[ad_1]

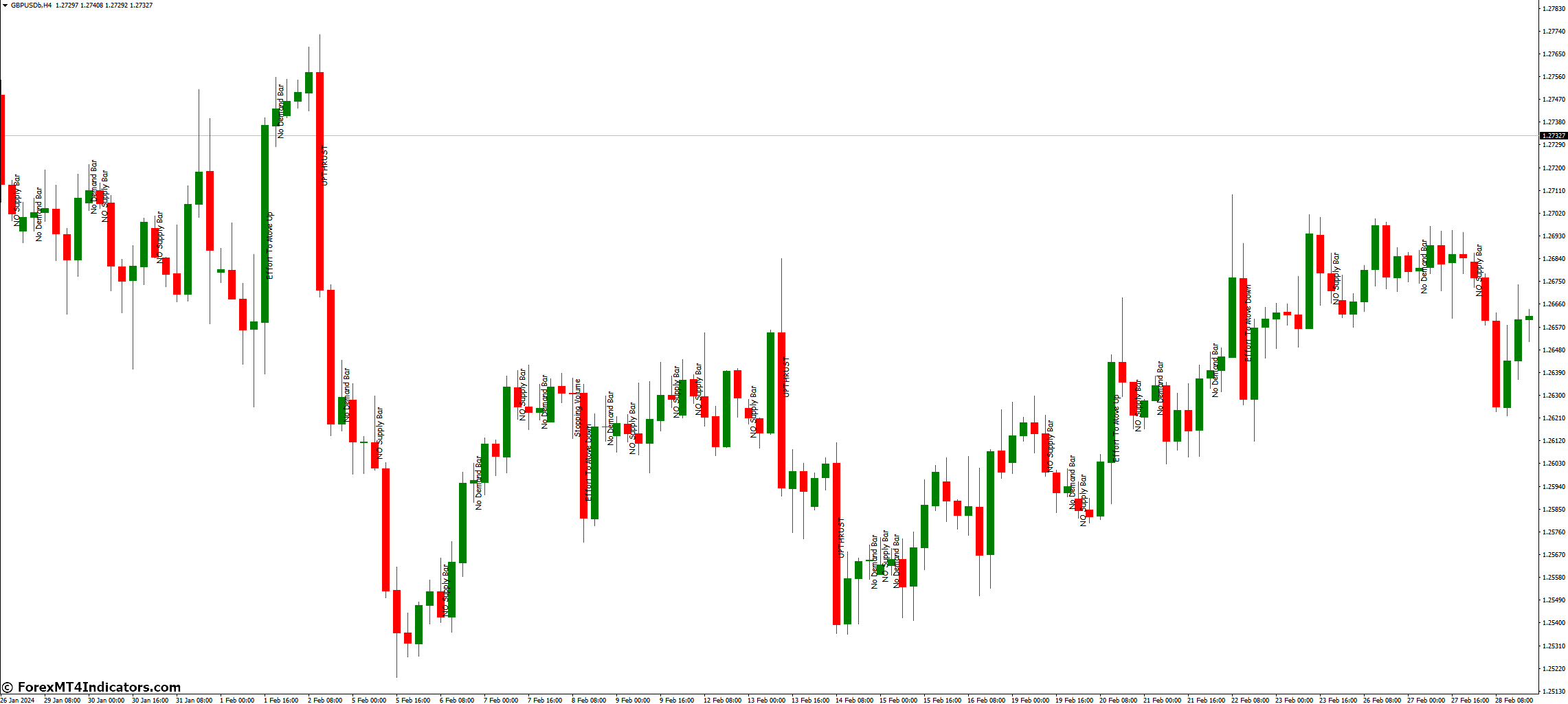

The VSA Textual content MT4 Indicator bridges the hole between worth and quantity, a cornerstone of VSA. It simplifies the evaluation by translating complicated quantity knowledge into easy-to-understand textual content labels displayed straight in your charts. However earlier than delving into its functionalities, let’s set up a basis.

