[ad_1]

Khanchit Khirisutchalual

Introduction

Liberty All-Star Fairness Fund (NYSE:USA) is a closed-end fund incepted on Oct. 31, 1986. The fund primarily invests in frequent fairness of large-cap shares within the U.S. market, with an goal of incomes complete returns and present revenue within the type of capital features and dividends. Almost 90% of its property are invested within the U.S. and North America, and the remainder from the developed markets, together with Europe, the U.Okay., Japan, and Australia. Its portfolio consists of development in addition to worth shares, and with one single funding, it supplies publicity to a diversified pool of core shares from varied industries that make up the U.S. economic system. The fund supplies a beneficiant however fastened distribution coverage primarily based on the NAV in every quarter.

As per the fund’s literature,

It’s a multi-managed fund that allocates its portfolio property on an roughly equal foundation amongst a number of unbiased funding administration organizations (presently 5 in quantity) having totally different funding kinds really useful and monitored by ALPS Advisors, Inc., the Fund’s funding advisor. The Fund’s property are roughly equally distributed amongst three worth managers (Aristotle Capital Administration, Fiduciary Administration, and Pzena Funding Administration) and two development managers (Sustainable Progress Advisers and TCW Funding Administration Firm).

Different salient options of this fund are as follows:

- The fund employs close to zero leverage, and as such, beneath regular circumstances, the fund has no curiosity bills incurred.

- The fund has been in existence for a very long time, since 1986. The fund invests in a diversified portfolio of fairness securities. As per the mandate, it invests not less than 80% of its property in fairness securities, and the remainder may very well be in short-term cash market devices. Nonetheless, the fund is over 95% invested in fairness shares.

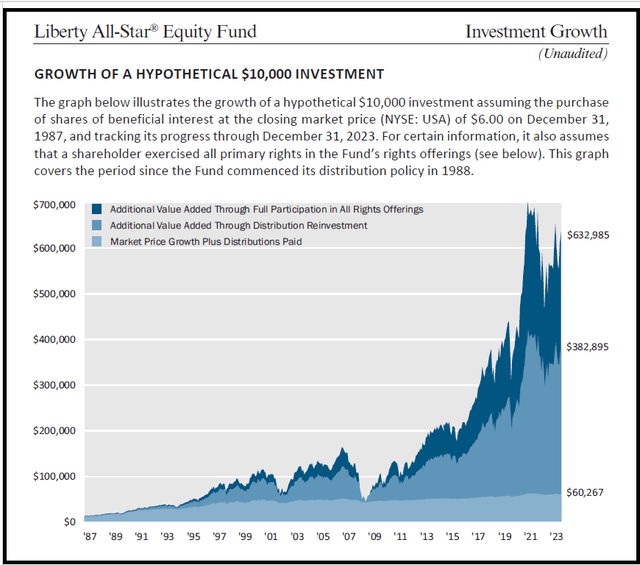

- As of Dec.31, 2023, since Jan.1, 1988, the fund has returned 10.66% (annualized) on an NAV foundation, in comparison with 10.79% for the S&P 500. These outcomes assume that each one distributions had been reinvested. So, we are able to see that it carefully mirrors the efficiency of the S&P 500 over an extended time frame. The fund was incepted on the finish of 1986 however it began a dividend coverage beginning Jan. 1988.

- The fund pays a quarterly distribution. It additionally follows a ‘managed’ distribution coverage, which might imply that the fund might not all the time earn sufficient in funding revenue and capital features and pay among the distribution as ROC (return of capital). As a coverage, it pays out the equal of two.5% of NAV every quarter. It will imply that the fund pays much less when the market is doing poorly however pays extra in distribution when the market is doing higher.

- The funds’ mandate permits it to take a position globally, however the majority of its property are invested (almost 90%) within the U.S. markets.

- It’s a moderately diversified fund and has a complete of 146 holdings (as of Dec.31, 2023), and it’s much less concentrated within the high 10 holdings, as they accounted for under 22%. As compared, the S&P 500 has almost 29% of its property in simply the highest 7 expertise funds.

