[ad_1]

Final time, we launched the SGX knowledge within the SpreadCharts app and briefly described the history of commodity trading in Singapore. At this time, we’ll take a better have a look at essentially the most attention-grabbing futures contract from dealer’s perspective – the Rubber futures.

Earlier than transferring on, I need to make clear that there are literally two rubber futures contracts traded on the SGX – the TSR20 and RSS3. Each are produced from pure latex harvested from rubber timber. Technically Specified Rubber (TSR) is liquid latex which has been allowed to congeal naturally and reformed into blocks that can be utilized in tyre manufacturing. Ribbed Smoked Sheet (RSS) is liquid latex rolled into sheets and put by way of a smoking course of.

What shall be vital for us is that TSR20 is far more liquid contract than RSS3, so I’ll focus solely on the TSR20 contract any longer. Detailed specs for each contracts are listed on the finish of this text.

Why you need to be focused on SGX Rubber:

- Bodily settlement

- Seasonal habits

- Small contract dimension

- USD denominated

Bodily settlement

Futures contracts will be settled both financially or bodily. Bodily implies that the contract should be settled by the precise commodity upon its expiration, not merely with money. Why you need to care about this, if you happen to’re only a dealer? Effectively, bodily settlement ensures that the contract intently tracks the worth of the underlying commodity. It results in fewer failures in futures convergence to identify costs at expiration, and the contract is extra common amongst hedgers. The explanation you need to care is that as a speculator, you need the futures’ worth to precisely mirror the true circumstances within the bodily market. Think about coming into a commerce and failing to revenue from it, even when the market evolves as you anticipated.

Nonetheless, this could be a double edged sword typically. Bear in mind the unfavourable crude oil costs in spring 2020? Effectively, it occurred simply on the WTI contract, primarily as a result of its bodily settlement. Against this, Brent futures, that are financially settled, didn’t expertise unfavourable costs throughout the identical interval.

Once you commerce a bodily settled contract, you commerce an precise commodity. Such contracts are uncommon in Southeast Asia, as bodily supply requires intensive storage and loading services. That’s why most contracts are cash-settled.

Seasonal habits

Rubber reveals notable seasonal tendencies. In case you observe us for a while, you understand that we don’t think about seasonality as one thing dependable. It does fail terribly form time to time. However, it might function an vital tailwind in your trades if different knowledge is aligned with it. And rubber exhibits robust seasonal patterns.