Understanding Quantity Unfold Evaluation (VSA)

VSA, pioneered by legendary dealer Tom Weldon, goes past conventional technical evaluation. It focuses on the interaction between worth motion and quantity, revealing the underlying battle between patrons and sellers. By analyzing quantity distribution throughout worth ranges (the unfold), VSA practitioners can determine potential market imbalances and anticipate future worth actions.

Advantages of Utilizing the VSA Textual content MT4 Indicator

The VSA Textual content MT4 Indicator streamlines VSA evaluation by automating the identification of key quantity patterns. Right here’s the way it empowers your buying and selling:

- Simplified VSA Interpretation: No extra wrestling with uncooked quantity knowledge. The indicator interprets complicated data into clear textual content labels, making VSA accessible to merchants of all expertise ranges.

- Enhanced Market Consciousness: Acquire worthwhile insights into shopping for and promoting stress. The VSA Textual content MT4 Indicator highlights potential provide and demand zones, permitting you to anticipate potential pattern reversals or continuations.

- Improved Buying and selling Confidence: By integrating VSA alerts along with your current buying and selling technique, you can also make extra knowledgeable choices and enhance your buying and selling confidence.

Understanding VSA Textual content Indicator Performance

Now that we’ve grasped the ability of VSA and the VSA Textual content MT4 Indicator, let’s get right down to brass tacks and perceive the way it works.

Varieties of VSA Textual content Indicator Alerts

The VSA Textual content MT4 Indicator shows 5 distinct textual content labels, every revealing a selected price-volume dynamic:

- No Provide: This label suggests a scarcity of promoting stress, doubtlessly indicating an uptrend continuation.

- No Demand: Conversely, “No Demand” signifies weak shopping for curiosity, hinting at a possible downtrend.

- Up Thrust: A powerful worth motion accompanied by comparatively low quantity, probably foreshadowing a pattern reversal upwards.

- Reverse Up Thrust: Just like an Up Thrust, however with a downward worth motion, suggesting a possible pattern reversal downwards.

- Stopping Quantity: This label seems when worth motion stalls with minimal quantity, indicating indecision available in the market.

Integrating the VSA Textual content Indicator into Your Buying and selling Technique

The VSA Textual content MT4 Indicator is a strong instrument, however it’s not a magic bullet. Right here’s find out how to seamlessly combine it into your current buying and selling technique:

Figuring out Potential Market Path with VSA Textual content Alerts

Use VSA Textual content labels as preliminary filters. As an example, a mix of “No Provide” and “Up Thrust” may recommend a possible shopping for alternative. Nevertheless, keep in mind, affirmation is essential.

Combining VSA Textual content with Worth Motion Patterns

Don’t work in isolation! VSA Textual content alerts shine brightest when mixed with established worth motion patterns like head and shoulders or double tops/bottoms. This confluence strengthens your buying and selling conviction.

Affirmation Methods for VSA Textual content Alerts

Don’t chase each VSA Textual content sign. Search for affirmation from different technical indicators like transferring averages or relative power index (RSI) to validate the sign earlier than coming into a commerce.

Limitations and Issues of the VSA Textual content Indicator

Whereas the VSA Textual content MT4 Indicator is a worthwhile instrument, it’s important to acknowledge its limitations:

The Subjectivity of VSA Interpretation

VSA evaluation, by nature, entails a point of interpretation. Completely different merchants may interpret the identical VSA Textual content sign in another way.

Significance of Market Context

VSA Textual content alerts want context. A “No Provide” label throughout a powerful downtrend may not be a dependable purchase sign. At all times take into account the prevailing market pattern and different technical indicators.

False Alerts and the Want for Affirmation

The market is a posh beast, and no indicator is foolproof. The VSA Textual content MT4 Indicator can generate false alerts, particularly in periods of excessive volatility or uneven worth motion. Subsequently, relying solely on VSA Textual content labels for buying and selling choices is a recipe for catastrophe. At all times search affirmation from different technical indicators and worth motion patterns earlier than committing capital.