- As of Dec. 31, 2023, the fund beneath its administration had roughly $1.87 billion in internet property.

- The fund is an actively managed fund, and as per the fund’s literature, it has an expense ratio (together with the administration payment) of 0.93% on the web property. The fund’s internet property and complete property are almost the identical, because it doesn’t use leverage. Based on our calculations, its bills got here out to be 0.84% on the idea of year-end internet property.

- As of Mar. 21, 2024, its distribution yield available on the market value was 9.65% and 9.45% on the NAV.

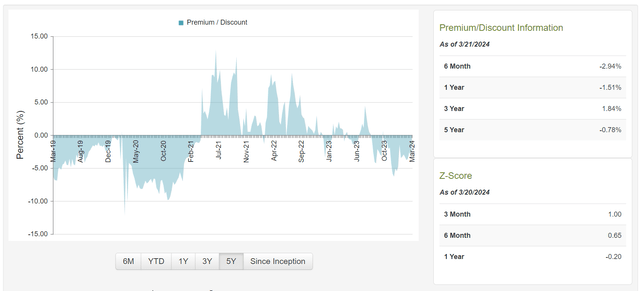

- As of Mar. 21, 2024, USA’s market value provided a reduction of -1.95% to its NAV, which is best than the 3-year common premium of +1.84%, however barely worse off of the 6-month common low cost of -2.93%.

Monetary Outlook

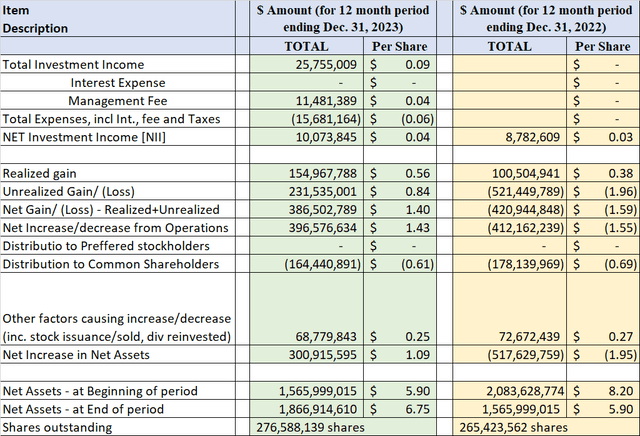

Let us take a look at the Fund’s Monetary well being and efficiency. The fund has already launched its 2023 annual report protecting the previous 12 months for the interval of Jan. 2023 – Dec. 31. 2023. We’ll analyze the monetary knowledge intimately in Desk-1, which is introduced under.

Internet Funding Revenue:

The web funding revenue (or NII briefly) is the web revenue {that a} fund earns from its funding within the type of dividends, distributions, and pursuits or derivatives like choices, minus all the fund’s bills, together with administration charges, working bills, commissions, and curiosity on leverage, if any. For equity-based funds, particularly in high-growth sectors like expertise, the NII shouldn’t be very related. Nonetheless, for fixed-income or bond funds, it’s extremely related. Within the case of USA fund, it’s purely an fairness fund. It makes use of no leverage, and lots of of its fairness holdings pay no dividends or little or no. For instance, in 2023, it generated solely $0.09 a share of funding revenue (earlier than bills), whereas the distributions had been $0.61 a share. So, for essentially the most half, the fund has to rely on short-term and long-term capital features.

Here’s what it appears like by way of NII, Distributions, and Internet Belongings initially and finish of the assertion interval.

(all quantities are in US $ (besides Shares Excellent); adverse quantities are proven inside parentheses, per the annual report, 12-months ending Dec. 31, 2023).

