[ad_1]

Throughout the final 24 hours, the market witnessed a big rally within the Bitcoin worth, which soared by 10% from a day by day low of $60,805 to a peak of $68,250. This outstanding worth motion may be attributed to a number of key elements, together with yesterday’s Federal Open Market Committee (FOMC) assembly, a notable change within the Coinbase Premium, and Bitcoin’s technical breakout from a downtrend channel.

#1 FOMC Assembly: Dovish Remarks By Jerome Powell Gasoline Optimism

As reported yesterday, the macro setting got here again into focus for Bitcoin and crypto following the warmer than anticipated Shopper Value Index (CPI) and Producer Value Index (PPI) inflation information within the US. Buyers appeared to have de-risked their positions previous to the FOMC occasion. Nevertheless, traders received a positive consequence.

The pivot level for Bitcoin’s rally may be traced again to the Federal Reserve’s newest FOMC assembly, the place Chairman Jerome Powell delivered a speech that the market interpreted as dovish. The Fed’s stance, particularly in mild of current inflation information, has reassured traders.

Crypto analyst Furkan Yildirim provided a abstract of the FOMC’s key factors: “The ‘Dot Plot’ projections present that the median official expects three quarter-percent cuts in 2024 […] The FOMC voted unanimously to go away the federal funds charge unchanged […] The median forecast for PCE inflation stays unchanged at 2.4% for 2024 […] Officers have additionally raised forecasts for the place they see rates of interest in the long run.”

The response to those bulletins was instantly bullish within the conventional finance markets in addition to Bitcoin and crypto. QCP Capital, a Singapore-based crypto asset buying and selling agency, highlighted the dovish nature of the FOMC’s stance: “1. In Powell’s press convention speech, he was not involved concerning the excessive inflation numbers in Jan and Feb. 2. Within the dot plot, extra members shifted their projection to three cuts in 2024 (9 members vs 6 in Dec).”

Analyst Ted (@tedtalksmacro) additional emphasized the constructive implications: “FOMC abstract: – 3x charge cuts occurring this yr regardless of inflation remaining above 2% (Fed expects core PCE at 2.6%). Development outlook upgraded. Ship it.”

#2 Coinbase Premium Turns Inexperienced: A Signal Of Spot ETF Demand

The Coinbase Premium’s shift to constructive territory may be recognized as one other crucial issue influencing Bitcoin’s worth motion. Whereas yesterday’s ETF flows have been unfavourable once more for the third day in a row, the Bitcoin Coinbase Premium was a glimmer of hope that spot Bitcoin ETFs will additional gasoline worth.

CryptoQuant analyst Maartunn remarked: “Coinbase Premium is constructive once more. It’s round +$50. Stunning.” The Coinbase Premium is essential for BTC worth in current months because it displays the demand from spot Bitcoin ETFs earlier than the precise numbers are launched sooner or later later. Coinbase custodies eight of 11 spot Bitcoin ETFs or about 90% of the Bitcoin ETF property because of this. Thus, Coinbase premium is essential for a continued rally.

Coinbase Premium is constructive once more. It is round +$50. Stunning 😁 https://t.co/YJhYLdbipc pic.twitter.com/Hd3xXsg7Bq

— Maartunn (@JA_Maartun) March 20, 2024

GBTC had $386.6 million value of outflows yesterday. Notably, Blackrock solely had $49.3 million of inflows, Constancy had $12.9 million. This was one of many weakest influx days for the main Bitcoin ETFs to this point – an enormous disappointment.

However famend crypto analyst WhalePanda remarked: “We pumped after the FOMC and general it was higher than what boomers anticipated. Value is now dumping on the information of unfavourable flows however I believe they’ll be in for a pleasant shock tomorrow.”

Yesterday’s ETF flows have been unfavourable once more for third in a row.$GBTC had $386.6 million value of outflows.

Blackrock with solely $49.3 million of inflows and Constancy with $12.9 million.I’ve a suspicion that the precise flows will solely be seen in tomorrow’s numbers.