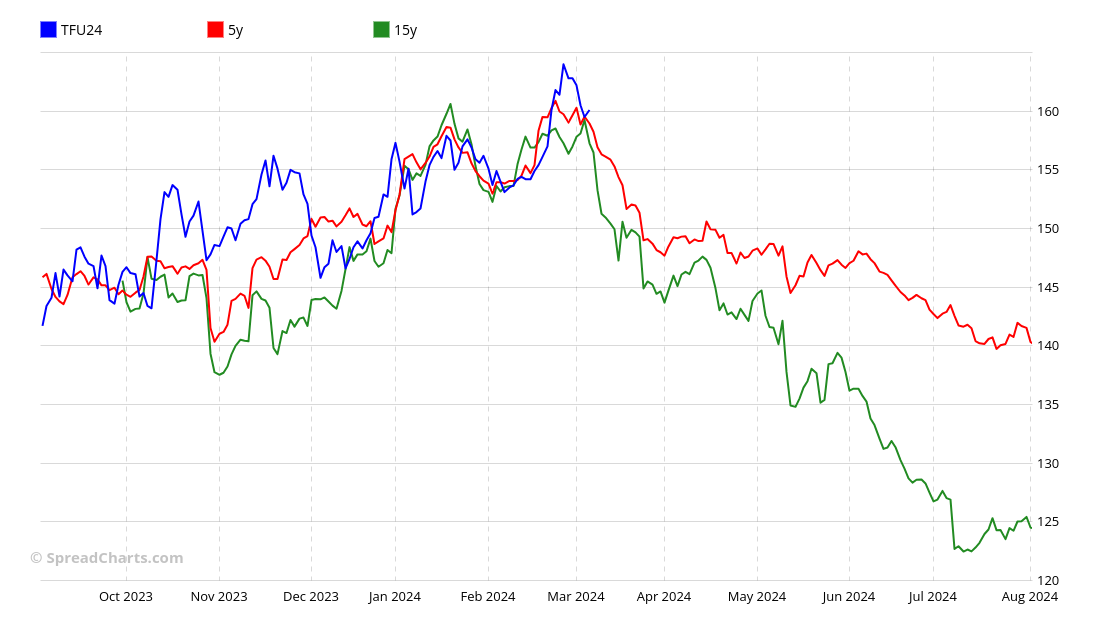

As an illustration, a pleasant seasonal uptrend has simply concluded, which the worth adopted reasonably effectively this 12 months. And now, a powerful seasonal downtrend is starting.

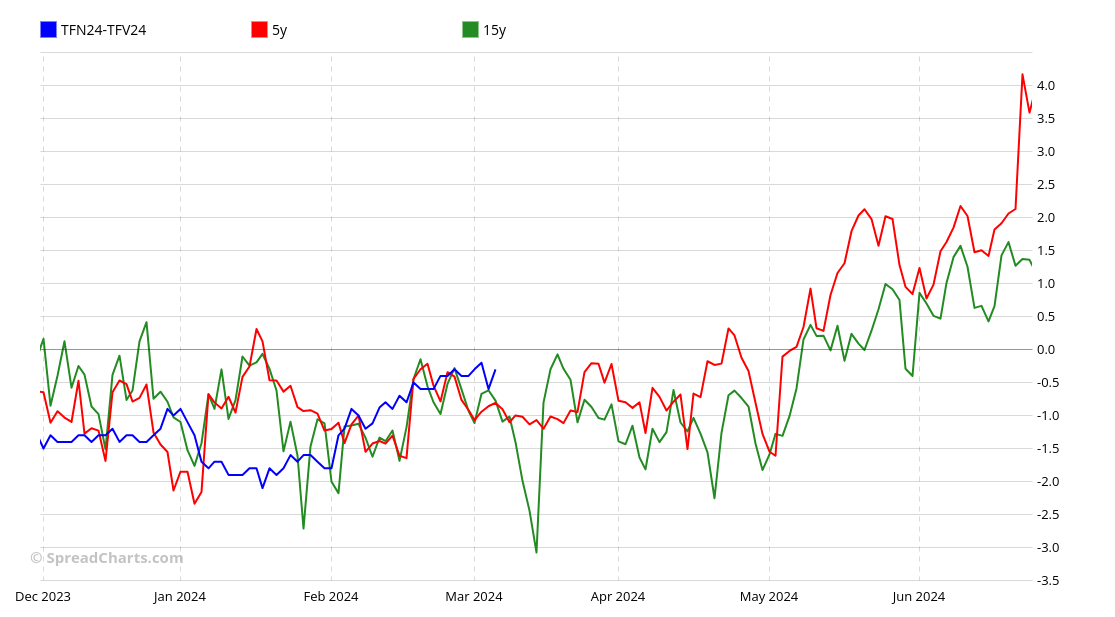

This seasonal habits is obvious not solely in outright futures but additionally in interdelivery spreads.

Small contract dimension

It is a enormous benefit for retail merchants. Futures contracts are usually giant for historic causes. To begin with, solely skilled merchants and hedgers traded them within the twentieth century. These have been often giant companies and the contract dimension was tailor-made for them. Furthermore, buying and selling commissions have been a lot increased earlier than the appearance of digital buying and selling and buying one huge contract was less expensive than shopping for a few smaller ones.

That is now not the case. Now, smaller contracts have gotten the norm, providing extra flexibility to hedgers and attracting speculators who present the a lot wanted liquidity. Even the CME Group learned it the hard way with some area of interest commodities.

The SGX rubber futures contract dimension is simply 5 metric tonnes, translating to a level worth of solely $50. To place this into perspective, the months-long buying and selling vary for this contract represented a mere $500 change in contract worth! Typical values for some US futures contracts throughout a comparable interval could be a number of thousand {dollars}.

