[ad_1]

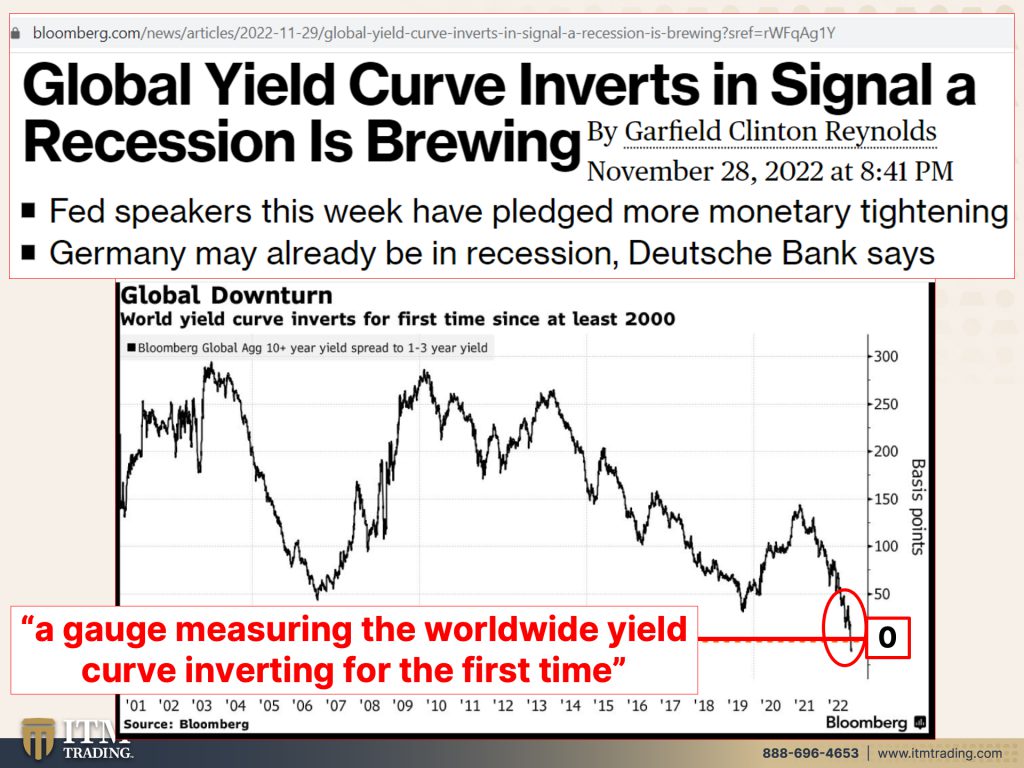

For the primary time since they started the monitoring in financial historical past, the worldwide yield curve simply inverted. This, after all, contains 26 international locations, together with the U.S., the U.Ok., Canada and Hong Kong. And if this isn’t your signal to get financially ready for a collapse, I simply don’t know what’s. I’ve been displaying the items to this Jenga economic system falling one after the other by one. Properly, think about 26 items simply acquired pushed . And when the yield curve inverts simply within the U.S., it’s all the time adopted by a recession. However that is catastrophically totally different. It’s on a world scale and charges are rising on the similar time. And all the basis of our foreign money is being destroyed from the within out. It’s the top of a foreign money’s life cycle, they usually’re going responsible everybody however themselves when it occurs. You maintain your wealth on this system. You might be on the mercy of these driving this bus. And there’s just one strategy to take again management, and that’s the privateness and security of gold. Arising.

CHAPTERS:

1:20 World Yield Curve Inverts for 1st Time

3:05 World Monetary Disaster Imminent

4:37 This All the time Results in Recession

8:00 Spot Silver & Spot Gold

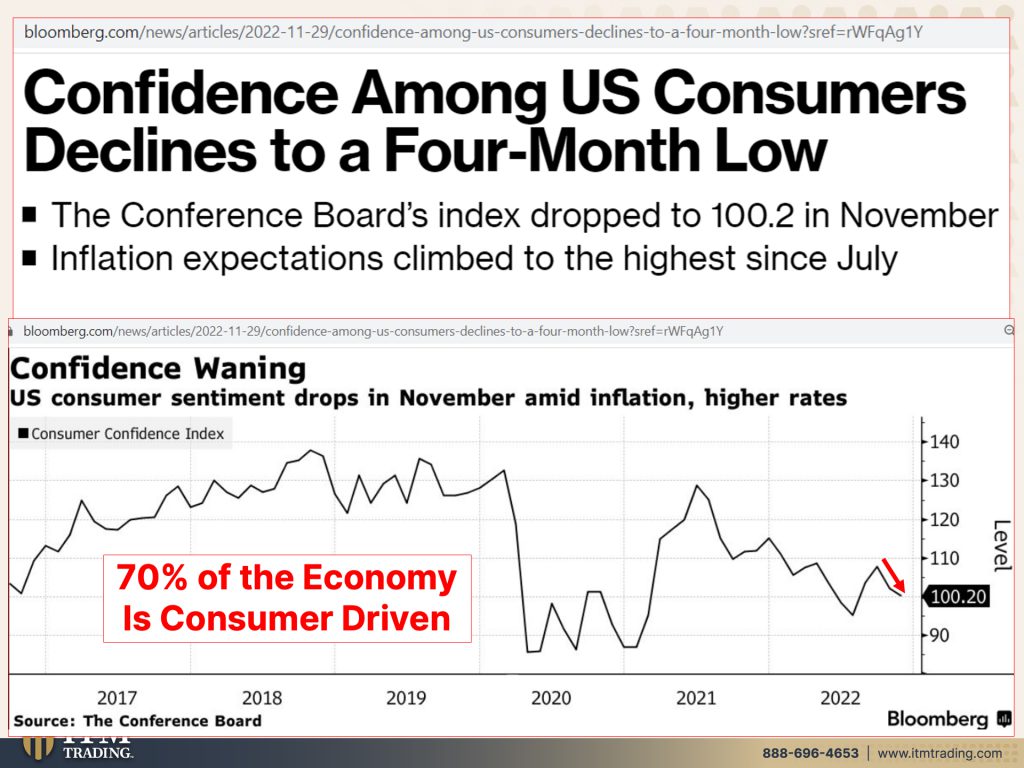

9:57 When Shopper Confidence Declines

12:00 Ghana’s Gold Shopping for Plan for Bartering

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

For the primary time since they started the monitoring in financial historical past, the worldwide yield curve simply inverted. This after all contains 26 international locations, together with the US, the UK, Canada, and Hong Kong. And if this isn’t your signal to get financially ready for a collapse, I simply don’t know what’s. I’ve been displaying the items to this Jenga economic system falling one after the other by one. Properly think about 26 items simply acquired pushed . And when the yield curve inverts simply within the US it’s all the time adopted by a recession. However that is catastrophically totally different. It’s on a world scale and, and charges are rising on the similar time, and all the basis of our foreign money is being destroyed from the within out. It’s the top of a foreign money’s lifecycle, they usually’re going responsible everybody however themselves when it occurs. In the event you maintain your wealth within the system, you’re on the mercy of these driving this bus. And there’s just one strategy to take again management, and that’s the privateness and security of gold, developing.

Let me present you what simply occurred as a result of this has by no means occurred since they began monitoring it. You understand, we’ve talked many occasions over time about yield curve inversion, which is when the decrease price, the shorter time period price, is greater than the long term price, and that’s the speed that you just receives a commission for holding this debt. Properly now, on a world foundation, and I talked about it in the beginning of this yr, and I feel it’s sort of attention-grabbing, we’ve acquired the start of the yr the place we noticed the 20 and 30 yr bond invert yield curve invert. And I mentioned at that time that that’s, it all the time begins on the top after which it really works its approach in. Now you’ve acquired a full world yield curve inversion, which implies that we’re about to have a full world, greater than a recession, greater than a recession. That is what that appears like since they began monitoring it. This can be a main sample shift and when any sample, a standard sample shifts, it is advisable to know that meaning one thing. And look all over the world, you possibly can see all of the chaos they’re establishing for the brand new system to return into play. As a result of what’s actually occurring is that we’re on the finish of this entire huge fiat cash experiment, first time ever. That retains me up at night time, to be sincere with you. I’m grateful that I’m as ready as I’m, may use extra preparation and extra time. However the actuality is we solely have as a lot time as we now have and there isn’t one individual that is aware of precisely that second. So I extremely, extremely encourage you to prepare now as a result of a world monetary disaster is coming our approach and meaning everybody’s approach.