Superior VSA Textual content Indicator Methods

As you achieve expertise, delve deeper into the world of VSA with the VSA Textual content MT4 Indicator:

Figuring out Provide and Demand Zones with VSA Textual content

Search for clusters of particular VSA Textual content labels. For instance, a string of “No Provide” labels may point out a possible help zone, whereas a focus of “No Demand” labels might recommend a resistance zone.

Utilizing the Indicator for Scalping and Day Buying and selling Methods

The VSA Textual content MT4 Indicator will be notably helpful for short-term buying and selling methods like scalping and day buying and selling. The indicator’s real-time suggestions on quantity and worth motion lets you determine fleeting buying and selling alternatives.

Combining VSA Textual content with Different Technical Indicators

Don’t restrict your self! The VSA Textual content MT4 Indicator performs properly with others. Mix it along with your favourite technical indicators, like transferring averages or Bollinger Bands, for a extra complete market evaluation.

Actual-World Examples of VSA Textual content Indicator in Motion

Seeing is believing! Let’s discover some real-world eventualities the place the VSA Textual content MT4 Indicator can illuminate the trail:

Case Research: Figuring out Pattern Reversals and Continuations

Think about a downtrend with a worth bar closing decrease, accompanied by the “No Demand” label. This reinforces the downtrend and suggests a possible promoting alternative. Conversely, throughout an uptrend, a worth bar closing greater with the “Up Thrust” label may sign a continuation of the uptrend and a possible shopping for alternative.

Utilizing VSA Textual content to Gauge Market Sentiment

The VSA Textual content MT4 Indicator acts as a sentiment meter. A preponderance of “No Provide” labels suggests bullish sentiment, whereas a dominance of “No Demand” labels signifies bearish sentiment. This understanding may also help you tailor your buying and selling technique accordingly.

Examples of Combining VSA Textual content with Worth Motion Patterns

Think about recognizing a double-bottom worth sample in your chart. Now, add the magic contact of VSA. If the second backside coincides with a “No Provide” label, your confidence in a possible pattern reversal upwards considerably will increase.

The Psychology Behind VSA and Worth Motion

Understanding the VSA Textual content MT4 Indicator goes past the technical elements. It’s about peering into the soul of the market, the fixed push and pull between patrons and sellers.

Understanding the Battle Between Patrons and Sellers

Worth motion is a mirrored image of the continued battle between patrons and sellers. VSA Textual content alerts enable you to decipher this battle by highlighting areas of power and weak point in every camp.

How VSA Textual content Alerts Can Mirror Market Dynamics

A “No Provide” label throughout an uptrend suggests patrons are in management, overpowering sellers. Conversely, a “No Demand” label throughout a downtrend signifies sellers are firmly within the driving seat.

The Significance of Market Self-discipline and Threat Administration

Irrespective of how highly effective the VSA Textual content MT4 Indicator appears, by no means abandon sound threat administration rules. At all times keep correct self-discipline, stick with your buying and selling plan, and use stop-loss orders to guard your capital.

Frequent Errors to Keep away from When Utilizing VSA Textual content

Even seasoned merchants can fall prey to widespread pitfalls. Right here’s find out how to keep away from them with the VSA Textual content MT4 Indicator:

Overreliance on the Indicator

The VSA Textual content MT4 Indicator is a strong instrument, however it’s not a holy grail. Don’t grow to be overly reliant on its alerts. At all times take into account the broader market context and ensure alerts with different technical indicators.

Ignoring Affirmation Alerts

By no means chase each VSA Textual content sign blindly. Search affirmation from different indicators or worth motion patterns earlier than coming into a commerce. Keep in mind, a single VSA Textual content label is only a piece of the puzzle.