Such a small contract dimension permits merchants to make the most of their danger administration with out resorting to excessively tight cease losses. It additionally permits the buying and selling of a number of contracts even by retail merchants, which is critical for correct cash administration

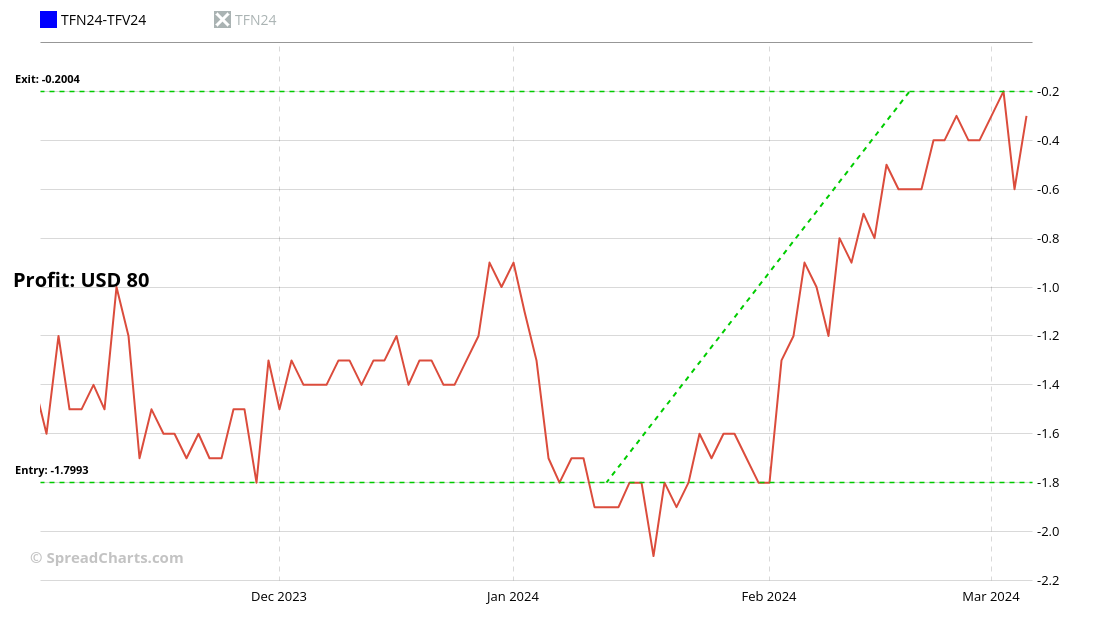

And do you keep in mind that unfold on the seasonal chart just a few paragraphs above? Its worth change over two months is value simply $80!

USD denominated

Regardless of being traded on the SGX, a Singaporean trade, the Rubber futures are denominated in US {Dollars}. This eliminates forex danger for US buyers and simplifies margin calculations. And even for merchants from different international locations, changing cash to USD is mostly simpler than changing to SGD.

I hope you now perceive why we’re so excited by including SGX Rubber knowledge to the SpreadCharts app. Under, we connect full contract specs for each the TSR20 (artificial) and RSS3 (pure) contracts.

We have been in a position to signal the license with the SGX and add this new knowledge into the app solely due to our premium subscribers. If you wish to see extra knowledge within the app, think about purchasing the premium subscription.

|

|

|

| Contract identify | SGX SICOM TSR20 Rubber |

|

|

|

| Change | SGX |

|

|

|

| Ticker | TF |

|

|

|

| Expiration months | F, G, H, J, Ok, M, N, Q, U, V, X, Z |

|

|

|

| Foreign money | USD |

|

|

|

| Contract dimension | 5 metric tonnes |

|

|

|

| Level worth | $50 |

|

|

|

| Tick dimension / worth | 0.1 / $5 |

|

|

|

| Settlement | Bodily |

|

|

|

|

|

|

| Contract identify | SGX SICOM RSS3 Rubber |

|

|

|

| Change | SGX |

|

|

|

| Ticker | RT |

|

|

|

| Expiration months | F, G, H, J, Ok, M, N, Q, U, V, X, Z |

|

|

|

| Foreign money | USD |

|

|

|

| Contract dimension | 5 metric tonnes |

|

|

|

| Level worth | $50 |

|

|

|

| Tick dimension / worth | 0.1 / $5 |

|

|

|

| Settlement | Bodily |

|

|

|

[ad_2]