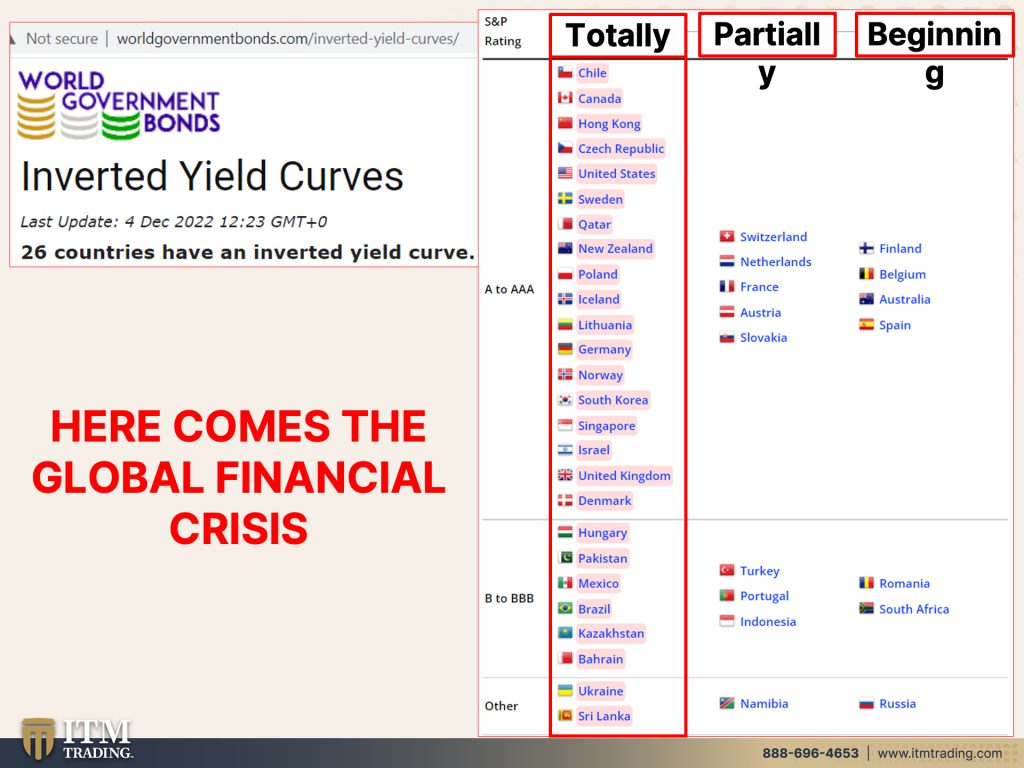

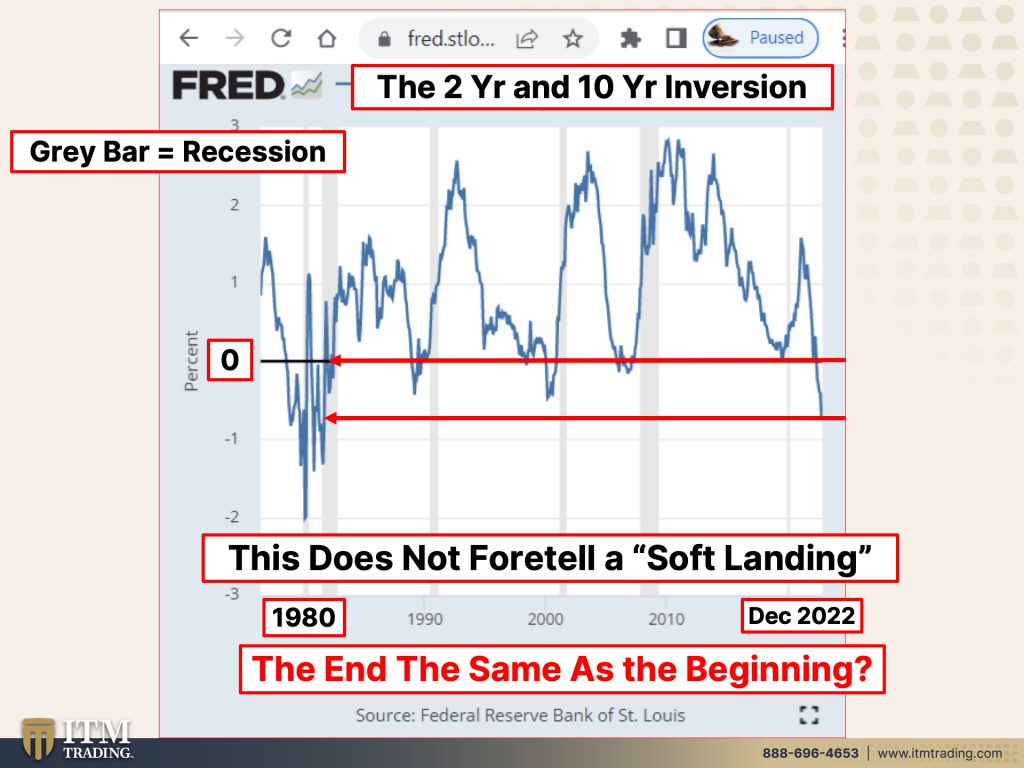

And what do the central banks should get us via this disaster? This my associates, is all they’ve is cash printing. That’s it. The remainder of the boldness that the general public might need within the central bankers might be destroyed and we are going to enter a hyperinflationary melancholy. And I’m sorry to say that, however it simply is what it’s. So have a look at this world authorities bond, inverted yield curves. Now, I’ve been monitoring this for thus a few years, that is the primary time that I’ve seen it, this inverted. 26 international locations, together with the US and the UK and, and all the main entities. And so listed below are some which might be partially inverted, however keep in mind usually as soon as they begin, and right here’s some which might be simply in the beginning phases, all proper? So that is principally the entire world is inverting. They’re yield. Virtually the entire world’s yield curves are inverting on the similar time. That is the 2 10 unfold that I’ve talked about many, many occasions. These grey bars are official recessions. So wherever you see like this grey bar, this grey bar, now that is 1980, proper? So when Nixon took us off the gold customary, formally absolutely 1971, so this entire interval was about going into this new debt-based system. And you’ll see each time the yield curve, we may return even sooner than this, however each time the yield curve inverts, a recession follows, this was nearly an inversion. And you’ll see the recession, however have a look at this. Right here we’re December, 2022 and there’s zero. Now we have the yield curve going again to the eighties. So that you would possibly, in case you’re listening, they’re speaking heads on television, they’re speaking about, they all the time are speaking