Desk-1:

Knowledge supply: USA’s 2023 12-Month Annual-report

Distributions

The fund follows a ‘managed’ distribution coverage. ‘USA’ presently supplies a quarterly distribution of $0.17 per share, which comes out to be a yield of 9.71% at present costs and 9.52% on the NAV as of 03/20/2024. Nonetheless, the distribution quantity can change often from quarter to quarter primarily based on the NAV value. The fund has a coverage to distribute 2.5% of the quarter NAV, thus distributing roughly 10% of the NAV on an annual foundation. So, meaning, in a down market, it’ll distribute much less, whereas in a bull market, when NAV ought to have appreciated, it’ll distribute extra. That type of is smart and may profit the long-term traders. That stated, 10% seems to be fairly aggressive and doesn’t go away a lot for the expansion of the unique capital. So, it’s as much as the investor to reinvest among the distribution again into the fund to have some capital development.

So, is the distribution lined?

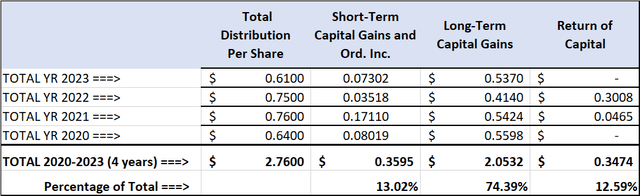

Desk-2: Distribution (from 2020-2023)

Creator (Knowledge supply: Fund’s web site)

Please observe that the above desk takes the distributions primarily based on the tax 12 months, and the dividend declared in November annually shall be counted within the subsequent 12 months (for tax functions, as it’s payable in January). So, the quantity might not match the distribution expense proven within the annual report precisely.

The fund doesn’t generate a considerable quantity of funding revenue. For instance, in 2023, it generated solely about $0.09 per share, whereas $0.05 was spent on bills, leaving solely 4 cents a share. Because the fund doesn’t use any leverage, it doesn’t have any curiosity bills. With little or no funding revenue, it has to depend on capital features. Throughout a down market, it might should pay among the distribution within the type of ROC (Return of Capital), as we are able to see that the fund paid roughly 12% as ROC over a interval of 4 years, however largely within the 12 months 2022.

So long as we do not need a chronic bear market, the fund ought to do high quality, and there must be no damaging ROC. The fund has to rely on good years to generate sufficient capital features to maintain the present degree of distributions. So long as the down cycles will not be extended multi-years, this fund ought to do exactly high quality.

Low cost/Premium

The fund is presently buying and selling at a really small low cost of -2% (to its NAV), which is roughly in the identical vary as its one-year common.

Under is the historical past of premium/low cost for the final 5 years. The fund often goes from premium to low cost and vice-versa. But it surely has largely stayed in a variety between +5% premium to -5% low cost. At present, there’s a low cost however not a lot, and it might change from everyday. Nonetheless, low cost/premium shouldn’t be the one issue that we must always take a look at. We also needs to take a look at the fund’s general valuation.

Chart-1: USA- Premium/Low cost Chart (five-year interval)

