Revenue Accelerator Portfolio’s diminished threat degree might be reached because of the portfolio’s broad diversification over sectors and industries and the inclusion of corporations with a low Beta Issue.

Under yow will discover the traits of The Dividend Revenue Accelerator Portfolio:

- Engaging Weighted Common Dividend Yield [TTM]

- Engaging Weighted Common Dividend Progress Price [CAGR] 5 Yr

- Comparatively low Volatility

- Comparatively low Danger-Degree

- Engaging anticipated reward within the type of the anticipated compound annual fee of return

- Diversification over asset lessons

- Diversification over sectors

- Diversification over industries

- Diversification over nations

- Purchase-and-Maintain suitability

Cohen & Steers High quality Revenue Realty Fund

The graphic beneath illustrates the High 10 Holdings of the Cohen & Steers High quality Revenue Realty Fund:

Within the following, I’ll briefly current the 5 largest holdings of this fund:

American Tower

American Tower (NYSE:AMT) is among the many world’s largest REITs. The corporate operates throughout the Telecom Tower REITs Business.

With a share of 10.15%, American Tower is by far the most important place of the Cohen & Steers High quality Revenue Realty Fund. Right now, American Tower pays shareholders a Dividend Yield [FWD] of three.33% whereas the corporate has proven a powerful 5 Yr Dividend Progress Price [CAGR] of 15.41%.

Prologis

Prologis (NYSE:PLD) was based in 1983 in San Francisco and is among the many world leaders in logistics real estate. The corporate presently accounts for six.79% of the Cohen & Steers High quality Revenue Realty Fund. It pays a Dividend Yield [FWD] of two.98%.

Welltower

Welltower (NYSE:WELL) is an organization from the Well being Care REITs Business that was based again in 1970. Right now, the corporate has 533 staff.

Welltower is the third largest place of the Cohen & Steers High quality Revenue Realty Fund, accounting for five.95%.

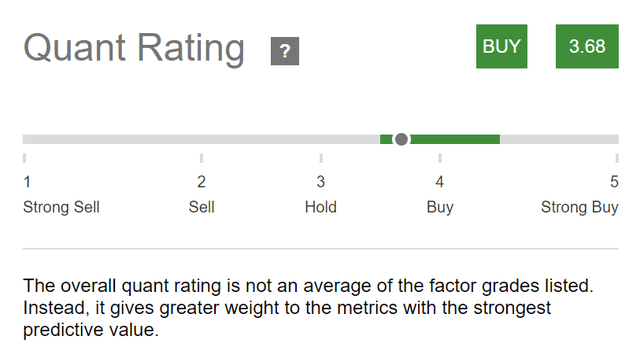

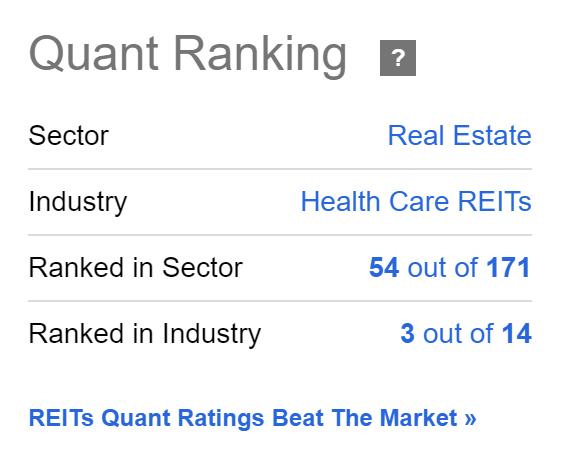

In accordance with the Looking for Alpha Quant Rating, Welltower is at the moment ranked in third place throughout the Well being Care REITs Business and 54th within the Actual Property Sector. These positions underscore the corporate’s robust aggressive place.

Supply: Looking for Alpha

Simon Property Group

Simon Property Group (NYSE:SPG) was based in 1960 and is predicated in Indianapolis. On the firm’s present share worth, it pays a Dividend Yield [FWD] of 5.02%. The corporate presently reveals a P/AFFO [FWD] Ratio of 14.20, which is barely beneath the Sector Median of 14.60.

Simon Property Group at the moment accounts for 4.93% of the Cohen & Steers High quality Revenue Realty Fund, representing the fourth largest place.

Invitation Properties

Invitation Properties (NYSE:INVH) is an organization from the Single-Household Residential REITs Business positioned in Dallas. The agency presently employs 1,555 employees. The corporate pays a Dividend Yield [FWD] of three.21% whereas its Payout Ratio of 59.89% signifies that there’s room for dividend enhancements within the years to come back.

With a share of 4.65%, Invitation Properties represents the fifth largest place of the Cohen & Steers High quality Revenue Realty Fund.

In accordance with the Looking for Alpha Quant Score, the corporate is presently a purchase, additional underlying the attractiveness of the Cohen & Steers High quality Revenue Realty Fund.

Why The Cohen & Steers High quality Revenue Realty Fund Aligns With the Funding Strategy of The Dividend Revenue Accelerator Portfolio and Why You Ought to Additionally Contemplate Together with This Fund in Your Dividend Portfolio

The Cohen & Steers High quality Revenue Realty Fund presently pays a Dividend Yield [TTM] of 8.16%, which strongly aligns with the funding method of The Dividend Revenue Accelerator Portfolio to generate earnings. The fund’s inclusion contributes to growing the Weighted Common Dividend Yield [TTM] of our dividend portfolio.

It’s additional value highlighting that this fund invests in 203 totally different holdings, which is a transparent indicator of its broad diversification and diminished threat degree. As soon as once more this aligns with the funding method of our dividend portfolio.