about going again to the seventies, going again to 33, going again to the eighties. What they by no means actually speak about, however you want to pay attention to is that that’s when the entire system shifted economically, socially, and financially. The place are we now? Yeah, we’re getting into a shift. Properly, we’re already in the course of that shift. Socially, economically, and financially, you may not absolutely perceive this, however I’m telling you it’s a really, very, very huge deal and it tells us that point is operating out. I don’t suppose frankly, if 2022 was a pivotal yr as a result of they’re getting issues arrange for 2023. And naturally I may very well be unsuitable as a result of my crystal balls don’t actually telling me something. It’s simply all the info and the expertise and having lived via it and being able of hindsight and being sufficiently old to acknowledge the identical sort of issues occurring once more. And what we’re taking a look at right here, they preserve speaking about, nicely, yeah, it’s simply gonna be a gentle recession. They’re gonna engineer a smooth touchdown. It’s by no means occurred earlier than, however this time is totally different? The distinction on this time is that they’re gonna should shift us into a very new system. There is not going to be a smooth touchdown. And I’ll put my technical neck on the road on that. This isn’t gonna be a smooth touchdown. They’re added instruments, excuse me. And I do discover it actually attention-grabbing that it’s like we’ve gone full circle and the top at that stage of inversion is similar as the start. So for these of us that had been round, you then keep in mind the inflation that we had been coping with at that time. I imply, I keep in mind getting a 5 yr CD at 15%, proper? My first mortgage was at 12%. That was within the late seventies, early eighties.