Buying and selling In opposition to the Pattern With out Correct Justification

Buying and selling towards the prevailing pattern is usually a recipe for catastrophe. Whereas VSA Textual content alerts can trace at potential pattern reversals, all the time have a powerful rationale for going towards the pattern. Search for confluence with different technical indicators and robust worth motion patterns to help your resolution.

The Way forward for VSA Textual content Indicator and VSA Buying and selling

The world of finance is consistently evolving, and VSA evaluation isn’t any exception. Right here’s a glimpse into what the longer term holds:

Technological Developments and VSA Evaluation

The rise of synthetic intelligence (AI) and machine studying (ML) might revolutionize VSA evaluation. Think about AI-powered instruments that may automate complicated VSA interpretations, additional streamlining the evaluation course of.

The Evolving Panorama of Technical Evaluation

Technical evaluation is a dynamic subject, consistently adapting to new market circumstances and buying and selling devices. The VSA Textual content MT4 Indicator will seemingly evolve alongside these modifications, providing new options and functionalities to cater to the ever-changing market panorama.

The Function of VSA Textual content in Fashionable Buying and selling Methods

The VSA Textual content MT4 Indicator, together with VSA evaluation on the whole, will seemingly proceed to play a big function within the arsenal of recent merchants. By offering worthwhile insights into market psychology and hidden worth dynamics, VSA Textual content can empower merchants of all expertise ranges to make extra knowledgeable buying and selling choices.