Furthermore, solely three of the fund’s 203 holdings (American Tower, Prologis, and Welltower) account for greater than 5%, additional highlighting its elevated diversification and diminished threat degree.

The diminished threat degree of this fund is additional highlighted by the credit score rankings of the three largest positions: whereas American Tower reveals a Baa3 credit standing from Moody’s, Prologis and Welltower showcase a Baa1 ranking from the identical company.

Investor Advantages of The Dividend Revenue Accelerator Portfolio After Investing $400 within the Cohen & Steers High quality Revenue Realty Fund

After the incorporation of the Cohen & Steers High quality Revenue Realty Fund into The Dividend Revenue Accelerator Portfolio, the Weighted Common Dividend Yield [TTM] has been elevated from 4.30% to 4.73%. This quantity signifies that the portfolio is now even higher positioned for dividend earnings buyers aiming to generate a major quantity of earnings through dividend funds.

After the inclusion of the fund, the portfolio’s 5 Yr Weighted Common Dividend Progress Price [CAGR] stands at 7.56%.

Since this newest addition, the share of the Financials Sector in comparison with the general portfolio has decreased from 29.57% to 27.49%. This means an elevated diversification and a diminished general threat degree for our portfolio.

On the similar time, the proportion of the Actual Property Sector has elevated from 5.71% to 12.25% in relation to the general funding portfolio.

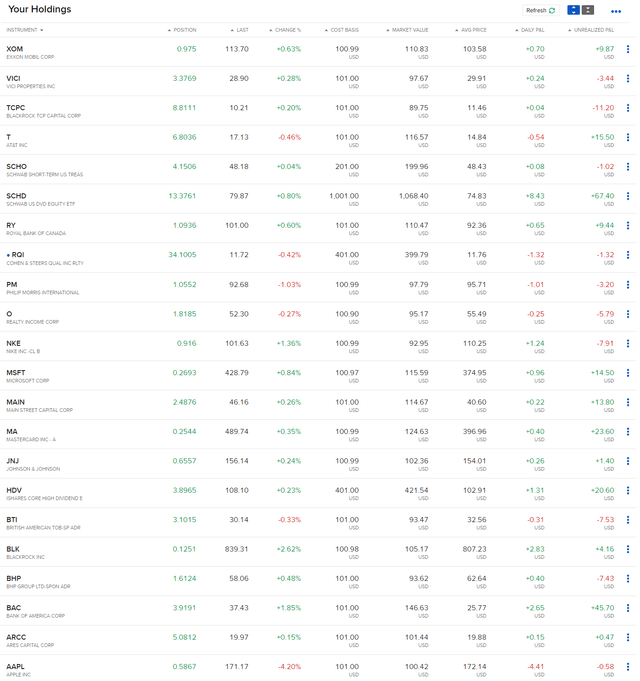

The graphic beneath showcases the positions which might be a part of this dividend portfolio.

Danger Components

Earlier than investing within the Cohen & Steers High quality Revenue Realty Fund, it’s essential to evaluate the a number of components that underscore the fund’s heightened threat profile.

The fund has a 24M Beta Issue of 1.36, which signifies an elevated volatility when in comparison with the general market.

It’s additional value noting that the High 10 holdings of this fund account for 50.77% of the general portfolio, indicating an elevated focus threat regardless of the fund comprising 203 holdings in complete.

It is very important point out the elevated Expense Ratio of two.21%, which you need to consider earlier than making the choice to take a position on this fund.

Along with that, it ought to be talked about that the Cohen & Steers High quality Revenue Realty Fund makes use of leverage as a part of its funding technique, a apply that may improve the volatility of the fund and due to this fact serves as an extra threat issue for buyers.

Conclusion

By the incorporation of the Cohen & Steers High quality Revenue Realty Fund into The Dividend Revenue Accelerator Portfolio, we have now considerably elevated the Weighted Common Dividend Yield [TTM] of our portfolio.

As a result of fund’s elevated Dividend Yield [TTM] of 8.16%, we have now managed to extend the Weighted Common Dividend Yield [TTM] of the portfolio from 4.30% to 4.73%.

It’s additional value highlighting that we have now elevated the portfolio’s diversification, decreasing the proportion of the Financials Sector from 29.57% to 27.49%. On the similar time, the proportion of the Actual Property Sector has been considerably raised from 5.71% to 12.25%.

As a result of fund’s incorporation, I’m satisfied that the portfolio is now even higher positioned for the era of earnings via dividends, which is certainly one of its principal aims. Subsequently, I’m satisfied that this fund has been a strategically necessary addition.

The portfolio is now much more appropriate for buyers aiming to search for methods to generate additional earnings through dividend funds whereas implementing an funding method with a diminished threat degree, which presents a excessive chance for constructive funding outcomes.

In case you determine to incorporate the Cohen & Steers High quality Revenue Realty Fund into your individual dividend portfolio, I counsel offering the fund with lower than 10% of the general portfolio.

Whereas the fund might function a strategically necessary element to your portfolio resulting from its elevated potential for earnings era through dividend funds, it additionally entails a better threat degree, as detailed within the threat part of this evaluation.

Creator’s Observe: Thanks for studying! I’d recognize listening to your opinion on my choice of the Cohen & Steers High quality Revenue Realty Fund as the most recent acquisition for The Dividend Revenue Accelerator Portfolio. Be happy to share any ideas concerning the present composition of the portfolio. I’d love to listen to any options of corporations that will match its funding method!

[ad_2]