[ad_1]

ryasick

The inflation outlook appears to be like more and more unsure, and regardless of the Fed signaling its intent to chop charges this yr, the truth is nobody actually is aware of for certain what occurs subsequent. For those who’re an investor searching for secure revenue and low portfolio length to take away the danger that charges do not fall and even rise additional, you may need to think about the Invesco Variable Price Funding Grade ETF (NASDAQ:VRIG). VRIG is an actively managed ETF that primarily invests in high-grade variable charge devices. The fund’s goal is to generate present revenue whereas sustaining a low portfolio length. A secondary goal is capital appreciation.

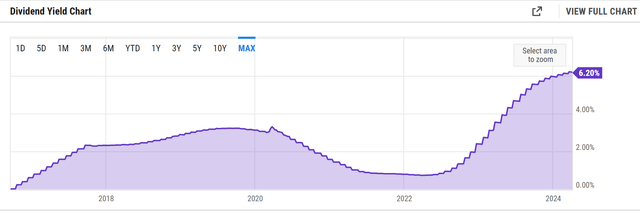

The enchantment of the fund is the variable charge dynamic, which explains why the yield has risen so considerably within the final two years, with a present yield of 6.2%

A Look On the ETF’s Holdings

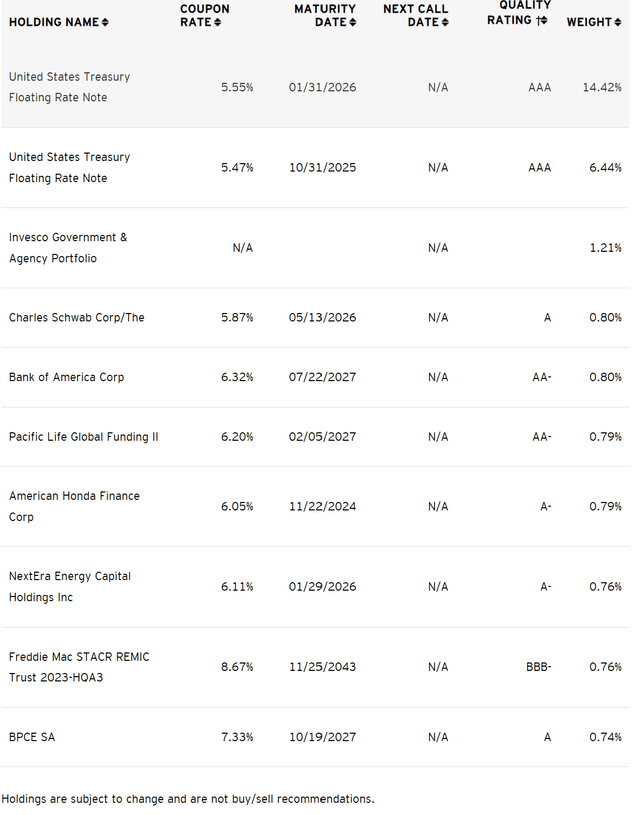

The VRIG ETF’s portfolio is numerous and consists of a mixture of floating-rate U.S. Treasuries, government-sponsored company mortgage-backed securities, U.S. company debt, structured securities, and floating-rate investment-grade company securities. It could possibly additionally make investments as much as 20% in non-investment-grade securities. The fund’s high holdings are predominantly in U.S. Treasury Floating Price Notes and high-grade company bonds issued by firms comparable to Financial institution of America Corp. and Charles Schwab Corp.

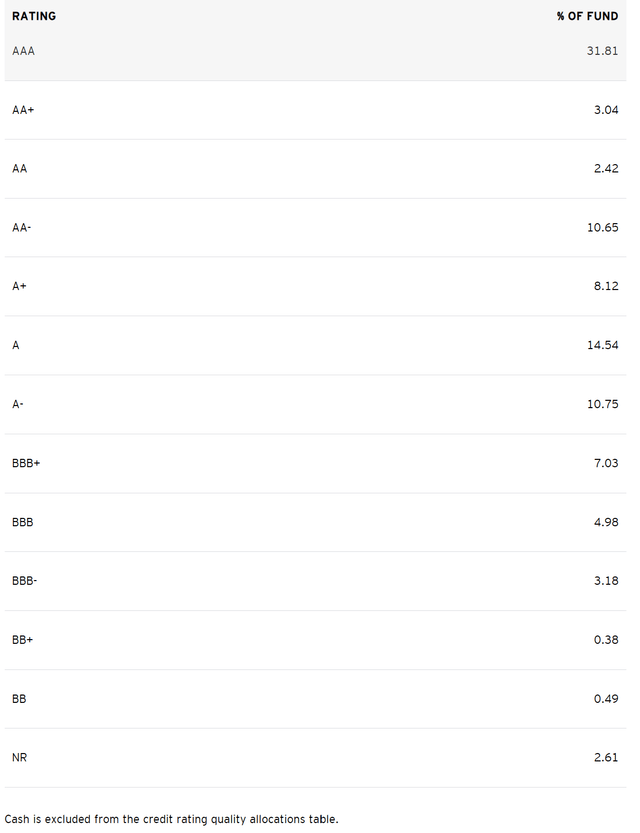

Importantly, the credit score high quality of the fund’s holdings is rated extremely, signaling little default threat. This to me is necessary given my considerations round a credit score occasion.