We pumped… pic.twitter.com/WVTntqG1by

— WhalePanda (@WhalePanda) March 21, 2024

#3 BTC Value Breaks Out Of Downtrend Channel

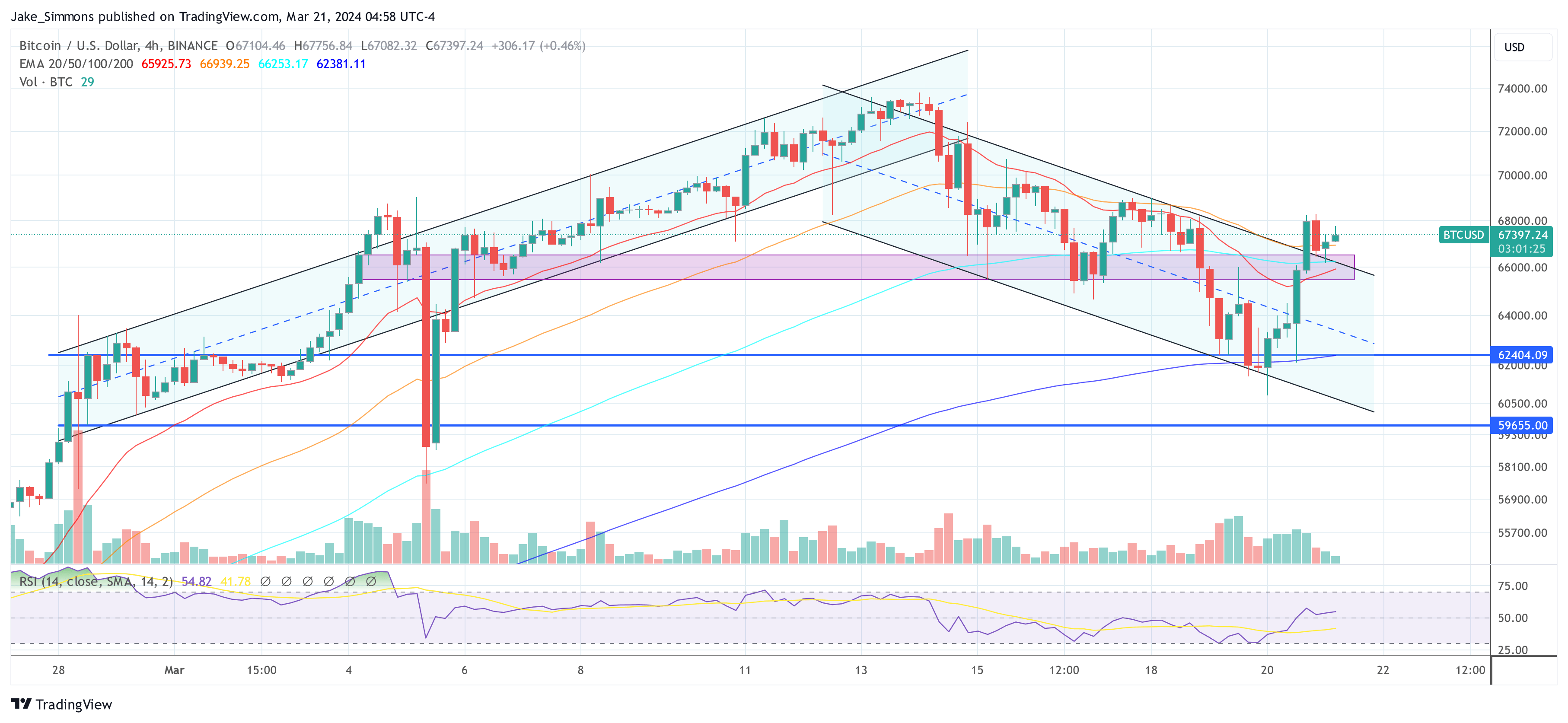

On the technical entrance, Bitcoin’s breakout from a parallel downtrend channel has caught the eye of merchants and analysts alike. Daan Crypto Trades highlighted the significance of this motion on X (previously Twitter): “Bitcoin examined its 4H 200MA/EMA and has been holding properly there and broke out. Nonetheless watching this channel which is able to dictate BTC’s subsequent transfer.”

#Bitcoin Examined its 4H 200MA/EMA and has been holding properly there and broke out.

Nonetheless watching this channel which is able to dictate $BTC‘s subsequent transfer.

Bulls would wish to see this consolidate above and never fall again into the channel. pic.twitter.com/94etUo6YAR

— Daan Crypto Trades (@DaanCrypto) March 20, 2024

The chart shared by Daan exhibits that BTC worth has been consolidating in a parallel downtrend channel for greater than per week. Yesterday’s surge catapulted the value above the channel. Presently a retest is happening. If that is profitable, the BTC worth may rally additional north.

At press time, BTC traded at $67,397.

Featured picture created with DALLE, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site totally at your individual threat.

[ad_2]