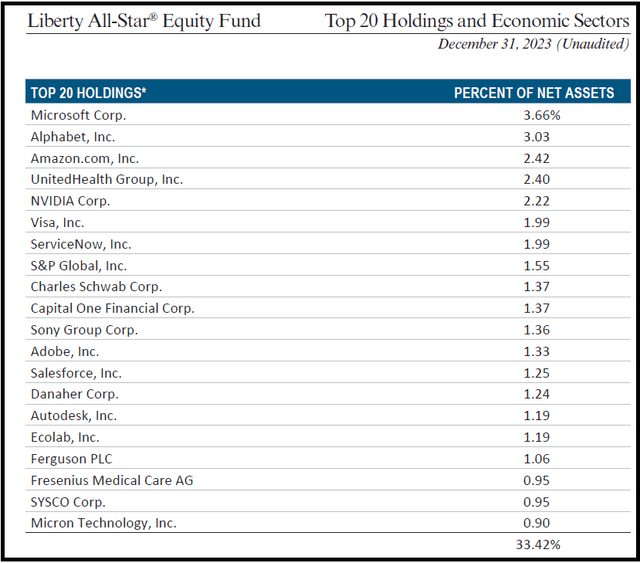

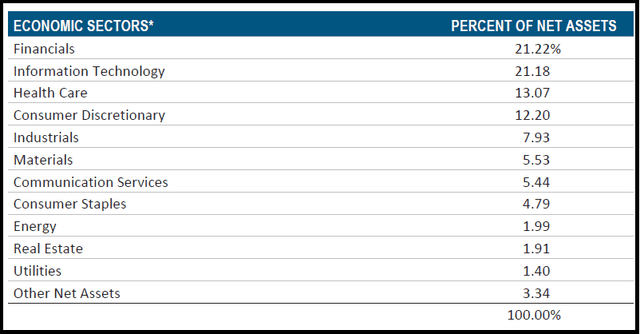

Fund Holdings

The fund is pretty various by way of the variety of holdings, which stood at 146 as of Dec. 31, 2023. Additionally, it isn’t too concentrated within the high 10 holdings as they accounted for under 22%. The highest 20 holdings accounted for 33.5% of the fund’s property. The highest 20 holdings as of Dec. 31, 2023, and sector allocations are introduced under. A number of the high holdings are Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN), UnitedHealth (UNH), NVIDIA (NVDA), Visa (V), ServiceNow (NOW), S&P International (SPGI), Charles Schwab (SCHW), and Capital One (COF). We will see that among the high holdings are much like the S&P 500, however they range by way of allocation/focus. The S&P 500 has a lot greater publicity to the ‘magnificent seven’ shares, roughly at 29%, whereas ‘USA’ is barely at about 11%.

Desk-3: (High 20 Holdings as of Dec. 31, 2023)

Desk-3B: Sector diversification

Efficiency and Valuation

First, we are going to current three charts from the fund’s paperwork that present a good concept of the efficiency, each brief and long-term. The fund is sort of outdated (almost 37 years) and has seen each good and dangerous durations. The fund tries to supply the seemingly capital appreciation within the type of distributions, with its coverage to distribute 2.5% of the NAV every quarter (almost 10% on an annual foundation). That is additionally the long-term complete returns from the broader market over a really lengthy interval.

Chart-2:

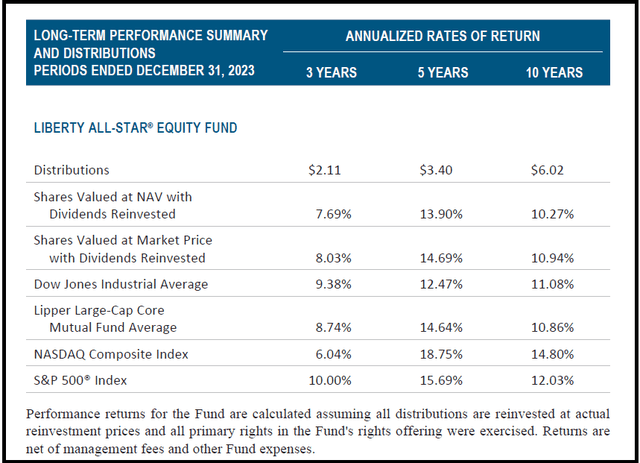

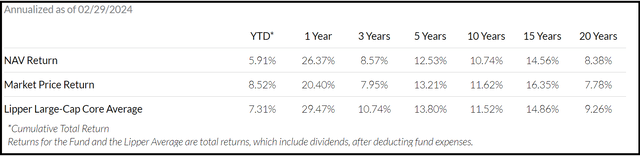

Within the chart above, for those who assume that you just by no means invested within the rights choices however reinvested all distributions, the CAGR (Cumulative Annual Progress Charge) involves 10.66% (in comparison with 10.79% from the S&P 500). That is fairly good contemplating that the fund additionally paid roughly a 0.90% payment for the energetic administration. Nonetheless, the short-term efficiency would range primarily based on which interval you’re looking at. Additionally, the correct benchmark for the fund is Lipper Massive-cap Core and never the S&P 500. The short- and mid-term comparability is supplied within the desk under.

