[ad_1]

Societe Generale asserts that the trajectory of the S&P 500 will be steered by ‘U.S. exceptionalism,‘ in keeping with studies. This sentiment underlies their bullish outlook, with a year-end goal of 5,500, reflecting a modest improve of simply over 5% from present ranges.

Amongst main monetary establishments tracked by MarketWatch, Societe Generale’s projection seems to be probably the most optimistic. Whereas 5,200 was beforehand seen as a peak on the shut of 2023, sure analysis corporations have proposed even greater targets.

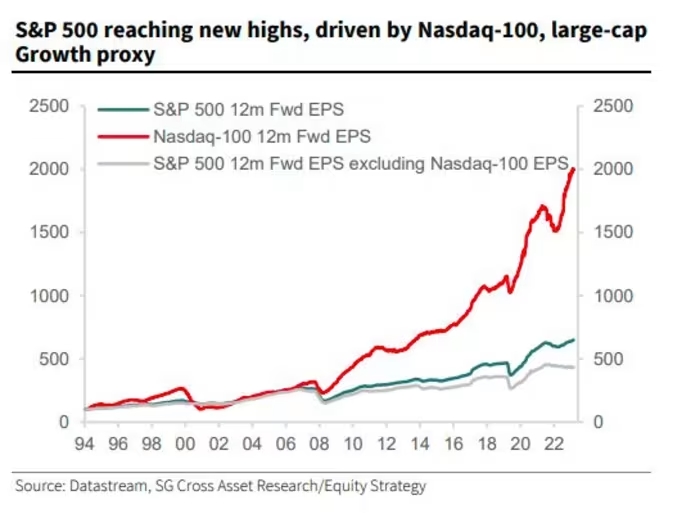

Key drivers of this optimism embody ongoing macroeconomic enhancements in the USA. Elements such because the ‘reshoring increase’ in industrials, the surge in synthetic intelligence inside the Nasdaq-100, and enhanced credit score circumstances have all contributed to this optimistic outlook.

Regardless of the prevailing market optimism, Societe Generale views it as rational given the sustained progress in earnings and the broader financial panorama. They anticipate continued revenue progress, albeit at a considerably slower tempo.

The current Federal Reserve determination to keep up its present coverage stance has additional buoyed market sentiment, with the S&P 500 poised for added positive factors. Societe Generale’s analysts observe two distinct revenue cycles inside the index, with vital disparities between progress shares and others.

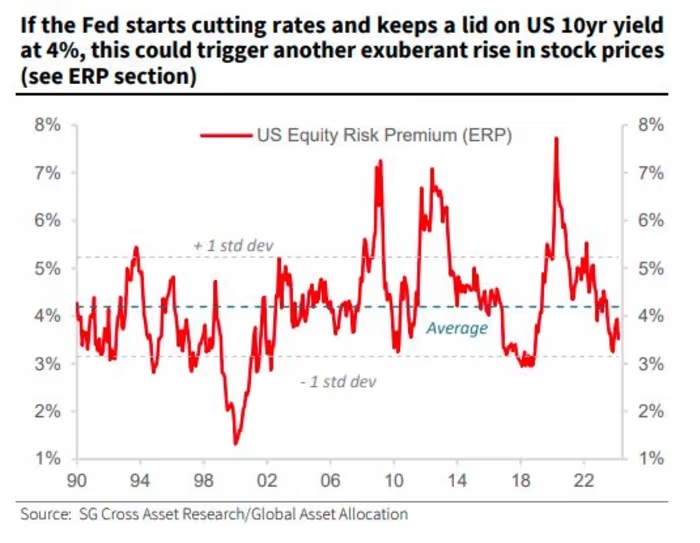

Whereas acknowledging the spectacular positive factors in current months, Societe Generale warns of potential challenges forward. Elements similar to rising bond yields, hovering fuel costs, and the eventual resumption of Fed fee hikes pose draw back dangers to their forecast.

Conversely, they spotlight the potential for even larger upside if market exuberance mirrors past tech bubbles or if favorable circumstances persist, similar to Fed fee cuts and managed bond yields.

General, Societe Generale’s bullish stance on the S&P 500 displays a nuanced evaluation of each optimistic and negative forces shaping the market landscape, with a watch towards continued progress tempered by potential dangers.

[ad_2]