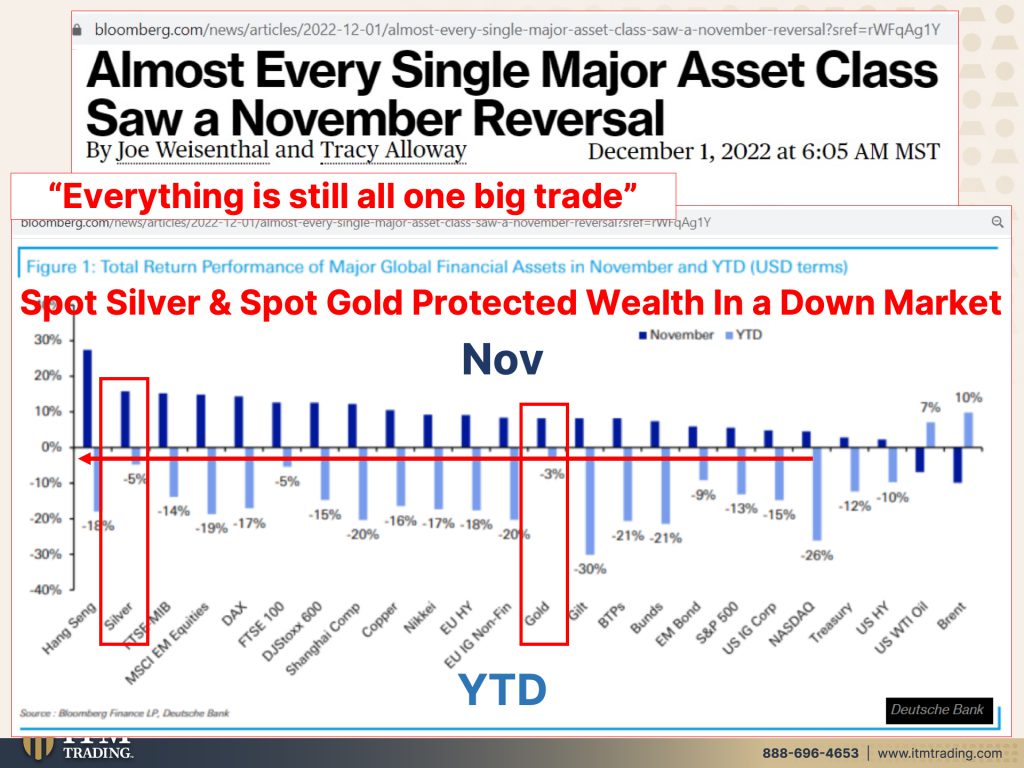

So possibly that’s why we’ve seen a reversal in November, proper? Cash coming into the markets. This high half is November, so the darkish blue, however up till there, that’s yr thus far. What I’d prefer to level out to you, that is silver. This one is silver, this one is gold. Are you able to see that though, and that is spot silver and spot gold by the best way, and I actually wanna watch out about that as a result of we’ve been skilled that once they speak in regards to the spot market which is a contract, what they’re actually speaking about isn’t gold. It’s a contract that’s presupposed to signify gold. However as I’ve proven you latterly, there was a decoupling between the spot market and the bodily gold market. And these are making highs. And that protected your wealth in a down market. I imply it did, it fell each silver and gold fell lower than the rest. And in an up market, it’s performing nicely as nicely. However that’s a contract. So don’t lose sight of that as a result of the truth is, is that all the pieces remains to be one huge commerce and all the pieces is coordinated. So when the markets implode and those who have used borrowed cash to purchase shares or bonds or the rest, get these margin calls, they should provide you with cash or their positions might be bought out. And lots of occasions the place they get that cash is from gold contracts as a result of that’s what the market will purchase, not the illiquid stuff like we’ve been speaking about for, nicely frankly, not simply months, however years.