Chart-2B:

Chart-2C:

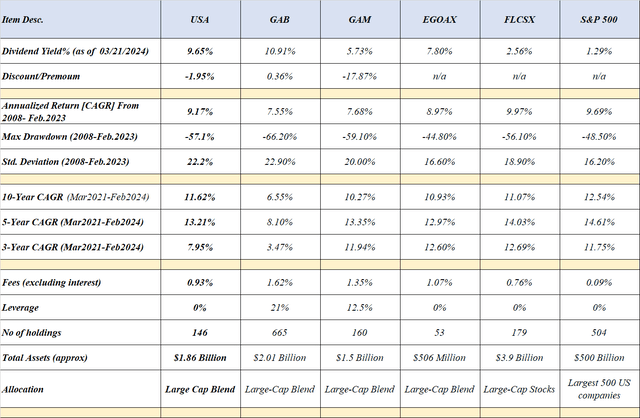

We’re going to evaluate a number of of the same funds on efficiency metrics. These funds are:

- (GAM) – Normal American Buyers

- (EGOAX) Allspring Massive Cap Core (mutual fund)

- (FLCSX) Constancy Massive Cap Inventory (mutual fund)

- (SPY) – S&P 500 ETF

Desk 4: Comparability of 6 funds

Notice: A number of the knowledge (e.g., variety of holdings and leverage) might not be present. Return calculations had been performed utilizing Portfolio Visualizer.

What in regards to the future efficiency? Within the final two to 3 years, we now have had excessive inflation and a excessive rate of interest regime. Nonetheless, attributable to price reduce expectations, the inventory market, on the whole, has been touching new highs. Since Jan. 2023, the S&P 500, in addition to ‘USA’ have gained almost 30%. Additionally, we now have a small low cost of almost -2%, however not a lot to talk of.

Threat Elements

Buyers want to pay attention to sure threat components which are related to this fund and CEFs on the whole. Threat components may very well be summarized as follows:

- USA fund is classed as “Massive-Cap Core.” It usually mirrors the efficiency of large-cap core shares minus the fund’s bills. So, on the whole, the efficiency of the fund is tied to the U.S. economic system and its markets.

- USA fund doesn’t make use of any leverage, so it isn’t straight impacted by the motion of rates of interest within the U.S. Nonetheless, the businesses through which it’s invested are impacted by the identical. So, the long run efficiency could be impacted by the path and motion of rates of interest. The rates of interest appear to have peaked this cycle and are more likely to come down from right here. Nonetheless, there isn’t any certainty as to when and at what tempo they’d come down.

- The fund is topic to normal inventory market threat. Because of this if the broader inventory market had been to say no, that will adversely affect the efficiency of this fund as properly.

- The overall dangers such because the geo-political state of affairs.

- We can’t rule out the potential of a recession within the U.S. in 2024. If a recession had been to happen and develop into deeper than anticipated, nearly all of its holdings would undergo and decline in worth.

Concluding Ideas

In case you are younger and retirement is many a long time away, there isn’t any want for revenue. There’s not a lot goal in investing in a closed-end fund that’s, at greatest, going to match or replicate the efficiency of the S&P 500. Nonetheless, in case you are an revenue investor, nearing retirement, or already a retiree, ‘USA’ generally is a very fascinating and dependable fund. In a single single funding, you get publicity to the whole U.S. large-cap shares, together with each development and worth shares. For a payment of 0.90%, the fund managers do the choice, portfolio administration, periodic balancing, determine when to seize capital features and pay common distributions set on a hard and fast norm (fastened % of NAV). The fund’s coverage of distributing much less when the markets are down and extra when the markets are booming works properly in the long term. Nonetheless, we really feel the fund distributes an excessive amount of (as 10% of NAV yearly), and thus, there’s little scope left for capital appreciation. Nonetheless, as a person investor, you could possibly reinvest (not less than 1 / 4) of the distribution again within the fund to allow it to compound.

The brand new patrons ought to purchase in a number of phases utilizing the dollar-cost-average. In the event that they make investments a hard and fast quantity each time, they purchase extra shares when the worth is down however fewer shares when the worth is excessive. The prevailing house owners ought to maintain the shares for the long run and reinvest not less than a part of the distribution quantity.

[ad_2]