Sector Composition and Geographic Allocation

VRIG has a big allocation to securitized, company, and treasury sectors. As of the top of 2023, the fund had 40.63% of its portfolio in securitized securities, 37.64% in company securities, and 21.73% in Treasuries.

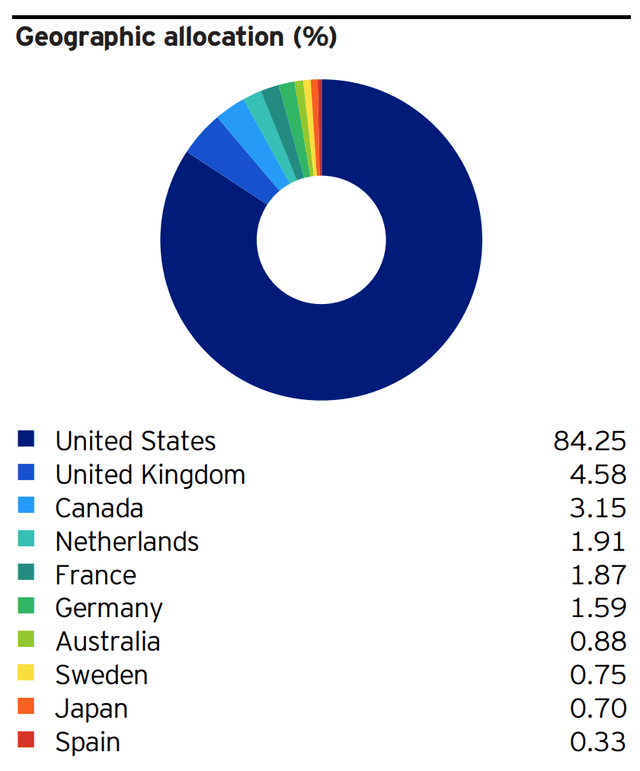

Geographically, the fund is closely weighted in the direction of the USA, with 84.25% of its portfolio invested in U.S.-based property. The remaining portion is unfold throughout the UK, Canada, the Netherlands, France, Germany, Australia, Sweden, Japan, and Spain.

Evaluating VRIG with Peer ETFs

VRIG and the iShares Floating Price Bond ETF (FLOT) each cater to traders searching for publicity to floating charge bonds, minimizing rate of interest threat. VRIG, an actively managed fund by Invesco, focuses on investment-grade, variable charge devices, primarily U.S. dollar-denominated and U.S.-issued. Then again, FLOT is a passively managed ETF by iShares that tracks the Bloomberg US Floating Price Be aware < 5 Years Index, emphasizing short-maturity, high-quality notes with 82% rated A or increased. FLOT has a bigger asset base, decrease expense ratio of 0.15%, making it extra interesting for cost-conscious traders in search of stability and decrease volatility in a rising charge situation.

VRIG relative to FLOT has outperformed, however not by a lot.

Weighing the Professionals and Cons

One of the vital benefits of investing in VRIG is its low length (near 0), which reduces sensitivity to rate of interest adjustments. This function, coupled with its give attention to investment-grade securities, makes it a pretty possibility for conservative traders in search of secure revenue.

Nevertheless, the fund’s reliance on floating-rate securities means its yield might lower if short-term rates of interest fall. Furthermore, regardless of its emphasis on high-grade bonds, the fund does carry some credit score threat, particularly from its publicity to non-investment-grade securities and company bonds.

Ought to You Spend money on VRIG?

The choice to put money into VRIG ought to be based mostly in your funding objectives, threat tolerance, and market outlook. For those who imagine that rates of interest will stay excessive or improve, and also you’re comfy with the fund’s credit score threat, VRIG may very well be an excellent match. Its yield is enticing, and its low length gives some safety in opposition to rising charges. Nevertheless, when you count on charges to fall otherwise you’re involved about credit score threat, different funding choices could be extra appropriate.

It is a good fund general and might match nicely inside a conservative asset allocation combine. Simply perceive that it’ll carry out in a different way every time we return to a falling charge surroundings once more.

[ad_2]