And the issue is, is that we’re a shopper pushed economic system. That implies that we’re relying on the patron to proceed to eat. And in case you take heed to the speaking heads on television, what do they are saying? The shoppers actually held up so significantly better than what we thought that they had been. They usually’ve taken on much more debt to try to take care of a sure lifestyle within the face of this inflation. However confidence, which keep in mind this can be a con sport. Meaning all the pieces relies upon confidence, proper? Shopper confidence. Confidence that inflation, the Federal Reserve will have the ability to get inflation beneath management. Properly, guess what? Each the extent of inflation, the boldness that the inflation’s gonna keep low, in addition to confidence that individuals are nonetheless gonna have the incomes to proceed to eat, have declined to a 4 month low, they’re gonna go an entire lot decrease. I imply, you realize, you possibly can see it. But when 70% of the economic system is shopper pushed and the patron can not eat, what do you suppose is gonna occur? That’s why it’s a Jenga economic system. I can’t let you know which domino goes to fall first, however they, they’re already falling. And it actually doesn’t even take, you realize, creativeness. All it’s important to do is go searching and you’ll see what’s occurring. And the way do you suppose a determined authorities would possibly reply in the event that they actually really feel threatened or they actually get right into a bind and no one will settle for their fiat cash anymore? Properly, right here’s an ideal instance of that. Gold miners ordered to promote 20% of refined bullion to Ghana and Ghana, the federal government. And Ghana’s is Africa’s second largest gold producer they usually’ve ordered massive mining firms to promote 20% of the steel. They refine to the nation’s central financial institution as the federal government embarks on a plan to barter bullion for gasoline. As a result of the Cedi, which is true right here, that’s their foreign money, has dropped 57% this yr. It’s in free fall. So who needs to take it? No one. Now you is perhaps pondering, oh, nicely that’s Ghana and that might not occur right here. However traditionally it has occurred within the US and even in 2016 it occurred in India and Venezuela and Argentina and lots of, many, many different locations. However gold is actual cash and it’s accepted as actual cash globally. The fact is although the federal government has additionally ordered even small scale miners to promote their gold to state owned valuable minerals advertising and marketing firm. So lots of occasions individuals will say, nicely what about gold shares? Properly, this can be a threat that the gold shares run, you realize, possibly it’ll occur, possibly it received’t occur. And it’s sort of onerous for me to know someway. There may be very robust historic priority for governments to confiscate gold. And we now have current examples, this one being certainly one of them. And it’s onerous for me to think about whereas, and there’s so many various methods which you can speak about confiscation or names which you can give it. I imply, are they saying we’re confiscating gold in right here? No, however it definitely seems like a confiscation to me as a result of these gold miners are being pressured to promote their gold to the central financial institution within the type of the Cedi, the native foreign money, with on the spot value, which is a contract that’s simply manipulated with none reductions or the rest.

So do you suppose that by manipulating the worth of gold over all these years, by getting you to not actually wanna purchase gold, as a result of in any case, like we noticed, you realize, it’s efficiency is definitely higher than the rest. However they don’t speak about gold as as in case you ought to maintain it. However the actuality is, is in case you don’t maintain it, you don’t personal it. I would like you to comprehend and keep in mind that the worldwide yield curve simply inverted and what meaning, backside line is one thing terribly nasty this manner comes.

Just be sure you watch final week’s video on inflation safety. It’s critically essential that you just perceive this and also you get your self ready to climate this very, very, very nasty storm. And in case you haven’t already began that technique, click on that calendly hyperlink beneath, take a while, speak to our consultants, arrange your individual private technique as a result of we’re shut for the globe yield curve to invert. We’re actually shut and it’s gonna be nasty, nasty, nasty. Who’s gonna are available in and save us? China? They’ve acquired their very own issues on a world foundation. The US we acquired our personal issues. There are issues in each single economic system. And in case you haven’t accomplished so but, ensure you subscribe. Hit that bell. So we let you realize after we’re happening. Depart us a remark, give us a thumbs up. And actually greater than something, share, share, share. And till subsequent we meet, please be secure on the market. Bye-Bye.

SOURCES:

http://www.worldgovernmentbonds.com/inverted-yield-curves/

[ad_2]