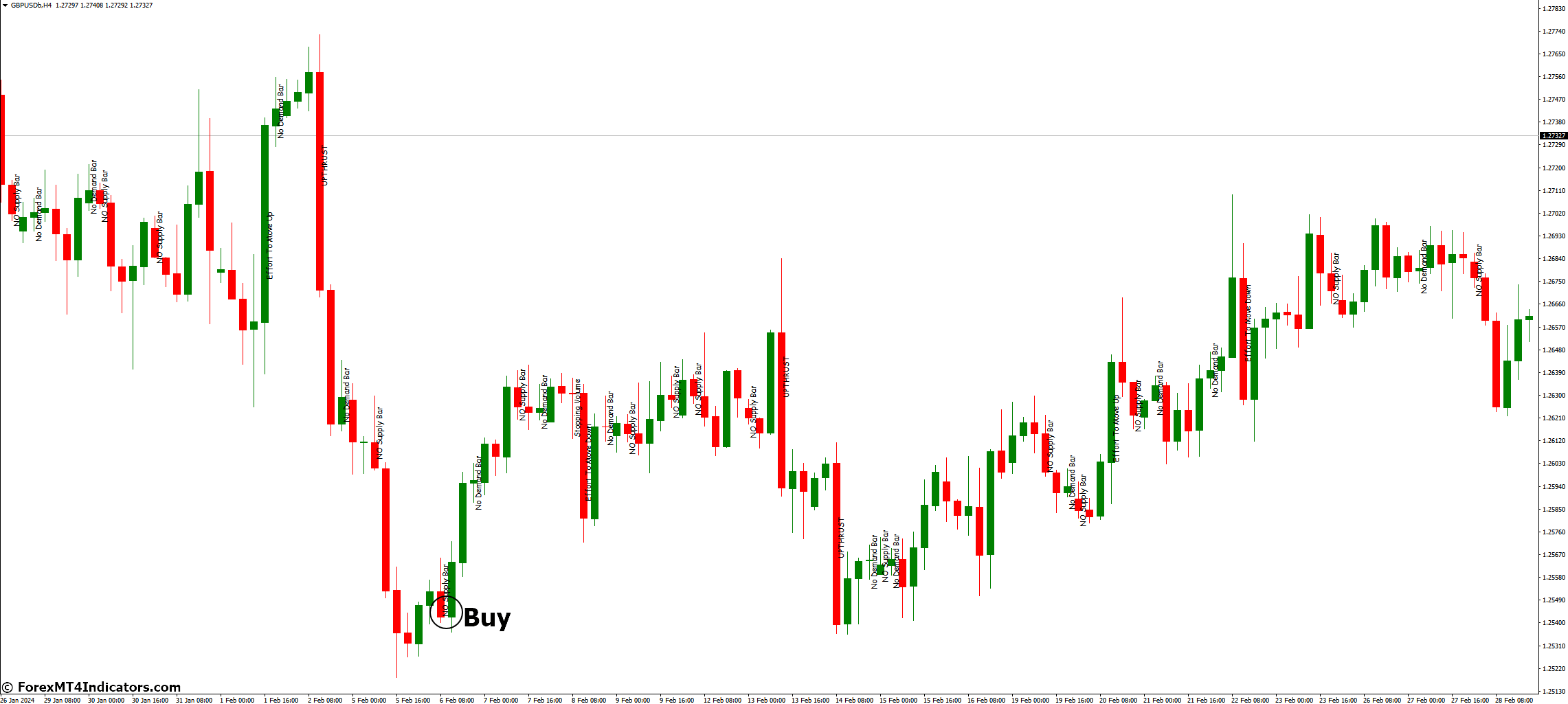

The way to Commerce with VSA Textual content Indicator

Purchase Entry

Up Thrust + Affirmation:

- Search for a worth bar closing greater with the “Up Thrust” label.

- Affirmation: This could possibly be a bullish worth motion sample (e.g., hammer, engulfing bullish) or an increase in a supporting indicator (e.g., transferring common crossover).

- Entry: Enter lengthy (purchase) simply above the excessive of the Up Thrust bar.

- Cease-Loss: Place a stop-loss order beneath the low of the Up Thrust bar.

- Take-Revenue: Goal a revenue stage based mostly in your risk-reward ratio or a resistance stage.

No Provide Throughout Uptrend:

- Determine an uptrend with a worth bar closing greater accompanied by the “No Provide” label.

- This signifies continued shopping for stress, doubtlessly extending the uptrend.

- Entry: Enter lengthy (purchase) above the excessive of the bar with No Provide.

- Cease-Loss: Place a stop-loss order beneath the low of the No Provide bar.

- Take-Revenue: Goal a revenue stage based mostly in your risk-reward ratio or a resistance stage.

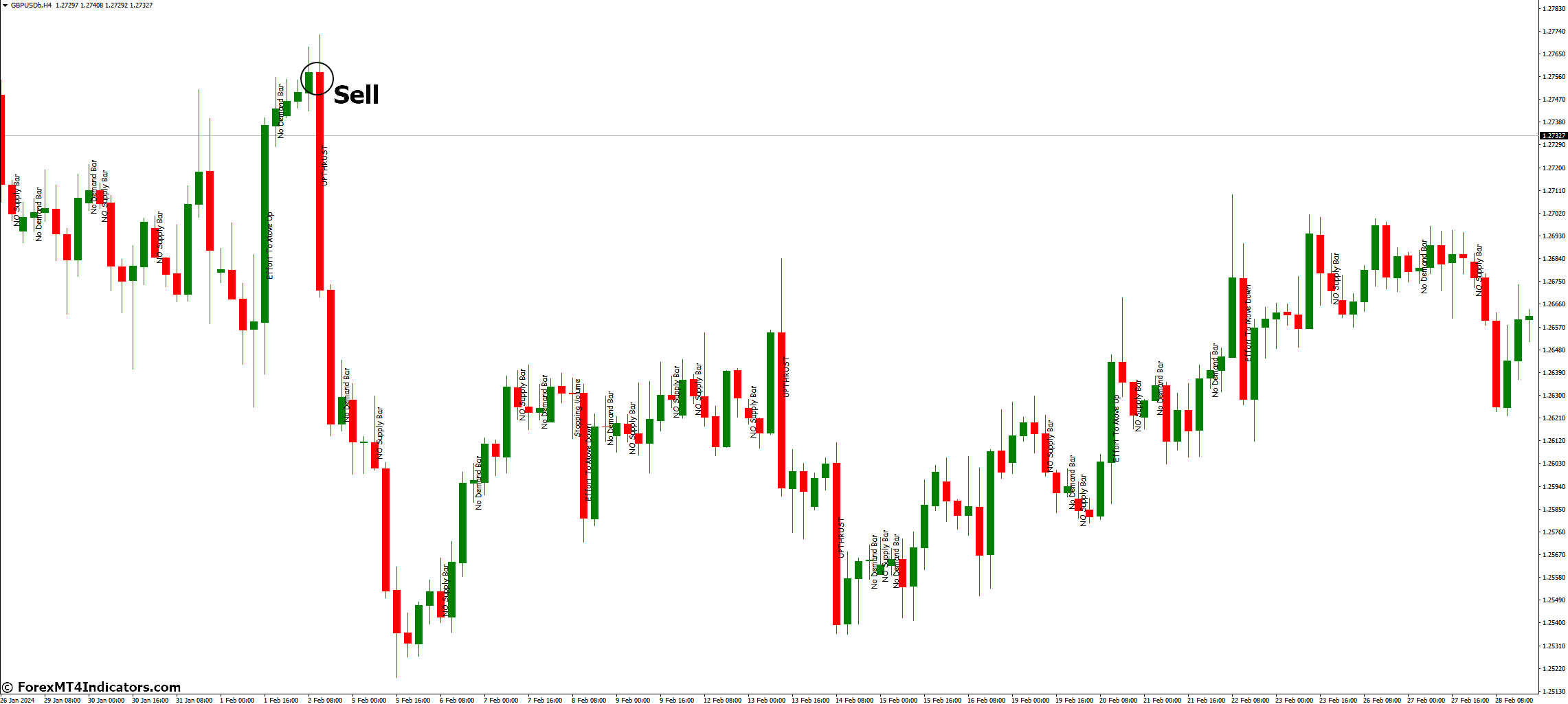

Promote Entry

Reverse Up Thrust + Affirmation:

- Search for a worth bar closing decrease with the “Reverse Up Thrust” label.

- Affirmation: This could possibly be a bearish worth motion sample (e.g., capturing star, bearish engulfing) or a decline in a resistance indicator (e.g., transferring common crossover beneath the value).

- Entry: Enter brief (promote) just under the low of the Reverse Up Thrust bar.

- Cease-Loss: Place a stop-loss order above the excessive of the Reverse Up Thrust bar.

- Take-Revenue: Goal a revenue stage based mostly in your risk-reward ratio or a help stage.

No Demand Throughout Downtrend:

- Determine a downtrend with a worth bar closing decrease accompanied by the “No Demand” label.

- This signifies continued promoting stress, doubtlessly extending the downtrend.

- Entry: Enter brief (promote) beneath the low of the bar with No Demand.

- Cease-Loss: Place a stop-loss order above the excessive of the No Demand bar.

- Take-Revenue: Goal a revenue stage based mostly in your risk-reward ratio or a help stage.

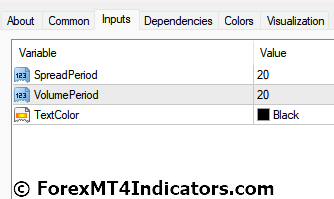

VSA Textual content Indicator Settings

Conclusion

The VSA Textual content MT4 Indicator is a strong instrument that may unlock a deeper understanding of the markets. By integrating VSA evaluation into your buying and selling technique, you achieve worthwhile insights into market sentiment, potential worth actions, and the underlying battle between patrons and sellers.

Keep in mind, the important thing lies in utilizing the VSA Textual content Indicator at the side of different technical evaluation instruments, correct threat administration, and a well-defined buying and selling plan. With dedication and steady studying, the VSA Textual content Indicator can grow to be a worthwhile asset in your buying and selling journey.

Really helpful MT4 Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

>> Claim Your $50 Bonus Here <<

(Free MT4 Indicators Obtain)

Click on right here beneath to obtain:

[ad_2]